Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

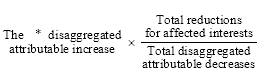

Commonwealth Consolidated Acts(1) The scaling - down formula for the purposes of section 727 - 800 is:

Note: The numerator in the fraction can never exceed the denominator. This means that the fraction can never exceed 1, so the uplift will never exceed the disaggregated attributable increase.

(2) For the purposes of the formula:

"total disaggregated attributable decreases" means the total of:

(a) all * disaggregated attributable decreases that the * indirect value shift has produced, in the * market values of * affected interests in the * losing entity, for the entities that owned those interests immediately before the * IVS time; and

(b) if:

(i) section 727 - 850 (as applying to the * scheme from which the indirect value shift results) reduces losses that are * realised for income tax purposes by * realisation events happening before the * IVS time to * equity or loan interests, or to * indirect equity or loan interests, in the losing entity; and

(ii) the indirect value shift is the only indirect value shift, or is the greater or greatest of 2 or more indirect value shifts, that results from the scheme and for which the losing entity is the losing entity;

for each of those realisation events, the amounts that would, if:

(iii) the * presumed indirect value shift were an indirect value shift; and

(iv) the IVS time for the presumed indirect value shift were the time of that realisation event;

be the disaggregated attributable decreases that the presumed indirect value shift has produced, in the market value of the equity or loan interests to which that realisation event happened, for the entities that owned those interests immediately before the time of that realisation event.

"total reductions for affected interests" means the total of:

(a) all reductions under this Division, because of the indirect value shift, of * adjustable values of affected interests in the losing entity; and

(b) if paragraph (b) of the definition of total disaggregated attributable decreases applies--the amounts by which section 727 - 850 reduces the losses (if any) referred to in that paragraph.