Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts

Income Tax (Transitional Provisions) Act 1997

1 Section 405 - 1 (link note)

Repeal the link note, substitute:

[The next Division is Division 700.]

2 After Part 3 - 45

Insert:

Part 3 - 90 -- Consolidated groups

Division 700 -- Application of Part 3 - 90 of Income Tax Assessment Act 1997

Table of sections

700 - 1 Application of Part 3 - 90 of Income Tax Assessment Act 1997

700 - 1 Application of Part 3 - 90 of Income Tax Assessment Act 1997

Part 3 - 90 of the Income Tax Assessment Act 1997 applies on and after 1 July 2002.

[The next Division is Division 703.]

Division 703 -- Consolidated groups and their members

Table of sections

703 - 30 Debt interests that are not membership interests

703 - 30 Debt interests that are not membership interests

(1) For the purposes of Part 3 - 90 of the Income Tax Assessment Act 1997 , this section affects whether an interest or right that is held by an entity on or after 1 July 2002 and relates to another entity is a membership interest of the entity in the other entity.

(2) Apply Division 974 of the Income Tax Assessment Act 1997 in determining under Subdivision 960 - G of that Act whether the interest or right is a membership interest of the entity in the other entity.

Note: Under Subdivision 960 - G of the Income Tax Assessment Act 1997 , a debt interest relating to an entity is not a membership interest in the entity. Division 974 of that Act explains what a debt interest is.

(3) This section has effect whether or not the debt and equity test amendments (as defined in item 118 of Schedule 1 to the New Business Tax System (Debt and Equity) Act 2001 ) apply to transactions in relation to the interest or right at the relevant time.

[The next Division is Division 707.]

Division 707 -- Losses for head companies when head companies become members etc.

Table of Subdivisions

707 - C Amount of transferred losses that can be utilised

707 - D Special rules about losses

Subdivision 707 - C -- Amount of transferred losses that can be utilised

Table of sections

707 - 325 Increasing the available fraction for a bundle of losses by increasing the real loss - maker's modified market value

707 - 327 Choosing available fraction to apply to value donor's loss

707 - 328 Income year and conditions for possible transfer under Division 170 of the Income Tax Assessment Act 1997

707 - 329 Modified market value at a time before 8 December 2004

707 - 350 Alternative loss utilisation regime to Subdivision 707 - C of the Income Tax Assessment Act 1997

Conditions for increasing real loss - maker's modified market value

(1) This section affects the working out of the available fraction for a bundle of losses under subsection 707 - 320(1) of the Income Tax Assessment Act 1997 if:

(a) the transferee mentioned in that subsection chooses under subsection ( 5) of this section to increase the available fraction using a percentage of the modified market value of a company (the value donor ) other than the real loss - maker mentioned in subsection 707 - 315(1) of that Act for the bundle; and

(b) both the real loss - maker and the value donor became members of the group mentioned in subsection 707 - 315(1) of that Act in connection with the bundle at the time (which is the initial transfer time mentioned in that subsection in connection with the bundle) the group became a consolidated group; and

(c) the initial transfer time is before 1 July 2004; and

(d) the bundle includes a loss that is not :

(i) an overall foreign loss (as defined in section 160AFD of the Income Tax Assessment Act 1936 ); or

(ii) a loss whose utilisation is affected by section 707 - 350 (about utilisation of certain losses originally made for an income year ending on or before 21 September 1999); and

(e) the value donor would have been able to transfer the loss to the transferee under Subdivision 707 - A of the Income Tax Assessment Act 1997 at the initial transfer time had the value donor:

(i) made the loss for the income year for which the real loss - maker made it; and

(ii) not utilised it; and

(f) the requirement in subsection ( 2) is met.

(2) It must have been possible for the real loss - maker to have transferred the loss to the value donor under Subdivision 170 - A or 170 - B of the Income Tax Assessment Act 1997 for an income year consisting of the period described in section 707 - 328 had the conditions in that section existed.

Increase in the modified market value of the real loss - maker

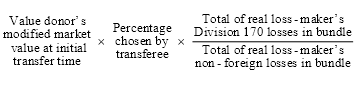

(3) Work out the available fraction for the bundle of losses as if the modified market value of the real loss - maker at the initial transfer time were increased by the amount worked out using the formula:

(4) In subsection ( 3):

"total of real loss-maker's Division 170 losses in bundle" is the total of the amount of each loss:

(a) that is covered by paragraphs ( 1)(d) and (e); and

(b) in relation to which the requirements in subsection ( 2) are met.

"total of real loss-maker's non-foreign losses in bundle" is the total of the amount of each loss that is described in paragraph ( 1)(d).

Choice to increase available fraction

(5) The transferee may choose to use a fixed percentage (greater than 0% and not more than 100%) of the value donor's modified market value to increase the available fraction for the bundle. The transferee may do so only by the day on which it lodges its income tax return for the first income year for which it utilises (except in accordance with section 707 - 350) losses transferred to it under Subdivision 707 - A of the Income Tax Assessment Act 1997 .

(6) The choice cannot be amended or revoked.

If this section applies more than once for the same value donor

(7) If subsection ( 3) applies 2 or more times in relation to the same value donor but different real loss - makers, the transferee cannot choose for those applications percentages of the value donor's modified market value at the initial transfer time that result in the total of the amounts worked out under those applications exceeding that value.

Increase in real loss - maker's value reduces value donor's value

(8) Work out the available fraction for a bundle of losses transferred under Subdivision 707 - A of the Income Tax Assessment Act 1997 from the value donor at the initial transfer time as if the value donor's modified market value at the time were reduced by the amount worked out under subsection ( 3).

This section does not affect utilisation of overall foreign losses

(9) This section has effect for working out the available fraction of a bundle of losses only so far as it affects the utilisation of a tax loss, film loss or net capital loss. It does not affect the utilisation of an overall foreign loss (as defined in section 160AFD of the Income Tax Assessment Act 1936 ) included in a bundle of losses:

(a) transferred from the real loss - maker under Subdivision 707 - A of the Income Tax Assessment Act 1997 ; or

(b) transferred from the value donor under that Subdivision.

Note: If a bundle of losses includes an overall foreign loss and a loss of another sort:

(a) utilisation of the overall foreign loss is limited by the available fraction for the bundle worked out apart from this section; and

(b) utilisation of the loss of the other sort is limited by the available fraction for the bundle as affected by this section, if applicable.

707 - 327 Choosing available fraction to apply to value donor's loss

Conditions for choosing available fraction for value donor's loss

(1) This section has effect for the purposes of working out under Subdivision 707 - C of the Income Tax Assessment Act 1997 how much of a tax loss, film loss or net capital loss can be utilised if:

(a) section 707 - 325 affects the available fraction for a bundle of other losses by increasing the modified market value of the real loss - maker of those other losses by an amount worked out by reference to the value donor's modified market value; and

(b) the loss was transferred under Subdivision 707 - A of that Act at the initial transfer time from the value donor ; and

(c) the loss is not a loss whose utilisation is affected by section 707 - 350 (about utilisation of certain losses originally made for an income year ending on or before 21 September 1999); and

(d) each company covered by subsection ( 2) would have been able to transfer the loss under Subdivision 707 - A of that Act at the initial transfer time had the company:

(i) made the loss for the income year for which the value donor made it; and

(ii) not utilised it; and

(e) the requirement in subsection ( 3) is met.

(2) This subsection covers:

(a) the real loss - maker; and

(b) each other company (if any) by reference to which the available fraction for the bundle was affected under an application of section 707 - 325 separate from the application of that section mentioned in paragraph ( 1)(a) of this section.

(3) It must have been possible for the value donor to have transferred an amount (greater than a nil amount) of the loss to each company covered by subsection ( 2) under Subdivision 170 - A or 170 - B of the Income Tax Assessment Act 1997 for an income year consisting of the period described in section 707 - 328 had the conditions in that section existed.

Treating value donor's loss as included in bundle

(4) If the transferee mentioned in subsection 707 - 325(1) chooses, sections 707 - 310, 707 - 335 (except paragraph 707 - 335(2)(a)) and 707 - 340 of the Income Tax Assessment Act 1997 (and subsections 707 - 315(3) and (4) of that Act, so far as they relate to those sections) operate as if, at the initial transfer time:

(a) the bundle of losses included the loss; and

(b) the loss was not included in any other bundle of losses.

Note: This section has the effect that the utilisation of the loss will be affected by the available fraction for the bundle of losses.

Choice to treat value donor's loss as included in bundle

(5) A choice for the purposes of subsection ( 4):

(a) may be made only by the day on which the transferee lodges its income tax return for the first income year for which it utilises (except in accordance with section 707 - 350) losses transferred to it under Subdivision 707 - A of the Income Tax Assessment Act 1997 ; and

(b) cannot be revoked.

Loss already in bundle with increased available fraction

(6) Subsection ( 4) does not apply in relation to the loss if it was covered by paragraphs 707 - 325(1)(d) and (e) and subsection 707 - 325(2) in an application of section 707 - 325 separate from the application of that section mentioned in paragraph ( 1)(a) of this section.

Note: This means that a loss that provided a basis for working out an increased available fraction for a bundle of losses under section 707 - 325 cannot be treated under this section as if it were included in another bundle of losses.

707 - 328 Income year and conditions for possible transfer under Division 170 of the Income Tax Assessment Act 1997

(1) This section sets out the period and conditions referred to:

(a) in subsections 707 - 325(2) and 707 - 327(3); and

(b) in connection with the requirement that it must have been possible for a company (the notional transferor ) to transfer to another company (the notional transferee ) for an income year a loss under Subdivision 170 - A or 170 - B of the Income Tax Assessment Act 1997 .

Period to be treated as income year for transfer

(2) The period:

(a) starts at the later of these times:

(i) the start of the trial year;

(ii) the start of the income year for which the loss was made; and

(b) ends immediately after the initial transfer time mentioned in subsection 707 - 320(1) of the Income Tax Assessment Act 1997 .

Note: For the purposes of identifying the trial year using the definition in section 707 - 120 of the Income Tax Assessment Act 1997 , the notional transferor mentioned in this section is the same as the joining entity mentioned in that section, and the initial transfer time mentioned in this section is the same as the joining time mentioned in that section.

Conditions

(3) The first condition is that neither the notional transferor nor the notional transferee became a subsidiary member of a consolidated group before, at or after the initial transfer time mentioned in the relevant subsection.

(4) The second condition is that neither of those Subdivisions had been amended to provide only for transfers involving an Australian branch (as defined in section 160ZZV of the Income Tax Assessment Act 1936 ) of a foreign bank.

(5) The third condition is that the notional transferee's income or gains for the income year were great enough not to prevent the transfer.

(6) The fourth condition is that those Subdivisions operated as if the notional transferor had made the loss for the income year if the notional transferor had actually made it for an income year ending just before the initial transfer time.

707 - 329 Modified market value at a time before 8 December 2004

Disregard an event that is described in subsection 707 - 325(4) of the Income Tax Assessment Act 1997 and occurred on or before 8 December 2000 in working out under section 707 - 325 of that Act the modified market value of an entity at the time it becomes a member of a consolidated group on a day before 8 December 2004.

[The next section is section 707 - 350.]

707 - 350 Alternative loss utilisation regime to Subdivision 707 - C of the Income Tax Assessment Act 1997

(1) This section affects the way in which one or more losses of one particular sort in a bundle of losses transferred under Subdivision 707 - A of the Income Tax Assessment Act 1997 before 1 July 2004 can be utilised by the transferee if:

(a) they were actually made (disregarding that Subdivision) by a company (the real loss - maker ) for an income year ending on or before 21 September 1999; and

(b) they were transferred at the time (the initial transfer time ) the transferee became the head company of a consolidated group; and

(c) they were transferred to the transferee from the real loss - maker because:

(i) the real loss - maker met the conditions in section 165 - 12 of that Act; and

(ii) the conditions in one or more of paragraphs 165 - 15(1)(a), (b) and (c) did not exist in relation to the real loss - maker; and

(d) none of them had been transferred under that Subdivision before the initial transfer time; and

(e) the transferee has made a choice under subsection ( 5).

Losses to be utilised only after non - transferred losses

(2) The transferee may utilise for an income year the losses only after utilising for the year losses (the non - transferred losses ) of the same sort that the transferee made without a transfer under Subdivision 707 - A of the Income Tax Assessment Act 1997 (even if the income year for which the transferee made the losses is earlier than an income year for which the transferee made any of the non - transferred losses).

Further limit on utilising the losses

(3) The amount of the losses that the transferee may utilise for an income year cannot exceed the amount worked out for the year using the table.

Limit on utilising the losses | ||

Item | For this income year: | The amount of the losses that the transferee may utilise cannot exceed: |

1 | The first income year ending after the initial transfer time | 1 / 3 of the total of the amounts of the losses that were transferred to the transferee |

2 | The second income year ending after the initial transfer time | The difference between: (a) 2 / 3 of the total of the amounts of the losses that were transferred to the transferee; and (b) the amount of the losses utilised for the income year mentioned in item 1 |

3 | The third income year ending after the initial transfer time, or a later income year | The difference between: (a) the total of the amounts of the losses that were transferred to the transferee; and (b) the total of the amounts of the losses utilised for earlier income years ending after the initial transfer time |

Subdivision 707 - C of Income Tax Assessment Act 1997 disapplied

(4) Subdivision 707 - C of the Income Tax Assessment Act 1997 operates as if the losses had been made by the transferee without being transferred under Subdivision 707 - A of that Act.

Note: This has 2 effects. First, Subdivision 707 - C of that Act does not limit utilisation of the losses. Secondly, it affects the limit that Subdivision sets on utilising other losses in any bundle (because that limit depends on the transferee's income and gains remaining after utilisation of losses that have not been transferred under Subdivision 707 - A of that Act).

Making choice

(5) The transferee may choose that this section apply to the utilisation for any income year of all losses (of any sort) in the bundle that meet the conditions in paragraphs ( 1)(a), (b), (c) and (d). The transferee may do so only by the day on which it lodges its income tax return for the first income year for which it could utilise any losses transferred to it under Subdivision 707 - A of the Income Tax Assessment Act 1997 (as described in subsection ( 1) or otherwise).

When choice has effect

(6) The choice has effect for that income year and all later income years (and cannot be revoked).

Future transfer of the losses not affected

(7) This section does not limit the transfer under Subdivision 707 - A of the Income Tax Assessment Act 1997 of any of the losses from the transferee to another company.

Subdivision 707 - D -- Special rules about losses

Table of sections

707 - 405 Special rules about losses referable to part of income year

707 - 405 Special rules about losses referable to part of income year

Section 707 - 405 of the Income Tax Assessment Act 1997 has effect in relation to this Division, and Division 170 of that Act as it has effect for the purposes of this Division, in the same way as that section has effect in relation to Division 707 of that Act.

[The next Division is Division 820.]