Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAssessment of annual rate

(1) The Registrar must assess the total of the annual rates of child support payable by a parent for all the children in a child support case for a day in a child support period as the minimum annual rate of child support for the child support period if:

(a) the parent does not have at least regular care of at least one of the children in the child support case for the day; and

(b) the total payable by the parent for all the children in the child support case would (apart from this section) be assessed as less than the minimum annual rate of child support for the child support period.

Note: The Registrar must not make an assessment under this subsection in certain cases (see subsections (2) and (8)).

(2) To avoid doubt, the Registrar must not make an assessment in respect of a parent whose annual rate of child support could be assessed under section 65A (low income parents not on income support) unless the Registrar has determined under section 65B that section 65A does not apply.

When assessment applies

(4) An assessment in respect of a parent covered by paragraph (1)(b) applies to each day in the period:

(a) beginning on the first day in the child support period on which the total payable by the parent in respect of the child support case would (apart from this section) be assessed as less than the minimum annual rate of child support for the child support period; and

(b) ending:

(i) if the parent would be so assessed until the end of the child support period--at the end of the child support period; or

(ii) otherwise--28 days after the day on which the person would cease to be so assessed (even if that day is after the end of the child support period).

How much is the minimum annual rate

(5) The minimum annual rate of child support is $320.

Note: The minimum annual rate of child support specified in subsection (5) is indexed under section 153A.

(6) If:

(a) the Registrar makes an assessment in respect of a parent under subsection (1); and

(b) the parent is assessed (whether under subsection (1) or otherwise) for a day in a child support period in respect of the costs of children in more than 3 child support cases;

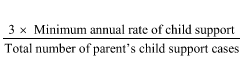

then the annual rate of child support payable by the parent for a day in the child support period for a particular child support case is:

(6A) For the purposes of subsection (6), if a parent is liable to pay child support for one or more children for a day under an administrative assessment under the law of a reciprocating jurisdiction, then the parent is taken to be assessed for the day in respect of the costs of children in a child support case.

Paying the minimum annual rate to more than one person for a single child support case

(7) If the rate worked out under subsection (5) or (6) is payable by a parent for a child support case to:

(a) the parent of the children to whom the case relates and to one or more non - parent carers of those children; or

(b) 2 or more non - parent carers of those children;

then:

(c) if 2 or more persons have equal percentages of care of the children, and those percentages are the highest percentages--each of those persons is entitled to be paid an equal proportion of the annual rate of child support that is payable by the parent; and

(d) otherwise--only the person who has the highest percentage of care of the children is entitled to be paid the annual rate of child support that is payable by the parent.

Registrar not to make minimum rate assessment in certain cases

(8) The Registrar must not make an assessment under subsection (1) in relation to the child support payable by a parent:

(a) in accordance with a determination made under Part 6A (departure determinations); or

(b) in accordance with an order made under Division 4 of Part 7 (departure orders); or

(c) in accordance with provisions of a child support agreement that have effect, for the purposes of this Part, as if they were such an order made by consent.

Definition of income support payment

(9) In this Act:

"income support payment" :

(a) has the meaning given by subsection 23(1) of the Social Security Act 1991 ; and

(b) includes a payment under the ABSTUDY scheme that includes an amount identified as living allowance, being an allowance that is paid at the maximum basic rate.