Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In this section:

"relevant service" means a service:

(a) in respect of which benefit is payable; and

(b) the medical expenses in respect of which exceed the amount of benefit that, apart from this section, would be payable in respect of the service;

but does not include a service rendered to a person while hospital treatment, or hospital - substitute treatment in respect of which the person chooses to receive a benefit from a private health insurer, is provided to the person.

"year" means a calendar year.

(2) Subject to this Act, if this section applies to a claim (the current claim ), the benefit payable in respect of the claim is increased by 80% of the out - of - pocket expenses for the current claim.

(3) The out - of - pocket expenses for a claim are:

(a) the medical expenses incurred in respect of a relevant service for which the claim is made;

reduced by:

(b) any amounts payable under any other section of this Act in respect of those expenses.

(4) This section applies to the current claim if:

(a) the current claim is a claim that is made by a claimant for a benefit in respect of a relevant service which was rendered to the claimant or to a member of the claimant's registered family; and

(b) the medical expenses incurred in respect of the relevant service are incurred in a year (the expense year ); and

(c) the claimant has paid at least 20% of the out - of - pocket expenses for the service directly to the person by whom, or on whose behalf, the service was rendered; and

(d) the current claim is accepted by the Chief Executive Medicare; and

(e) one or more of the following apply to the claim:

(i) the person to whom the service was rendered is a concessional person in relation to the expense year at the time that the claim is made and the concessional safety - net applies to the current claim;

(ii) the person to whom the service was rendered is a member of an FTB(A) family in relation to the expense year at the time that the claim is made and the FTB(A) safety - net applies to the current claim;

(iii) the extended general safety - net applies to the current claim.

Note: Subsection 10AC(3) deals with a person being a member of more than one family.

(5) A safety - net mentioned in paragraph (4)(e) applies to the current claim if the Chief Executive Medicare is satisfied at the time when the current claim was accepted for payment that the sum of the out - of - pocket expenses for the current claim and all relevant prior claims for a safety - net for the expense year is equal to or exceeds the applicable safety - net amount.

(6) A claim is a relevant prior claim for a safety - net for the expense year if:

(a) the claim has been made for benefit in respect of relevant services which were rendered to:

(i) for the concessional safety - net--any member of the family who is a concessional person in relation to the expense year at the time that the current claim is made; and

(ii) for the FTB(A) safety - net or the extended general safety - net--any person who is a member of the family at the time that the current claim is made; and

(b) the claim is related to medical expenses incurred during the expense year; and

(c) the claim was accepted for payment by the Chief Executive Medicare before the time when the current claim was accepted for payment; and

(d) the Chief Executive Medicare is satisfied at the time when the current claim was accepted for payment that the out - of - pocket expenses for the claim have been paid.

(7) If:

(a) this section applies to the current claim; but

(b) the sum of the out - of - pocket expenses for all relevant prior claims for the expense year is less than the applicable safety - net amount;

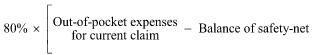

the benefit payable in respect of the claim is not increased under subsection (2) but is instead increased by the amount worked out using the formula:

where:

"balance of safety-net" means the amount by which the sum of the out - of - pocket expenses for all relevant prior claims for the expense year is less than the applicable safety - net amount.

(7A) Despite subsections (2) and (7), if the current claim is for a service specified in an item determined under section 10B to be an item to which this subsection applies, the increase under this section in the benefit payable in respect of the claim cannot exceed the amount determined under section 10B as the maximum increase for that item.

Note: This subsection does not limit the increase payable in respect of a claim for a service specified in an item not determined under section 10B to be an item to which this subsection applies.

(7AA) If:

(a) 2 or more services (the original services ) that are each specified in an item are deemed to constitute, or are treated as, one service (the deemed service ) under this Act (other than a provision of this Act prescribed by the regulations); and

(b) all of the items in which the original services are specified are items determined under section 10B to be items to which subsection (7A) of this section applies; and

(c) the current claim is for the deemed service;

then, despite subsections (2) and (7) of this section, the increase under this section in the benefit payable in respect of the claim cannot exceed the sum of the amounts determined under section 10B as the maximum increases for those items.

Note: For when 2 or more services are deemed to constitute one service, see sections 15 and 16.

(7B) If:

(a) for the purposes of the pathology services table:

(i) 2 or more pathology services are treated as a single pathology service; and

(ii) the fee for the single service is the fee specified in one or more particular items in the table; and

(b) one or more of those particular items (the limited increase items ) are items determined under section 10B to be items to which subsection (7A) of this section applies;

then, for the purposes of that subsection, the single service is taken to be specified in the limited increase item or, if there are 2 or more limited increase items, in the one of those items for which the maximum increase determined under section 10B is the greatest.

Note: Section 4B lets regulations provide for a rule of interpretation of the pathology services table to treat 2 or more pathology services as a single pathology service.

(8) This section applies only to a benefit that becomes payable after a family becomes registered, even though expenses incurred before the registration in the year the family becomes registered may be taken into account for the purposes of determining whether a safety - net applies.

(9) For the purposes of this section (other than paragraph (4)(c)), without affecting the meaning of an expression in any other provision of this Act, if a person to whom benefit is payable in respect of a relevant service is given or sent a cheque under subsection 20(2) or (2A) for the amount of the benefit, the person is taken to have paid so much of the medical expenses in respect of that service as is represented by the amount of the benefit.

(10) For the purposes of this section, without affecting the meaning of an expression in any other provision of this Act, despite anything else in this Act, the question when medical expenses are incurred in respect of relevant services relating to prescribed items is to be determined under the regulations.