Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsAct No. 44 of 1999 as amended

This compilation was prepared on 23 January 2001

[This Act was amended by Acts Nos. 24 and 160 of 2000]

Amendments from Act No. 24 of 2000

[Schedule 11 (item 4) amended section 3

The amendment commenced on 17 June 1999]

Amendments from Act No. 160 of 2000

[Schedule 4 (item 4) amended subsection 3(2)(e);

Schedule 4 (item 5) repealed subsections 3(14) and (15)

Schedule 4 (items 4 and 5) commenced on 18 January 2001]

Prepared by the Office of Legislative Drafting,

Attorney-General's Department, Canberra

Contents

1 Short title...................................

2 Definitions..................................

3 Commencement...............................

4 Schedule(s)..................................

Schedule 1--Amendment of the Australian Prudential Regulation Authority Act 1998

Schedule 2--Amendment of the Banking Act 1959

Schedule 3--Amendment of the Corporations Law

Part 1--Transfer of financial institutions and friendly societies

Part 2--Consequential amendments

Part 3--Other minor amendments

Schedule 4--Amendment of the Life Insurance Act 1995

Schedule 5--Amendment of the Reserve Bank Act 1959

Schedule 6--Miscellaneous amendments

Australian Securities and Investments Commission Act 1989

Authorised Deposit-taking Institutions Supervisory Levy Imposition Act 1998

Authorised Non-operating Holding Companies Supervisory Levy Imposition Act 1998

Financial Laws Amendment Act 1997

Financial Sector Reform (Amendments and Transitional Provisions) Act 1998

Financial Sector Reform (Consequential Amendments) Act 1998

General Insurance Supervisory Levy Imposition Act 1998

High Court of Australia Act 1979

Life Insurance Supervisory Levy Imposition Act 1998

Retirement Savings Account Providers Supervisory Levy Imposition Act 1998

Superannuation Supervisory Levy Imposition Act 1998

Schedule 7--Consequential amendment of Acts

Child Support (Registration and Collection) Act 1988

Commonwealth Inscribed Stock Act 1911

Debits Tax Administration Act 1982

Defence Force Retirement and Death Benefits Act 1973

Farm Household Support Act 1992

Financial Corporations Act 1974

Financial Sector (Shareholdings) Act 1998

Financial Transaction Reports Act 1988

Fringe Benefits Tax Assessment Act 1986

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Insurance (Agents and Brokers) Act 1984

Life Insurance (Conduct and Disclosure) Act 1999

Military Superannuation and Benefits Act 1991

Petroleum Resource Rent Tax Assessment Act 1987

Retirement Savings Accounts Act 1997

States Grants (Housing) Act 1971

Superannuation Contributions Tax (Assessment and Collection) Act 1997

Superannuation Guarantee (Administration) Act 1992

Taxation Administration Act 1953

Termination Payments Tax (Assessment and Collection) Act 1997

Veterans' Entitlements Act 1986

Wool Tax (Administration) Act 1964

Schedule 8--Transitional, saving and application provisions

Part 1--Transitional provisions relating to transfer from State and Territory regulatory regimes

Division 1--Interpretation

Division 2--Transitional provisions relating to staff

Division 3--Transfer of assets and liabilities

Division 4--Transitional provisions relating to operation of the Banking Act 1959

Division 5--Transitional provisions relating to operation of the Life Insurance Act 1995

Division 6--Other transitional provisions

Part 2--Transitional provisions relating to other amendments

Part 3--Regulations

This Act may be cited as the Financial Sector Reform (Amendments and Transitional Provisions) Act (No. 1) 1999.

In this Act:

Corporations Law means the Corporations Law set out in section 82 of the Corporations Act 1989 .

transfer date means the date that is, under subsection 3(16), specified as the transfer date for the purposes of this Act.

(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) The following provisions commence on the transfer date:

(a) item 4 of Schedule 1 (the commencement of the rest of the items in this Schedule is covered by subsection (1));

(b) subject to subsections (3), (4) and (5), Schedule 3, other than items 1, 33, 34, 45, 46 and 63 (the commencement of those items is covered by subsection (1));

(c) Schedule 4;

(d) item 26 of Schedule 6;

(e) subject to subsection (12), Schedule 7, other than items 43, 44, 118, 205 and 207 (the commencement of those items is covered by subsections (10), (11) and (13)).

(3) If item 1 of Schedule 3 commences before the commencement of Schedule 1 to the Corporate Law Economic Reform Program Act 1999, item 60 of Schedule 3 commences on the transfer date and item 61 of Schedule 3 commences immediately after the commencement of Schedule 1 to that Act.

(4) If item 1 of Schedule 3 commences on the commencement of Schedule 1 to the Corporate Law Economic Reform Program Act 1999, item 60 of Schedule 3 does not commence and item 61 of Schedule 3 commences immediately after the commencement of Schedule 1 to that Act.

(5) If item 1 of Schedule 3 commences after the commencement of Schedule 1 to the Corporate Law Economic Reform Program Act 1999, item 60 of Schedule 3 does not commence and item 61 of Schedule 3 commences on the transfer date.

(6) Item 3 of Schedule 6 commences on a day to be fixed by Proclamation.

(7) Item 6 of Schedule 6 is taken to have commenced on the commencement of Schedule 12 to the Financial Laws Amendment Act 1997.

(7A) Items 8, 9, 11 and 12 of Schedule 6 are taken to have commenced immediately after the Financial Sector Reform (Amendments and Transitional Provisions) Act 1998 received the Royal Assent.

(8) Item 10 of Schedule 6 is taken to have commenced immediately before the commencement of Part 1 of Schedule 13 to the Financial Sector Reform (Amendments and Transitional Provisions) Act 1998.

(9) Items 18 and 19 of Schedule 6 are taken to have commenced immediately before the commencement of the Australian Prudential Regulation Authority Act 1998.

(10) Items 43 and 44 of Schedule 7 commence on the later of:

(a) the day fixed for the commencement of the section amended by those items, immediately after the commencement of that section; and

(b) the transfer date.

(11) Item 118 of Schedule 7 commences on the later of:

(a) immediately after the commencement of section 17 of the Life Insurance (Conduct and Disclosure) Act 1999; and

(b) the transfer date.

(12) If item 7 of Schedule 2 to the Assistance for Carers Legislation Amendment Act 1999 commences on or before the transfer date, item 206 of Schedule 7 to this Act does not commence.

(13) Items 205 and 207 of Schedule 7 commence on the later of:

(a) immediately after the commencement of item 7 of Schedule 2 to the Assistance for Carers Legislation Amendment Act 1999;

(b) the transfer date.

(16) The Governor -General may, by Proclamation published in the Gazette, specify the date that is to be the transfer date for the purposes of this Act.

Subject to section 3, the Corporations Law and each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 Subsection 3(1)

Insert:

prudential regulation or advice services means services of either or both of the following kinds:

(a) services consisting of APRA performing a role in the prudential regulation or supervision of entities;

(b) services consisting of APRA providing advice relating to the prudential regulation or supervision of entities.

2 Section 9

Repeal the section, substitute:

9 APRA's functions

APRA has the following functions:

(a) the functions conferred on it by or under this Act or any other law of the Commonwealth;

(b) the functions conferred on it by or under any law of a State or Territory in accordance with subsection 9A(1);

(c) the function of providing prudential regulation or advice services under agreements entered into in accordance with subsection 9A(2).

9A Conferral of functions by State or Territory laws or by agreements

Conferral of functions by or under State or Territory laws

(1) APRA may have functions or powers conferred on it by or under a law of a State or Territory if the conferral of the functions or powers is in accordance with:

(a) provisions of an agreement entered into by the Commonwealth and the State or Territory, being provisions approved by the Minister for the purposes of this subsection; or

(b) an approval given by the Minister for the purposes of this subsection.

APRA has the functions and powers so conferred by that law.

Agreements for performance of prudential regulation or advice services

(2) APRA may, with the approval of the Minister, enter into an agreement with a State, Territory or other person under which APRA is, for a fee, to provide prudential regulation or advice services (whether in Australia or a foreign country). The agreement is only effective for the purposes of this Act to the extent to which APRA's provision of the services is for a purpose or purposes within the Commonwealth's legislative power.

Subsection (2) agreement may deal with liabilities between the parties

(3) An agreement entered into in accordance with subsection (2) may make provision in relation to the circumstances in which, and the extent to which, one party to the agreement is liable to the other party to the agreement in respect of matters arising under or out of the agreement.

Delegation of Minister's power to approve subsection (2) agreement

(4) The Minister may, in writing, delegate the power under subsection (2) to approve the entering into of agreements to a person holding or performing the duties of a Senior Executive Service office in the Department.

3 After subsection 51(1)

Insert:

(1A) Subsection (1) does not apply to a fee payable to APRA under an agreement entered into in accordance with subsection 9A(2).

4 Subsection 56(1) (after paragraph (c) of the definition of Act covered by this section)

Insert:

(ca) the Financial Sector (Transfers of Business) Act 1999;

5 Paragraph 56(5)(a)

Omit "or any other agency (including foreign agencies) specified in the regulations", substitute ", or any other agency (including foreign agencies) specified in the regulations,".

6 Paragraph 56(5)(b)

Omit "if the disclosure".

7 Subsections 57(1) and (2)

Omit "or an agent or other person carrying on any business of APRA", substitute "or an agent of APRA, a Board member or an APRA staff member,".

8 Subsection 57(3)

After "subsection", insert "(1) or".

9 Section 58

Repeal the section, substitute:

58 Protection from liability

(1) Subject to subsection (2), APRA, a Board member, an APRA staff member, or an agent of APRA, a Board member or an APRA staff member, is not subject to any liability to any person in respect of anything done, or omitted to be done, in the exercise or performance, or the purported exercise or performance, of powers, functions or duties conferred or imposed on APRA, the Board, a Board member or an APRA staff member by or under:

(a) this Act or another law of the Commonwealth; or

(b) a law of a State or Territory referred to in paragraph 9(b); or

(c) subject to subsection (3), an agreement referred to in paragraph 9(c).

(2) Subsection (1) does not apply to an act or omission in bad faith.

(3) Subsection (1), as it applies in relation to powers, functions or duties conferred or imposed by an agreement referred to in paragraph 9(c), has effect subject to provisions of the agreement referred to in subsection 9A(3) (which allows the agreement to deal with liabilities as between the parties).

1 Subsection 5(1) (definition of bank)

Repeal the definition.

2 Subsection 5(1) (definition of industry liquidity contract)

Repeal the definition.

3 Subsection 5(1)

Insert:

industry support contract means a contract under which emergency financial support is to be provided by parties to the contract to any ADI that is a party to the contract if a specified event occurs. The contract may also deal with matters associated with the provision of the financial support.

4 After section 6A

Insert in Part I:

6B Application of Criminal Code

The Criminal Code applies to all offences against this Act.

5 Sections 7 and 8

Repeal the sections, substitute:

7 Person other than a body corporate must not carry on banking business

(1) A person is guilty of an offence if:

(a) the person carries on any banking business in Australia; and

(b) the person is not a body corporate; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 200 penalty units.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

(2) An offence against subsection (1) is an indictable offence.

(3) If a person carries on banking business in circumstances that give rise to the person committing an offence against subsection (1), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

8 Only the Reserve Bank and bodies corporate that are ADIs may carry on banking business

(1) A body corporate is guilty of an offence if:

(a) the body corporate carries on any banking business in Australia; and

(b) the body corporate is not the Reserve Bank; and

(c) the body corporate is not an ADI; and

(d) there is no order in force under section 11 determining that this subsection does not apply to the body corporate.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(2) An offence against subsection (1) is an indictable offence.

(3) If a body corporate carries on banking business in circumstances that give rise to the body corporate committing an offence against subsection (1), the body corporate is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the body corporate committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

6 Subsection 9(6)

Repeal the subsection, substitute:

(6) An ADI is guilty of an offence if:

(a) it does, or fails to do, an act; and

(b) doing, or failing to do, the act results in a contravention of a condition of the ADI's authority; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(6A) An offence against subsection (6) is an indictable offence.

(6B) If an ADI does or fails to do an act in circumstances that give rise to the ADI committing an offence against subsection (6), the ADI is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the ADI committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

7 Subsection 10(3)

Repeal the subsection, substitute:

(3) An ADI is guilty of an offence if:

(a) an alteration is made to the Act, charter, deed of settlement, memorandum of association, articles of association, constitution or other document by which the ADI was constituted as a body corporate; and

(b) the ADI does not, within 3 months of the making of the alteration, give to APRA a written statement:

(i) that sets out particulars of the alteration; and

(ii) that is verified by a statutory declaration made by a senior officer of the ADI; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

8 Subsection 11(1)

Omit "or specified provisions", substitute "provisions (other than section 63) or specified provisions (other than section 63)".

9 Subsection 11(3)

Repeal the subsection, substitute:

(3) A person is guilty of an offence if:

(a) the person does, or fails to do, an act; and

(b) doing, or failing to do, the act results in a contravention of a condition to which an order under this section is subject (being an order that is in force and that applies to the person).

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(3A) An offence against subsection (3) is an indictable offence.

(3B) If a person does or fails to do an act in circumstances that give rise to the person committing an offence against subsection (3), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

10 Subsection 11AA(5)

Repeal the subsection, substitute:

(5) The body corporate is guilty of an offence if:

(a) it does, or fails to do, an act; and

(b) doing, or failing to do, the act results in a contravention of a condition of the authority; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the body corporate.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(5A) An offence against subsection (5) is an indictable offence.

(5B) If the body corporate does or fails to do an act in circumstances that give rise to the body corporate committing an offence against subsection (5), the body corporate is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the body corporate committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

11 Subsection 11AF(1)

Omit all the words from and including "by", substitute:

by:

(a) all ADIs; or

(b) all authorised NOHCs; or

(c) a specified class of ADIs or authorised NOHCs; or

(d) one or more specified ADIs or authorised NOHCs.

12 After subsection 11AF(1)

Insert:

(1A) A standard may impose different requirements to be complied with in different situations or in respect of different activities.

13 Subsection 11AF(4)

Omit "If APRA determines or varies a standard", substitute "Subject to subsection (6A), if APRA determines or varies a standard referred to in paragraph (1)(a), (b) or (c)".

14 After subsection 11AF(4)

Insert:

(4A) If APRA determines or varies a standard referred to in paragraph (1)(d) it must, as soon as practicable, give a copy of the standard, or of the variation, to the ADI or authorised NOHC, or to each ADI or authorised NOHC, to which the standard applies. Whenever APRA gives a copy of a standard, or of a variation, to an ADI or authorised NOHC, it must also provide a copy to the Treasurer.

15 Subsection 11AF(5)

After "revokes a standard", insert "referred to in paragraph (1)(a), (b) or (c)".

16 After subsection 11AF(5)

Insert:

(5A) If APRA revokes a standard referred to in paragraph (1)(d) it must, as soon as practicable, give notice of the revocation to the ADI or authorised NOHC, or to each ADI or authorised NOHC, to which the standard applied. Whenever APRA gives a notice of revocation to an ADI or authorised NOHC, it must also provide a copy to the Treasurer.

17 Subsection 11AF(6)

Before "APRA", insert "Subject to subsection (6A),".

18 After subsection 11AF(6)

Insert:

(6A) If APRA considers that a standard, or a variation of a standard, contains commercially sensitive information:

(a) APRA is not required to include that information in a notice published under subsection (4) or in the version of the standard that is available under subsection (6); but

(b) APRA may include some or all of that information in either or both of those things if APRA considers it appropriate to do so.

19 Subsection 11AF(7)

Omit ", (5) or (6)", substitute ", (4A), (5), (5A) or (6)".

20 Subdivision A of Division 1BA of Part II (heading)

Repeal the heading, substitute:

Subdivision A--Directions other than to enforce certified industry support contracts

21 After subsection 11CA(2)

Insert:

(2A) Without limiting the generality of subsection (2), a direction referred to in a paragraph of that subsection may:

(a) deal with some only of the matters referred to in that paragraph; or

(b) deal with a particular class or particular classes of those matters; or

(c) make different provision with respect to different matters or different classes of matters.

22 Subdivision B of Division 1BA of Part II (heading)

Repeal the heading, substitute:

Subdivision B--Directions to enforce certified industry support contracts

23 Section 11CB

Omit "liquidity", substitute "support".

Note: The heading to section 11CB is altered by omitting "liquidity" and substituting "support".

24 Subsections 11CC(1), (4) and (6)

Omit "liquidity", substitute "support".

Note: The heading to section 11CC is altered by omitting "liquidity" and substituting "support".

25 Subsections 11CG(1) and (2)

Repeal the subsections, substitute:

(1) An ADI or an authorised NOHC is guilty of an offence if:

(a) it does, or fails to do, an act; and

(b) doing, or failing to do, the act results in a contravention of a direction given to it under Subdivision A or Subdivision B; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI or authorised NOHC.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1A) If an ADI or an authorised NOHC does or fails to do an act in circumstances that give rise to the ADI or NOHC committing an offence against subsection (1), the ADI or NOHC is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the ADI or NOHC committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

(2) An officer of an ADI or an authorised NOHC is guilty of an offence if:

(a) the officer fails to take reasonable steps to ensure that the ADI or NOHC complies with a direction given to it under Subdivision A or Subdivision B; and

(b) the officer's duties include ensuring that the ADI or NOHC complies with the direction, or with a class of directions that includes the direction; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the officer.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(2A) If an officer of an ADI or an authorised NOHC fails to take reasonable steps to ensure that the ADI or NOHC complies with a direction given to it under Subdivision A or Subdivision B in circumstances that give rise to the officer committing an offence against subsection (2), the officer is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the officer committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

26 Subsection 11CG(3)

Repeal the subsection, substitute:

(3) In this section, officer has the meaning given by section 9 of the Corporations Law.

27 Subsection 11E(2)

Repeal the subsection, substitute:

(2) A foreign ADI is guilty of an offence if:

(a) it accepts a deposit from a person in Australia; and

(b) before accepting the deposit, the foreign ADI did not inform the person, in a manner approved by APRA, of the requirements of this Act to which the foreign ADI is not subject because of subsection (1); and

(c) there is no order in force under section 11 determining that this subsection does not apply to the foreign ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

28 Subsection 13(3)

Repeal the subsection, substitute:

Information to be supplied if ADI unable, or likely to be unable, to meet obligations

(3) An ADI is guilty of an offence if:

(a) the ADI considers that it is likely to become unable to meet its obligations, or that it is about to suspend payment; and

(b) the ADI does not immediately inform APRA of the situation; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(3A) An offence against subsection (3) is an indictable offence.

29 Subsection 13A(4)

Repeal the subsection, substitute:

(4) An ADI is guilty of an offence if:

(a) it does not hold assets (excluding goodwill) in Australia of a value that is equal to or greater than the total amount of its deposit liabilities in Australia; and

(b) APRA has not authorised the ADI to hold assets of a lesser value; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(5) An offence against subsection (4) is an indictable offence.

(6) If the circumstances relating to the asset holdings of an ADI are such that give rise to the ADI committing an offence against subsection (4), the ADI is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the ADI committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

30 Subsection 13B(1)

Repeal the subsection, substitute:

(1) A person appointed by APRA to investigate the affairs of an ADI under section 13 or 13A is entitled to have access to the books, accounts and documents of the ADI, and to require the ADI to give the person information or facilities to conduct the investigation.

(1A) An ADI is guilty of an offence if:

(a) APRA has appointed a person to investigate the affairs of the ADI under section 13 or 13A; and

(b) the ADI:

(i) does not give the person access to its books, accounts and documents; or

(ii) fails to comply with a requirement made under subsection (1) for the provision of information or facilities; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1B) If the ADI does or fails to do an act in circumstances that give rise to the ADI committing an offence against subsection (1A), the ADI is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the ADI committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

31 Subsection 14A(2) (second sentence and penalty)

Repeal the sentence and the penalty.

32 After subsection 14A(2)

Insert:

(2A) A person who is or has been an officer of an ADI is guilty of an offence if:

(a) there is an ADI statutory manager in relation to the ADI; and

(b) under subsection (2), the ADI statutory manager requires the person to give the ADI statutory manager information; and

(c) the person fails to comply with the requirement; and

(d) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: Imprisonment for 12 months.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: Subsection 4B(2) of the Crimes Act 1914 allows a court to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine a court may impose is worked out as provided in that subsection.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the maximum fine worked out as mentioned in Note 2.

33 Subsection 16B(1) (second sentence and penalty)

Repeal the sentence and the penalty.

34 After subsection 16B(1)

Insert:

(1A) A person who is or has been an auditor of an ADI, an authorised NOHC, or a subsidiary of an ADI or an authorised NOHC, is guilty of an offence if:

(a) under subsection (1), APRA requires the person to provide information; and

(b) the person fails to comply with the requirement; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: Imprisonment for 6 months.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: Subsection 4B(2) of the Crimes Act 1914 allows a court to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine a court may impose is worked out as provided in that subsection.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the maximum fine worked out as mentioned in Note 2.

35 Subsections 16B(2), (3) and (4)

Repeal the subsections, substitute:

Additional duty to give information about ADIs

(2) A person who is or has been an auditor of an ADI is guilty of an offence if:

(a) the person has reasonable grounds for believing that:

(i) the ADI is insolvent, or there is a significant risk that the ADI will become insolvent; or

(ii) the ADI has failed to comply with a prudential standard, a requirement under this Act or the regulations, a direction under Division 1BA of Part II or a condition of its section 9 authority; or

(iii) an existing or proposed state of affairs may materially prejudice the interests of depositors of the ADI; and

(b) the person does not inform APRA of the matter; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: Imprisonment for 6 months.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: Subsection 4B(2) of the Crimes Act 1914 allows a court to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine a court may impose is worked out as provided in that subsection.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the maximum fine worked out as mentioned in Note 2.

Additional duty to give information about authorised NOHCs

(3) A person who is or has been an auditor of an authorised NOHC is guilty of an offence if:

(a) the person has reasonable grounds for believing that:

(i) the NOHC is insolvent, or there is a significant risk that the NOHC will become insolvent; or

(ii) the NOHC has failed to comply with a prudential standard, a requirement under this Act or the regulations, a direction under Division 1BA of Part II or a condition of its NOHC authority; or

(iii) an existing or proposed state of affairs may materially prejudice the interests of depositors of any ADI that is a subsidiary of the NOHC; and

(b) the person does not inform APRA of the matter; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: Imprisonment for 6 months.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: Subsection 4B(2) of the Crimes Act 1914 allows a court to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine a court may impose is worked out as provided in that subsection.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the maximum fine worked out as mentioned in Note 2.

Additional duty to give information about subsidiaries of ADIs or authorised NOHCs

(4) A person who is or has been an auditor of a subsidiary of an ADI or an authorised NOHC (other than a subsidiary that itself is an ADI or an authorised NOHC) is guilty of an offence if:

(a) the person has reasonable grounds for believing that:

(i) the subsidiary is insolvent, or there is a significant risk that the subsidiary will become insolvent; or

(ii) the subsidiary has failed to comply with a requirement under this Act or the regulations; or

(iii) if the subsidiary is a subsidiary of an ADI--an existing or proposed state of affairs may materially prejudice the interests of depositors of the ADI; or

(iv) if the subsidiary is a subsidiary of an authorised NOHC--an existing or proposed state of affairs may materially prejudice the interests of depositors of any ADI that is a subsidiary of the NOHC; and

(b) the person does not inform APRA of the matter; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: Imprisonment for 6 months.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: Subsection 4B(2) of the Crimes Act 1914 allows a court to impose a fine instead of, or in addition to, a term of imprisonment. The maximum fine a court may impose is worked out as provided in that subsection.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the maximum fine worked out as mentioned in Note 2.

36 Subsection 23(1)

Repeal the subsection, substitute:

(1) An ADI is guilty of an offence if:

(a) it fails to comply with section 22 on any day; and

(b) that day is not a day to which subsection (2) applies; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

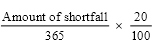

(1A) If an ADI is convicted of an offence against subsection (1), it is liable to a fixed penalty equal to the amount worked out using the formula:

37 Subsection 33(4)

Repeal the subsection, substitute:

(4) An ADI is guilty of an offence if:

(a) the ADI receives a notice under subsection (1); and

(b) the ADI does not comply with the notice within:

(i) 7 days after receiving the notice; or

(ii) if a longer period for compliance is specified by the Reserve Bank--the period so specified; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(4A) An offence against subsection (4) is an indictable offence.

(4B) If an ADI does or fails to do an act in circumstances that give rise to the ADI committing an offence against subsection (4), the ADI is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the ADI committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

38 Subsection 36(1)

Omit all the words after "ADIs".

39 After subsection 36(1)

Insert:

(1A) An ADI is guilty of an offence if:

(a) the Reserve Bank has made a determination under subsection (1) of a policy that applies to the ADI; and

(b) the ADI fails to follow the policy; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1B) An offence against subsection (1A) is an indictable offence.

40 Subsection 36(2)

Omit all the words after "ADIs".

41 After subsection 36(2)

Insert:

(2A) An ADI is guilty of an offence if:

(a) the Reserve Bank has given a direction under subsection (2) that applies to the ADI; and

(b) the ADI fails to comply with the directions; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(2B) An offence against subsection (2A) is an indictable offence.

Note: The heading to section 38A is altered by omitting "bank" and substituting "ADI".

42 At the end of section 41

Add:

(2) A person is guilty of an offence if:

(a) the person contravenes subsection (1); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of this subsection.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(3) An offence against subsection (2) is an indictable offence.

43 After subsection 42(1)

Insert:

(1A) A person is guilty of an offence if:

(a) the person fails to comply with subsection (1); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of this subsection.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

44 At the end of section 42

Add:

(3) A person is guilty of an offence if:

(a) the person fails to comply with subsection (2); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of this subsection.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

45 After subsection 45(1)

Insert:

(1A) A person is guilty of an offence if:

(a) the person fails to comply with subsection (1); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of this subsection.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1B) An offence against subsection (1A) is an indictable offence.

46 At the end of section 45

Add:

(4) A person is guilty of an offence if:

(a) the person fails to comply with subsection (3); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of this subsection.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(5) An offence against subsection (4) is an indictable offence.

47 At the end of section 46

Add:

(2) A person is guilty of an offence if:

(a) the person fails to comply with subsection (1); and

(b) there is no order in force under section 11 determining that subsection (1) does not apply to the person; and

(c) there is no instrument in force under section 48 exempting the person from the application of subsection (1).

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(3) An offence against subsection (2) is an indictable offence.

48 Part VI (heading)

Repeal the heading, substitute:

Part VI--Collection and publication of information about ADIs, authorised NOHCs and their subsidiaries

49 After subsection 61(2)

Insert:

(2A) A body corporate is guilty of an offence if:

(a) under subsection (1), APRA has appointed a person to investigate and report on prudential matters in relation to the body corporate; and

(b) the body corporate:

(i) does not give the person access to its books, accounts and documents; or

(ii) fails to comply with a requirement made under subsection (2) for the provision of information or facilities; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the body corporate.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(2B) If a body corporate does or fails to do an act in circumstances that give rise to the body corporate committing an offence against subsection (2A), the body corporate is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the body corporate committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

50 Subsection 62(1) (second sentence)

Repeal the sentence.

51 After subsection 62(1)

Insert:

(1A) A person is guilty of an offence if:

(a) under subsection (1), APRA requires the person to provide information; and

(b) the person fails to comply with the requirement; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1B) An offence against subsection (1A) is an indictable offence.

(1C) If a person fails to comply with a requirement under subsection (1) in circumstances that give rise to the person committing an offence against subsection (1A), the person is guilty of an offence against subsection (1A) in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

52 Subsection 63(1)

Repeal the subsection, substitute:

(1) An ADI, other than a foreign ADI, is guilty of an offence if:

(a) the ADI:

(i) enters into an arrangement or agreement for any sale or disposal of its business by amalgamation or otherwise, or for the carrying on of business in partnership with another ADI; or

(ii) effects a reconstruction of the ADI; and

(b) the Treasurer did not give prior consent in writing to the ADI entering into the arrangement or agreement or effecting the reconstruction.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1A) An offence against subsection (1) is an indictable offence.

53 Subsection 63(4)

Repeal the subsection, substitute:

(4) A foreign ADI is guilty of an offence if:

(a) there is a proposal that involves the ADI:

(i) entering into an arrangement or agreement for any sale or disposal of its business by amalgamation or otherwise, or for the carrying on of business in partnership with another ADI; or

(ii) effecting a reconstruction of the ADI; and

(b) the ADI does not give the Treasurer reasonable notice, in writing, of the proposal.

Maximum penalty: 200 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(4A) An offence against subsection (4) is an indictable offence.

54 Subsections 66(1) and (1A)

Repeal the subsections, substitute:

(1) A person is guilty of an offence if:

(a) the person carries on a financial business, whether or not in Australia; and

(b) the person assumes or uses, in Australia, a restricted word or expression in relation to that financial business; and

(c) neither subsection (1AB) nor subsection (1AC) allows that assumption or use of that word or expression; and

(d) APRA did not consent to that assumption or use of that word or expression; and

(e) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 50 penalty units.

Note 1: For the meanings of restricted word or expression , assume or use and financial business, see subsection (4).

Note 2: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1AA) If a person assumes or uses a word or expression in circumstances that give rise to the person committing an offence against subsection (1), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

(1AB) It is not an offence against subsection (1) for the Reserve Bank to assume or use the words bank, banker or banking in relation to its financial business.

(1AC) It is not an offence against subsection (1) for an ADI to assume or use the word banking in referring to the fact that it has been granted an authority under this Act.

Note: For example, an ADI may, in its letterhead, refer to itself as being authorised under the Banking Act 1959 to carry on banking business.

55 After subsection 66(2A)

Insert:

(2B) If APRA:

(a) grants a consent; or

(b) takes action under subsection (2) in relation to a consent;

APRA must give ASIC notice of the granting of the consent or the taking of the action.

56 Subsection 66(3)

Repeal the subsection, substitute:

(3) A person is guilty of an offence if:

(a) the person has been given a consent under this section; and

(b) the person contravenes a condition to which the consent is subject; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(3A) If a person does or fails to do an act in circumstances that give rise to the person committing an offence against subsection (3), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

57 Subsection 66A(1)

Repeal the subsection, substitute:

(1) A person, other than an ADI, is guilty of an offence if:

(a) the person carries on a financial business, whether or not in Australia; and

(b) the person assumes or uses, in Australia, the expression authorised deposit-taking institution, or ADI, in relation to that financial business; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 50 penalty units.

Note 1: For the meanings of assume or use and financial business, see subsection (2).

Note 2: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 3: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1A) If a person assumes or uses an expression in circumstances that give rise to the person committing an offence against subsection (1), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

58 Subsection 67(1)

Repeal the subsection, substitute:

(1) A person, other than an ADI, is guilty of an offence if:

(a) the person carries on banking business in a foreign country but does not carry on banking business in Australia; and

(b) the person establishes or maintains an office in Australia wholly or partly in connection with the carrying on of that banking business in that foreign country; and

(c) APRA did not consent, in writing, to the establishment or maintenance of that office; and

(d) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(1A) If a person establishes or maintains an office in circumstances that give rise to the person committing an offence against subsection (1), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

59 Subsection 67(3)

Repeal the subsection, substitute:

(3) A person is guilty of an offence if:

(a) the person has been given a consent under this section; and

(b) the person contravenes a condition to which the consent is subject; and

(c) there is no order in force under section 11 determining that this subsection does not apply to the person.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

(4) If a person does or fails to do an Act in circumstances that give rise to the person committing an offence against subsection (3), the person is guilty of an offence against that subsection in respect of:

(a) the first day on which the offence is committed; and

(b) each subsequent day (if any) on which the circumstances that gave rise to the person committing the offence continue (including the day of conviction for any such offence or any later day).

Note: This subsection is not intended to imply that section 4K of the Crimes Act 1914 does not apply to offences against this Act or the regulations.

60 Subsection 68(2)

Omit "A bank", substitute "An ADI".

61 Subsection 68(2)

Omit "the bank", substitute "the ADI".

62 Subsection 68(4)

Repeal the subsection, substitute:

(4) In this section:

ADI includes the Reserve Bank.

63 Subsections 69(1), (2), (6), (7), (11) and (11A)

Omit "a bank", substitute "an ADI".

64 Subsection 69(3)

Omit "A bank", substitute "An ADI".

65 Subsection 69(3)

After "statement", insert ", complying with subsection (4) and any regulations under subsection (3),".

66 After subsection 69(3)

Insert:

(3AA) The ADI is guilty of an offence if:

(a) it does not give the Treasurer a statement as required by subsection (3); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

67 Subsections 69(4), (5) and (7)

Omit "the bank" (wherever occurring), substitute "the ADI".

68 After subsection 69(5)

Insert:

(5A) The ADI is guilty of an offence if:

(a) it does not pay, at the time of the delivery of the statement, the amount specified in the statement, as required by subsection (5); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

69 Subsection 69(7)

Omit "that bank" (wherever occurring), substitute "that ADI".

70 Subsection 69(7)

Omit "first-mentioned bank", substitute "first-mentioned ADI".

71 After subsection 69(7)

Insert:

(7A) The ADI is guilty of an offence if:

(a) it does not pay moneys to a person as required by subsection (7); and

(b) there is no order in force under section 11 determining that this subsection does not apply to the ADI.

Maximum penalty: 50 penalty units.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: If a body corporate is convicted of an offence against this subsection, subsection 4B(3) of the Crimes Act 1914 allows a court to impose a fine of up to 5 times the penalty stated above.

72 Subsection 69(10)

Repeal the subsection.

73 Section 69A

Repeal the section.

74 Subsections 69C(1) and (2)

Repeal the subsections.

75 Subsection 69C(6)

Omit "(1) or".

76 Subsection 69C(7)

Repeal the subsection.

77 At the end of section 69C

Add:

Note: For provisions relating to proof of offences by bodies corporate, see Part 2.5 of the Criminal Code.

78 Subsection 71(3)

Omit "banks", substitute "ADIs or NOHCs".

79 Schedule 1 (heading)

Repeal the heading, substitute:

Note: See section 38A.

Part 1--Transfer of financial institutions and friendly societies

1 At the end of the Corporations Law

Add:

Note: See section 1465A.

Part 1--Preliminary

1 Definitions

In this Schedule, except so far as the contrary intention appears:

AFIC Code of this jurisdiction means the Australian Financial Institutions Commission Code as set out in the Australian Financial Institutions Commission Act 1992 of Queensland as in force immediately before the transfer date and as applied as a law of this jurisdiction.

Financial Institutions Code of this jurisdiction means the Financial Institutions Code set out in the Financial Institutions (Queensland) Act 1992 as in force immediately before the transfer date and as applied as a law of this jurisdiction.

Friendly Societies Code means the Friendly Societies Code set out in Schedule 1 to the Friendly Societies (Victoria) Act 1996 as in force immediately before the transfer date.

Friendly Societies Code of this jurisdiction means:

(a) the Friendly Societies Code as applied as a law of this jurisdiction; or

(b) if this Law is being applied as a law of Western Australia--the Friendly Societies (Western Australia) Code set out in the Friendly Societies (Western Australia) Act 1999.

member of a transferring financial institution means a person who, immediately before the transfer date, is a member of the institution under:

(a) the previous governing Code; or

(b) the rules of the institution.

membership share has the meaning given in subclause 12(3).

previous governing Code for a transferring financial institution means the Code or law under which the institution is registered immediately before the transfer date.

State Supervisory Authority (SSA) for a transferring financial institution means:

(a) the SSA for the institution within the meaning of the previous governing Code; or

(b) in the case of The Cairns Cooperative Weekly Penny Savings Bank Limited--the Queensland Office of Financial Supervision.

transfer date means the date that is the transfer date for the purposes of the Financial Sector Reform (Amendments and Transitional Provisions) Act (No. 1) 1999 .

transferring financial institution of this jurisdiction means:

(a) a building society of this jurisdiction (that is, a society that is registered under the Financial Institutions Code of this jurisdiction, and authorised to operate as a building society, immediately before the transfer date); or

(b) a credit union of this jurisdiction (that is, a society that is registered under the Financial Institutions Code of this jurisdiction, and authorised to operate as a credit union, immediately before the transfer date); or

(c) a friendly society of this jurisdiction (that is, a body that is registered as a friendly society under the Friendly Societies Code of this jurisdiction immediately before the transfer date); or

(d) a body registered as an association under Part 12 of the Financial Institutions Code of this jurisdiction immediately before the transfer date; or

(e) a body registered as a Special Services Provider under the AFIC Code of this jurisdiction immediately before the transfer date; or

(f) a body registered as an association under Part 12 of the Friendly Societies Code of this jurisdiction immediately before the transfer date; or

(g) The Cairns Cooperative Weekly Penny Savings Bank Limited referred to in section 263 of the Financial Intermediaries Act 1996 of Queensland if:

(i) this definition is being applied as a law of Queensland; and

(ii) a determination by APRA under subitem 7(2) of the Financial Sector Reform (Amendments and Transitional Provisions) Act (No. 1) 1999 is in force immediately before the transfer date.

Note: If a determination is made, the Bank will be covered by the Banking Act 1959 from the transfer date. APRA may only make a determination if the Treasurer and the Queensland Minister responsible for the administration of the Financial Intermediaries Act 1996 of Queensland have agreed that the Bank should be covered by the Banking Act 1959.

transition period means the period of 18 months starting on the transfer date.

withdrawable share means a withdrawable share within the meaning of the Financial Institutions Code of this jurisdiction as in force immediately before the transfer date.

2 Objective

The objective of this Schedule is to facilitate the registration of:

(a) building societies and credit unions currently covered by the Financial Institutions Code of this jurisdiction; and

(b) friendly societies currently covered by the Friendly Societies Code of this jurisdiction; and

(c) related bodies and associations;

as Corporations Law companies with as little disturbance to the operations of, and as little conversion costs for, the bodies concerned as possible.

Part 2--Transfer to Corporations Law registration

Division 1--The transfer process

3 Registration of transferring financial institution as company

Registration as company on transfer date

(1) On the transfer date, each transferring financial institution of this jurisdiction is taken to become registered as a company under the Law of this jurisdiction under the name under which the institution was registered under the previous governing Code immediately before the transfer date.

(2) Subclause (1) applies even if the institution is an externally -administered body corporate immediately before the transfer date.

Type of company

(3) The following table sets out the types of company the institution may be registered as under subclause (1):

Type of company that institution may be registered as | ||

| Type of institution | Type of company |

1 | building society with shares on issue | * public company limited by shares and by guarantee |

|

| public company limited by shares |

2 | building society with no shares on issue | * public company limited by guarantee |

|

| public company limited by shares and by guarantee |

|

| public company limited by shares |

3 | credit union with shares on issue | * public company limited by shares |

|

| public company limited by shares and by guarantee |

4 | credit union with no shares on issue | * public company limited by guarantee |

|

| public company limited by share and by guarantee |

|

| public company limited by shares |

5 | friendly society with no shares on issue | * public company limited by guarantee |

|

| public company limited by shares and by guarantee |

6 | friendly society with shares on issue | *public company limited by shares and by guarantee |

|

| public company limited by shares |

7 | association registered under the Financial Institutions Code of this jurisdiction | * public company limited by shares |

|

| public company limited by guarantee |

|

| public company limited by shares and by guarantee |

|

| proprietary company limited by shares [see note] |

8 | Special Services Provider incorporated under the AFIC Code of this jurisdiction | * public company limited by shares |

9 | friendly society association | * public company limited by guarantee |

|

| public company limited by shares |

|

| public company limited by shares and by guarantee |

|

| proprietary company limited by shares [see note] |

10 | other | * public company limited by guarantee |

|

| public company limited by shares |

|

| public company limited by shares and by guarantee |

|

| proprietary company limited by shares [see note] |

Note: To be registered as a proprietary company, the institution would need to comply with subsection 113(1) (no more than 50 non -employee shareholders). A proprietary company cannot engage in fundraising activities (see subsection 113(3)).

(4) The institution may elect which particular type of company it is to be registered as under subclause (1). The election:

(a) must be agreed to by a resolution of the board of the institution; and

(b) is to be made by written notice lodged with ASIC at least 7 days before the transfer date.

The election must be in the prescribed form.

(5) The institution is taken to be registered under subclause (1) as the following type of company:

(a) if the institution's board makes an election under subclause (4)--the type specified in the election; or

(b) if the institution's board does not make an election under subclause (4):

(i) if regulations under this subparagraph are in force for that type of institution on the transfer date--the type of company prescribed by the regulations; or

(ii) if no regulations under subparagraph (i) are in force for that type of institution on the transfer date--the type of company that is specified in the table in subclause (3) for that type of institution and is marked with an asterisk.

4 Documents to be lodged with ASIC by SSA

(1) The SSA for a transferring financial institution of this jurisdiction must lodge with ASIC:

(a) a notice that sets out:

(i) the institution's name; and

(ii) the address of the institution's registered office;

under the previous governing Code immediately before the transfer date; and

(b) a copy of the institution's rules as in force immediately before the transfer date; and

(c) a copy of any entry in its register of charges kept under section 265 of this Law (as applied by the previous governing Code) that relates to the institution; and

(d) any document lodged under section 263 or 264 of this Law (as applied by the previous governing Code) that relates to:

(i) the institution; and

(ii) a charge that is in force immediately before the transfer date.

(2) If the transferring financial institution is under external administration immediately before the transfer date, the notice referred to in paragraph (1)(a) must also set out:

(a) the type of external administration; and

(b) any other prescribed details.

5 Documents to be lodged with ASIC by transferring financial institution

(1) Within 1 month after a transferring financial institution of this jurisdiction is registered as a company under clause 3, it must lodge with ASIC a notice that sets out the personal details of each director and secretary of the company as at the transfer date. The notice must be in the prescribed form.

Penalty: 5 penalty units.

(2) The personal details of a director or secretary are the details that would need to be set out in the notice if it were being given under section 242.

6 Company to set up registers and minute books

Setting up registers and minute books

(1) A company registered under clause 3 must, within 14 days after the transfer date:

(a) set up the registers required by sections 168 (registers of members, debenture holders and options holders) and 271 (charges); and

(b) include in those registers all the information that is required to be in those registers and that is available to the company on registration; and

(c) set up the minute books required by section 251A.

Incorporation of prior minute books

(2) The minute books set up under paragraph (1)(c) must incorporate any minute books or similar records kept by the company prior to its registration under clause 3.

Access to registers and minute books

(3) During the 14 days, the company need not comply with a person's request to inspect or obtain a copy of:

(a) information in a register; or

(b) a minute of a general meeting.

However, the period within which the company must comply with the request begins at the end of the 14 days.

7 ASIC to complete formalities of registration

(1) As soon as practicable after a transferring financial institution of this jurisdiction is registered as a company under clause 3, ASIC must:

(a) give the company an ACN; and

(b) keep a record of the company's registration; and

(c) issue a certificate to the company that states:

(i) the company's name; and

(ii) the company's ACN; and

(iii) the company's type; and

(iv) that the company is registered as a company under the Corporations Law of this jurisdiction; and

(v) the transfer date as the date of registration.

Note: For the evidentiary value of a certificate of registration, see subsection 1274(7A).

(2) If:

(a) the company is registered with a name that does not include "Limited" or "Proprietary Limited" (as the type of company requires), or an acceptable abbreviation; and

(b) the company is not exempt from the requirement to use that word or those words in its name by or under section 150 or 151;

ASIC may change the company's name so that it includes the required words by altering the details of the company's registration to reflect that change.

Note: For acceptable abbreviations see section 149.

(3) Subsections 1274(2) and (5) apply to the record of the company's registration referred to in paragraph (1)(b) as if they were a document lodged with ASIC.

8 Registration of registered bodies