Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A member of the scheme who is entitled to invalidity benefit and is classified as Class A or Class B under section 30 (whether on his retirement or by reason of his having been reclassified under subsection 34(1)) is entitled to invalidity pay at the rate applicable to him in accordance with this section.

(2) Subject to subsections (3) and (4), the rate at which invalidity pay is payable to a member of the scheme under this section is such amount per annum as is equal to, in the case of a recipient member classified as Class A under section 30, 76.5%, and, in the case of a recipient member classified as Class B, 38.25%, of the annual rate of pay applicable to him immediately before his retirement.

(3) Subject to section 33, where but for this subsection, the rate of invalidity pay payable to a member of the scheme under subsection (2) at any time would be less than the rate at which retirement pay would have been payable to him at that time if, at the time when he was retired on the ground of invalidity or of physical or mental incapacity to perform his duties, he had retired on other grounds, the rate of invalidity pay payable to him at that first - mentioned time is the rate at which retirement pay would have been so payable at that time.

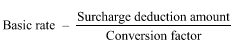

(4) If the member of the scheme makes an election under subsection 124(1), the rate at which invalidity pay is payable to the member is the rate worked out by using the formula:

where:

"basic rate" means the annual rate at which invalidity pay would be payable to the member under this section if the member did not make the election.

"conversion factor" is the factor that is applicable to the member under the determination made by CSC under section 124A.

"surcharge deduction amount" means the member's surcharge deduction amount.