Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

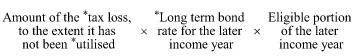

Commonwealth Consolidated Acts(1) The amount of a * tax loss of a * loss year of an entity is increased, at the end of each later income year (and before any * utilisation of the tax loss by the entity in the later income year), by the amount worked out using the following formula:

where:

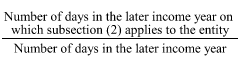

"eligible portion of the later income year" means the amount worked out using the following formula:

(2) This subsection applies to the entity on a day in the later income year if:

(a) the entity is a * designated infrastructure project entity on that day; and

(b) on the day mentioned in subsection (3), the entity has notified the Commissioner (whether before, during or after the later income year) in the * approved form that the entity was, at any time, a designated infrastructure project entity.

(3) For the purposes of paragraph (2)(b), the day is the day after the latest of the following days:

(a) the day before which the entity:

(i) is required to lodge its * income tax return for the later income year with the Commissioner; or

(ii) if the entity is not required to lodge an income tax return for the later income year--would be required to lodge its income tax return for the later income year were the entity required to lodge such a return;

(b) the 28th day after the first day the entity carries on the infrastructure project mentioned in paragraph 415 - 20(1)(b);

(c) the 28th day after the day the * Infrastructure CEO designates the infrastructure project under section 415 - 70;

(d) a later day allowed by the Commissioner.

Note: The increase under this section can occur at the end of an income year even if, at the end of the year, the entity does not know the entity is a designated infrastructure project entity (e.g. because the Infrastructure CEO has not yet designated the infrastructure project that the entity carries on, but the Infrastructure CEO does so later).

Consolidated groups

(4) Disregard paragraph 701 - 30(3)(a) for the purposes of the denominator in the formula in the definition of eligible portion of the later income year in subsection (1) of this section.

Note: Paragraph 701 - 30(3)(a) applies if the entity becomes a subsidiary member of a consolidated group during the later income year.

(5) For the purposes of applying this section to a * tax loss the * head company of a * consolidated group makes as mentioned in subsection 707 - 140(1):

(a) the head company is treated as having made the loss in the income year before the income year in which the transfer mentioned in that subsection occurs; and

(b) subsection (2) of this section is treated as not applying to the head company on or before the day the transfer occurs;

unless the transferred loss was a non - membership period loss (within the meaning of subsection 701 - 30(3)) in relation to the group.

Note: Subsection 707 - 140(1) treats the head company of a consolidated group as having made a loss in an income year in which a loss is transferred to the head company from an entity that joins the group.