Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A parent's multi - case allowance for a child (the particular child ) for a day in a child support period is worked out using this method statement.

Method statement

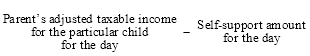

Step 1. Work out the following amount:

Step 2. If the parent has a relevant dependent child, take the parent's relevant dependent child amount (see section 46) for the day from the amount worked out under step 1.

Step 3. For each of the children (the multi - case children ) for whom the parent is assessed in respect of the costs of the child for the day, work out the multi - case child costs for the particular child for the day under section 55HA, as if:

(a) the parent's annual rate of child support were assessed under Subdivision D of Division 2; and

(b) the reference in subsection 55HA(2) to the parent's child support income were a reference to the amount worked out under step 1 or 2 (as the case requires); and

(c) references in section 55HA to children in the child support case that relates to the child were references to all of the parent's multi - case children.

Step 4. The parent's multi - case allowance for the particular child for the day is the sum of the multi - case child costs for each of the other multi - case children (excluding the particular child and any other children in the child support case that relates to the particular child).

(2) For the purposes of step 3 of the method statement, a parent is taken to be assessed in respect of the costs of a child if the parent is liable to pay child support for the child under an administrative assessment under the law of a reciprocating jurisdiction.