Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies if any part (the residual amount ) of the * total net forgiven amount in relation to a partnership in respect of the * forgiveness income year remains after the total net forgiven amount has been applied in accordance with Subdivision 245 - E.

(2) If there is a * net income in relation to the partnership in respect of the * forgiveness income year:

(a) each partner is taken to have had a debt * forgiven during the forgiveness income year; and

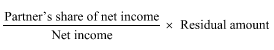

(b) there is taken to be, in respect of the debt of each partner, a * net forgiven amount worked out in accordance with the following formula:

where:

partner's share of net income means the part of the net income of the partnership for the forgiveness income year that is included in the partner's assessable income.

(3) If there is a * partnership loss in relation to the partnership in respect of the * forgiveness income year:

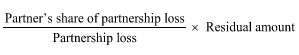

(a) each partner is taken to have had a debt * forgiven during the forgiveness income year; and

(b) there is taken to be, in respect of the debt of each partner, a * net forgiven amount worked out in accordance with the following formula:

where:

partner's share of partnership loss means the part of the partnership loss that the partner has deducted or can deduct.

(4) The * total net forgiven amount of a partner for the * forgiveness income year as worked out under subsection 245 - 105(1) includes the * net forgiven amount worked out in relation to the partner under this section.

(5) This section has effect in relation to a partnership irrespective of any agreement between the partners as to the operation of this section.