Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) If the employer elects that this Subdivision applies for an FBT year then, despite any other provision of this Act, the taxable value of meal entertainment fringe benefits for the employer for the FBT year is worked out using the formula:

![]()

Note: This means that the employer's aggregate fringe benefits amount (see section 5C) for the FBT year will include a proportion of the expenses incurred by the employer for the provision of meal entertainment for all persons in the FBT year. The proportion is worked out on the basis of the 12 week register.

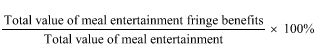

(2) The register percentage is the percentage worked out using the formula:

where:

"total value of meal entertainment fringe benefits" means the total value of meal entertainment fringe benefits that are provided by the employer in the 12 week period covered by the employer's register.

"total value of meal entertainment" means the total value of meal entertainment provided by the employer during the 12 week period covered by the register.

(3) The total meal entertainment expenditure is the total of expenses incurred by the employer in providing meal entertainment for the FBT year.