Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsOverview

(1) This section explains how to work out whether an employee has a reportable fringe benefits amount for a year of income in respect of the employee's employment by an employer described in section 57A or 58, and the size of that amount, if:

(a) a benefit is provided in respect of the employee's employment by the employer; and

(b) the benefit is an exempt benefit because of one of those sections; and

(c) apart from those sections and section 8A, the benefit would be a fringe benefit relating to the employee, the employer and the year of tax ending on 31 March in the employee's year of income.

Note: Section 57A deals with public benevolent institutions, certain registered charities, employers of employees connected with certain hospitals and employers of employees connected with public ambulance services. Section 58 deals with persons employed by government bodies, religious institutions and non - profit companies to care for the elderly or disadvantaged. Section 8A exempts car benefits for zero or low emissions vehicles.

Does an employee have a reportable fringe benefits amount?

(2) The employee has a reportable fringe benefits amount (worked out under subsection (4)) for the year of income in respect of the employee's employment by the employer if the sum of the following is more than $2,000:

(a) the employee's individual fringe benefits amount (if any) for the year of tax ending on 31 March in the year of income in respect of the employee's employment by the employer;

(b) the employee's individual quasi - fringe benefits amount for the year of tax ending on 31 March in the year of income in respect of the employee's employment by the employer.

Note: An employee of an employer described in section 57A will not have an individual fringe benefits amount from that employer, because all benefits provided in respect of employment by that employer are exempt benefits.

What is the employee's individual quasi - fringe benefits amount ?

(3) The employee's individual quasi - fringe benefits amount is the amount that would be the employee's individual fringe benefits amount for the year of tax in respect of the employee's employment by the employer if:

(a) each benefit described in subsection (1) in relation to the employee, employer and year of tax were a fringe benefit; and

(b) there were no other fringe benefits relating to the employee, the employer and the year of tax.

Note: Section 5E explains how to work out the employee's individual fringe benefits amount for the year of tax.

Size of the reportable fringe benefits amount

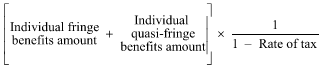

(4) The reportable fringe benefits amount is the amount worked out using the formula:

where:

"individual fringe benefits amount" is the employee's individual fringe benefits amount (if any) for the year of tax in respect of the employee's employment by the employer.

"individual quasi-fringe benefits amount" is the employee's individual quasi - fringe benefits amount for the year of tax in respect of the employee's employment by the employer.

"rate of tax" is the rate of tax for the year of tax.

Relationship with section 135P

(5) This section has effect despite section 135P.