Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Subject to this Subdivision, the attributable income of a non - resident trust estate of a year of income is:

(a) if the non - resident trust estate is not a listed country trust estate in relation to the year of income--the net income of the non - resident trust estate of the year of income; or

(b) if the non - resident trust estate is a listed country trust estate in relation to the year of income--the amount that would have been the net income of the non - resident trust estate of the year of income if the exempt income of the trust estate included all income and profits of the trust estate, other than eligible designated concession income in relation to any listed country in relation to the year of income;

reduced by:

(c) so much (if any) of the amount covered by paragraph (a) or (b) as represents:

(i) an amount:

(A) that is or has been included in the assessable income of a beneficiary under section 97; or

(B) in respect of which the trustee of the non - resident trust estate is or has been assessed and liable to pay tax under section 98, 99 or 99A; or

(C) on which trustee beneficiary non - disclosure tax is payable under Division 6D; or

(ii) an amount:

(A) that is paid to a beneficiary, being a resident of a listed country, during the period of 13 months commencing at the beginning of the year of income; and

(B) subject to tax in a listed country in a tax accounting period ending before the end of the year of income or commencing during the year of income; or

(iii) an amount that consists of, or is attributable to, the franked part of a distribution, or the part of a distribution that has been franked with an exempting credit; or

(v) if an amount is or has been included in the assessable income of any taxpayer under section 102AAZD because the taxpayer is an attributable taxpayer in relation to any year of income (in this subparagraph called the taxpayer's year of income ) and in relation to a trust estate other than the non - resident trust estate--so much of an amount paid to the trustee of the non - resident trust estate as represents the attributable income of that other trust estate of the taxpayer's year of income; or

(vii) if:

(A) an attribution account payment is made to the trustee of the trust estate during the year of income; and

(B) the making of the attribution account payment gives rise to an attribution debit, in relation to any taxpayer, for the entity making the payment;

the amount of the attribution debit; or

(viii) an amount of income or profits of the trust estate:

(A) that is subject to tax in any listed country in a tax accounting period ending before the end of the year of income or commencing during the year of income; and

(B) that is not eligible designated concession income in relation to any listed country in relation to the year of income; and

(d) so much of any foreign tax or Australian tax paid by the trustee or a beneficiary as is attributable to so much of the amount covered by paragraph (a) or (b), as the case requires, as remains after the reduction or reductions covered by paragraph (c).

(2) The attributable income of a resident trust estate of a year of income is 0.

(3) For the purposes of sub - subparagraph (1)(c)(ii)(A), a beneficiary is to be taken to be a resident of a listed country if, and only if, the beneficiary is treated as a resident of the listed country for the purposes of the tax law of the listed country.

(4) If the tax law of a listed country adopts some criterion other than treatment as a resident as the criterion for applying a worldwide source tax base to a beneficiary, then, subsection (3) has effect, in relation to that tax law, as if that criterion were the same as treatment as a resident of the listed country for the purposes of that tax law.

(5) For the purposes of this section, where, because of section 101, a beneficiary is presently entitled to a particular amount, the amount is taken to have been paid to the beneficiary.

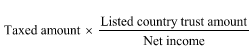

(6) For the purposes of this section, the extent to which an amount referred to in subparagraph (1)(c)(i) or (ii) (in this subsection called the taxed amount ) represents the amount covered by paragraph (1)(b) (in this subsection called the listed country trust amount ) is calculated using the formula:

where:

"Listed country trust amount" means the number of dollars in the listed country trust amount.

"Taxed amount" means the taxed amount.

"Net income" means the number of dollars in the net income of the non - resident trust estate concerned of the year of income concerned.