Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Amendment of the social security law

1 Subsection 23(1) (at the end of the definition of clean energy payment )

Add:

(d) an essential medical equipment payment.

2 Subsection 23(1)

Insert:

"EMEP residence" has the meaning given by section 917A.

3 Subsection 23(1)

Insert:

"essential medical equipment payment" has the meaning given by section 917A.

4 Subsection 23(1)

Insert:

"medical equipment" has the meaning given by section 917A.

5 Subsection 23(1)

Insert:

"person with medical needs" has the meaning given by section 917A.

6 After Division 3 of Part 2.18A

Insert:

Division 4 -- Essential medical equipment payment

In this Division:

"EMEP residence" has the meaning given by subsection 917C(1).

"essential medical equipment payment" :

(a) means an essential medical equipment payment under this Division (except in section 917F); and

(b) in section 917F--has the meaning given by that section.

"medical equipment" , in relation to a person who satisfies the medical needs requirement under paragraph 917C(1)(b), means the heating or cooling system (as the case requires) of the residence described in that paragraph.

"person with medical needs" has the meaning given by paragraph 917C(2)(b).

917B Qualification for essential medical equipment payment

(1) A person (the claimant ) is qualified for an essential medical equipment payment for an income year if:

(a) the Secretary is satisfied that the claimant satisfies each of the following on the EMEP test day:

(i) the medical needs requirement in section 917C;

(ii) the concession card requirement in section 917D;

(iii) the energy account requirement in section 917E; and

(b) a medical practitioner has (subject to subsection (2)) certified that:

(i) the claimant meets the medical needs requirement under subsection 917C(1) on a day; or

(ii) another specified person meets the medical needs requirement under subsection 917C(1) on a day;

(as the case requires); and

(c) the claimant is not prevented from receiving an essential medical equipment payment by section 917F; and

(d) the claimant is not a dependent child of another person on the EMEP test day; and

(e) the claimant is in Australia on the EMEP test day.

(2) Paragraph (1)(b) does not apply if the Secretary is otherwise satisfied that the claimant or another specified person meets the medical needs requirement in section 917C.

Meaning of EMEP test day

(3) For the purposes of subsection (1), the EMEP test day is either:

(a) the day in the income year referred to in subsection (1) on which the claimant makes the claim for the payment; or

(b) an anniversary (in the income year referred to in subsection (1)) of the day on which the claimant made a claim for the payment if:

(i) the claimant made the claim in a previous income year; and

(ii) since the claimant made the claim, the Secretary has not determined that the claimant has ceased to be qualified for the payment.

Note 1: Under section 11 of the Administration Act, a person is required to make a claim for a social security payment.

Note 2: For additional rules relating to the claim, see section 19 of the Administration Act.

Determining qualification for later income years

(4) In determining whether a person is qualified for an essential medical equipment payment for an income year after the income year in which the claim for the payment is made, the Secretary:

(a) may act on the basis of the documents and information in his or her possession; and

(b) is not required to conduct any inquiries or investigations into the matter or to require (whether under this Act or otherwise) the giving of any information or the production of any document.

(5) Despite subsection (4), the Secretary may require a further certification for the purposes of paragraph (1)(b), or further information or a further document for the purposes of subsection (2), in an income year after the income year in which the claim is made.

917C The medical needs requirement

Person who has medical needs

(1) A person satisfies the medical needs requirement on a day if:

(a) the person has a medical condition on that day, and as a result:

(i) the person requires the use of specified essential medical equipment in a residence (the EMEP residence ) that is the person's home and is either a private residence or a specified residence; and

(ii) the person uses that equipment in that residence; or

(b) the person has a specified medical condition on that day, and as a result:

(i) the person is unable to regulate his or her body temperature; and

(ii) additional heating or cooling is required, in a residence (the EMEP residence ) that is the person's home and is either a private residence or a specified residence, to manage the person's condition; and

(iii) the person uses additional heating or cooling in that residence.

Caring for a person who has medical needs

(2) A person (the carer ) also satisfies the medical needs requirement on a day if:

(a) the carer provides care and attention on a regular and ongoing basis for a person; and

(b) the person (the person with medical needs ) satisfies the medical needs requirement under subsection (1) on the day; and

(c) the person with medical needs is specified in the certification under subparagraph 917B(1)(b)(ii) or is the person specified for the purposes of subsection 917B(2) (as the case requires); and

(d) the carer's home is the EMEP residence that is the home of the person with medical needs.

Legislative instrument

(3) The Minister may, by legislative instrument, specify:

(a) essential medical equipment for the purposes of paragraph (1)(a); and

(b) medical conditions for the purposes of paragraph (1)(b); and

(c) residences for the purposes of paragraphs (1)(a) and (b).

917D The concession card requirement

A person satisfies the concession card requirement on a day if:

(a) the person is a holder of a concession card, or the person's name is included on a concession card, on that day; or

(b) both of the following apply:

(i) the person satisfies the medical needs requirement under subsection 917C(2) (caring for a person) on that day in relation to a person with medical needs;

(ii) the person with medical needs is a holder of a concession card, or the name of the person with medical needs is included on a concession card, on that day.

917E The energy account requirement

(1) A person satisfies the energy account requirement on a day if:

(a) on that day, the energy account for the relevant EMEP residence is in the name of that person; or

(b) on that day, the energy account for the relevant EMEP residence is in the name of that person's partner; or

(c) the person contributes (whether wholly or partly) to paying the energy account for the relevant EMEP residence; or

(d) if the person is not the person with medical needs--the person with medical needs contributes (whether wholly or partly) to paying the energy account for the relevant EMEP residence.

(2) For the purposes of subsection (1), an energy account for a residence means any account for:

(a) electricity; or

(b) any other specified form of energy;

that is supplied to the residence.

(3) The Minister may, by legislative instrument, specify forms of energy for the purposes of paragraph (2)(b).

(1) No essential medical equipment payment may be made for an income year in relation to medical equipment that is used in an EMEP residence if an essential medical equipment payment has already been made for that income year in relation to the same equipment and the same residence.

(2) No more than 2 essential medical equipment payments may be made in relation to the same medical equipment for an income year (subject to subsection (1)).

(3) Essential medical equipment payments for an income year may not be made, in relation to a person with medical needs, in relation to more than 2 EMEP residences.

Meaning of essential medical equipment payment

(4) In this section, an essential medical equipment payment means an essential medical equipment payment under this Division or Division 3 of Part IIIE of the Veterans' Entitlements Act.

The amount of an essential medical equipment payment for an income year is $140.

Note: The amount specified is indexed on each 1 July (see sections 1190 and 1191).

917H Non - receipt of social security payment

(1) This section applies for the purposes of a provision of this or another Act if:

(a) the provision provides a benefit (whether the benefit is a pension, benefit, payment, supplement or any other sort of benefit) if a person meets specified criteria; and

(b) one of the specified criteria is that the person is receiving a social security payment, or is a recipient of a social security payment.

(2) For the purposes of the provision, a person is not taken to be receiving a social security payment, or to be a recipient of a social security payment, merely because the person receives an essential medical equipment payment.

7 Section 1190 (at the end of the table)

Add:

| Essential medical equipment payment |

|

|

70. | essential medical equipment payment | EMEP | section 917G |

8 Subsection 1191(1) (at the end of the table)

Add:

| Essential medical equipment payment |

|

|

|

|

42. | EMEP | 1 July | December | highest December quarter before reference quarter (but not earlier than the December quarter of 2011) | $1.00 |

9 At the end of section 1192

Add:

(9) The first indexation of amounts under item 42 of the CPI Indexation Table in subsection 1191(1) is to take place on 1 July 2013.

Social Security (Administration) Act 1999

10 After section 18

Insert:

19 Special requirements regarding claims for essential medical equipment payment

(1) A claim for an essential medical equipment payment must include a statement by the person making the claim that the medical equipment to which the claim relates is used in the relevant EMEP residence.

(2) If:

(a) a person who provides care and attention for a person with medical needs makes a claim for an essential medical equipment payment; and

(b) the person with medical needs is not a dependent child of that or any other person;

the claim must be signed by the person with medical needs.

Part 2 -- Amendment of the Veterans' Entitlements Act

Veterans' Entitlements Act 1986

11 Section 5 (index of definitions)

Insert:

EMEP residence | 5Q(1) |

12 Section 5 (index of definitions)

Insert:

essential medical equipment payment | 5Q(1) |

13 Section 5 (index of definitions)

Insert:

income year | 5Q(1) |

14 Section 5 (index of definitions)

Insert:

medical equipment | 5Q(1) |

15 Section 5 (index of definitions)

Insert:

person with medical needs | 5Q(1) |

16 Subsection 5Q(1) (at the end of the definition of clean energy payment )

Add:

(c) an essential medical equipment payment.

17 Subsection 5Q(1)

Insert:

"EMEP residence" has the meaning given by section 63A.

18 Subsection 5Q(1)

Insert:

"essential medical equipment payment" has the meaning given by section 63A.

19 Subsection 5Q(1)

Insert:

"income year" has the meaning given by the Income Tax Assessment Act 1997 .

20 Subsection 5Q(1)

Insert:

"medical equipment" has the meaning given by section 63A.

21 Subsection 5Q(1)

Insert:

"person with medical needs" has the meaning given by section 63A.

22 Subsection 5Q(1) (paragraph (b) of the definition of tax year )

Omit "(within the meaning of the Income Tax Assessment Act 1997 )".

23 After Division 1 of Part IIIE

Insert:

Division 3 -- Essential medical equipment payment

In this Division:

"EMEP residence" has the meaning given by subsection 63C(1).

"essential medical equipment payment" :

(a) means an essential medical equipment payment under this Division (except in section 63F); and

(b) in section 63F--has the meaning given by that section.

"medical equipment" , in relation to a person who satisfies the medical needs requirement under paragraph 63C(1)(b), means the heating or cooling system (as the case requires) of the residence described in that paragraph.

"person with medical needs" has the meaning given by paragraph 63C(2)(b).

Subdivision B -- Eligibility for essential medical equipment payment

63B Eligibility for essential medical equipment payment

(1) A person (the claimant ) is eligible for an essential medical equipment payment for an income year if:

(a) the Commission is satisfied that the claimant satisfies each of the following on the EMEP test day:

(i) the medical needs requirement in section 63C;

(ii) the concession card requirement in section 63D;

(iii) the energy account requirement in section 63E; and

(b) a medical practitioner has (subject to subsection (2)) certified that:

(i) the claimant meets the medical needs requirement under subsection 63C(1) on a day; or

(ii) another specified person meets the medical needs requirement under subsection 63C(1) on a day;

(as the case requires); and

(c) the claimant is not prevented from receiving an essential medical equipment payment by section 63F; and

(d) the claimant is not a dependent child of another person on the EMEP test day; and

(e) the claimant is in Australia on the EMEP test day.

(2) Paragraph (1)(b) does not apply if the Commission is otherwise satisfied that the claimant or another specified person meets the medical needs requirement in section 63C.

Meaning of EMEP test day

(3) For the purposes of subsection (1), the EMEP test day is either:

(a) the day in the income year referred to in subsection (1) on which the claimant makes the claim for the payment; or

(b) an anniversary (in the income year referred to in subsection (1)) of the day on which the claimant made a claim for the payment if:

(i) the claimant made the claim in a previous income year; and

(ii) since the claimant made the claim, the Commission has not determined that the claimant has ceased to be eligible for the payment.

Note: For claims, see Subdivision C.

Determining eligibility for later income years

(4) In determining whether a person is eligible for an essential medical equipment payment for an income year after the income year in which the claim for the payment is made, the Commission:

(a) may act on the basis of the documents and information in its possession; and

(b) is not required to conduct any inquiries or investigations into the matter or to require (whether under this Act or otherwise) the giving of any information or the production of any document.

(5) Despite subsection (4), the Commission may require a further certification for the purposes of paragraph (1)(b), or further information or a further document for the purposes of subsection (2), in an income year after the income year in which the claim is made.

63C The medical needs requirement

Person who has medical needs

(1) A person satisfies the medical needs requirement on a day if:

(a) the person has a medical condition on that day, and as a result:

(i) the person requires the use of specified essential medical equipment in a residence (the EMEP residence ) that is the person's home and is either a private residence or a specified residence; and

(ii) the person uses that equipment in that residence; or

(b) the person has a specified medical condition on that day, and as a result:

(i) the person is unable to regulate his or her body temperature; and

(ii) additional heating or cooling is required, in a residence (the EMEP residence ) that is the person's home and is either a private residence or a specified residence, to manage the person's condition; and

(iii) the person uses additional heating or cooling in that residence.

Caring for a person who has medical needs

(2) A person (the carer ) also satisfies the medical needs requirement on a day if:

(a) the carer provides care and attention on a regular and ongoing basis for a person; and

(b) the person (the person with medical needs ) satisfies the medical needs requirement under subsection (1) on the day; and

(c) the person with medical needs is specified in the certification under subparagraph 63B(1)(b)(ii) or is the person specified for the purposes of subsection 63B(2) (as the case requires); and

(d) the carer's home is the EMEP residence that is the home of the person with medical needs.

Meaning of specified essential medical equipment , specified medical condition and specified residence

(3) In this section:

"specified essential medical equipment" means any medical equipment that is specified under subsection 917C(3) of the Social Security Act.

"specified medical condition" means any medical condition that is specified under subsection 917C(3) of the Social Security Act.

"specified residence" means any residence that is specified under subsection 917C(3) of the Social Security Act.

63D The concession card requirement

(1) A person satisfies the concession card requirement on a day if:

(a) the person is a holder of a concession card, or the person's name is included on a concession card, on that day; or

(b) both of the following apply:

(i) the person satisfies the medical needs requirement under subsection 63C(2) (caring for a person) on that day in relation to a person with medical needs;

(ii) the person with medical needs is a holder of a concession card, or the name of the person with medical needs is included on a concession card, on that day.

(2) For the purposes of subsection (1), a concession card means any of the following cards:

(a) a pensioner concession card issued under section 53;

(b) a seniors health card issued under section 118ZG;

(c) a card known as the Repatriation Health Card--For All Conditions, that evidences a person's eligibility, under this Act or the Military Rehabilitation and Compensation Act 2004 , to be provided with treatment for all injuries or diseases;

(d) a card known as the Repatriation Health Card--For Specific Conditions, that evidences a person's eligibility, under this Act or the Military Rehabilitation and Compensation Act 2004 , to be provided with treatment for specific injuries or diseases.

63E The energy account requirement

(1) A person satisfies the energy account requirement on a day if:

(a) on that day, the energy account for the relevant EMEP residence is in the name of that person; or

(b) on that day, the energy account for the relevant EMEP residence is in the name of that person's partner; or

(c) the person contributes (whether wholly or partly) to paying the energy account for the relevant EMEP residence; or

(d) if the person is not the person with medical needs--the person with medical needs contributes (whether wholly or partly) to paying the energy account for the relevant EMEP residence.

(2) For the purposes of subsection (1), an energy account for a residence means any account for:

(a) electricity; or

(b) any other specified form of energy;

that is supplied to the residence.

(3) In this section:

"specified form of energy" means any form of energy that is specified under subsection 917E(3) of the Social Security Act.

(1) No essential medical equipment payment may be made for an income year in relation to medical equipment that is used in an EMEP residence if an essential medical equipment payment has already been made for that income year in relation to the same equipment and the same residence.

(2) No more than 2 essential medical equipment payments may be made in relation to the same medical equipment for an income year (subject to subsection (1)).

(3) Essential medical equipment payments may not be made, in relation to a person with medical needs, in relation to more than 2 EMEP residences.

Meaning of essential medical equipment payment

(4) In this section, an essential medical equipment payment means an essential medical equipment payment under this Division or Division 4 of Part 2.18A of the Social Security Act.

The amount of an essential medical equipment payment for an income year is $140.

Note: The amount specified is indexed on each 1 July (see section 198E).

63H Debts arising in respect of essential medical equipment payments

(1) If:

(a) an individual has been paid an essential medical equipment payment because of a determination made under this Division; and

(b) after the payment was made to the individual, the determination is or was (however described) changed, revoked, set aside, or superseded by another determination; and

(c) the decision to change, revoke, set aside or supersede the determination is or was made for the reason, or for reasons including the reason, that the individual knowingly made a false or misleading statement, or knowingly provided false information; and

(d) apart from that statement or information, the payment would not have been paid to the individual;

the amount of the payment is a debt due to the Commonwealth by the individual.

(2) The other provisions of this Act under which debts arise do not apply in relation to essential medical equipment payments.

Subdivision C -- Claim for essential medical equipment payment

A person who wants to be paid an essential medical equipment payment must make a proper claim.

Note: For proper claim see section 63M (form) and section 63N (residence in Australia).

63K Special requirements regarding claims for essential medical equipment payment

(1) A claim for an essential medical equipment payment must include a statement by the person making the claim that the medical equipment to which the claim relates is used in the relevant EMEP residence.

(2) If:

(a) a person who provides care and attention for a person with medical needs makes a claim for an essential medical equipment payment; and

(b) the person with medical needs is not a dependent child of that or any other person;

the claim must be signed by the person with medical needs.

(1) Subject to subsection (2), a claim must be made by:

(a) the person who wants to be paid an essential medical equipment payment; or

(b) with the approval of the person--another person on the person's behalf.

(2) If the person is unable, because of physical or mental incapacity, to approve another person to make the claim on his or her behalf, the Commission may approve another person to make the claim.

(1) To be a proper claim, the claim must be:

(a) made in writing; and

(b) in accordance with a form approved by the Commission; and

(c) accompanied by any evidence available to the claimant that the claimant considers may be relevant to the claim; and

(d) lodged at an office of the Department in Australia in accordance with section 5T.

(2) A claim lodged in accordance with section 5T is taken to have been made on a day determined under that section.

63N Claimant must be an Australian resident

A claim is not a proper claim unless the person making the claim, or on whose behalf the claim is being made, is an Australian resident on the day on which the claim is lodged.

Note: For Australian resident see section 5G.

(1) A claimant for an essential medical equipment payment or a person on behalf of a claimant may withdraw a claim that has not been determined.

(2) A claim that is withdrawn is taken to have not been made.

(3) A withdrawal may be made either orally or by document lodged at an office of the Department in Australia in accordance with section 5T.

Oral withdrawal of a claim

(4) An oral withdrawal of a claim must be made to a person in an office of the Department in Australia.

Acknowledgement of oral withdrawal of a claim

(5) As soon as practicable after receiving an oral withdrawal of a claim, the Secretary must give the claimant an acknowledgement notice in writing stating that:

(a) an oral withdrawal of the claim was made; and

(b) the claimant, or a person on behalf of the claimant, may, within 28 days from the day the acknowledgement notice is given, request the Secretary to treat the withdrawal as if it had not been made.

Reactivating the withdrawn claim

(6) If, within 28 days from the day on which the Secretary gave the acknowledgement notice, a claimant, or a person on behalf of a claimant, requests the Secretary to treat the oral withdrawal of the claim as if it had not been made, the oral withdrawal is taken not to have been made.

Note: A request made under paragraph (5)(b) has the effect of reactivating the claim. In particular, the commencement day of the claim stays the same.

Subdivision D -- Investigation of claim

63Q Secretary to investigate claim and submit it to Commission

(1) If a person makes a proper claim for an essential medical equipment payment, the Secretary must investigate the matters to which the claim relates.

(2) When the investigation is completed, the Secretary must submit the claim to the Commission for consideration and determination.

(3) When the claim is submitted to the Commission it must be accompanied by:

(a) any evidence supplied by the claimant in support of the claim; and

(b) any documents or other evidence obtained by the Department in the course of the investigation that are relevant to the claim; and

(c) any other documents or other evidence under the control of the Department that are relevant to the claim.

Subdivision E -- Consideration and determination of claim

63R Duties of Commission in relation to claim

(1) When the claim is submitted to the Commission, the Commission must consider all matters that are, in the Commission's opinion, relevant to the claim and must then determine the claim.

(2) In considering the claim, the Commission must:

(a) satisfy itself with respect to; or

(b) determine;

(as the case requires) all matters relevant to the determination of the claim.

(3) Without limiting subsection (1), the Commission, in considering the claim, must consider:

(a) the evidence submitted with the claim under section 63Q; and

(b) any further evidence subsequently submitted to the Commission in relation to the claim.

Note: A claimant may apply to the Commission for review of a determination made under this section (see section 64A).

The Commission must determine that a person is entitled to an essential medical equipment payment if the Commission is satisfied that the person is eligible for the payment.

63T Date of effect of determination

A determination under section 63S takes effect, on the day that the determination is made or on such later day or earlier day as is specified in the determination.

Division 4 -- Review of decisions

64A Review of certain decisions

A person who is dissatisfied with a decision of the Commission in relation to a clean energy payment may request the Commission to review the decision.

(1) A request for review of a decision under section 64A must:

(a) be made within 3 months after the person seeking review was notified of the decision; and

(b) set out the grounds on which the request is made; and

(c) be in writing; and

(d) be lodged at an office of the Department in Australia in accordance with section 5T.

(2) A request lodged in accordance with section 5T is taken to have been made on a day determined under that section.

(3) If a request for review of a decision is made in accordance with subsection (1), the Commission must review the decision.

(4) If the Commission has delegated its powers under this section to the person who made the decision under review, that person must not review the decision.

64C Commission's powers where request for review

(1) If the Commission reviews a decision under this Part, the Commission must affirm the decision or set it aside.

(2) If the Commission sets the decision aside it must, subject to subsection (3), substitute a new decision in accordance with this Act.

(3) If the decision set aside is a decision that a person ceases to be entitled to a clean energy payment, the Commission need not substitute another decision.

Note: For the Commission's evidence gathering powers, see section 64G.

64D Date of effect of certain review decisions

(1) If the Commission sets aside a decision and substitutes for it a decision that a person is entitled to a clean energy payment, the substituted decision takes effect from a date specified by the Commission.

(2) The date specified by the Commission must not be earlier than the date from which, had the Commission determined that the person is entitled to a clean energy payment, such a determination could have taken effect.

64E Commission must make written record of review decision and reasons

(1) When the Commission reviews a decision under this Part it must make a written record of its decision upon review.

(2) The written record must include a statement that:

(a) sets out the Commission's findings on material questions of fact; and

(b) refers to the evidence or other material on which those findings are based; and

(c) provides reasons for the Commission's decision.

64F Person who requested review to be notified of decision

(1) When the Commission affirms or sets aside a decision under this Part it must give the person who requested the review of the decision:

(a) a copy of the Commission's decision; and

(b) subject to subsection (2), a copy of the statement about the decision referred to in subsection 64E(2); and

(c) if the person has a right to apply to the Administrative Appeals Tribunal for review of the Commission's decision--a statement giving the person particulars of that right.

(2) If the statement referred to in paragraph (1)(b) contains any matter that, in the opinion of the Commission:

(a) is of a confidential nature; or

(b) might, if communicated to the person who requested review, be prejudicial to his or her physical or mental health or well - being;

the copy given to the person is not to contain that matter.

64G Powers of Commission to gather evidence

(1) The Commission or the Commission's delegate may, in reviewing a decision under this Part:

(a) take evidence on oath or affirmation for the purposes of the review; and

(b) adjourn a hearing of the review from time to time.

(2) The presiding member of the Commission or the Commission's delegate may, for the purposes of the review:

(a) summon a person to appear at a hearing of the review to give evidence and to produce such documents (if any) as are referred to in the summons; and

(b) require a person appearing at a hearing of the review for the purpose of giving evidence either to take an oath or to make an affirmation; and

(c) administer an oath or affirmation to a person so appearing.

(3) The person who applied for the review under this Division is a competent and compellable witness upon the hearing of the review.

(4) The oath or affirmation to be taken or made by a person for the purposes of this section is an oath or affirmation that the evidence that the person will give will be true.

(5) The Commission's power under paragraph (1)(a) to take evidence on oath or affirmation:

(a) may be exercised on behalf of the Commission by:

(i) the presiding member or the Commission's delegate; or

(ii) another person (whether a member or not) authorised by the presiding member or the Commission's delegate; and

(b) may be exercised within or outside Australia; and

(c) must be exercised subject to any limitations specified by the Commission.

(6) Where a person is authorised under subparagraph (5)(a)(ii) to take evidence for the purposes of a review, the person has:

(a) all the powers of the Commission under subsection (1); and

(b) all the powers of the presiding member under subsection (2);

for the purposes of taking that evidence.

(7) In this section:

"Commission's delegate" means a person to whom the Commission has delegated its powers under section 64B and who is conducting the review in question.

64H Withdrawal of request for review

(1) A person who requests a review under section 64A may withdraw the request at any time before it is determined by the Commission.

(2) To withdraw the request, the person must give written notice of withdrawal to the Secretary and the notice must be lodged at an office of the Department in Australia in accordance with section 5T.

(3) Subject to section 64B, a person who withdraws a request for review may subsequently make another request for review of the same decision.

Note: Section 64B provides that a person who wants to request a review of a decision must do so within 3 months after the person has received notice of the decision.

24 Paragraph 127(1)(b)

Omit "or recreation transport allowance", substitute ", recreation transport allowance or essential medical equipment payment".

25 After subsection 175(2)

Insert:

(2A) If the Commission, under section 64C, affirms a decision of the Commission referred to in that section or sets it aside and substitutes another decision, a person may apply to the Administrative Appeals Tribunal for review of the decision so affirmed or substituted.

26 Subsection 175(2AAA)

Omit "(2AAA)", substitute "(2B)".

27 Subsection 175(2AAAA)

Omit "(2AAAA)", substitute "(2C)".

28 Subsection 175(2AA)

Omit "(2AA)", substitute "(2D)".

29 Subsection 175(2A)

Omit "(2A)", substitute "(2E)".

30 Subsection 175(2A)

Omit "subsection (1A), (2), (2AAAA), (2AAA) or (2AA)", substitute "any of subsections (1A) to (2D)".

31 Paragraph 176(3)(a)

Omit "(2AA)", substitute "(2A), (2D)".

32 Paragraph 176(3)(a)

After "57E,", insert "64F,".

33 Subsections 177(5A) and (5C)

Omit "175(2AA)", substitute "175(2D)".

34 After section 198D

Insert:

198E Variation of amount of essential medical equipment payment

(1) This section applies to the dollar amount mentioned in section 63G (essential medical equipment payment).

(2) That dollar amount, for an indexation day on which the indexation factor is greater than 1, is replaced by the amount that is worked out using the following formula:

![]()

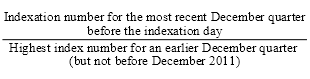

(3) The indexation factor for an indexation day is the number worked out using the following formula:

(4) The indexation factor is to be calculated to 3 decimal places, but increased by 0.001 if the fourth decimal place is more than 4.

(5) If an amount worked out under subsection (2) is not a multiple of a dollar, the amount is to be rounded to the nearest multiple of a dollar (rounding up in the case of 50 cents).

(6) In this section:

"indexation day" means 1 July 2013 and each later 1 July.

Part 3 -- Application and transitional provisions

35 Application

The amendments made by this Schedule apply in relation to the 2012 - 13 and later income years.

36 Transitional

(1) A person may make a claim for an essential medical equipment payment under the Social Security Act 1991 or the Veterans' Entitlements Act 1986 for the 2012 - 13 income year on or after 18 June 2012.

Note: A claim for an essential medical equipment payment for the 2012 - 13 income year must be made before 1 July 2013 (see paragraph 917B(3)(a) of the Social Security Act 1991 and paragraph 63B(3)(a) of the Veterans' Entitlements Act 1986 ).

(2) For the purposes of the Social Security Act 1991 , the Social Security (Administration) Act 1999 and the Veterans' Entitlements Act 1986 , a person who makes a claim for the 2012 - 13 income year before 1 July 2012 is taken to have made the claim on 1 July 2012.