Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if:

(a) either:

(i) a child support agreement accepted by the Registrar includes lump sum payment provisions in accordance with paragraph 84(1)(e) of the Assessment Act; or

(ii) a court has made an order under section 123A of that Act in relation to the provision of child support in the form of a lump sum payment; and

(b) the Registrar has been notified that the lump sum payment has been paid in accordance with the agreement or order.

(2) The Registrar must, in accordance with subsection (3):

(a) in respect of a day in an initial period, or in respect of a day in a payment period, in a year of income, for a registered maintenance liability, credit the remaining lump sum payment against:

(i) if the agreement or order states that the lump sum payment is to be credited against a specified percentage of the amount payable under the liability--that percentage of the amount payable under the liability; and

(ii) if subparagraph (i) does not apply--100% of the amount payable under the liability; and

(b) reduce, but not below nil, the remaining lump sum payment by the amount so credited.

(3) The Registrar must credit a remaining lump sum payment and reduce the remaining lump sum payment at the end of each year of income.

(4) The remaining lump sum payment , in relation to the lump sum payment paid under the agreement or order, means:

(a) for the first day after the agreement is accepted or the order is made--the lump sum payment; and

(b) for 1 July in a year of income (except if that 1 July is covered by paragraph (a))--the remaining lump sum payment for the previous day as indexed under subsection (5); and

(c) otherwise--so much of the remaining lump sum payment as remains after crediting under the previous application of this section.

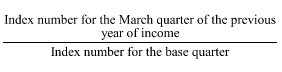

(5) The remaining lump sum payment, for 1 July in a year of income, is indexed as follows:

![]()

where:

"base quarter" means the March quarter (before the March quarter for the previous year of income, but after the agreement is accepted or the order is made) with the highest index number.

"indexation factor" means:

"index number" for a quarter is the All Groups Consumer Price Index number that is the weighted average of the 8 capital cities and is published by the Australian Statistician in respect of that quarter.

"March quarter" means the quarter ending on 31 March.

(6) If an indexation factor worked out under subsection (5) would be less than 1, the indexation factor is to be increased to 1.

(7) Subject to subsection (8), if at any time (whether before or after the commencement of this subsection), the Australian Statistician publishes an index number for a quarter in substitution for an index number previously published by the Australian Statistician for that quarter, the publication of the later index number is to be disregarded for the purposes of subsection (5).

(8) If at any time the Australian Statistician changes the index reference period for the Consumer Price Index, regard is to be had, for the purposes of applying subsection (5) after the change takes place, only to index numbers published in terms of the new index reference period.