Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsApportionment on acquisition of an asset

(1) If you * acquire a * CGT asset because of a transaction and only part of the expenditure you incurred under the transaction relates to the acquisition of the asset, the first element of your * cost base and * reduced cost base of the asset is that part of the expenditure that is reasonably attributable to the acquisition of the asset.

The expenditure can include giving property: see section 103 - 5.

Apportionment of expenditure in other elements

(1A) If you incur expenditure and only part of it relates to another element of the * cost base or * reduced cost base of a * CGT asset, that element includes that part of the expenditure that is reasonably attributable to that element.

Apportionment for CGT asset that was part of another asset

(2) The * cost base and * reduced cost base of a * CGT asset is apportioned if a * CGT event happens to some part of the asset, but not to the remainder of it.

Note: The full list of CGT events is in section 104 - 5.

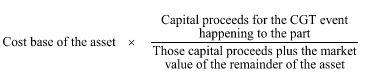

(3) The * cost base for the * CGT asset representing the part to which the * CGT event happened is worked out using the formula:

The * reduced cost base is worked out similarly.

(4) The remainder of the * cost base and * reduced cost base of the asset is attributed to the part that remains.

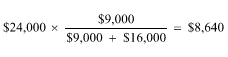

Example: You acquire a truck for $24,000 and sell its motor for $9,000. Suppose the market value of the remainder of the truck is $16,000.

Under subsection (3), the cost base of the motor is:

Under subsection (4), the cost base of the remainder of the truck is:

![]()

(5) However, an amount forming part of the * cost base or * reduced cost base of the asset is not apportioned if, on the facts, that amount is wholly attributable to the part to which the * CGT event happened or to the remaining part.