Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A * franking debit arises in a company's * franking account if an amount (the transferred amount ) to which this Division applies is transferred to the company's * share capital account. The debit arises immediately before the end of the * franking period in which the transfer of the amount occurs.

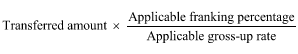

(2) The amount of the * franking debit is calculated in accordance with the formula:

where:

"applicable franking percentage" means:

(a) if, before the debit arises, the * benchmark franking percentage for the * franking period in which the transfer of the amount occurs has already been set by section 203 - 30--that percentage; or

(b) otherwise--100%.

"applicable gross-up rate" means the company's * corporate tax gross - up rate for the income year in which the franking debit arises.

Table of sections

197 - 50 The share capital account becomes tainted (if it is not already tainted)

197 - 55 Choosing to untaint a tainted share capital account

197 - 60 Choosing to untaint--liability to untainting tax

197 - 65 Choosing to untaint--further franking debits may arise

197 - 70 Due date for payment of untainting tax

197 - 75 General interest charge for late payment of untainting tax

197 - 80 Notice of liability to pay untainting tax

197 - 85 Evidentiary effect of notice of liability to pay untainting tax