Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) The entity's maximum allowable debt for an income year is the greatest of the following amounts:

(a) the * safe harbour debt amount;

(c) unless subsection (2) applies to the entity--the * worldwide gearing debt amount.

Entities that are not eligible for the worldwide gearing debt amount

(2) This subsection applies to an entity, if:

(a) the entity has * statement worldwide equity, or * statement worldwide assets, of nil or a negative amount; or

(b) * audited consolidated financial statements for the entity for the income year do not exist; or

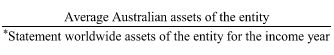

(c) the result of applying the following formula is greater than 0.5:

where:

"average Australian assets" :

(a) of an * Australian entity--is the average value, for the statement period mentioned in subsection (3), of all the assets of the entity, other than:

(i) any * debt interests held by the entity, to the extent to which any value of the interests is all or a part of the * controlled foreign entity debt of the entity; or

(ii) any * equity interests or debt interests held by the entity, to the extent to which any value of the interests is all or a part of the * controlled foreign entity equity of the entity; and

(b) of a * foreign entity--is the average value, for the statement period mentioned in subsection (3), of all the assets of the entity that are:

(i) located in Australia; or

(ii) attributable to the entity's * Australian permanent establishments; or

(iii) debt interests held by the entity, that were * issued by an * Australian entity and are * on issue;

(iv) equity interests held by the entity in an * Australian entity.

(3) For the purposes of the definition of average Australian assets in subsection (2) the statement period is the period for which the * audited consolidated financial statements for the entity for the income year have been prepared.

(4) For the purposes of the formula in paragraph (2)(c), if:

(a) an amount is included in * statement worldwide assets in respect of an asset; and

(b) the asset was acquired, held or otherwise dealt with by an entity for a purpose (other than an incidental purpose) that included ensuring that subsection (2) does not apply to an entity; and

(c) as a result of the acquisition, holding or dealing with of the asset, the amount included in statement worldwide assets exceeds the amount (including nil) that would otherwise be so included;

apply the amount of the excess to reduce statement worldwide assets (or statement worldwide assets as reduced by a previous application of this subsection).