Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Where:

(a) the recipient of any of the following fringe benefits in relation to an employer in relation to a year of tax (in this section called the benefit year of tax ) is an employee of the employer:

(i) a property fringe benefit where the recipients property is remote area residential property;

(ii) a property fringe benefit where the recipients property is a remote area residential property option fee;

(iii) an expense payment fringe benefit where the recipients expenditure is in respect of remote area residential property;

(b) in the case of a property fringe benefit where the recipients property is remote area residential property--at or before the provision time, the employee entered into a recognised remote area housing obligation restricting the disposal of the estate or interest concerned;

(c) in the case of an expense payment fringe benefit--at or before the time when the employee acquired the estate or interest concerned, the employee entered into a recognised remote area housing obligation restricting the disposal of the estate or interest concerned; and

(d) in all cases--the period (in this section called the overall amortisation period ) commencing at whichever of the following times is applicable:

(i) if subparagraph (a)(i) or (ii) applies--the provision time;

(ii) if subparagraph (a)(iii) applies--the time when the recipients expenditure was incurred;

(which time is in this section called the benefit time ) and ending at the earliest of the following later times:

(iii) the time when the employee ceases or first ceases to be subject to the recognised remote area housing obligation referred to in paragraph (b) or (c) of this subsection or in paragraph 142(2A)(e), as the case requires;

(iv) the time when the employee ceases or first ceases to be employed by the employer;

(v) the time when the employee ceases or first ceases to occupy or use the dwelling concerned as his or her usual place of residence;

(vi) the time of the death of the employee;

(vii) the end of the period of 7 years after the benefit time;

commences and ends in different years of tax;

the fringe benefit is an amortised fringe benefit.

(2) The notional amortisation period in relation to the amortised fringe benefit is the period commencing at the benefit time and ending at the earlier of the following times:

(a) the end of the period specified in the contract to which the recognised remote area housing obligation concerned relates, being the period during which the employee is to be subject to that obligation;

(b) the end of the period of 7 years after the benefit time.

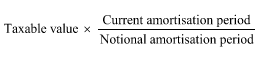

(3) If the overall amortisation period has not come to an end before the end of a particular year of tax (in this subsection called the current year of tax ), the amortised amount, in relation to the current year of tax, of the amortised fringe benefit is the amount calculated in accordance with the formula:

where:

"Taxable value" is the taxable value, in relation to the benefit year of tax, of the fringe benefit.

"Current amortisation period" is the whole number of months (or part months) in the current year of tax that are included in the notional amortisation period.

"Notional amortisation period" is the whole number of months (or part months) that are included in the notional amortisation period.

(4) If the overall amortisation period comes to an end during a particular year of tax (in this subsection called the current year of tax ), the amortised amount, in relation to the current year of tax, of the amortised fringe benefit is the amount calculated in accordance with the formula:

![]()

where:

"Taxable value" is the taxable value, in relation to the benefit year of tax, of the fringe benefit.

"Previously amortised amounts" is the sum of the amortised amounts, in relation to each year of tax preceding the current year of tax, of the fringe benefit.

(5) Where the recipients expenditure in relation to an expense payment fringe benefit was incurred before 1 July 1986, paragraph (1)(d) applies in relation to the fringe benefit as if the recipients expenditure had been incurred on 1 July 1986.

(6) Where the following paragraphs apply in relation to a fringe benefit in relation to an employer in relation to a year of tax:

(a) the fringe benefit would have been an amortised fringe benefit if the reference in subsection 142(2D) to 5 years were a reference to 7 years;

(b) the benefit time occurred before 31 August 1988;

the employer is eligible for extended amortisation treatment.

(7) Where:

(a) an employer is eligible for extended amortisation treatment; and

(b) a fringe benefit in relation to the employer in relation to a year of tax would have been an amortised fringe benefit if the reference in subsection 142(2D) to a contractual obligation were a reference to a contractual obligation entered into before the end of the period of 6 months after the commencement of this subsection;

the following provisions have effect:

(c) a reference in subsection (3) or (4) of this section to the overall amortisation period in relation to the fringe benefit is to be read as a reference to the period that would have been the overall amortisation period in relation to the fringe benefit if the reference in subparagraph (1)(d)(vii) of this section to 7 years were a reference to 15 years;

(d) for the purpose of determining the notional amortisation period in relation to the fringe benefit, the reference in paragraph (2)(b) of this section to 7 years is to be read as a reference to 15 years.