Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section ensures that the total ( total gain reductions ) of the amounts by which section 727 - 620 reduces gains * realised for income tax purposes by * realisation events happening at the same time does not exceed the total ( total loss reductions ) of:

(a) the amounts by which section 727 - 615 reduces losses that:

(i) would, apart from this Division, be * realised for income tax purposes by * realisation events happening before or at that time; and

(ii) have not already been taken into account in a previous application of this section; and

(b) the amounts by which section 727 - 850 (as applying to the * scheme from which the * indirect value shift results) reduces losses that:

(i) would, apart from this Division, be realised for income tax purposes by realisation events happening before the * IVS time to * equity or loan interests, or * indirect equity or loan interests, in the * losing entity; and

(ii) have not already been taken into account in a previous application of this section.

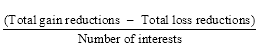

(2) If, apart from this section, the total gain reductions would exceed the total loss reductions, the amount by which section 727 - 620 reduces each of the gains is itself reduced by the amount worked out using this formula:

(3) For the purposes of the formula:

"number of interests" means the number of * affected interests in the * gaining entity to which * realisation events happened at that time.