Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Pension is payable to an eligible orphan in accordance with this section while he is an eligible orphan.

(2) Subject to subsections (2AA) and (2A), pension under this section is payable to an eligible orphan, being the child of a contributing member who died before retirement, as follows, pension at the rate of $5,000 per annum, as indexed in accordance with subsection 98B(5A), and additional pension at a rate equal to one - eighth of five - eighths of the rate at which invalidity pay would have been payable to the member if, on the date of his death, he had become entitled to invalidity benefit and had been classified as Class A under section 30.

(2AA) If:

(a) a contributing member dies and is survived by one or more eligible orphans; and

(b) the member's surcharge debt account is in debit when pension becomes payable to the orphan or orphans;

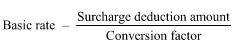

then, subject to subsection (2A), there is payable to the orphan or each of the orphans, instead of the pensions described in subsection (2), a pension at the rate worked out by using the formula:

where:

"basic rate" means the amount per annum equal to the sum of the rates of the pensions described in subsection (2).

"conversion factor" is the factor that is applicable to the member under the determination made by CSC under section 124A.

"surcharge deduction amount" means the member's surcharge deduction amount.

(2A) Where the number of eligible orphans in respect of whom pensions are payable under subsection (2), or a pension is payable under subsection (2AA), because of the death of the contributing member is such that the sum of the rates of all the pensions so payable exceeds the rate at which invalidity pay would have been payable to the member in the circumstances mentioned in subsection (2), then, while that position exists, there is payable, in respect of each of the orphans, instead of the pensions described in subsection (2) or the pension described in subsection (2AA) (as the case may be), a pension at the rate calculated by dividing the number of orphans into the rate exceeded.

(3) Subject to subsection (4) and sections 47 and 75, pension under this section is payable to an eligible orphan, being the child of a member of the scheme who was a recipient member at the time of his death, as follows, pension at the rate of $5,000 per annum, as indexed in accordance with subsection 98B(5A), and additional pension at a rate equal to one - eighth of five - eighths of the rate at which retirement pay or invalidity pay was payable to the member immediately before his death or, if the member had commuted a portion of his retirement pay under section 24 or a portion of his invalidity pay under section 32A, at a rate equal to one - eighth of five - eighths of the rate at which retirement pay or invalidity pay, as the case may be, would have been payable to the member immediately before his death if he had not so commuted a portion of his retirement pay or invalidity pay, as the case may be.

(4) Where the number of eligible orphans in respect of whom pensions are payable under subsection (3) because of the death of the recipient member is such that the sum of the rates of all the pensions so payable exceeds the rate of the retirement or invalidity pay used for the calculation of the orphans' pensions under that subsection, then, while that position exists, there is payable, in respect of each of the orphans, instead of the pensions described in subsection (3), a pension at the rate calculated by dividing the number of orphans into the rate exceeded.