Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsObject

(1) The object of this section is to prevent a distortion under section 705 - 35 in the allocation of * allocable cost amount to an entity that becomes a * subsidiary member of the group where that entity has direct or indirect * membership interests in another entity that has certain profits or tax losses when it becomes a subsidiary member.

Adjustment to allocation of allocable cost amount where direct interest in entity with profits/losses

(2) If:

(a) an entity becomes a * subsidiary member of the group at the formation time; and

(b) the entity has * membership interests in a second entity that becomes a subsidiary member of the group at that time; and

(c) in working out the group's * allocable cost amount for the second entity:

(i) an amount is required to be added (the second entity's profit/loss adjustment amount ) under step 3 in the table in section 705 - 60 (about profits accruing before becoming a subsidiary member of the group); or

(ii) an amount is required to be subtracted (also the second entity's profit/loss adjustment amount ) under step 5 in the table in section 705 - 60 (about losses accruing before becoming a subsidiary member of the group); or

(iii) an amount is required to be subtracted (also the second entity's profit/loss adjustment amount ) under step 5A in the table in section 705 - 60 (about * FRT disallowed amounts accruing to a joined group before the joining time);

then, for the purposes of working out under section 705 - 35 the * tax cost setting amount for the assets of the first entity, the * market value of the first entity's membership interests in the second entity is reduced (in a subparagraph (c)(i) case) or increased (in a subparagraph (c)(ii) or (iii) case) by the first entity's interest in the second entity's profit/loss adjustment amount (see subsection (3)).

First entity's interest in second entity's profit/loss adjustment amount

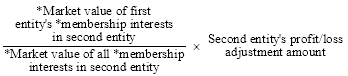

(3) The first entity's interest in the second entity's profit/loss adjustment amount is worked out using the formula:

Adjustment to allocation of allocable cost amount for indirect interest in entity with profits/losses

(4) If:

(a) an entity becomes a * subsidiary member of the group at the formation time; and

(b) the entity has * membership interests in a second entity that becomes a subsidiary member of the group at that time; and

(c) the second entity has, directly or indirectly through one or more interposed entities that become subsidiary members of the group at the formation time, membership interests in a third entity that becomes a subsidiary member of the group at that time; and

(d) in working out the group's * allocable cost amount for the third entity:

(i) an amount is required to be added (the third entity's profit/loss adjustment amount ) under step 3 in the table in section 705 - 60 (about profits accruing before becoming a subsidiary member of the group); or

(ii) an amount is required to be subtracted (also the third entity's profit/loss adjustment amount ) under step 5 in the table in section 705 - 60 (about losses accruing before becoming a subsidiary member of the group); or

(iii) an amount is required to be subtracted (also the third entity's profit/loss adjustment amount ) under step 5A in the table in section 705 - 60 (about * FRT disallowed amounts accruing to a joined group before the joining time);

then, for the purposes of working out under section 705 - 35 the * tax cost setting amount for the assets of the first entity, the * market value of the first entity's membership interests in the second entity is reduced (in a subparagraph (d)(i) case) or increased (in a subparagraph (d)(ii) or (iii) case) by the first entity's interest in the third entity's profit/loss adjustment amount (see subsection (5)).

First entity's interest in third entity's profit/loss adjustment amount

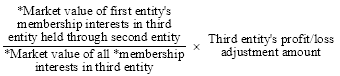

(5) The first entity's interest in the third entity's profit/loss adjustment amount is worked out using the formula:

where:

"market value of first entity's membership interests in third entity held through second entity" means the * market value of all * membership interests in the third entity that the first entity holds indirectly through the second entity (including through that entity and one or more other entities that become * subsidiary members of the group and are interposed between the second entity and the third entity).