Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The * R&D entity must include, in the entity's assessable income for the present year, the sum of the following amounts for each offset year relating to the clawback amount:

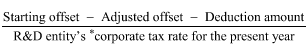

where:

"adjusted offset" means the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) for that tax offset were reduced by the portion of the clawback amount that is attributable to the offset year.

"deduction amount" means the portion of the clawback amount that is attributable to the offset year, multiplied by the R&D entity's * corporate tax rate for the offset year.

"starting offset" means the amount of the * tax offset the R&D entity has received, or is entitled to receive, under section 355 - 100 for the offset year.

(2) However, if this section, or section 355 - 475, has previously applied (whether in the present year or an earlier income year) in relation to another clawback amount, or catch up amount, the * R&D entity has that relates to the offset year, subsection (1) of this section applies as if:

(a) the starting offset were the * tax offset the R&D entity would have received under section 355 - 100 for the offset year if the total amount mentioned in subsection 355 - 100(1) were:

(i) decreased by the sum of the portions of any such other clawback amounts that are attributable to the offset year; and

(ii) increased by the sum of the portions of any such other catch up amounts that are attributable to the offset year; and

(b) the reference to the "total amount" in the definition of adjusted offset were a reference to that amount as so adjusted.