Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The deferred benefits applicable under this Division to or in respect of a person who is a member of the scheme shall, subject to this Division, be benefits of the same nature, and payable in the same circumstances, on the same conditions and, upon his death, to the same persons (if any), as the benefits that would have been payable to or in respect of the person under this Act if he had not retired from the Defence Force and had not made the election by virtue of which the deferred benefits became applicable to or in respect of him and:

(a) if paragraph 78(2)(a) applies to him:

(i) he had retired from the Defence Force on whichever date specified in subparagraph (i) or (ii) of that paragraph is applicable to him; and

(ii) in a case where his total period of effective service is less than 20 years--his total period of such service were 20 years;

(b) if paragraph 78(2)(b) applies in relation to him--he had, immediately before his death become entitled, by virtue of this subsection, to retirement pay under section 23;

(c) if paragraph 78(2)(c) applies to him--he had retired from the Defence Force on whichever date specified in that paragraph is applicable to him;

(d) if paragraph 78(2)(d) applies to him--he had retired from the Defence Force on the date specified in that paragraph;

(e) if paragraph 78(2)(e) applies to him and his total period of effective service is less than 15 years--his total period of such service were 15 years; and

(f) if paragraph 78(2)(e) applies to him and he had not attained the age of 60 years before he ceased to be an eligible member of the Defence Force--he had retired from the Defence Force on the date on which he attained that age.

(2) Subject to subsection 78(3), no period after the actual retirement of a member of the scheme from the Defence Force shall, by virtue of the operation of subsection (1), be treated as a period of effective service in relation to him for the purposes of this Act.

(3) Where, by virtue of the operation of subsection (1), a person becomes entitled to retirement pay under section 23, then, subject to subsection (3A), the rate at which that retirement pay is payable to the person is, in lieu of the rate provided for in that section, an amount per annum equal to 1.75% of the product of the number of complete years included in his total period of effective service and the amount of the annual rate of pay applicable to him immediately before his actual retirement.

(3A) If:

(a) because of subsection (1), a person becomes entitled to retirement pay under section 23; and

(b) the person's surcharge deduction amount exceeds the amount of the person's productivity superannuation benefit;

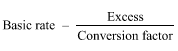

the rate at which retirement pay is payable to the person is (instead of the rate provided for in section 23) an amount per annum worked out by using the formula:

where:

"basic rate" means the amount per annum referred to in subsection (3).

"conversion factor" is the factor that is applicable to the person under the determination made by CSC under section 124A.

"excess" means the amount by which the person's surcharge deduction amount exceeds the amount of the person's productivity superannuation benefit.

Note: For productivity superannuation benefit see subsection 3(1).

(4) Where:

(a) by virtue of subsection (1), a person becomes entitled to retirement pay under section 23;

(b) he is a person to whom paragraph 78(2)(d) applies;

(c) he was, immediately before his actual retirement, an officer; and

(d) at the time he becomes entitled to retirement pay, he had not attained the age that, having regard to his rank immediately before his actual retirement, is his notional retiring age as ascertained under Schedule 2;

then, subject to subsection (4A), the rate at which retirement pay is payable to him is the amount per annum that, but for this subsection, would be payable under subsection (3) of this section, reduced by 3% of that amount for each year included in the period equal to the difference between his age on his birthday last preceding the time when he becomes entitled to retirement pay and his notional retiring age as ascertained under Schedule 2.

(4A) If:

(a) because of subsection (1), a person becomes entitled to retirement pay under section 23; and

(b) paragraphs 4(b), (c) and (d) apply to a person; and

(c) the person's surcharge deduction amount exceeds the amount of the person's productivity superannuation benefit;

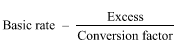

the rate at which retirement pay is payable to the person is the amount per annum worked out by using the formula:

where:

"basic rate" means the amount per annum referred to in subsection (4).

"conversion factor" is the factor that is applicable to the person under the determination made by CSC under section 124A.

"excess" means the amount by which the person's surcharge deduction amount exceeds the amount of the person's productivity superannuation benefit.

(5) Where, upon the death of a person to whom paragraph 78(2)(b) applies, a person becomes entitled, by virtue of subsection (1) of this section, to spouse pension under section 39 or to child's pension under subsection 42(3) or subsection 43(3), then, for the purposes of section 39, subsection 42(3) or subsection 43(3), as the case may be, the person in relation to whom paragraph 78(2)(b) applies shall be deemed to have been in receipt of retirement pay immediately before his death at such rate as would have been payable to him if he were a person to whom paragraph 78(2)(a) applies.

(6) A reference in this section to the actual retirement of a person from the Defence Force, being a person who has made an election under section 76, shall be read as a reference to the retirement by virtue of which, upon his ceasing to be an eligible member of the Defence Force, he made the election.