Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to the dollar amount mentioned in the definition of disclosure threshold in subsection 287(1).

(2) The dollar amount mentioned in the definition, for an indexation year whose indexation factor is greater than 1, is replaced by the amount worked out using the following formula:

![]()

(3) For the purposes of sections 304 and 305A, the dollar amount mentioned in the definition for an indexation year is not replaced if the indexation period begins:

(a) while a person is a candidate or member of a group in an election or by - election; or

(b) during the period specified by legislative instrument under paragraph 305A(1A)(a).

(3A) The dollar amount worked out for the purposes of subsection (2) is to be rounded to the nearest $100, rounding up in the case of $50 or more.

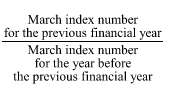

(4) The indexation factor for an indexation year is the number worked out using the following formula:

(5) The indexation factor is to be calculated to 3 decimal places, but increased by .001 if the fourth decimal place is more than 4.

(6) Calculations under subsection (4):

(a) are to be made using only the March index numbers published in terms of the most recently published index reference period for the Consumer Price Index; and

(b) are to be made disregarding March index numbers that are published in substitution for previously published March index numbers (except where the substituted numbers are published to take account of changes in the index reference period).

(7) In this section:

"indexation year" means each financial year beginning on 1 July.

"March index number" means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of the 3 months ending on 31 March.