Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies in relation to the amounts listed at items 8 to 12 in section 960 - 265.

Indexing amounts

(2) You index the amount by:

(a) first, multiplying its base amount mentioned in subsection (3) by its * indexation factor mentioned in subsection (5); and

(b) next, rounding the result in paragraph (a) down to the nearest multiple of its * rounding amount.

Example 1: An amount of $140,000 is to be indexed, with a rounding amount of $5,000. If the indexation factor increases this to an indexed amount of $143,000, the indexed amount is rounded back down to $140,000.

Example 2: An amount of $140,000 is to be indexed, with a rounding amount of $5,000. If the indexation factor increases this to an indexed amount of $146,000, the indexed amount is rounded down to $145,000.

(3) The amount (the base amount ) for an amount to which this section applies is:

(a) unless paragraph (b) applies--the amount for the 2007 - 2008 income year or * financial year; or

(b) if the amount is mentioned in item 9 or 10A in section 960 - 265--the amount for the 2017 - 2018 financial year.

(4) You do not index the amount if the * indexation factor is 1 or less.

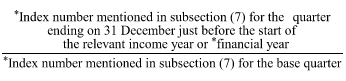

(5) For indexing an amount, its indexation factor is:

where:

"base quarter" means:

(a) unless paragraph (b) applies--the quarter ending on 31 December 2006; or

(b) if the amount is mentioned in item 9 or 10A in section 960 - 265--the quarter ending on 31 December 2016.

(6) You work out the * indexation factor mentioned in subsection (5) to 3 decimal places (rounding up if the fourth decimal place is 5 or more).

Index number and rounding amount

(7) For indexing an amount to which this section applies:

(a) the index number for a * quarter is set out in column 2 of the relevant item in the following table; and

(b) the rounding amount is set out in column 3 of that item.

Concepts for indexing rounded caps | |||

Item | Column 1 | Column 2 | Column 3 |

1 | Items 8, 10, 11 and 12 | the * index number mentioned in subsection 960 - 280(4) (which is about average weekly ordinary time earnings) | $5,000 |

2 | Item 9 (concessional contributions cap) | the * index number mentioned in subsection 960 - 280(4) (which is about average weekly ordinary time earnings) | $2,500 |

3 | Item 10A (general transfer balance cap) | the * index number mentioned in subsection 960 - 280(1) (which is about the CPI) | $100,000 |