Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You must, for each income year (the present year ) after the year in which a * depreciating asset is allocated to a pool, make a reasonable estimate of the proportion you use the asset, or have it * installed ready for use, for a * taxable purpose in that year.

Note: This section is modified in its application to a transferee for certain assets if roll - over relief under section 40 - 340 is chosen: see sections 328 - 243 and 328 - 257.

(1A) You must make an adjustment for the present year if your estimate for that year under subsection (1) is different by more than 10 percentage points from:

(a) your original estimate (see section 328 - 205); or

(b) if you have made an adjustment under this section--the most recent estimate you made under subsection (1) that resulted in an adjustment under this section.

(2) The adjustment is made to the * opening pool balance of the * general small business pool to which the asset was allocated, and it must be made before you calculate your deduction under this Subdivision for the present year.

Note: The opening pool balance will be reduced if the adjustment worked out under subsection (3) is a negative amount. It will be increased if the adjustment is positive.

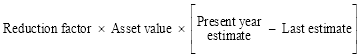

(3) The adjustment is:

where:

"asset value" is:

(a) for a * depreciating asset you started to use, or have * installed ready for use, for a * taxable purpose during an income year for which you were a * small business entity and chose to use this Subdivision--the asset's * adjustable value at that time; or

(b) for an asset you started to use, or have installed ready for use, for a taxable purpose during an income year for which you were not a * small business entity or did not choose to use this Subdivision--its adjustable value at the start of the income year for which it was allocated to a * general small business pool;

increased by any amounts included in the second element of the asset's * cost from the time mentioned in paragraph (a) or (b) until the beginning of the income year for which you are making the adjustment.

"last estimate" is:

(a) your original estimate of the proportion you use, or have * installed ready for use, a * depreciating asset for a * taxable purpose (see section 328 - 205); or

(b) if you have made an adjustment under this section--the latest estimate taken into account under this section.

"present year estimate" is your reasonable estimate of the proportion you use the asset, or have it * installed ready for use, for a * taxable purpose during the present year.

"reduction factor" is the number worked out under subsection (4).

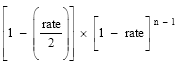

(4) The reduction factor in the formula in subsection (3) is:

(a) for a * depreciating asset you started to use, or have * installed ready for use, for a * taxable purpose during an income year for which you were a * small business entity and chose to use this Subdivision:

(b) for an asset you started to use, or have * installed ready for use, for a taxable purpose during an income year for which you were not a * small business entity or did not choose to use this Subdivision:

where:

"n" is the number of income years (counting part of an income year as a whole year) before the present year for which you have deducted or can deduct an amount for the * depreciating asset under this Subdivision.

"rate" is the rate applicable to the pool to which the asset is allocated.

Note: The reduction factor for a depreciating asset in your general small business pool which you started to use, or have installed ready for use, for a taxable purpose during an income year for which you were not a small business entity or did not choose to use this Subdivision is:

The reduction factor for a depreciating asset in your general small business pool which you started to use, or have installed ready for use, for a taxable purpose during an income year for which you were a small business entity and chose to use this Subdivision is:

Exceptions

(5) However:

(a) you do not need to make an estimate or an adjustment under this section for a * depreciating asset for an income year that is at least 3 income years after the income year in which the asset was allocated; and

(b) you cannot make an adjustment for a depreciating asset if your reasonable estimate of the proportion you use a depreciating asset, or have it * installed ready for use, for a * taxable purpose changes in a later income year by the 10 percentage points mentioned in subsection (1) or less.