Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The table explains how to work out the amount (if any) that is offset against the value of a debt when it is forgiven (calculated under section 245 - 55, 245 - 60 or 245 - 61) in working out the * gross forgiven amount of the debt.

Amount offset against value of debt | ||

Item | Column 1 In this case: | Column 2 the amount offset is: |

1 | the debt is a * moneylending debt, and neither of items 4 and 6 applies | the sum of: (a) each amount that the debtor has paid; and (b) the * market value, at the time of the * forgiveness, of each item of property (other than money) that the debtor has given; and (c) the market value, at that time, of each obligation of the debtor to pay an amount, or to give such an item of property; as a result of, or in respect of, the forgiveness of the debt. |

2 | the debt is not a * moneylending debt, and none of items 3, 4, 5 and 6 applies | the sum of: (a) each amount that the debtor has paid, or is required to pay; and (b) the * market value, at the time of the * forgiveness, of each item of property (other than money) that the debtor has given, or is required to give; as a result of, or in respect of, the forgiveness of the debt. |

3 | the debt is not a * moneylending debt, the conditions in subsection (2) are met and none of items 4, 5 and 6 applies | the * market value of the debt at the time of the * forgiveness. |

4 | the debt is assigned as mentioned in section 245 - 36, and item 5 does not apply | the sum of: (a) the amount or * market value of the consideration (if any) that the debtor has paid or given, or is required to pay or give, in respect of the assignment; and (b) the amount or market value of the consideration (if any) paid or given by the new creditor in respect of the assignment. |

5 | the debt is assigned as mentioned in section 245 - 36, and: (a) the debt is not a * moneylending debt; and (b) the creditor and the new creditor were not dealing with each other at * arm's length in connection with the assignment | the * market value of the debt at the time of the assignment. |

6 | the debt is * forgiven by subscribing for * shares in a company as mentioned in section 245 - 37 | the amount worked out using the formula in subsection (3). |

(2) The conditions for the purposes of item 3 of the table in subsection (1) are:

(a) at least one of the following is satisfied:

(i) at the time when the debt was * forgiven, the creditor was an Australian resident;

(ii) the forgiveness of the debt was a * CGT event involving a * CGT asset that was * taxable Australian property; and

(b) at least one of the following is satisfied:

(i) there is no amount, and no property, covered by column 2 of item 2 of the table;

(ii) the amount worked out under item 2 of the table is greater or less than the * market value of the debt at the time of the forgiveness and the debtor and creditor did not deal with each other at * arm's length in connection with the forgiveness.

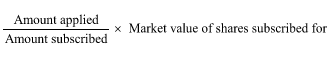

(3) The formula for the purposes of item 6 of the table in subsection (1) is:

where:

"amount applied" means the amount applied by the company as mentioned in section 245 - 37.

"amount subscribed" means the amount subscribed as mentioned in section 245 - 37.

"market value of shares subscribed for" means the * market value of all the shares in the company that were subscribed for as mentioned in section 245 - 37, immediately after those shares were issued.