Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if section 115 - 105 or 115 - 110 applies to a * discount capital gain.

Periods starting after 8 May 2012

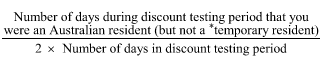

(2) If the discount testing period starts after 8 May 2012, the following (expressed as a percentage) is the percentage resulting from this section:

Note 1: The percentage will be 0% if you were a foreign resident or temporary resident during all of the discount testing period.

Note 2: Subsection 115 - 105(3) or 115 - 110(3) may change your residency status for this formula.

Periods starting earlier--Australian residents

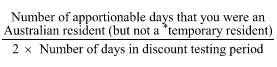

(3) If:

(a) the discount testing period starts on or before 8 May 2012; and

(b) you were an Australian resident (but not a * temporary resident) on 8 May 2012;

the following (expressed as a percentage) is the percentage resulting from this section:

where:

"apportionable day" means a day, after 8 May 2012, during the discount testing period.

Note: Subsection 115 - 105(3) or 115 - 110(3) may change your residency status for this formula.

Periods starting earlier--other residents may choose market value

(4) The percentage resulting from this section is worked out from the following table if:

(a) the discount testing period starts on or before 8 May 2012; and

(b) you were a foreign resident or * temporary resident on 8 May 2012; and

(c) the most recent * acquisition (before the * CGT event) of the * CGT asset happened on or before 8 May 2012; and

(d) the CGT asset's * market value on 8 May 2012 exceeds the amount that was its * cost base at the end of that day; and

(e) you choose for this subsection to apply.

Note 1: The CGT event and CGT asset are those expressly or impliedly referred to in section 115 - 105 or 115 - 110.

Note 2: Section 115 - 30 has special rules about when assets are acquired.

Percentage using market value | ||

Item | Column 1 | Column 2 then, the percentage is: |

1 | is equal to or greater than the amount of the * discount capital gain | 50%. |

2 | falls short of the amount of the * discount capital gain | worked out under subsection (5). |

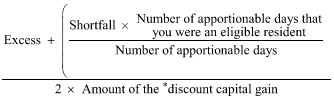

(5) For the purposes of table item 2 in subsection (4), the following (expressed as a percentage) is the percentage resulting from this section:

where:

"apportionable day" means a day, after 8 May 2012, during the discount testing period.

"eligible resident" means an Australian resident who is not a * temporary resident.

"excess" means the excess from paragraph (4)(d).

"shortfall" means the amount that the excess falls short of the amount of the * discount capital gain.

Note: Subsection 115 - 105(3) or 115 - 110(3) may change your residency status for this formula.

Periods starting earlier--other residents not choosing market value

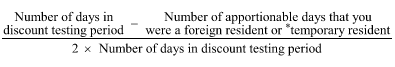

(6) If:

(a) the discount testing period starts on or before 8 May 2012; and

(b) you were a foreign resident or * temporary resident on 8 May 2012; and

(c) subsection (4) does not apply;

the following (expressed as a percentage) is the percentage resulting from this section:

where:

"apportionable day" means a day, after 8 May 2012, during the discount testing period.

Note 1: The percentage will be 0% if you were a foreign resident or temporary resident on each of the apportionable days.

Note 2: Subsection 115 - 105(3) or 115 - 110(3) may change your residency status for this formula.