Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section operates for the purposes of sections 23AK and 23B of the Income Tax Assessment Act 1936 (the 1936 Act ) if:

(a) a company (the leaving company ) ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ); and

(b) just before the leaving time, there was a post FIF abolition surplus for a FIF attribution account entity in relation to the * head company of the group for the purposes of those sections; and

(c) at the leaving time, the leaving company's FIF attribution account percentage in relation to the FIF attribution account entity for the purposes of those sections is more than nil.

Credit in relation to the leaving company

(2) A post FIF abolition credit arises at the leaving time for the FIF attribution account entity in relation to the leaving company. The credit is the amount worked out under subsection (4).

Debit in relation to head company

(3) A post FIF abolition debit arises at the leaving time for the FIF attribution account entity in relation to the company that was the * head company of the group just before the leaving time. The debit is the amount worked out under subsection (4).

Amount of credit and debit

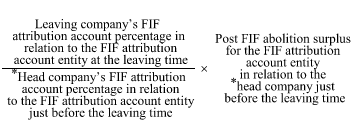

(4) The amount of the credit and debit is worked out using the formula:

(5) In this section:

"FIF attribution account entity" has the same meaning as in former Part XI of the Income Tax Assessment Act 1936 .

"FIF attribution account percentage" has the same meaning as in former Part XI of the Income Tax Assessment Act 1936 .

"post FIF abolition credit" has the same meaning as in the Income Tax Assessment Act 1936 .

"post FIF abolition debit" has the same meaning as in the Income Tax Assessment Act 1936 .

"post FIF abolition surplus" has the same meaning as in the Income Tax Assessment Act 1936 .