Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section operates for the purposes of Part X of the Income Tax Assessment Act 1936 if:

(a) a company (the leaving company ) ceases to be a * subsidiary member of a * consolidated group at a time (the leaving time ); and

(b) disregarding this section, an attribution credit (the original credit ) will arise under subsection 371(8) of that Act at a later time for an attribution account entity in relation to the * head company of the group (including because of the operation of section 717 - 227) for the purposes of that Part; and

(c) at the leaving time the leaving company's attribution account percentage in relation to the attribution account entity for the purposes of that Part is more than nil.

Credit in relation to the leaving company

(2) An attribution credit arises at the later time for the attribution account entity in relation to the leaving company. The credit is the amount worked out under subsection (3).

Amount of credit

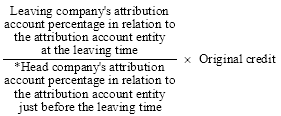

(3) The amount of the credit is worked out using the formula:

Reduction in credit in relation to the head company

(4) The attribution credit that arises at the later time for the attribution account entity in relation to the * head company is reduced by the amount of the attribution credit that arises under subsection (2) in relation to the leaving company.