Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsRecipient may make recurring fringe benefit declaration

(1) If a person is provided with a benefit (the declaration benefit ), the person may make a recurring fringe benefit declaration in relation to the declaration benefit.

Expense payment fringe benefits covered by declaration

(2) If the recurring fringe benefit declaration covers another benefit (the later benefit ) that is an expense payment fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 24(1)(e) in respect of the recipients expenditure for that benefit; and

(b) the gross deduction in paragraph 24(1)(b) in relation to the later benefit is taken to be the amount worked out using the formula:

![]()

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 24(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration benefit as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 24(1)(ba).

Property fringe benefits covered by declaration

(3) If the recurring fringe benefit declaration covers another benefit (the later benefit ) that is a property fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 44(1)(c) in respect of the recipients property for that benefit; and

(b) the gross deduction in paragraph 44(1)(b) in relation to the later benefit is taken to be the amount worked out using the formula:

![]()

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 44(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 44(1)(ba).

Residual fringe benefits covered by declaration

(4) If the recurring fringe benefit declaration covers another benefit (the later benefit ) that is a residual fringe benefit:

(a) the recurring fringe benefit declaration is taken to have been made under paragraph 52(1)(c) in respect of the recipients benefit for that benefit; and

(b) the gross deduction in paragraph 52(1)(b) in relation to the later benefit is taken to be the amount worked out using the formula:

![]()

where:

Gross expenditure (later benefit) is the gross expenditure mentioned in paragraph 52(1)(b) in relation to the later benefit.

Deductible proportion of declaration benefit is the deductible proportion of the declaration benefit as worked out under subsection (9).

Note: The gross deduction is used as component GD in the formula in paragraph 52(1)(ba).

(5) The declaration must be in a form approved in writing by the Commissioner and be made, and given to the employer, by the declaration date for the employer for the FBT year in which the declaration benefit is provided.

What benefit declaration covers

(6) The declaration covers all benefits that are identical to the declaration benefit received by the person before the earlier of:

(a) the time when the person revokes the declaration; and

(b) the end of 5 years starting when the declaration is made.

(7) The declaration does not cover a benefit if the deductible proportion of the benefit is more than 10 percentage points less than the deductible proportion of the declaration benefit.

(8) If a taxpayer makes a declaration for a benefit that is an identical benefit to a benefit covered by an earlier declaration, the earlier declaration is revoked.

Meaning of deductible proportion

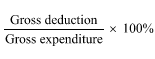

(9) The deductible proportion of a benefit is the percentage worked out using the formula:

where:

"gross deduction" means the gross deduction mentioned in whichever of paragraph 24(1)(b), 44(1)(b) or 52(1)(b) applied to the benefit.

"gross expenditure" means the gross expenditure mentioned in whichever of paragraph 24(1)(b), 44(1)(b) or 52(1)(b) applied to the benefit.

Meaning of identical

(10) A benefit is identical to another benefit if the benefits are the same in all respects except for any differences:

(a) that are minimal or insignificant; or

(b) that relate to the value of the benefits; or

(c) in the deductible proportion of the benefits.