Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendment of the social security law

1 Subsection 23(1) (at the end of the definition of clean energy payment )

Add:

(c) low income supplement; or

2 Subsection 23(1)

Insert:

"low income supplement" means low income supplement under Division 3 of Part 2.18A.

3 After Division 1 of Part 2.18A

Insert:

Division 3 -- Low income supplement

In this Division:

"income tax return" has the same meaning as in the Income Tax Assessment Act 1997 .

"tax-free threshold" has the same meaning as in the Income Tax Rates Act 1986 .

916B Qualification for low income supplement

A person is qualified for a low income supplement for an income year if:

(a) the person satisfies each of the following for the previous income year:

(i) the income requirement in section 916C;

(ii) the excluded payment requirement in section 916D;

(iii) the tax requirement in section 916E;

(iv) the remaining requirements in section 916F; and

(b) the person makes a claim for the supplement; and

(c) when the person makes a claim for the supplement, the person is not in gaol or a psychiatric institution.

Note: Generally a person must make a claim for low income supplement for an income year in that income year (see section 27C of the Administration Act).

(1) A person satisfies the income requirement for an income year if the person's qualifying income for the year is less than:

(a) $30,000 if the person is not a member of a couple, and does not have a dependent child, at the claim time; or

(b) $45,000 if:

(i) the person is a member of a couple at the claim time; and

(ii) neither the person, nor the person's partner at that time, has a dependent child at that time; or

(c) $60,000 if the person has a dependent child at the claim time; or

(d) $60,000 if the person is a member of a couple at the claim time, and the person's partner at that time has a dependent child at that time.

Qualifying income

(2) A person's qualifying income for an income year is:

(a) if the person is a member of a couple at the claim time--the sum of:

(i) the person's accepted adjusted taxable income for the income year; and

(ii) the accepted adjusted taxable income for the income year of the person's partner; or

(b) otherwise--the person's accepted adjusted taxable income for the income year.

Adjusted taxable income

(3) A person's adjusted taxable income for an income year is the sum of:

(a) the person's adjusted taxable income (within the meaning of Schedule 3 to the Family Assistance Act, disregarding clauses 3 and 3A of that Schedule) for the income year; and

(b) any superannuation income stream benefits (within the meaning of the Income Tax Assessment Act 1997 ) received by the person in relation to the income year, to the extent that those benefits are non - assessable non - exempt income (within the meaning of that Act).

Note: A person's adjusted taxable income (within the meaning of the Family Assistance Act) has several income components (see Schedule 3 to that Act).

Accepted adjusted taxable income

(4) A person has an accepted adjusted taxable income if:

(a) the Commissioner of Taxation has made an assessment of the person's taxable income for the income year and, for each of the other components of the person's adjusted taxable income for the income year, either or both of the following apply:

(i) the Commissioner holds information about the component;

(ii) to the extent that the Commissioner does not hold information about the component--the Secretary accepts under subsection (5) an estimate of the component; or

(b) the Secretary accepts under subsection (6) an estimate of the person's adjusted taxable income for the income year.

Note: For paragraph (a), a person's taxable income is a component of the person's adjusted taxable income (see Schedule 3 to the Family Assistance Act).

When the Secretary may accept estimates

(5) The Secretary may, for the purposes of subparagraph (4)(a)(ii), accept an estimate of a component of a person's adjusted taxable income for an income year if the Secretary is satisfied that the estimate is reasonable.

(6) The Secretary may, for the purposes of paragraph (4)(b), accept an estimate of a person's adjusted taxable income for an income year if:

(a) the person's estimated taxable income for the income year is not more than the tax - free threshold for the income year; and

(b) the Secretary is satisfied that:

(i) the estimate of each of the components of the person's adjusted taxable income is reasonable; and

(ii) the Commissioner of Taxation has not made an assessment of the person's taxable income for the income year; and

(iii) the person has not lodged, and is not required under the Income Tax Assessment Act to lodge, an income tax return for the income year.

Definition

(7) In this section:

"claim time" means the time a person makes a claim for low income supplement for an income year.

916D The excluded payment requirement

(1) A person satisfies the excluded payment requirement for an income year if:

(a) there were at least 92 days during the year in respect of which relevant clean energy payments were not paid to the person; and

(b) the person satisfies subsection (2) for the income year; and

(c) there were at least 13 weeks during the year for which the person did not receive any of the payments set out in subsection (3).

Note: For relevant clean energy payment , see subsection (5).

(2) A person satisfies this subsection for an income year if either:

(a) there were at least 13 weeks during the income year for which the person did not have an FTB child; or

(b) if paragraph (a) does not apply--all of the following apply:

(i) the Secretary determined under paragraph 19(b) of the Family Assistance Administration Act that the person was not entitled to be paid family tax benefit for a past period;

(ii) because of that determination, there were at least 13 weeks during the income year for which the person was not entitled to be paid family tax benefit;

(iii) the determination was not made because of section 26 of the Family Assistance Act.

Excluded payments

(3) The payments are the following:

(a) a social security pension (other than a sole parent pension or special needs pension);

(b) a social security benefit;

(c) seniors supplement under Part 2.25B of this Act or Part VIIAD of the Veterans' Entitlements Act;

(d) a payment under the ABSTUDY Scheme that included an amount identified as living allowance;

(e) a payment under Part 5 or 6 of the Farm Household Support Act 1992 ;

(f) a pension under Part II, III or IV of the Veterans' Entitlements Act (other than a pension that is payable at a rate specified in subsection 30(2) of that Act);

(g) compensation under Part 2 of Chapter 4, or Division 2 of Part 2 of Chapter 5, of the Military Rehabilitation and Compensation Act;

(h) a Special Rate Disability Pension (within the meaning of section 198 of the Military Rehabilitation and Compensation Act);

(i) a payment under the Military Rehabilitation and Compensation Act Education and Training Scheme worked out by reference to the maximum basic rate of youth allowance;

(j) a payment under the Veterans' Children Education Scheme worked out by reference to the maximum basic rate of youth allowance.

(4) For the purposes of paragraph (3)(g), if a person has received compensation mentioned in that paragraph as a lump sum (whether paid before, on or after the commencement of this Division), the person is taken to be receiving the weekly amount that would have been payable had the person not chosen to receive that compensation as a lump sum.

Meaning of relevant clean energy payment

(5) In this section, relevant clean energy payment means:

(a) a clean energy payment (other than a low income supplement and an essential medical equipment payment); or

(b) a clean energy advance (within the meaning of the Family Assistance Act); or

(c) family tax benefit, to the extent that the amount of the family tax benefit worked out under Schedule 1 to the Family Assistance Act includes either or both an amount of clean energy supplement (Part A) or clean energy supplement (Part B); or

(d) single income family supplement (within the meaning of the Family Assistance Act); or

(e) a clean energy advance (within the meaning of the Farm Household Support Act 1992 ); or

(f) a clean energy payment (within the meaning of the Military Rehabilitation and Compensation Act); or

(g) a clean energy payment (within the meaning of the Veterans' Entitlements Act), other than an essential medical equipment payment (within the meaning of that Act) .

(1) A person satisfies the tax requirement for an income year if the person's accepted taxable income for the income year is:

(a) less than $18,000; or

(b) $18,000 or more, but less than the person's LIS threshold amount for the income year.

Accepted taxable income

(2) A person has an accepted taxable income for an income year if:

(a) the Commissioner of Taxation has made an assessment of the person's taxable income for the income year; or

(b) the Secretary accepts an estimate of the person's taxable income for the income year under subsection (3).

(3) The Secretary may accept an estimate of a person's taxable income for an income year if:

(a) the estimate is not more than the tax - free threshold for the income year; and

(b) the Secretary is satisfied that:

(i) the estimate is reasonable; and

(ii) the Commissioner of Taxation has not made an assessment of the person's taxable income for the income year; and

(iii) the person has not lodged, and is not required under the Income Tax Assessment Act to lodge, an income tax return for the income year; and

(c) if the estimate is $18,000 or more:

(i) the person has provided the Secretary with an estimate of the person's eligible tax offsets (within the meaning of subsection (4)) for the income year; and

(ii) the Secretary is satisfied that that estimate is reasonable.

LIS threshold amount

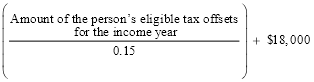

(4) The LIS threshold amount for a person for an income year is worked out as follows:

where:

"eligible tax offsets" , for a person for an income year, means the person's tax offsets (if any) for the income year, disregarding any tax offset under section 159N of the Income Tax Assessment Act 1936 (tax offset for certain low income earners).

"tax offset" has the same meaning as in the Income Tax Assessment Act 1997 .

916F The remaining requirements

A person (the claimant ) satisfies the remaining requirements for an income year if:

(a) the claimant was, at all times during the year, an Australian resident or a special category visa holder residing in Australia; and

(b) the claimant was in Australia for at least 39 weeks of the year; and

(c) the claimant was not subject to a newly arrived resident's waiting period at any time during the year; and

(d) the claimant was not a dependent child of another person for more than 25 weeks of the year; and

(e) the claimant was not in gaol and/or psychiatric institutions for more than 25 weeks of the year; and

(f) no person was eligible for family tax benefit in respect of the claimant in relation to more than 25 weeks of the year.

916G Availability of supplement

A person cannot receive more than one low income supplement for an income year.

916H Non - receipt of social security payment

(1) This section applies for the purposes of a provision of this or another Act if:

(a) the provision provides a benefit (whether the benefit is a pension, benefit, payment, supplement or any other sort of benefit) if a person meets specified criteria; and

(b) one of the specified criteria is that the person is receiving a social security payment, or is a recipient of a social security payment.

(2) For the purposes of the provision, a person is not taken to be receiving a social security payment, or to be a recipient of a social security payment, merely because the person receives low income supplement.

The amount of a low income supplement for an income year is $300.

Social Security (Administration) Act 1999

4 Subsection 16(3)

After "person may", insert ", subject to subsection (3A),".

5 After subsection 16(3)

Insert:

(3A) A claim by a person for low income supplement for an income year must not be combined with any other claim.

6 Before Subdivision G of Division 1 of Part 3

Insert:

Subdivision FC -- Time limit for claims for low income supplement

(1) A claim for low income supplement for an income year must be made during that income year.

(2) However, the claim may be made after the end of that income year if the Secretary is satisfied that:

(a) there are special circumstances applying to the person's claim that justify making a late claim; and

(b) the claim is made within a reasonable period having regard to those circumstances.

7 After section 204A

Insert:

(1) The Secretary may, in relation to claims for low income supplement, require the Commissioner of Taxation to provide the Secretary with information about people, including tax file numbers, being information:

(a) that is in the possession of the Commissioner; and

(b) that relates to any of the following for an income year:

(i) taxable income;

(ii) tax offsets (within the meaning of the Income Tax Assessment Act 1997 );

(iii) adjusted taxable income (within the meaning of the Family Assistance Act);

(iv) income tax (within the meaning of the Income Tax Assessment Act 1997 ); and

(c) that the Secretary is not otherwise able to require the Commissioner to provide under section 204A.

(2) Information provided to the Secretary under a requirement made under subsection (1) may be used only for the purposes of ascertaining whether a person is or was qualified for low income supplement for an income year.

Part 2 -- Application and transitional provisions

8 Application--claims from 1 July 2012

The amendments to the Social Security Act 1991 and the Social Security (Administration) Act 1999 made by Part 1 of this Schedule apply in relation to claims for low income supplement made on or after 1 July 2012.

9 Transitional--tax - free threshold for the 2011 - 12 income year

For the purposes of applying subsections 916C(6) and 916E(3) of the Social Security Act 1991 (as inserted by this Schedule) in relation to the 2011 - 12 income year:

(a) the definition of tax - free threshold in section 916A does not apply; and

(b) tax - free threshold means $6,000 .

10 Transitional--tax requirement for claims made in the 2012 - 13 income year

(1) For a person who makes a claim for low income supplement for the 2012 - 13 income year:

(a) subsection 916E(1) of the Social Security Act 1991 , as inserted by this Schedule, does not apply in relation to the claim; and

(b) the person is taken to satisfy the tax requirement referred to in subparagraph 916B(1)(a)(iii) of that Act (as inserted by this Schedule) for the 2011 - 12 income year if the person satisfies the requirement in subitem (2).

(2) A person satisfies this subitem if:

(a) the person has an accepted taxable income (within the meaning of subsection 916E(2) of the Social Security Act 1991 , as inserted by this Schedule) for the 2011 - 12 income year; and

(b) the amount of income tax owed by the person for that year, as worked out under subsection 4 - 10(3) of the Income Tax Assessment Act 1997 by reference to the person's accepted taxable income, is less than $300.

(3) This item does not apply to a person if item 12 or 13 of Schedule 6 to the Social Security and Other Legislation Amendment (2012 Budget and Other Measures) Act 2012 applies in relation to the person.

Income Tax Assessment Act 1936

11 After paragraph 202(h)

Insert:

(haa) to facilitate the administration of Division 3 of Part 2.18A of the Social Security Act 1991 (which deals with payment of low income supplement); and

Taxation Administration Act 1953

12 Paragraph 8WA(1AA)(b)

After "(h),", insert "(haa),".

13 Paragraphs 8WB(1A)(a) and (b)

After "(h),", insert "(haa),".