Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You get only a partial exemption for a * CGT event that happens in relation to a * dwelling or your * ownership interest in it if:

(a) you are an individual; and

(b) the dwelling was your main residence for part only of your * ownership period; and

(c) the interest did not * pass to you as a beneficiary in, and you did not * acquire it as a trustee of, the estate of a deceased person.

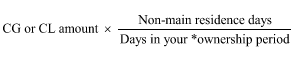

(2) You calculate your * capital gain or * capital loss using the formula:

where:

"CG or CL amount" is the * capital gain or * capital loss you would have made from the * CGT event apart from this Subdivision.

"non-main residence days" is the number of days in your * ownership period when the * dwelling was not your main residence.

Note: The capital gain or loss may be further adjusted if the dwelling was used to produce assessable income: see section 118 - 190.

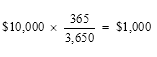

Example: You bought a house in July 2020 and moved in immediately. In July 2023, you moved out and began to rent it. You sold it in July 2030, making (apart from this Subdivision) a capital gain of $10,000. At the time you sold the house, you were an Australian resident.

You choose to continue to treat the dwelling as your main residence under section 118 - 145 (about absences) for the first 6 of the 7 years during which you rented the house out.

Under this section, you will be taken to have made a capital gain of:

(3) However, this section does not apply if, at the time the * CGT event happens, you:

(a) are an * excluded foreign resident; or

(b) are a foreign resident who does not satisfy the * life events test.