Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) A * venture capital debit arises for a * PDF where the PDF's net venture capital credits for the income year exceed whichever is the lesser of:

(a) the PDF's CGT limit for that income year; and

(b) the tax paid by the PDF on its * SME income component for that income year.

(2) The * PDF's net venture capital credits for the income year is:

![]()

where:

"venture capital credits" is the total * venture capital credits of the * PDF that relate to tax in relation to taxable income of that income year.

"venture capital debits" is the total * venture capital debits of the * PDF that relate to tax in relation to taxable income of that income year.

CGT limit

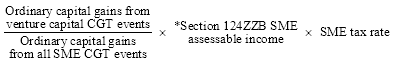

(3) The * PDF's CGT limit for the income year is worked out using the formula:

where:

"ordinary capital gains from all SME CGT events" means the total of the * ordinary capital gains for the income year for * CGT events in relation to * SME investments of the * PDF.

"ordinary capital gains from venture capital CGT events" means the total of * ordinary capital gains for the income year for * CGT events in relation to shares in companies that are * qualifying SME investments.

"SME tax rate" is the tax rate applicable to the * SME income component of the * PDF for the income year.

Tax paid by the PDF on its SME income component

(4) The tax paid by the PDF on its SME income component for the income year is the tax paid by the * PDF on its * SME income component after allowing * tax offsets referred to in section 4 - 10 .