Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) Where a taxpayer, being a natural person, has been engaged on qualifying service on a particular approved project for a continuous period of not less than 91 days, any eligible foreign remuneration derived by the person that is attributable to that qualifying service is exempt from tax.

(3) Subject to subsections (4) and (5), a person shall be taken for the purposes of this section to be engaged on qualifying service on an approved project during any period during which:

(a) the person is outside Australia and is engaged in the performance of personal services in connection with the approved project;

(b) the person is travelling between Australia and the site of the approved project;

(c) by reason of an incapacity for work due to accident or illness occurring while the person was, by virtue of paragraph (a) or (b), to be taken to be engaged on qualifying service on the approved project, the person is absent from work; or

(d) the person is on eligible leave, being leave that accrued in respect of a period during which the person was, by virtue of any of the preceding paragraphs, to be taken to be engaged on qualifying service on the approved project.

(4) A person shall not be taken to have been engaged on qualifying service on a particular approved project while the person was travelling between Australia and the site of the approved project unless the Commissioner is satisfied that the time taken for the journey is reasonable.

(5) A person shall not be taken to have been engaged on qualifying service on a particular approved project by virtue of paragraph (3)(c) during a period of incapacity for work unless the person is taken to have been engaged on qualifying service on that approved project by virtue of paragraph (3)(a), (b) or (d) during a period that commenced immediately after the incapacity ceased.

(6) Where:

(a) a person was engaged on qualifying service on a particular approved project; and

(b) due to unforeseen circumstances, the person ceased to be engaged on qualifying service on that approved project;

the period during which the person is to be taken to have been engaged on qualifying service on that approved project shall, except for the purpose of determining whether income derived by the person is eligible foreign remuneration, be taken to include the additional period after the person ceased to be engaged on qualifying service on that approved project during which the person would, in the opinion of the Commissioner, have continued to be engaged on qualifying service on that approved project but for those unforeseen circumstances.

(7) Where:

(a) a person (in this subsection referred to as the original person ) was engaged on qualifying service on a particular approved project;

(b) due to unforeseen circumstances, the original person ceased to be engaged on qualifying service on that approved project; and

(c) as soon as practicable after the time when the original person ceased to be engaged on qualifying service on that approved project, another person (in this subsection referred to as the substituted person ) commenced to be engaged on qualifying service on that approved project in lieu of the original person;

the period during which the substituted person is to be taken to have been engaged on qualifying service on that approved project shall, except for the purpose of determining whether income derived by the substituted person is eligible foreign remuneration, be taken to include a period that ended immediately before the substituted person commenced to be engaged on qualifying service on that approved project in lieu of the original person and was of the same duration as the continuous period during which the original person was, immediately before the original person ceased to be engaged on qualifying service on that approved project, taken to have been engaged on qualifying service on that approved project.

(8) Where:

(a) during the period (in this subsection referred to as the total project period ) commencing at the time when a person was first engaged on qualifying service on an approved project and ending at the time when the person was last engaged on qualifying service on that approved project, the person was in Australia during a period or periods (in this subsection referred to as the intervening period or intervening periods ) during which the person was not engaged on qualifying service on that approved project;

(b) the total number of days in the intervening period or intervening periods does not exceed one - sixth of the total number of days during the total project period during which the person was engaged on qualifying service on the approved project; and

(c) at all times during the total project period, the person was engaged on qualifying service on the approved project or was in Australia;

the periods during the total project period during which the person was engaged on qualifying service on the approved project shall together be taken to constitute a continuous period during which the person was engaged on qualifying service on the approved project.

(9) Where, immediately before a person commences to take eligible leave, leave of the same kind as the eligible leave has accrued in relation to the person but has not been used and that unused leave consists of:

(a) leave that accrued in respect of a period or periods when the person was engaged on qualifying service on an approved project and leave that accrued in respect of a period or periods when the person was not engaged on qualifying service on an approved project;

(b) leave that accrued in respect of 2 or more periods when the person was engaged on qualifying service on 2 or more different approved projects; or

(c) leave that accrued in respect of 2 or more periods when the person was engaged on qualifying service on 2 or more different approved projects and leave that accrued in respect of a period or periods when the person was not engaged on qualifying service on an approved project;

the following provisions apply for the purposes of determining the extent to which the eligible leave taken by the person was eligible leave that accrued in respect of a period when the person was engaged on qualifying service on a particular approved project:

(d) in a case to which paragraph (a) applies--the person shall be deemed first to have taken leave that accrued in respect of the period when the person was engaged on qualifying service on the approved project referred to in that paragraph;

(e) in a case to which paragraph (b) applies--the leave shall be deemed to have been taken in the order that is reverse to the order in which it accrued;

(f) in a case to which paragraph (c) applies:

(i) the person shall be deemed not to have taken any of the leave that accrued in respect of a period or periods when the person was not engaged on qualifying service on an approved project until the person had taken leave for a number of days equal to the number of days of leave referred to in that paragraph that had accrued in respect of periods when the person was engaged on qualifying service on approved projects; and

(ii) the leave that had accrued in respect of periods when the person was engaged in qualifying service on approved projects shall be deemed to have been taken by the person in the order that is reverse to the order in which that leave accrued.

(10) Where the amount of income derived by a person that:

(a) is attributable to qualifying service on an approved project; and

(b) would, apart from this subsection, be eligible foreign remuneration;

exceeds the amount of income that the Commissioner considers would be reasonable remuneration in respect of that qualifying service, the amount of the excess is not eligible foreign remuneration for the purposes of this section.

(11) Where the Trade Minister is satisfied that the undertaking of an eligible project that was commenced, or is proposed to be commenced, after 19 August 1980 is, or will be, in the national interest, that Minister may, by writing signed by that Minister, approve that eligible project for the purposes of this section.

(12) The Trade Minister may, either generally or as otherwise provided by the instrument of delegation, by writing signed by that Minister, delegate to a person that Minister's power under subsection (11).

(13) The power so delegated, when exercised by the delegate shall, for the purposes of this section, be deemed to have been exercised by the Trade Minister.

(14) A delegation under subsection (12) does not prevent the exercise of a power by the Trade Minister.

(15) Where:

(a) a person has derived eligible foreign remuneration during a year of income; and

(b) at the time of making an assessment in respect of income of the person of the year of income, the Commissioner is of the opinion that, at a later time, circumstances will exist by reason of which that eligible foreign remuneration will be exempt from tax by virtue of this section;

the Commissioner may apply the provisions of this section as if those circumstances existed at the time of making the assessment.

(16) Where, in the making of an assessment, this section has been applied on the basis that a circumstance that did not exist at the time of making the assessment would exist at a later time and the Commissioner, after making the assessment, becomes satisfied that that circumstance will not exist, then, notwithstanding anything contained in section 170, the Commissioner may amend the assessment at any time for the purposes of ensuring that this section shall be taken always to have applied on the basis that that circumstance did not exist.

(17) For the purposes of this section, income is excluded income if:

(a) the income is income to which section 23AG applies; or

(aa) the income is a payment, consideration or amount that:

(i) is included in assessable income under Division 82, section 83 - 295 or Division 301, 302, 304 or 305 of the Income Tax Assessment Act 1997 ; or

(ii) is included in assessable income under Division 82 of the Income Tax (Transitional Provisions) Act 1997 ; or

(iii) is mentioned in paragraph 82 - 135(e), (f), (g), (i) or (j) of the Income Tax Assessment Act 1997 ; or

(iv) is an amount transferred to a fund, if the amount is included in the assessable income of the fund under section 295 - 200 of the Income Tax Assessment Act 1997 ; or

(b) the income is derived from sources in a country other than Australia and:

(i) is exempt from income tax in that country; and

(ii) would not be exempt from income tax in that country apart from the operation of an agreement applying to Australia and that other country relating to the avoidance of double taxation or of a law of that other country giving effect to such an agreement; or

(c) the income consists of:

(i) payments in lieu of long service leave; or

(ii) payments by way of superannuation or pension.

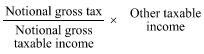

(17A) If the income of a taxpayer of a year of income consists of an amount that is exempt from tax under this section (in this section called the exempt amount ) and other income, the amount of tax (if any) payable in respect of the other income is calculated using the formula:

where:

"Notional gross tax" means the number of whole dollars in the amount of income tax that would be assessed under this Act in respect of the taxpayer's taxable income of the year of income if:

(a) the exempt amount were not exempt income; and

(aa) if the exempt amount is a payment covered by section 83 - 240 or 305 - 65 of the Income Tax Assessment Act 1997 --the exempt amount (excluding any part of that amount that represented contributions made by the taxpayer) were assessable income of the taxpayer; and

(b) the taxpayer were not entitled to any rebate of tax.

"Notional gross taxable income" means the number of whole dollars in the amount that would have been the taxpayer's taxable income of the year of income if the exempt amount were not exempt income.

"Other taxable income" means the amount (if any) remaining after deducting from so much of the other income as is assessable income:

(d) any deductions allowable to the taxpayer in relation to the year of income that relate exclusively to that assessable income; and

(e) so much of any other deductions (other than apportionable deductions) allowable to the taxpayer in relation to the year of income as, in the opinion of the Commissioner, may appropriately be related to that assessable income; and

(f) the amount calculated using the formula in subsection (17B).

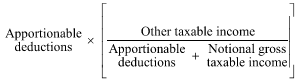

(17B) The formula referred to in paragraph (17A)(f) is:

where:

"Apportionable deductions" means the number of whole dollars in the apportionable deductions allowable to the taxpayer in relation to the year of income.

"Other taxable income" means the amount that, apart from paragraph (17A)(f), would be represented by the component Other taxable income in subsection (17A).

"Notional gross taxable income" means the number of whole dollars in the amount that would have been the taxpayer's taxable income of the year of income if the exempt amount were not exempt income.

(17C) Subsection (17A) applies to a taxpayer in respect of income of a year of income as if any payment covered by section 83 - 240 or 305 - 65 of the Income Tax Assessment Act 1997 in relation to qualifying service that was made in respect of the taxpayer during that year of income were income of the taxpayer of that year of income that is exempt from tax under this section.

(18) In this section, unless the contrary intention appears:

"approved project" means a project in respect of which there is in force an approval granted under subsection (11).

"eligible contractor" means:

(b) the Commonwealth, a State, a Territory, the government of a country other than Australia or an authority of the Commonwealth, of a State, of a Territory or of the government of a country other than Australia;

(c) an organization:

(i) of which Australia and a country or countries other than Australia are members; or

(ii) that is constituted by a person or persons representing Australia and a person or persons representing a country or countries other than Australia; or

(d) an agency of an organization to which paragraph (c) applies.

"eligible foreign remuneration" , in relation to a person, means income (not being excluded income) that is derived by the person at a time when the person is a resident, being:

(a) income consisting of salary, wages, commission, bonuses or allowances, or of amounts included in a person's assessable income under Division 83A of the Income Tax Assessment Act 1997 (about employee share schemes), derived by the person in his or her capacity as an employee of an eligible contractor; or

(b) income, or amounts included in a person's assessable income under that Division, derived by the person under a contract with an eligible contractor, being a contract that is wholly or substantially for the personal services of the person;

that is directly attributable to qualifying service by the person on an approved project and includes any payments received in lieu of eligible leave that accrued in respect of a period during which the person was a resident and was engaged on qualifying service on an approved project.

"eligible leave" means leave other than long service leave.

"eligible project" means:

(a) a project for the design, supply or installation of any equipment or facilities; or

(b) a project for the construction of works; or

(c) a project for the development of an urban area or a regional area; or

(d) a project for the development of agriculture; or

(e) a project consisting of giving advice or assistance relating to the management or administration of a government department or of a public utility; or

(f) a project included in a class of projects approved in writing for the purposes of this section by the Trade Minister.

"employee" includes:

(a) a person employed by the Commonwealth, by a State, by a Territory, by the government of a country other than Australia or by an authority of the Commonwealth, of a State, of a Territory or of the government of a country other than Australia; and

(b) a member of the Defence Force.

"long service leave" means long leave, furlough, extended leave or leave of a similar kind (however described).