Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncrease

(1) Subject to this Part, a pensioner is entitled, at the commencement of a prescribed half - year, to an increase in the pensioner's relevant rate of pension benefit in relation to that half - year. The increase is worked out by using:

(a) if the pensioner is aged 55 or older at the commencement of the prescribed half - year--the 55 - plus percentage; and

(b) otherwise--the prescribed percentage.

Increase by prescribed percentage

(2) The increase provided for by subsection (1), for a pensioner aged under 55 at the commencement of a prescribed half - year (the relevant prescribed half - year ), is the prescribed percentage of the pensioner's relevant rate of pension benefit in relation to the relevant prescribed half - year.

Prescribed percentage

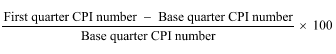

(3) Subject to subsection (3A), the prescribed percentage for a prescribed half - year is:

where:

"base quarter CPI number" means the CPI number in respect of the March quarter or September quarter that:

(a) is before the first quarter of the half - year immediately before the prescribed half - year; and

(b) has the highest CPI number.

"CPI number" , in respect of a quarter, means the All Groups Consumer Price Index number that is the weighted average of the 8 capital cities and is published by the Statistician in respect of the quarter.

"first quarter CPI number" means the CPI number in respect of the first quarter of the half - year immediately before the prescribed half - year.

(3A) If the first quarter CPI number is equal to or less than the base quarter CPI number, then, for the relevant prescribed half - year:

(a) the prescribed percentage is taken to be 0%; and

(b) subsection (1) does not provide for an increase for a pensioner aged under 55 at the commencement of that half - year.

Relevant rate of pension benefit

(4) The relevant rate of a pensioner's pension benefit, in relation to a relevant prescribed half - year, is:

(a) in relation to a pensioner who is a recipient member to whom invalidity pay is payable--the rate at which invalidity pay was payable to the pensioner immediately before the commencement of the relevant prescribed half - year or, if a notional rate of invalidity pay is applicable to the pensioner in accordance with subsection (5) and the notional rate of invalidity pay so applicable immediately before the commencement of that half - year is lower than the rate at which invalidity pay was payable to the pensioner immediately before the commencement of that half - year, the notional rate of invalidity pay so applicable immediately before the commencement of that half - year;

(ab) in relation to a pensioner who is the spouse of a recipient member to whom, immediately before his death, invalidity pay was payable--a rate equal to five - eighths of the rate at which invalidity pay would have been payable to the deceased recipient member immediately before the commencement of the relevant prescribed half - year if he had not died or, if a notional rate of invalidity pay is applicable to the deceased recipient member in accordance with subsection (5) and the notional rate of invalidity pay so applicable immediately before the commencement of that half - year is lower than the rate at which invalidity pay would have been payable to the deceased recipient member before the commencement of that half - year if he had not died, a rate equal to five - eighths of the notional rate of invalidity pay so applicable immediately before the commencement of that half - year;

(ac) in relation to a pensioner who is the spouse of a person who, immediately before his death, was a contributing member--the rate at which pension benefit was payable to the pensioner immediately before the commencement of the relevant prescribed half - year;

(b) in relation to a pensioner who is a recipient member to whom retirement pay is payable--the rate at which retirement pay was payable to the pensioner immediately before the commencement of the relevant prescribed half - year or, if a notional rate of retirement pay is applicable to the pensioner in accordance with subsection (5) and the notional rate of retirement pay so applicable immediately before the commencement of that half - year is lower than the rate at which retirement pay was payable to the pensioner immediately before the commencement of that half - year, the notional rate of retirement pay so applicable immediately before the commencement of that half - year;

(c) in relation to a pensioner who is the spouse of a recipient member to whom, immediately before his death, retirement pay was payable--a rate equal to five - eighths of the rate at which retirement pay would have been payable to the deceased recipient member immediately before the commencement of the relevant prescribed half - year if he had not died or, if a notional rate of retirement pay is applicable to the deceased recipient member in accordance with subsection (5) and the notional rate of retirement pay so applicable immediately before the commencement of that half - year is lower than the rate at which retirement pay would have been payable to the deceased recipient member immediately before the commencement of that half - year if he had not died, a rate equal to five - eighths of the notional rate of retirement pay so applicable immediately before the commencement of that half - year;

(d) in relation to a pensioner to whom subsection 42(2) or 43(2) applies--the rate at which pension benefit referred to as additional pension was payable immediately before the commencement of the relevant prescribed half - year to the pensioner under whichever of those subsections is applicable;

(e) in relation to a pensioner to whom subsection 42(3) or 43(3) applies and who is the child of a deceased recipient member--a rate equal to such proportion as, under subsection (6), is the appropriate proportion of the rate at which retirement pay or invalidity pay, as the case may be, would, immediately before the commencement of the relevant prescribed half - year, have been payable to the deceased recipient member if he had not died or, if a notional rate of retirement pay or invalidity pay, as the case may be, is applicable to the deceased recipient member in accordance with subsection (5) and the notional rate of retirement pay or invalidity pay, as the case may be, so applicable immediately before the commencement of that half - year is lower than the rate at which retirement pay or invalidity pay, as the case may be, would have been payable to the deceased recipient member immediately before the commencement of that half - year if he had not died, a rate equal to such proportion as, under subsection (6), is the appropriate proportion of the notional rate of retirement pay or invalidity pay, as the case may be, so applicable immediately before the commencement of that half - year; or

(f) in relation to a pensioner to whom a pension benefit is payable under section 43A or 44--a rate determined by CSC, being the rate which, in the opinion of CSC, is the appropriate rate to be regarded as the relevant rate of pension in relation to the pensioner for the relevant prescribed half - year.

(4A) For the purposes of paragraphs (4)(ab), (c) and (e), in working out the rate at which invalidity pay or retirement pay would have been payable to a deceased recipient member, work out any increases to which the member would have been entitled on or after the later of:

(a) 1 July 2014; and

(b) the day of the member's death;

using the pensioner's age at the time of the increase (not the age that the member would have been at that time, had the member not died).

(5) For the purposes of subsection (4):

(aa) a notional rate of invalidity pay is applicable to a recipient member if and only if that member:

(i) is a member of the scheme who:

(A) was retired after the commencement of section 32A; and

(B) on his retirement, was classified as Class C under section 30; and

(ii) has not elected under section 32A to commute a portion of his invalidity pay equal to or greater than 4 times the amount per annum of the invalidity pay to which he was entitled upon his retirement;

and the notional rate of invalidity pay applicable to the member at a particular time is the rate at which invalidity pay would have been payable to him at that time if he had immediately upon his retirement commuted a portion of his invalidity pay equal to 4 times the amount per annum of the invalidity pay to which he was entitled;

(ab) a notional rate of invalidity pay is applicable to a deceased recipient member if and only if that deceased member:

(i) was a member of the scheme who:

(A) was retired after the commencement of section 32A; and

(B) on his retirement, was classified as Class C under section 30; and

(ii) had not, before his death, elected under section 32A to commute a portion of his invalidity pay equal to or greater than 4 times the amount per annum of the invalidity pay to which he was entitled upon his retirement;

and the notional rate of invalidity pay applicable to the deceased member at a particular time is the rate at which invalidity pay would have been payable to him at that time if he had not died and if he had immediately upon his retirement commuted a portion of his invalidity pay equal to 4 times the amount per annum of the invalidity pay to which he was entitled;

(a) a notional rate of retirement pay is applicable to a recipient member if and only if that member has not elected under section 24 to commute a portion of his retirement pay equal to or greater than 4 times the amount per annum of the retirement pay to which he was entitled upon his retirement, and the notional rate of retirement pay applicable to the member at a particular time is the rate at which retirement pay would have been payable to him at that time if he had immediately upon his retirement commuted a portion of his retirement pay equal to 4 times the amount per annum of the retirement pay to which he was entitled; and

(b) a notional rate of retirement pay is applicable to a deceased recipient member if and only if that deceased member had not, before his death, elected under section 24 to commute a portion of his retirement pay equal to or greater than 4 times the amount per annum of the retirement pay to which he was entitled upon his retirement and the notional rate of retirement pay applicable to the deceased member at a particular time is the rate at which retirement pay would have been payable to him at that time if he had not died and if he had immediately upon his retirement commuted a portion of his retirement pay equal to 4 times the amount per annum of the retirement pay to which he was entitled.

Increases in children's pensions

(5A) If the all groups consumer price index number for the weighted average of the 8 capital cities published by the Statistician in respect of the first quarter of the half - year immediately preceding a prescribed half - year exceeds the highest all groups consumer price index number for the weighted average of the 8 capital cities published by the Statistician in respect of the first quarter of any earlier half - year, not being a half - year earlier than the half - year that commenced on 1 July 1985, sections 42 and 43 have effect, in that prescribed half - year, as if:

(a) for the amount of $312 specified in subsections 42(2) and (3); and

(b) for the amount of $5,000 specified in subsections 43(2) and (3);

there were substituted, on the first day of that prescribed half - year, an amount calculated by adding to the existing amount the prescribed percentage of the existing amount.

(5B) For the purposes of the application of subsection (5A) to a provision specified in that subsection, the existing amount is:

(a) in relation to the prescribed half - year that commenced on 1 July 2001--the amount that was the existing amount in relation to that provision, as calculated under this section immediately before the commencement of item 14 of Schedule 3 to the Superannuation Legislation Amendment (Indexation) Act 2001 ; and

(b) in relation to any subsequent prescribed half - year--the amount that, because of a previous application or previous applications of subsection (5A), is taken to have been substituted, or last substituted, for the amount specified in that provision.

(6) For the purposes of subsection (4), the appropriate proportion is:

(a) in the case of a pension benefit payable under subsection 42(3)--one - sixth of five - eighths; and

(b) in the case of a pension benefit payable under subsection 43(3)--one - eighth of five - eighths.

Death of recipient member on 30 June or 31 December

(7) Where, by reason of the death of a recipient member on 30 June or 31 December (as the case requires) immediately preceding the commencement of a prescribed half - year, a pension benefit becomes payable, on the following day, to another person, that other person shall be entitled, at the commencement of that prescribed half - year, to such an increase in the rate of that pension benefit as he would have been entitled to had the pension benefit become payable to him on that 30 June or 31 December (as the case requires).