Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

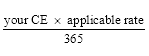

Commonwealth Consolidated ActsStep 1 Calculate for each day in the use period the amount worked out using the formula:

where:

"your CE" is * your construction expenditure.

"applicable rate" is:

(a) 0.04 if the capital works began after 21 August 1984 and before 16 September 1987; or

(b) 0.025 in any other case.

Note: For the purpose of working out the applicable rate, capital works begun after 15 September 1987 are taken to have begun before 16 September 1987 in certain circumstances. See section 43 - 220.

Step 2 Deduct the sum of the amounts calculated under Step 1 from * your construction expenditure. The result is the undeducted construction expenditure for * your area.