Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

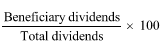

Commonwealth Consolidated Acts(1) A * beneficiary of a * CCIV sub - fund trust is taken to have a fixed entitlement to a share of income of the trust that the trust derives from time to time. At a particular time, that share is equal to the percentage worked out using the formula:

where:

"beneficiary dividends" is the total of the * dividends that the * beneficiary has a right to receive because of * shares that the beneficiary holds at that time and are * referable to the * sub - fund.

"total dividends" is the total of all * dividends that are payable on all * shares that are on issue at that time and are * referable to the * sub - fund.

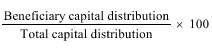

(2) A * beneficiary of a * CCIV sub - fund trust is taken to have a fixed entitlement to a share of the capital of the trust at a particular time equal to the percentage worked out using the formula:

where:

"beneficiary capital distribution" is the amount of a distribution of paid - up capital (in the event of a return of capital) that the * beneficiary has a right to receive because of * shares that the beneficiary holds at that time and are * referable to the * sub - fund.

"total capital distribution" is the total distribution of paid - up capital (in that event) payable on all * shares that are on issue at that time and are * referable to the * sub - fund.

(3) A fixed entitlement that exists because of this section is taken to be a fixed entitlement within the meaning given by sections 272 - 5, 272 - 10, 272 - 15 and 272 - 40 in Schedule 2F to the Income Tax Assessment Act 1936 .

Note: This is relevant to, for example, the definition of fixed entitlement in subsection 102UC(4) of the Income Tax Assessment Act 1936 .