Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If the Registrar has made an assessment under section 66 in respect of the annual rate of child support payable by a parent for all the children in a child support case for a day in a child support period, the Registrar may, on an application made by the parent that:

(a) is in accordance with the regulations; and

(b) either:

(i) nominates the whole (the nominated period ) of that child support period (if the first day of that child support period is the day referred to in paragraph 66(4)(a)); or

(ii) nominates a part (the nominated period ) of that child support period, being a part that is at least 2 months and that begins on or after the day referred to in paragraph 66(4)(a);

reduce the annual rate of child support payable by the parent for those children for the nominated period to nil. This subsection is subject to subsection (3C).

Note: If the Registrar refuses to grant an application under this section, the Registrar must serve a notice on the applicant under section 66C.

(2) The Registrar must not grant an application under subsection (1) unless the Registrar is satisfied that the amount worked out under subsection (3) is less than the amount worked out under subsection (3A).

(2A) For the purposes of subsection (2), a parent is taken to have a child support case if the parent is liable to pay child support for one or more children under an administrative assessment under the law of a reciprocating jurisdiction.

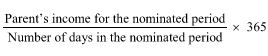

(3) The amount for the purposes of this subsection is:

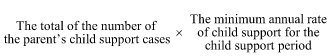

(3A) The amount for the purposes of this subsection is:

(3B) For the purposes of subsection (3A), a parent is taken to have a child support case if the parent is liable to pay child support for one or more children under an administrative assessment under the law of a reciprocating jurisdiction.

(3C) A reduction under subsection (1) has no effect in relation to a day to which the assessment under section 66 does not apply.

Note: Subsection 66(4) deals with when an assessment under section 66 applies.

(4) In this section:

"income" , in relation to a person, means:

(a) any money earned, derived or received by the parent for his or her own use or benefit, other than money earned, derived or received in a manner, or from a source, prescribed by the regulations for the purposes of this paragraph; or

(b) a periodical payment by way of a gift or allowance, other than a payment of a kind prescribed by the regulations for the purposes of this paragraph.