Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) You index, on a * quarterly basis, the amount mentioned in the provision listed at item 14 in section 960 - 265 by:

(a) first, multiplying the amount by its * indexation factor mentioned in subsection (3); and

(b) next, rounding the result in paragraph (a) down to the nearest multiple of $1,000,000.

(2) You do not index the amount if the * indexation factor is 1 or less.

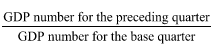

(3) For indexation of the amount, the indexation factor is:

where:

"GDP number for the base quarter" is the estimate that is, at the end of the * quarter to which the indexation is to be applied, the estimate of the Gross Domestic Product: Current Prices - Seasonally Adjusted most recently published by the Australian Statistician for the * quarter ending on 30 June 2017.

"GDP number for the preceding quarter" is the estimate of the Gross Domestic Product: Current Prices - Seasonally Adjusted first published by the Australian Statistician for the * quarter preceding the quarter to which the indexation is to be applied.

(4) You work out the * indexation factor mentioned in subsection (3) to 3 decimal places (rounding up if the fourth decimal place is 5 or more).