Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsIncome Tax Assessment Act 1997

1 Subsection 4 - 15(2) (after table item 1A)

Insert:

1B | An entity is a * member of a * consolidated group at any time in the income year | Part 3 - 90 |

2 Application

The amendment of section 4 - 15 of the Income Tax Assessment Act 1997 made by this Schedule applies to the income year including 1 July 2002 and each later income year.

Part 2 -- Head company terminology

Income Tax Assessment Act 1997

3 Section 166 - 220

Omit "(the head company )", substitute "(the tested company )".

4 Subsections 166 - 225(1) and (2)

Omit " * head company", substitute "tested company".

5 Paragraphs 166 - 225(2)(a), (b) and (c)

Omit "head company", substitute "tested company".

6 Subsection 166 - 230(1) (heading)

Repeal the heading, substitute:

Notional shareholder of the tested company

7 Subsection 166 - 230(1)

Omit " * head company", substitute "tested company".

8 Paragraph 166 - 230(1)(a)

Omit "head company", substitute "tested company".

9 Subparagraphs 166 - 230(1)(b)(i) and (ii)

Omit "head company", substitute "tested company".

10 Subsections 166 - 230(2) and (3)

Omit " * head company", substitute "tested company".

11 Paragraph 166 - 230(3)(a)

Omit "head company", substitute "tested company".

12 Subparagraphs 166 - 230(3)(b)(i) and (ii)

Omit "head company", substitute "tested company".

13 Subsections 166 - 235(1) and (2)

Omit " * head company", substitute "tested company".

14 Section 166 - 250

Omit " * head company", substitute "tested company".

15 Paragraphs 166 - 250(a) and (b)

Omit "head company", substitute "tested company".

16 Section 166 - 255

Omit " * head company", substitute "tested company".

Part 3 -- Limiting access to group concessions

Income Tax Assessment Act 1997

17 Subsection 104 - 175(6)

After "section 104 - 180", insert "or 104 - 182".

18 After section 104 - 180

Insert:

104 - 182 Consolidated group break - up

* CGT event J1 does not happen if the recipient company ceases to be a * subsidiary member of a * consolidated group at the break - up time (whether or not it becomes a subsidiary member of another consolidated group at that time).

19 Application of amendments of Subdivision 104 - J

The amendments of Subdivision 104 - J of the Income Tax Assessment Act 1997 made by this Schedule apply in relation to a break - up time happening after 30 June 2002.

20 Section 126 - 40

Repeal the section, substitute:

126 - 40 What this Subdivision is about

A roll - over may be available for the transfer of a CGT asset between 2 companies, or the creation of a CGT asset by one company in another, if:

(a) both companies are members of the same wholly - owned group; and

(b) at least one of the companies is a foreign resident.

21 Subsection 126 - 50(5) (table)

Repeal the table, substitute:

Additional requirements | |||

Item | At the time of the trigger event the originating company must be: | At the time of the trigger event the recipient company must be: | The roll - over asset must have the necessary connection with Australia: |

1 | Either: (a) a foreign resident; or (b) an Australian resident but not a * prescribed dual resident | A foreign resident | Either: (a) just before and just after the trigger event, for a disposal case; or (b) just after that event, for a creation case |

2 | A foreign resident | An Australian resident but not a * prescribed dual resident | Either: (a) just before the trigger event, for a disposal case; or (b) just after that event, for a creation case |

22 At the end of section 126 - 50

Add:

(6) If at the time of the trigger event:

(a) the originating company or the recipient company is an Australian resident; and

(b) that company is a * member of a * consolidatable group;

that company must also at that time be a member of a * consolidated group or * MEC group.

(7) If the originating company is a foreign resident, it must not have * acquired the * CGT asset described in subsection ( 8) because of:

(a) a single * CGT event giving rise to a roll - over under a previous application of this Subdivision (as amended by the New Business Tax System (Consolidation) Act (No. 1) 2002 ) involving an Australian resident originating company other than the company that is the recipient company for the current application of this Subdivision; or

(b) a series (whether or not it is the longest possible series) of consecutive CGT events giving rise to roll - overs under previous applications of this Subdivision (as amended by the New Business Tax System (Consolidation) Act (No. 1) 2002 ), the earliest involving an Australian resident originating company other than the company that is the recipient company for the current application of this Subdivision.

(8) Subsection ( 7) operates in relation to the * CGT asset:

(a) that was involved in the trigger event in a disposal case; or

(b) because of which the originating company was able to create the CGT asset that was involved in the trigger event in a creation case.

(9) Subsection ( 7) does not apply if each of the following companies mentioned in that subsection:

(a) the recipient company for the roll - over under the current application of this Subdivision;

(b) the Australian resident originating company for the roll - over under:

(i) for paragraph ( 7)(a)--the previous application of this Subdivision; or

(ii) for paragraph ( 7)(b)--the earliest previous application of this Subdivision for that series of consecutive * CGT events;

was, at the time of its roll - over, the * head company of the same * MEC group.

23 Application of amendments of Subdivision 126 - B

(1) The amendments of Subdivision 126 - B of the Income Tax Assessment Act 1997 made by this Schedule apply in relation to a trigger event happening after 30 June 2003, except a trigger event to which subitem ( 2) applies.

(2) This subitem and subitem ( 3) apply to a trigger event if:

(a) the originating company or the recipient company involved in the trigger event becomes a member of a consolidated group, or MEC group, on the day (the consolidation day ) on which that group comes into existence; and

(b) the consolidation day either is before 1 July 2003 or is both:

(i) the first day of the first income year starting after 30 June 2003 of the group's head company (for a consolidated group) or provisional head company (for a MEC group) on the consolidation day; and

(ii) before 1 July 2004; and

(c) the originating company was not a member of a consolidated group or MEC group before the consolidation day.

(3) The amendments of Subdivision 126 - B of the Income Tax Assessment Act 1997 made by this Schedule apply in relation to the trigger event if it happens on or after the consolidation day.

Income Tax Assessment Act 1997

24 Division 170 (heading)

Repeal the heading, substitute:

Division 170 -- Treatment of certain company groups for income tax purposes

25 Subdivision 170 - A (heading)

Repeal the heading, substitute:

Subdivision 170 - A -- Transfer of tax losses within certain wholly - owned groups of companies

26 Section 170 - 1

Repeal the section, substitute:

170 - 1 What this Subdivision is about

A company can transfer a surplus amount of its tax loss to another company so that the other company can deduct the amount in the income year of the transfer. One of the companies must be an Australian branch of a foreign bank, and both companies must be members of the same wholly - owned group.

27 After subsection 170 - 5(2)

Insert:

(2A) One of the companies must be an Australian branch of a foreign bank. The other company must be:

(a) the head company of a consolidated group or MEC group; or

(b) not a member of a consolidatable group.

28 At the end of section 170 - 30

Add:

(3) One of the companies must be an Australian branch (as defined in Part IIIB of the Income Tax Assessment Act 1936 ) of a * foreign bank.

Note: The Australian branch can be taken to be a separate entity from the foreign bank for this Subdivision. See Part IIIB of the Income Tax Assessment Act 1936 .

(4) The other company must be covered by an item of this table.

The other company | ||

Item | The other company must: | At this time: |

1 | Be the * head company of a * consolidated group | The end of the * deduction year or, if the company ceases to be * in existence during the deduction year, just before the cessation |

2 | Be the * head company of a * MEC group | The end of the * deduction year or, if the group ceases to exist during the deduction year because the company ceases to be * in existence, just before the cessation |

3 | Not be a * member of a * consolidatable group | The end of the * deduction year or, if the company ceases to be * in existence during the deduction year, just before the cessation |

Note: The heading to section 170 - 30 is altered by adding at the end " etc. ".

29 Subdivision 170 - B (heading)

Repeal the heading, substitute:

30 Section 170 - 101

Repeal the section, substitute:

170 - 101 What this Subdivision is about

A company can transfer a surplus amount of its net capital loss to another company so that the other company can apply the amount in working out its net capital gain for the income year of the transfer. One of the companies must be an Australian branch of a foreign bank, and both companies must be members of the same wholly - owned group.

31 After subsection 170 - 105(2)

Insert:

(2A) One of the companies must be an Australian branch of a foreign bank. The other company must be:

(a) the head company of a consolidated group or MEC group; or

(b) not a member of a consolidatable group.

32 At the end of section 170 - 130

Add:

(3) One of the companies must be an Australian branch (as defined in Part IIIB of the Income Tax Assessment Act 1936 ) of a * foreign bank.

Note: The Australian branch can be taken to be a separate entity from the foreign bank for this Subdivision. See Part IIIB of the Income Tax Assessment Act 1936 .

(4) The other company must be covered by an item of this table.

The other company | ||

Item | The other company must: | At this time: |

1 | Be the * head company of a * consolidated group | The end of the application year or, if the company ceases to be * in existence during the application year, just before the cessation |

2 | Be the * head company of a * MEC group | The end of the application year or, if the group ceases to exist during the application year because the company ceases to be * in existence, just before the cessation |

3 | Not be a * member of a * consolidatable group | The end of the application year or, if the company ceases to be * in existence during the application year, just before the cessation |

Note: The heading to section 170 - 130 is altered by adding at the end " etc. ".

33 Section 195 - 10

After "within", insert "certain".

34 Paragraph 195 - 15(5)(b)

After "within", insert "certain".

35 Section 195 - 30

After "within", insert "certain".

36 Paragraph 195 - 35(5)(b)

After "within", insert "certain".

37 Basic rule about application of amendments of Division 170

(1) The amendments of Division 170 of the Income Tax Assessment Act 1997 made by this Schedule apply in relation to a company for each of its:

(a) income years starting after 30 June 2003; and

(b) non - membership periods (if any) under section 701 - 30 of the Income Tax Assessment Act 1997 starting after 30 June 2003.

(2) This item does not apply in relation to a company to which item 38 applies.

38 Different application for members of certain groups

(1) This item applies to a company if:

(a) the company becomes a member of a consolidated group or MEC group on the day (the consolidation day ) the group comes into existence; and

(b) the consolidation day either is before 1 July 2003 or is both:

(i) the first day of the first income year starting after 30 June 2003 of the group's head company (for a consolidated group) or provisional head company (for a MEC group) on the consolidation day; and

(ii) before 1 July 2004; and

(c) the company was not a member of a consolidated group or MEC group before the consolidation day.

(2) The amendments of Division 170 of the Income Tax Assessment Act 1997 made by this Schedule apply in relation to the company for each of its:

(a) income years starting on or after the consolidation day; and

(b) non - membership periods (if any) under section 701 - 30 of the Income Tax Assessment Act 1997 starting on or after the consolidation day.

39 Transfer for final income year before amendments apply

(1) In this item:

apportioning day of a company means:

(a) if item 37 applies to the company--1 July 2003; or

(b) if item 38 applies to the company--the consolidation day.

Application

(2) This item applies to these transfers under Subdivision 170 - A or 170 - B of the Income Tax Assessment Act 1997 involving a company:

(a) a transfer by the company of a loss it made for the income year (the final year ) just before the first income year for which the amendments of those Subdivisions by this Schedule apply to the company;

(b) a transfer to the company for the final year of a loss made for that income year or an earlier income year.

However, this item does not apply to a transfer involving companies that would satisfy either subsections 170 - 30(3) and (4) or 170 - 130(3) and (4) of that Act (as amended by this Schedule) if those subsections applied for the final year.

Object

(3) The main object of this item is to ensure that the company can either:

(a) transfer a loss it makes for the final year only so far as the loss is attributable to so much of the final year as occurs before its apportioning day; or

(b) utilise a loss transferred to it to reduce income or gains for the final year only so far as the income or gains are attributable to so much of the final year as occurs before its apportioning day.

Apportioning limit on transferring company's loss for final year

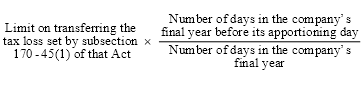

(4) Despite section 170 - 45 of the Income Tax Assessment Act 1997 , the amount of a tax loss made for the final year by the company that can be transferred cannot exceed the amount worked out using the formula:

Note: If the company's final year ends just before its apportioning day, this subitem does not reduce the amount of the tax loss the company can transfer.

(5) Despite section 170 - 145 of the Income Tax Assessment Act 1997 , a net capital loss made for the final year by the company:

(a) can be transferred only if the sum of the capital losses made by the company during the final year before its apportioning day exceeds the sum of the capital gains made by the company during the final year before its apportioning day; and

(b) cannot be transferred to an extent greater than that excess.

Note: If the company's final year ends just before its apportioning day, this subitem does not reduce the amount of the net capital loss the company can transfer.

Apportioning limit based on transferee company's income or gains for final year

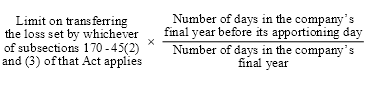

(6) Despite section 170 - 45 of the Income Tax Assessment Act 1997 , the amount of a tax loss (for the final year or an earlier income year) that can be transferred to the company for the final year cannot exceed the amount worked out using the formula:

Note: If the company's final year ends just before its apportioning day, this subitem does not reduce the amount of the tax loss that can be transferred to the company.

(7) Despite section 170 - 145 of the Income Tax Assessment Act 1997 , a net capital loss (for the final year or an earlier income year) can be transferred to the company for the final year:

(a) only if the company would have had a net capital gain for the final year apart from that section had the final year ended on the day before the company's apportioning day; and

(b) only to the extent to which it could have been transferred consistently with subsection 170 - 145(6) of that Act if the result of step 1 of the method statement had been the amount of the company's net capital gain worked out on the basis described in paragraph ( a) of this subitem.

Note: If the company's final year ends just before its apportioning day, this subitem does not reduce the amount of the net capital loss that can be transferred to the company.

Transfer not prevented by transferor joining consolidated group

(8) Subsections 170 - 45(1) and 170 - 145(1) of the Income Tax Assessment Act 1997 apply in relation to a transfer from a company (whether or not it is the company mentioned in subitem ( 4) or (5)) that becomes a member of a consolidated group or MEC group as if the fact that the company becomes such a member does not affect its ability to carry forward losses for the final year or an earlier income year.

Application to non - membership periods less than a year

(9) If, under section 701 - 30 of the Income Tax Assessment Act 1997 , the company has a non - membership period that ends just before the company first becomes a subsidiary member of a consolidated group or MEC group, Subdivisions 170 - A and 170 - B of that Act and subitems ( 3) to (8) (inclusive) apply in relation to the period as if it were the final year.

(10) To avoid doubt, section 701 - 30 of the Income Tax Assessment Act 1997 does not prevent a company from transferring under Subdivision 170 - A or 170 - B of that Act (applying as described in subitem ( 9)) a non - membership period loss described in that section for the non - membership period mentioned in that subitem.

Part 4 -- Anti - avoidance provision for franking credit trading

Income Tax Assessment Act 1936

40 After section 177EA

Insert:

177EB Cancellation of franking credits--consolidated groups

Expressions to have same meanings as in section 177EA and Income Tax Assessment Act 1997

(1) Unless the contrary intention appears, expressions used in this section:

(a) if those expressions are defined in section 177EA--have the same meanings as in that section (subject to subsection ( 10) of this section); and

(b) otherwise--have the same meanings as in the Income Tax Assessment Act 1997 .

This section and section 177EA do not limit each other

(2) This section does not limit the operation of section 177EA, and section 177EA does not limit the operation of this section.

Application of section

(3) This section applies if:

(a) there is a scheme for a disposition of membership interests in an entity (the joining entity ); and

(b) as a result of the disposition, the joining entity becomes a subsidiary member of a consolidated group; and

(c) a credit arises in the franking account of the head company of the group because of the joining entity becoming a subsidiary member of the group; and

(d) having regard to the relevant circumstances of the scheme, it would be concluded that the person, or one of the persons, who entered into or carried out the scheme or any part of the scheme did so for a purpose (whether or not the dominant purpose but not including an incidental purpose) of enabling the credit referred to in paragraph ( c) to arise in the head company's franking account.

Bare acquisition of membership interests

(4) It is not to be concluded for the purposes of paragraph ( 3)(d) that a person entered into or carried out a scheme for a purpose mentioned in that paragraph merely because the person acquired membership interests in the joining entity.

Commissioner to determine no franking credit

(5) The Commissioner may make, in writing, a determination that no credit is to arise in the head company's franking account because of the joining entity becoming a subsidiary member of the consolidated group. A determination does not form part of an assessment.

Effect of determination

(6) A determination under subsection ( 5) has effect according to its terms.

Notice of determination

(7) If the Commissioner makes a determination under subsection ( 5), the Commissioner must serve notice in writing of the determination on the head company. The notice may be included in a notice of assessment.

Evidence of determination

(8) The production of:

(a) a notice of a determination; or

(b) a document signed by the Commissioner, a Second Commissioner or a Deputy Commissioner purporting to be a copy of a determination;

is conclusive evidence:

(c) of the due making of the determination; and

(d) except in proceedings under Part IVC of the Taxation Administration Act 1953 on an appeal or review relating to the determination, that the determination is correct.

Objections

(9) If a taxpayer to whom a determination relates is dissatisfied with the determination, the taxpayer may object against it in the manner set out in Part IVC of the Taxation Administration Act 1953 .

Relevant circumstances

(10) The relevant circumstances of a scheme include the following:

(a) the extent and duration of the risks of loss, and the opportunities for profit or gain, from holding membership interests in the joining entity that are respectively borne by or accrue to the parties to the scheme, and whether there has been any change in those risks and opportunities for the head company or any other party to the scheme (for example, a change resulting from the making of any contract, the granting of any option or the entering into of any arrangement with respect to any membership interests in the joining entity);

(b) whether the head company, or a person holding membership interests in the head company, would, in the year of income in which the joining entity became a subsidiary member of the group or any later year of income, derive a greater benefit from franking credits than other persons who held membership interests in the joining entity immediately before it became a subsidiary member of the group;

(c) the extent (if any) to which the joining entity was able to pay a franked dividend or distribution immediately before it became a subsidiary member of the group;

(d) whether any consideration paid or given by or on behalf of, or received by or on behalf of, the head company in connection with the scheme (for example, the amount of any interest on a loan) was calculated by reference to the franking credit benefits to be received by the head company;

(e) the period for which the head company held membership interests in the joining entity;

(f) any of the matters referred to in subparagraphs 177D(b)(i) to (viii).