Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Income Tax Assessment Act 1997

1 Section 112 - 97 (after table item 12)

Insert:

12A | Entity has interest in loss company immediately before alteration time | The total reduced cost base | sections 165 - 115ZA and 165 - 115ZB |

2 Subsection 165 - 12(2) (note)

Omit "rights to".

3 At the end of section 165 - 12

Add:

Conditions in subsections ( 2), (3) and (4) may be treated as having been satisfied in certain circumstances

(7) If any of the conditions in subsections ( 2), (3) and (4) have not been satisfied, those conditions are taken to have been satisfied if:

(a) they would have been satisfied except for the operation of section 165 - 165; and

(b) the company has information from which it would be reasonable to conclude that less than 50% of the * tax loss has been reflected in deductions, capital losses, or reduced assessable income, that occurred, or could occur in future, because of the happening of any * CGT event in relation to any direct or indirect equity interests in the company during the * ownership test period.

Time of happening of CGT event

(8) The happening of a * CGT event in relation to a direct or indirect equity interest in the company that results in the failure of the company to satisfy a condition in subsection ( 2), (3) or (4) is taken, for the purposes of paragraph ( 7)(b), to have occurred during the * ownership test period.

Meaning of direct and indirect equity interests

(9) For the purposes of subsections ( 7) and (8):

(a) the direct equity interests in the company are * shares in the company; and

(b) the indirect equity interests in the company are shares or other interests in entities interposed between the company and persons referred to in subsection ( 2), (3) or (4).

4 Subsection 165 - 37(3)

Omit "at any time during", substitute "at the beginning of".

5 At the end of section 165 - 37

Add:

Conditions in subsection ( 1) may be treated as having been satisfied in certain circumstances

(4) If any of the conditions in subsection ( 1) have not been satisfied, those conditions are taken to have been satisfied if:

(a) they would have been satisfied except for the operation of section 165 - 165; and

(b) the company has information from which it would be reasonable to conclude that less than 50% of the * notional loss for the * ownership test period has been reflected in deductions, capital losses, or reduced assessable income, that occurred, or could occur in future, because of the happening of any * CGT event in relation to any direct or indirect equity interests in the company during that period.

Time of happening of CGT event

(5) The happening of a * CGT event in relation to a direct or indirect equity interest in the company that results in the failure of the company to satisfy a condition in subsection ( 1) is taken, for the purposes of paragraph ( 4)(b), to have occurred during the * ownership test period.

Meaning of direct and indirect equity interests

(6) For the purposes of subsections ( 4) and (5):

(a) the direct equity interests in the company are * shares in the company; and

(b) the indirect equity interests in the company are shares or other interests in entities interposed between the company and persons referred to in subsection ( 1).

6 Section 165 - 115

Repeal the section, substitute:

165 - 115 What this Subdivision is about

If a change occurs in the ownership or control of a company that has an unrealised net loss, the company cannot, to the extent of the unrealised net loss, have capital losses taken into account, or deduct revenue losses, in respect of CGT events that happen to CGT assets that it owned at the time of the change, unless it satisfies the same business test.

However, special rules, directed at saving compliance costs, apply to exempt any company that has a net asset value of under $5,000,000 at the time of the change. Further, the company may choose to exclude every asset that it acquired for less than $10,000 from the application of this Subdivision in respect of the change and, if it does so:

(a) unrealised losses and gains on assets so excluded will not be taken into account in calculating the company's unrealised loss at that time; and

(b) losses on assets so excluded that are held at that time will be allowed without the company being subject to the same business test.

7 Paragraph 165 - 115A(1)(c)

Repeal the paragraph, substitute:

(c) either of the following applies:

(i) the company makes a * capital loss, or apart from this Subdivision would be entitled to a deduction, in respect of a * CGT event that happens to a * CGT asset referred to in subsection ( 1A);

(ii) the company makes a * trading stock loss in respect of a CGT asset referred to in subsection ( 1A) that is an item of * trading stock; and

(d) the company would not, at the changeover time, satisfy the maximum net asset value test under section 152 - 15.

8 After subsection 165 - 115A(1)

Insert:

CGT assets in respect of which Subdivision applies

(1A) The * CGT assets for the purposes of paragraph 165 - 115A(1)(c) are:

(a) any CGT asset that the company owned at the changeover time; and

(b) any CGT asset that the company did not own at the changeover time but had owned at a previous time, where:

(i) a deferral event referred to in subsection 170 - 255(1) happened before the changeover time; and

(ii) the deferral event involved the company as the originating company referred to in that subsection; and

(iii) the deferral event would have resulted in the company making a * capital loss, or becoming entitled to a deduction, in respect of the CGT asset except for section 170 - 270; and

(iv) the company is not taken to have made a capital loss at or before the changeover time, or to have become entitled to a deduction at that time, under section 170 - 275 in respect of the asset.

Company may choose to disregard CGT assets acquired for less than $10,000

(1B) A company may choose, for the purposes of the application of this Subdivision to it in respect of a particular changeover time, that every * CGT asset that has been acquired by it for less than $10,000 is to be disregarded.

Time for making choice

(1C) A choice under subsection ( 1B) must be made on or before:

(a) the day on which the company lodges its income tax return for the income year in which the relevant changeover time occurred; or

(b) such later day as the Commissioner allows.

Trading stock loss

(1D) A company is taken to have made a trading stock loss in respect of an asset that is an item of * trading stock if, and only if:

(a) one of the following applies:

(i) the company * disposes of the item;

(ii) the item stops being trading stock (within the meaning of section 70 - 80);

(iii) the item is revalued under Division 70; and

(b) if subparagraph ( a)(i) or (ii) applies--the item's market value at the time when it is disposed of or stops being trading stock is less than:

(i) in respect of an item that has been valued under Division 70--its latest value under the Division; or

(ii) otherwise--its cost at that time; and

(c) if subparagraph ( a)(iii) applies--the item's value under the revaluation is less than:

(i) in respect of an item that has previously been valued under Division 70--its latest value under that Division before the revaluation; or

(ii) otherwise--its cost at the time of the revaluation.

The difference worked out under paragraph ( b) or (c), as the case may be, constitutes the amount of the * trading stock loss.

9 Paragraph 165 - 115A(2)(a)

Repeal the paragraph, substitute:

(a) if the company was in existence at 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999--that time; or

10 After subsection 165 - 115A(2)

Insert:

Reference time

(2A) For the purposes of the application of this Subdivision to a company in relation to a particular time (the test time ), the reference time is:

(a) if no changeover time occurred in respect of the company before the test time--the commencement time; or

(b) otherwise--the time immediately after the last changeover time that occurred in respect of the company before the test time.

11 Subsection 165 - 115B(1)

Omit "paragraph 165 - 115A(1)(c)", substitute "subparagraph 165 - 115A(1)(c)(i)".

Note: The heading to section 165 - 115B is altered by omitting " owned at a changeover time ", and substituting " after a changeover time ".

12 Subsection 165 - 115B(2)

Repeal the subsection, substitute:

Where capital loss or deduction is greater than residual unrealised net loss

(2) If the * capital loss or deduction referred to in subparagraph 165 - 115A(1)(c)(i) is greater than the company's residual unrealised net loss at the time of the occurrence of the event that resulted in the capital loss or entitled the company to the deduction:

(a) the part of the capital loss that is equal to the residual unrealised net loss is taken to have been a * net capital loss; or

(b) the part of the deduction that is equal to the residual unrealised net loss is taken to have been a * tax loss;

of the company for the income year immediately before the income year in which the changeover time occurred.

13 Subsections 165 - 115B(5) and (6)

Omit "paragraph 165 - 115A(1)(c)", substitute "subparagraph 165 - 115A(1)(c)(i)".

14 Subsections 165 - 115B(7) and (8) (excluding the note)

Repeal the subsections.

15 Sections 165 - 115C and 165 - 115D

Repeal the sections, substitute:

Application

(1) This section applies to the company if, after the changeover time, the company makes a * trading stock loss in respect of an item of * trading stock as mentioned in subparagraph 165 - 115A(1)(c)(ii).

Where trading stock loss is equal to or less than residual unrealised net loss

(2) If the * trading stock loss is equal to or less than the company's residual unrealised net loss at the time of the occurrence of the trading stock loss, the amount of the trading stock loss is to be included in the company's assessable income.

Where trading stock loss is greater than unrealised net loss

(3) If the * trading stock loss is greater than the company's residual unrealised net loss at the time of the occurrence of the trading stock loss, the part of the trading stock loss that is equal to the residual unrealised net loss is to be included in the company's assessable income.

No increase in assessable income if company satisfies the same business test

(4) Neither subsection ( 2) nor (3) applies to the company if the company meets the conditions in section 165 - 13 (the same business test).

Assumptions for purposes of same business test

(5) In determining whether the company meets the conditions in section 165 - 13, assume:

(a) that the * trading stock loss (if subsection ( 2) applies) or the part of the trading stock loss (if subsection ( 3) applies) is a * net capital loss of the company for the income year immediately before the income year in which the changeover time occurred; and

(b) that the company failed, at the changeover time, to meet the conditions in subsections 165 - 12(2), (3) and (4) in relation to the net capital loss referred to in paragraph ( a); and

(c) that the continuity period ended at the changeover time; and

(d) that the same business test period is the income year in which the loss occurred.

165 - 115BB Order of application of assets: residual unrealised net loss

Order in which assets are to be applied

(1) In applying subsection 165 - 115B(2) or 165 - 115BA(3) in respect of assets that the company owned at the changeover time:

(a) the company's * capital losses are taken to have been made, the company is taken to have become entitled to deductions and the company is taken to have made * trading stock losses in the order in which the events that resulted in the capital losses, deductions or trading stock losses occurred; and

(b) if 2 or more such events occurred at the same time, they are taken to have occurred in such order as the company determines.

Residual unrealised net loss

(2) The company's residual unrealised net loss , at the time of an event (the relevant event ) that resulted in the company making a * capital loss, becoming entitled to a deduction or making a * trading stock loss, in respect of an asset, is the amount worked out using the following formula:

![]()

where:

"previous capital losses, deductions or trading stock losses" means capital losses that the company made, deductions to which the company became entitled or trading stock losses that the company made as a result of events earlier than the relevant event in respect of other assets that the company owned at the changeover time.

"unrealised net loss" means the company's unrealised net loss at the last changeover time that occurred before the relevant event.

Note: For changeover time see sections 165 - 115C and 165 - 115D.

165 - 115C Changeover time--change in ownership of company

(1) A time (the test time ) is a changeover time in respect of a company if:

(a) persons who had * more than 50% of the voting power in the company at the reference time do not have more than 50% of that voting power immediately after the test time; or

(b) persons who had rights to * more than 50% of the company's dividends at the reference time do not have rights to more than 50% of those dividends immediately after the test time; or

(c) persons who had rights to * more than 50% of the company's capital distributions at the reference time do not have rights to more than 50% of those distributions immediately after the test time.

Note 1: See section 165 - 150 to work out who had more than 50% of the voting power in the company.

Note 2: See section 165 - 155 to work out who had rights to more than 50% of the company's dividends.

Note 3: See section 165 - 160 to work out who had rights to more than 50% of the company's capital distributions.

Note 4: For reference time see subsection 166 - 115A(2A).

(2) To work out whether paragraph ( 1)(a), (b) or (c) applied at a particular time, apply the primary test unless subsection ( 3) requires the alternative test to be applied.

Note: For the primary test see subsections 165 - 150(1), 165 - 155(1) and 165 - 160(1).

(3) Apply the alternative test if one or more other companies beneficially owned * shares or interests in shares in the company at the reference time.

Note: For the alternative test see subsections 165 - 150(2), 165 - 155(2) and 165 - 160(2).

(4) A * test time that would, apart from this subsection, be a changeover time in respect of the company because of the application of subsection ( 1) is taken not to be a changeover time if:

(a) that subsection would not have applied except for the operation of section 165 - 165; and

(b) the company has information from which it would be reasonable to conclude that less than 50% of the company's unrealised net loss at the test time has been reflected in deductions, capital losses, or reduced assessable income, that occurred, or could occur in future, because of the happening of any * CGT event in relation to any direct or indirect equity interests in the company during the period from the reference time to the test time.

(5) The happening of any * CGT event in relation to a direct or indirect equity interest in the company that results in the time of the happening of the event being a changeover time in respect of the company is taken, for the purposes of paragraph ( 4)(b), to have occurred during the period referred to in that paragraph.

(6) The direct equity interests in the company are * shares in the company.

(7) The indirect equity interests in the company are * shares or other interests in entities interposed between the company and persons referred to in subsection ( 1).

165 - 115D Changeover time--change in control of company

(1) A time (the test time ) is also a changeover time in respect of a company if, at the test time:

(a) a person or persons who did not control, and were not able to control, the voting power in the company at the reference time began to control, or became able to control, that voting power immediately after the test time; and

(b) that person or those persons so began, or became able, to control that voting power for the purpose of:

(i) getting some benefit or advantage in relation to how this Act applies; or

(ii) getting such a benefit or advantage for someone else;

or for purposes including that purpose.

(2) In this section:

"control" of the voting power in a company means control of that voting power either directly, or indirectly through one or more interposed entities.

16 Section 165 - 115E (method statement, step 4)

Repeal the step, substitute:

Step 4. If the unrealised gross loss at the relevant time exceeds the unrealised gross gain at that time, the excess is the company's preliminary unrealised net loss at that time.

Step 5. Add up the company's preliminary unrealised net loss and any * capital loss, deduction or share of a deduction disregarded under section 170 - 270 in relation to an asset referred to in paragraph 165 - 115A(1A)(b). The total is the company's unrealised net loss at the relevant time.

17 At the end of section 165 - 115F

Add:

(5) A company may choose that this section is to apply to the company at the relevant time in respect of an asset to which subsection ( 6) applied at that time as if references to the * market value of the asset were references to its * written down value.

(6) This subsection applies to an asset at the relevant time if:

(a) the asset is * plant (not a building or structure) for which the company has deducted or can deduct an amount for depreciation; and

(b) the expenditure incurred by the company to * acquire the plant was less than $1,000,000 (the expenditure can include the giving of property: see section 103 - 5); and

(c) it would be reasonable for the company to conclude that the * market value of the plant at that time was not less than 80% of its * written down value at that time.

(7) The Commissioner may give advice, in any way that he or she thinks appropriate, about methods to be used, and other things to be done, in valuing assets for the purposes of this Subdivision (including, where consistent with those purposes, the grouping together of assets) with the object of reducing the costs of compliance with this Subdivision.

18 After Subdivision 165 - CC

Insert:

Subdivision 165 - CD -- Reductions after alterations in ownership or control of loss company

165 - 115G What this Subdivision is about

This Subdivision requires reductions and other adjustments ( adjustments ) to be made to the tax attributes of significant equity and debt interests ( interests ) that entities ( affected entities ) (not individuals) have in a company (a loss company ) that has realised losses or unrealised losses, or both, if an event (an alteration time ) of a particular kind occurs in respect of the loss company. The purpose of the reductions and other adjustments is to prevent multiple recognition of the company's losses when the interests are realised.

An alteration time occurs in respect of the loss company when an alteration takes place in the control or ownership of the company. It also occurs if the liquidator of the loss company declares that shares in the company are worthless (CGT event G3). An alteration time is the trigger for the making of adjustments. Adjustments may also be made when an affected entity's interests in the loss company are partly realised within 12 months before an alteration time or where, under an arrangement, such interests are realised partly within that period or at the alteration time and partly at an earlier time.

An affected entity is one that, alone or with its associates, has a controlling stake in the loss company and has either a direct or indirect equity interest of at least 10% in the loss company or is owed a debt of at least $10,000 by the loss company or by another entity that has a significant equity or debt interest in the loss company. However, entities in which there are no interests in respect of which a company's losses have been, or can be, duplicated are not affected by this Subdivision.

Adjustments are made to the reduced cost base of the interests of an affected entity and also to deductions that relate to such interests if they are held as trading stock or otherwise on revenue account.

The adjustments are based on the overall loss of the loss company. This amount comprises its realised losses and unrealised losses on CGT assets.

Special rules, directed at saving compliance costs, apply to determine whether unrealised losses have to be counted at an alteration time. If that time is not also a changeover time for the purposes of Subdivision 165 - CC, and the company has no realised losses, it may not have to calculate its unrealised losses.

Unrealised losses on assets acquired for less than $10,000 do not have to be calculated at any time. In addition, an entity that (together with certain related entities) has a net asset value of under $5,000,000 does not have to count unrealised losses at an alteration time. This net asset value test is similar to the threshold for the small business CGT relief provisions.

Amounts (whether realised or unrealised) counted at a previous alteration time are not counted again at a later alteration time. However, if unrealised amounts are not counted at a previous alteration time (for example, because of the $10,000 or small business entity exclusions) and are not required to be taken into account in adjustments made at that time, they may be counted at a later time as part of a realised loss.

A formula is provided for the making of adjustments in straightforward cases where the application of the formula gives a reasonable result having regard to the object of the Subdivision. Otherwise, reasonable adjustments must be made having regard to a number of stated factors.

To assist entities in making the required adjustments, any entity that, in its own right, has a controlling stake in a loss company is required to provide a written notice to its associates setting out relevant information. In limited circumstances, the loss company itself may have to provide a written notice to entities that, to its knowledge, have a significant equity or debt interest in the loss company.

165 - 115H How this Subdivision applies

(1) This Subdivision provides for certain taxation consequences for an entity (not an individual) that had a significant equity or debt interest in a loss company immediately before an alteration time occurred in respect of the company.

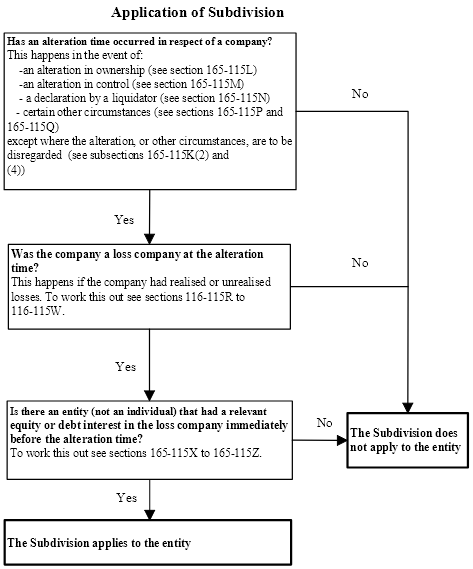

(2) The following flowchart explains how to work out whether this Subdivision applies to an entity.

(3) If this Subdivision applies to an entity, reductions are made to:

(a) the reduced cost base of the entity's equity or debt (see subsection 165 - 115ZA(3)); or

(b) any deduction to which the entity is entitled in respect of the disposal of the equity or debt (see subsection 165 - 115ZA(4)); or

(c) deductions in respect of, and the cost of, any of the equity or debt that is trading stock (see subsection 165 - 115ZA(5)).

Example: The following is an example of how this Subdivision operates:

Facts: Alpha Co acquired 80% of the shares in Beta Co on 5 May 1998 for $1,000.

Gamma Co owns 20% of the shares in Beta Co.

On 6 February 2000, Alpha Co disposed of its shares for $600.

At the beginning of the 1999 - 2000 income year, Beta Co had an unapplied net capital loss of $500 from the 1998 - 99 income year. This loss was fully reflected in the market value of shares in Beta Co.

Alpha Co and Gamma Co are not associated in any way.

Result:

Step 1: An alteration time occurred in respect of Beta Co as a result of the change in ownership that occurred when Alpha Co sold its shares.

Step 2: Beta Co was a loss company at the alteration time because it had an unapplied net capital loss from an earlier income year.

Step 3: Alpha Co had a relevant equity interest in Beta Co immediately before the alteration time because it had a controlling stake and significant interest (80% equity interest). Gamma Co did not have a relevant equity interest in Beta Co because it did not have a controlling stake.

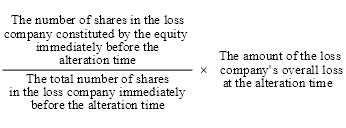

Step 4: Because Alpha Co had a relevant equity interest in Beta Co, the reduced cost bases of its shares in Beta Co are reduced by 80% of Beta Co's net capital loss:

![]()

Alpha Co does not make a capital gain on the disposal of its shares in Beta Co because the capital proceeds ($600) are less than the cost bases ($1,000).

Nor did Alpha Co make a capital loss on the disposal of its shares in Beta Co because the capital proceeds ($600) are not less than the reduced cost bases as further reduced by this Subdivision ($600).

The net capital loss in Beta Co is not duplicated on the sale of Alpha Co's shares in Beta Co.

Step 5. There are no notice requirements in this simple case. If Gamma Co and Alpha Co were associates (so that Gamma Co had a relevant equity interest in Beta Co), Alpha Co would need to provide the following information to Gamma Co:

(a) the alteration time: 6 February 2000;

(b) Beta Co's overall loss at the alteration time: $500;

(c) details of the overall loss: a net capital loss of $500 for the 1998 - 99 income year.

T able of sections

Operative provisions

165 - 115J Object of Subdivision

165 - 115K Application and interpretation

165 - 115L Alteration time--alteration in ownership of company

165 - 115M Alteration time--alteration in control of company

165 - 115N Alteration time--declaration by liquidator

165 - 115P Notional alteration time--disposal of interests in company within 12 months before alteration time

165 - 115Q Notional alteration time--disposal of interests in company earlier than 12 months before alteration time

165 - 115R When company is a loss company at first or only alteration time in income year

165 - 115S When company is a loss company at second or later alteration time in income year

165 - 115T Reduction of certain amounts included in company's overall loss at alteration time

165 - 115U Adjusted unrealised loss

165 - 115V Notional losses

165 - 115W Calculation of trading stock decrease

165 - 115X Relevant equity interest

165 - 115Y Relevant debt interest

165 - 115Z What constitutes a controlling stake in a company

165 - 115ZA Reductions and other consequences if entity has relevant equity interest or relevant debt interest in loss company immediately before alteration time

165 - 115ZB Adjustment amounts for the purposes of section 165 - 115ZA

165 - 115ZC Notices to be given

[This is the end of the Guide]

165 - 115J Object of Subdivision

The main object of this

Subdivision is to make appropriate adjustments (under section 165 -

115ZA) to the tax values of significant equity and debt interests held

directly or indirectly by entities other than individuals in a * loss company

whose ownership or control alters.

The purpose of the adjustments is to

prevent the duplication of the company's realised and unrealised losses

when any of those interests are * disposed of or otherwise realised. This

happens because the company's losses are reflected in the values of the

interests.

165 - 115K Application and interpretation

Application

(1) This Subdivision applies if:

(a) an alteration time occurs in respect of a company; and

(b) the company is a * loss company at the alteration time; and

(c) one or more entities had relevant equity interests or relevant debt interests in the company immediately before the alteration time.

Note 1: For alteration time , see sections 165 - 115L, 165 - 115M, 165 - 115N, 165 - 115P and 165 - 115Q.

Note 2: For relevant equity interests and relevant debt interests , see sections 165 - 115X and 165 - 115Y.

Alteration time before commencement time to be disregarded

(2) An alteration time does not include a time before the commencement time.

Commencement time

(3) The commencement time for a company is:

(a) if the company was in existence at 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999--that time; or

(b) if the company came into existence after that time--the time when it came into existence.

Certain alteration times to be disregarded

(4) If:

(a) a time (the test time ) would, apart from this subsection, be an alteration time in relation to a company; and

(b) the company does not have any losses of the kinds referred to in paragraphs 165 - 115R(3)(a), (b), (c) and (d) and 165 - 115S(3)(a) and (b); and

(c) the test time is not a changeover time in relation to the company under Subdivision 165 - CC; and

(d) if the test time were such a changeover time, it would be reasonable for the company to conclude that it would not have an unrealised net loss at that time under section 165 - 115E;

the test time is taken not to be an alteration time in relation to the company.

Application to CGT events other than disposals

(5) This Subdivision applies to a * CGT event (other than a * disposal) happening in relation to a CGT asset (for example, an interest in a company that is constituted by an equity or debt):

(a) in the same way as it applies to a disposal of a CGT asset; and

(b) as if the asset had been disposed of at the time when the CGT event happens.

165 - 115L Alteration time--alteration in ownership of company

(1) A time (the test time ) is an alteration time in respect of a company if:

(a) persons who had * more than 50% of the voting power in the company at the reference time do not have more than 50% of that voting power immediately after the test time; or

(b) persons who had rights to * more than 50% of the company's dividends at the reference time do not have rights to more than 50% of those dividends immediately after the test time; or

(c) persons who had rights to * more than 50% of the company's capital distributions at the reference time do not have rights to more than 50% of those distributions immediately after the test time.

Note 1: See section 165 - 150 to work out who had more than 50% of the voting power in the company.

Note 2: See section 165 - 155 to work out who had rights to more than 50% of the company's dividends.

Note 3: See section 165 - 160 to work out who had rights to more than 50% of the company's capital distributions.

(2) The reference time is:

(a) if no alteration time occurred in respect of the company before the * test time--the commencement time; or

(b) otherwise--the time immediately after the last alteration time.

(3) To work out whether paragraph ( 1)(a), (b) or (c) applied at a particular time, apply the primary test unless subsection ( 4) requires the alternative test to be applied.

Note: For the primary test see subsections 165 - 150(1), 165 - 155(1) and 165 - 160(1).

(4) Apply the alternative test if one or more other companies beneficially owned * shares or interests in shares in the company at the reference time.

Note: For the alternative test see subsections 165 - 150(2), 165 - 155(2) and 165 - 160(2).

165 - 115M Alteration time--alteration in control of company

(1) A time (the test time ) is also an alteration time in respect of a company if, at the test time:

(a) a person or persons who did not control, and were not able to control, the voting power in the company at the reference time began to control, or became able to control, that voting power immediately after the test time; and

(b) that person or those persons so began, or became able, to control that voting power for the purpose of:

(i) getting some benefit or advantage in relation to how this Act applies; or

(ii) getting such a benefit or advantage for someone else;

or for purposes including that purpose.

(2) The reference time is:

(a) if no alteration time occurred in respect of the company before the * test time--the commencement time; or

(b) otherwise--the time immediately after the last alteration time.

(3) In this section:

"control" of the voting power in a company means control of that voting power either directly, or indirectly through one or more interposed entities.

165 - 115N Alteration time--declaration by liquidator

If the liquidator of a company makes a declaration referred to in section 104 - 145, the time of the declaration is also an alteration time in respect of the company.

(1) This section applies if:

(a) an alteration time occurs in respect of a * loss company; and

(b) an entity * disposed of an interest in the company (an equity ) or a debt (a debt ) at a time (the disposal time ) within 12 months before the alteration time but not earlier than the commencement time; and

(c) immediately before the disposal time, the entity had a relevant equity interest or a relevant debt interest in the company that included the equity or debt, or would have had such an interest if any previous disposals of interests or debts by the entity had not occurred; and

(d) immediately before the alteration time, the entity had a relevant equity interest or a relevant debt interest in the company, or would have had such an interest if any previous disposals of interests or debts by the entity had not occurred.

(2) The references in paragraphs ( 1)(c) and (d) to previous * disposals of interests or debts by the entity are references to:

(a) previous disposals within the period referred to in paragraph ( 1)(b); and

(b) previous disposals before that period if those previous disposals and any one or more of the following:

(i) the disposal of the equity or debt;

(ii) a disposal referred to in paragraph ( a);

(iii) a disposal at the alteration time;

occurred as part of an * arrangement.

(3) The time immediately before the * disposal of the equity or debt is taken to have been an alteration time (a notional alteration time ) in respect of the company.

(4) The entity:

(a) is taken to have had, immediately before the notional alteration time, a relevant equity interest in the company constituted by the equity or a relevant debt interest in the company constituted by the debt, as the case may be; and

(b) is taken not to have had, immediately before the notional alteration time, any other relevant equity interest or relevant debt interest in the company.

(5) No entity (other than the entity referred to in paragraph ( 1)(b)) is taken to have had a relevant equity interest or a relevant debt interest in the company immediately before the notional alteration time.

(6) In applying this Subdivision in relation to the company in respect of a time after a notional alteration time, the notional alteration time is taken not to have occurred.

Note: For relevant equity interests and relevant debt interests , see sections 165 - 115X and 165 - 115Y.

(1) This section applies if:

(a) an alteration time occurs in respect of a * loss company; and

(b) an entity that * disposed of an interest in the company (the later equity ) or a debt (the later debt ) at, or within 12 months before, the alteration time also disposed of an interest in the company (the earlier equity ) or a debt (the earlier debt ) at a time (the earlier disposal time ) earlier than 12 months before the alteration time but not earlier than the commencement time; and

(c) the disposal of the later equity or later debt and the disposal of the earlier equity or earlier debt occurred as part of an * arrangement; and

(d) immediately before the earlier disposal time, the entity had a relevant equity interest or a relevant debt interest in the company that included the earlier equity or earlier debt, or would have had such an interest if any previous disposals of interests or debts by the entity had not occurred; and

(e) immediately before the alteration time, the entity had a relevant equity interest or a relevant debt interest in the company, or would have had such an interest if any previous disposals of interests or debts by the entity had not occurred.

(2) The references in paragraphs ( 1)(d) and (e) to previous * disposals of interests or debts by the entity are references to:

(a) previous disposals within the period referred to in paragraph ( 1)(b); and

(b) previous disposals before that period if those previous disposals and any one or more of the following:

(i) the disposal of the equity or debt;

(ii) a disposal referred to in paragraph ( a);

(iii) a disposal at the alteration time;

occurred as part of an * arrangement.

(3) The time immediately before the * disposal of the earlier equity or earlier debt is taken to have been an alteration time (a notional alteration time ) in respect of the company.

(4) The entity:

(a) is taken to have had, immediately before the notional alteration time, a relevant equity interest in the company constituted by the earlier equity or a relevant debt interest in the company constituted by the earlier debt, as the case may be; and

(b) is taken not to have had, immediately before the notional alteration time, any other relevant equity interest or relevant debt interest in the company.

(5) No entity (other than the entity referred to in paragraph ( 1)(b)) is taken to have had a relevant equity interest or a relevant debt interest in the company immediately before the notional alteration time.

(6) In applying this Subdivision in relation to the company in respect of a time after a notional alteration time, the notional alteration time is taken not to have occurred.

Note: For relevant equity interests and relevant debt interests , see sections 165 - 115X and 165 - 115Y.

165 - 115R When company is a loss company at first or only alteration time in income year

Application

(1) The question whether a company is a loss company at the first or only alteration time in a particular income year is to be worked out in this way.

Assumed income year

(2) Assume that the period that started at the beginning of the income year and ended at the alteration time is an income year and apply paragraphs ( 3)(a), (b), (c) and (d) on that assumption.

What is a loss company

(3) The company is a loss company at the alteration time if:

(a) at the beginning of the income year it had an undeducted * tax loss or undeducted tax losses for an earlier income year or earlier income years; or

(b) at the beginning of the income year it had an unapplied * net capital loss or unapplied net capital losses for an earlier income year or earlier income years; or

(c) it has a tax loss for the income year, calculated as if the income year were a period for the purposes of Subdivision 165 - B; or

(d) it has a net capital loss for the income year, calculated as if the income year were a period for the purposes of Subdivision 165 - CB; or

(e) it has an adjusted unrealised loss at the alteration time.

Note: For adjusted unrealised loss , see section 165 - 115U.

How losses are to be calculated

(4) In applying subsection ( 3):

(a) an undeducted * tax loss or unapplied * net capital loss that was taken into account in working out under this section whether the company was a * loss company at an alteration time in a previous income year is to be disregarded; and

(b) Subdivision 170 - D is to be disregarded.

Overall loss

(5) The sum of:

(a) the amount or amounts of any * tax loss or tax losses referred to in paragraph ( 3)(a); and

(b) the amount or amounts of any * net capital loss or net capital losses referred to in paragraph ( 3)(b); and

(c) the amount of any tax loss referred to in paragraph ( 3)(c); and

(d) the amount of any net capital loss referred to in paragraph ( 3)(d); and

(e) the amount of any adjusted unrealised loss referred to in paragraph ( 3)(e);

is the * loss company's overall loss at the alteration time.

Note: The loss company's overall loss is relevant for the purposes of subsections 165 - 115ZB(3) and (6).

Certain losses to be disregarded

(6) A reference in a paragraph of subsection ( 3) and in the corresponding paragraph of subsection ( 5) to a particular loss is a reference only to a loss to the extent to which it represents an outlay or loss of any of the economic resources of the company.

Note: Where the income tax law allows, as all or part of a loss, an amount for plant depreciation that exceeds the actual economic depreciation or depletion of the plant concerned, the excess is not to be regarded for the purposes of this subsection as representing an outlay or loss of economic resources of the company.

Amounts of losses may be reduced

(7) The amounts referred to in paragraphs ( 5)(a) to (d) may be reduced under section 165 - 115T.

165 - 115S When company is a loss company at second or later alteration time in income year

Application

(1) The question whether a company is a loss company at an alteration time (the current alteration time ) that is the second or a later alteration time in the same income year is to be worked out in this way.

Assumed income year

(2) Assume that the period that started immediately after the last alteration time and ended at the current alteration time is an income year and apply paragraphs ( 3)(a) and (b) on that assumption.

What is a loss company

(3) The company is a loss company at the current alteration time if:

(a) it has a * tax loss for the income year, calculated as if the income year were a period for the purposes of Subdivision 165 - B; or

(b) it has a * net capital loss for the income year, calculated as if the income year were a period for the purposes of Subdivision 165 - CB; or

(c) it has an adjusted unrealised loss at the current alteration time.

Note: For adjusted unrealised loss , see section 165 - 115U.

How losses are to be calculated

(4) In applying subsection ( 3), Subdivision 170 - D is to be disregarded.

Overall loss

(5) The sum of:

(a) the amount of any * tax loss referred to in paragraph ( 3)(a); and

(b) the amount of any * net capital loss referred to in paragraph ( 3)(b); and

(c) the amount of any adjusted unrealised loss referred to in paragraph ( 3)(c);

is the * loss company's overall loss at the current alteration time.

Note: The loss company's overall loss is relevant for the purposes of subsections 165 - 115ZB(3) and (6).

Certain losses to be disregarded

(6) A reference in a paragraph of subsection ( 3) and in the corresponding paragraph of subsection ( 5) to a particular loss is a reference only to a loss to the extent to which it represents an outlay or loss of any of the economic resources of the company.

Note: Where the income tax law allows, as all or part of a loss, an amount for plant depreciation that exceeds the actual economic depreciation or depletion of the plant concerned, the excess is not to be regarded for the purposes of this subsection as representing an outlay or loss of economic resources of the company.

Amounts of losses may be reduced

(7) The amounts referred to in paragraphs ( 5)(a) and (b) may be reduced under section 165 - 115T.

165 - 115T Reduction of certain amounts included in company's overall loss at alteration time

In working out under section 165 - 115R or 165 - 115S whether a company was a * loss company at an alteration time (the current alteration time ), if a loss (the realised loss ) referred to in paragraph 165 - 115R(3)(a), (b), (c) or (d) or 165 - 115S(3)(a) or (b) that the company had at the current alteration time reflected an amount of a notional revenue loss, a trading stock decrease or a notional capital loss included in an adjusted unrealised loss, that the company had at a previous alteration time, the realised loss is taken to be reduced by that amount.

Note 1: For notional revenue loss and notional capital loss see section 165 - 115V.

Note 2: For trading stock decrease see section 165 - 115W.

165 - 115U Adjusted unrealised loss

(1) The question whether a company has an adjusted unrealised loss at an alteration time (the relevant alteration time ) is worked out in this way.

Method statement

Step 1. Work out under section 165 - 115V or 165 - 115W in respect of each * CGT asset that the company owned at the relevant alteration time any notional capital loss, notional revenue loss or trading stock decrease that the company has at that time in respect of the asset.

To the extent that a notional capital loss or a notional revenue loss in respect of an asset at the relevant alteration time reflected an amount that was counted at an earlier alteration time, do not count it again at the relevant alteration time.

Step 2. Add up the notional capital losses and the notional revenue losses that the company had at the relevant alteration time. The total is the company's nominal unrealised loss at that time.

Step 3. Add up the trading stock decreases that the company had at the relevant alteration time. The total is the company's overall trading stock decrease at that time.

Step 4. The sum of the company's nominal unrealised loss and overall trading stock decrease at the relevant time is the company's adjusted unrealised loss at that time.

Note: Certain alteration times are disregarded (see subsections 165 - 115K(2) and (4)).

(2) However, the company does not have an adjusted unrealised loss at the relevant alteration time if the company would, at that time, satisfy the maximum net asset value test under section 152 - 15.

(1) This section applies for the purpose of calculating whether a company has at an alteration time a notional capital loss or a notional revenue loss in respect of a * CGT asset that it owned at that time.

(2) However, a company does not have a notional capital loss or a notional revenue loss at an alteration time in respect of a CGT asset that it * acquired for less than $10,000.

(3) The calculation is to be made on the assumption that the company disposed of the asset at its market value at the alteration time.

(4) If the company would make a * capital loss in respect of the disposal of the asset, the company has at the alteration time in respect of the asset a notional capital loss equal to the amount of the capital loss.

(5) If the company would be entitled to a deduction in respect of the disposal of the asset, the company has at the alteration time in respect of the asset a notional revenue loss equal to the amount of the deduction.

(6) A company may choose that this section is to apply to the company at the alteration time in respect of an asset to which subsection ( 7) applied at that time as if the reference in subsection ( 3) to the market value of the asset were a reference to its * written down value.

(7) This subsection applies to an asset at the alteration time if:

(a) the asset is * plant (not a building or structure) for which the company has deducted or can deduct an amount for depreciation; and

(b) the expenditure incurred by the company to * acquire the plant was less than $1,000,000 (the expenditure can include the giving of property: see section 103 - 5); and

(c) it would be reasonable for the company to conclude that the market value of the plant at the alteration time was not less than 80% of its * written down value at that time.

(8) The Commissioner may give advice, in any way that he or she thinks appropriate, about methods to be used, and other things to be done, in valuing assets for the purposes of this Subdivision (including, where consistent with those purposes, the grouping together of assets) with the object of reducing the costs of compliance with this Subdivision.

165 - 115W Calculation of trading stock decrease

(1) The question whether there is a trading stock decrease in relation to a company at an alteration time for a * CGT asset of the company that was an item of * trading stock at that time is worked out in this way.

Method statement

Step 1. Work out whether the item's market value immediately before the alteration time was less than:

(a) if there was no earlier alteration time in the income year in which that alteration time occurred--the item's value under subsection 70 - 40(1) at the start of that income year or its cost if subsection 70 - 40(2) applies; or

(b) if there was an earlier alteration time or there were earlier alteration times in that income year--the item's market value immediately before that earlier alteration time or the later or latest of those earlier alteration times, as the case may be, or its cost if the company did not own it at that time.

Step 2. If the item's market value immediately before the alteration time was less than:

(a) the item's value or cost referred to in paragraph ( a) in step 1; or

(b) its market value or cost (as applicable) in paragraph ( b) in step 1;

as the case requires, the difference is the trading stock decrease for the item.

To the extent (if any) to which the difference reflects an amount counted at an earlier alteration time, do not count that amount again.

Note: Certain alteration times are disregarded (see subsections 165 - 115K(2) and (4)).

(2) However, a company does not have a trading stock decrease at an alteration time in respect of an item of * trading stock that it * acquired for less than $10,000.

165 - 115X Relevant equity interest

(1) An entity (not an individual) has a relevant equity interest in a * loss company at a particular time if:

(a) at that time the entity has a controlling stake in the loss company (see section 165 - 115Z); and

(b) at that time the entity has an interest (an equity ) that gives, or interests (each of which is also called an equity ) that between them give, the entity:

(i) the control of, or the ability to control, 10% or more of the voting power in the loss company (either directly, or indirectly through one or more interposed entities); or

(ii) the right to receive (either directly, or indirectly through one or more interposed entities) 10% or more of any dividends that the loss company may pay; or

(iii) the right to receive (either directly, or indirectly through one or more interposed entities) 10% or more of any distribution of capital of the loss company; and

(c) the equity or each equity is either:

(i) an interest (including a * share or shares, or an option or right to acquire a share or shares) in the loss company; or

(ii) an interest (including an option or right to acquire an interest) held by the entity directly in another entity that has a relevant equity interest or relevant debt interest in the loss company.

(2) The equity or equities constitute the entity's relevant equity interest in the * loss company.

(3) An entity (the first entity ) that, apart from this subsection, would have a relevant equity interest in a * loss company at a particular time does not have such an interest if, at that time, there is no other entity that has a direct or indirect interest in, or is owed a debt by, the first entity, being an interest or debt in respect of which:

(a) the other entity could, if a * CGT event happened in respect of the interest or debt, make a * capital loss (other than a capital loss that would be disregarded) that reflects any part of the loss company's overall loss; or

(b) the other entity has deducted or can deduct, or could deduct at a later time:

(i) an amount in respect of the cost of the * acquisition of the interest or debt; or

(ii) a net loss on the * disposal of the interest or debt;

where the deduction reflected, or would reflect, any part of the loss company's overall loss.

(4) However, subsection ( 3) does not apply to the first entity in respect of a particular time if an entity that had a direct or indirect interest in, or was owed a debt by, the first entity at an earlier time:

(a) made a capital loss (other than a capital loss that was disregarded) because a * CGT event happened in respect of the interest or debt, where the capital loss reflected any part of the * loss company's overall loss; or

(b) has deducted or could have deducted at an earlier time, or could deduct at a later time, an amount in respect of the cost of the * acquisition, or a net loss on the * disposal, of the interest or debt, where the deduction reflected or would have reflected, or would reflect, as the case may be, any part of the company's overall loss.

(5) An individual is not taken to have a relevant equity interest in a * loss company at any time.

(6) A partnership that consists only of individuals is not taken to have a relevant equity interest in a * loss company at any time.

(7) If section 106 - 30, 106 - 50 or 106 - 60 would treat an act referred to in that section that is done in relation to an interest as having been done by an individual, the interest is not a relevant equity interest.

165 - 115Y Relevant debt interest

(1) An entity (not an individual) has a relevant debt interest in a * loss company at a particular time if, at that time:

(a) the entity has a controlling stake in the loss company (see section 165 - 115Z); and

(b) the entity is owed by the loss company a debt of not less than $10,000 (a debt ) or debts at least one of which is not less than $10,000 (each debt of not less than $10,000 is also called a debt ).

(2) An entity (not an individual) also has a relevant debt interest in a * loss company at a particular time if, at that time:

(a) the entity has a controlling stake in the loss company; and

(b) the entity is owed by an entity (the debtor entity ) other than the loss company a debt of not less than $10,000 (also a debt ) or debts at least one of which is not less than $10,000 (each debt of not less than $10,000 is also called a debt ); and

(c) the debtor entity has a relevant equity interest or a relevant debt interest in the loss company.

(3) The total of the debts referred to in subsections ( 1) and (2) constitutes the entity's relevant debt interest in the * loss company.

(4) An entity (the first entity ) that, apart from this subsection, would have a relevant debt interest in a * loss company at a particular time does not have such an interest if, at that time, there is no other entity that has a direct or indirect interest in, or is owed a debt by, the first entity, being an interest or debt in respect of which:

(a) the other entity could, if a * CGT event happened in respect of the interest or debt, make a * capital loss (other than a capital loss that would be disregarded) that reflects any part of the loss company's overall loss; or

(b) the other entity could deduct, or can deduct or could deduct at a later time:

(i) an amount in respect of the cost of the * acquisition of the interest or debt; or

(ii) a net loss on the * disposal of the interest or debt;

where the deduction reflects, or would have reflected, any part of the loss company's overall loss.

(5) However, subsection ( 4) does not apply to the first entity in respect of a particular time if an entity that had a direct or indirect interest in, or was owed a debt by, the first entity at an earlier time:

(a) made a capital loss (other than a capital loss that would be disregarded) at an earlier time because a * CGT event happened in respect of the interest or debt, where the capital loss reflected any part of the * loss company's overall loss; or

(b) has deducted or could have deducted at an earlier time, or could deduct at a later time, an amount in respect of the cost of the * acquisition, or a net loss on the * disposal, of the interest or debt, where the deduction reflected or would have reflected, or would reflect, as the case may be, any part of the company's overall loss.

(6) An individual is not taken to have a relevant debt interest in a * loss company at any time.

(7) A * partnership that consists only of individuals is not taken to have a relevant debt interest in a * loss company at any time.

(8) If section 106 - 30, 106 - 50 or 106 - 60 would treat an act referred to in that section that is done in relation to a debt as having been done by an individual, the debt is not a relevant debt interest.

165 - 115Z What constitutes a controlling stake in a company

(1) An entity has a controlling stake in a company at a particular time if the entity, or the entity and the entity's * associates between them:

(a) are able at that time to exercise, or control the exercise of, more than 50% of the voting power in the company (either directly, or indirectly through one or more interposed entities); or

(b) have at that time the right to receive (either directly, or indirectly through one or more interposed entities) more than 50% of any dividends that the company may pay; or

(c) have at that time the right to receive (either directly, or indirectly through one or more interposed entities) more than 50% of any distribution of capital of the company.

Note: The effect of subsection ( 1) is that, if an entity has a controlling stake in a company, each associate of the entity also has a controlling stake in the company.

(2) If:

(a) apart from this subsection, an interest that gives an entity and its * associates (if any):

(i) the ability to exercise, or control the exercise of, any of the voting power in a company; or

(ii) the right to receive dividends that a company may pay; or

(iii) the right to receive a distribution of capital of a company;

would, in the application of paragraph ( 1)(a), (b) or (c), be counted more than once; and

(b) the interest is both direct and indirect;

only the direct interest is to be counted.

Application of section

(1) This section applies to an entity (an affected entity ) that has a relevant equity interest or a relevant debt interest, or both, in a * loss company immediately before a time (a relevant time ) that is an alteration time in respect of the loss company.

Application of section nullified in certain circumstances

(2) However, if:

(a) this section has applied to an entity in respect of a debt owed to the entity; and

(b) section 245 - 10 in Schedule 2C to the Income Tax Assessment Act 1936 (which relates to the forgiveness of commercial debts) also applied in respect of the debt at the same time or at a later time;

any reductions or other consequences affecting the entity in respect of the debt under this section are taken not to have occurred or to have been required to occur.

Note: An amendment of an assessment can be made at any time to give effect to this subsection ( see subsection 170(10AA) of the Income Tax Assessment Act 1936 ).

Reduction of reduced cost base

(3) The * reduced cost base of an equity or debt that was * acquired on or after 20 September 1985 is to be reduced immediately before the relevant time by the adjustment amount calculated under section 165 - 115ZB.

Reduction of deduction--equity or debt is not trading stock

(4) If an equity or debt is not an item of * trading stock of the affected entity immediately before the relevant time, any amount that the entity can deduct in respect of the disposal of any of the equity or debt is to be reduced by the adjustment amount calculated under section 165 - 115ZB.

Reduction of cost--equity or debt is trading stock

(5) If:

(a) an equity or debt is an item of * trading stock of the affected entity immediately before the relevant time; and

(b) the * cost for the purposes of Division 70 of the equity or debt exceeds its market value immediately before the relevant time;

then, subject to any later application or applications of this Subdivision, the cost of the equity or debt for the purposes of Division 70, and any deduction for an outlay to * acquire it, are reduced by the lesser of the following amounts or, if they are equal, by one of them:

(c) the adjustment amount calculated under section 165 - 115ZB;

(d) the amount of the excess referred to in paragraph ( b).

Subsection ( 4) to apply only in respect of certain income years

(6) For the purpose of working out:

(a) deductions under section 8 - 1; or

(b) whether an amount is included in assessable income under subsection 70 - 35(2); or

(c) whether an amount can be deducted under subsection 70 - 35(3);

subsection ( 5) applies only in respect of income years ending after the later of the following:

(d) the commencement time;

(e) the time 12 months before the relevant time.

Further election to value trading stock

(7) If an election has been made under section 70 - 45 to value an item of * trading stock on hand at the end of an income year otherwise than at its * cost and subsection ( 5) applies in respect of it, a further election may be made under that section to value the item of trading stock at cost.

Previous applications of this section in relation to trading stock to be taken into account

(8) In applying this section to the affected entity in respect of an equity or debt that is * trading stock of the entity, any previous applications of this section to the entity in respect of the equity or debt are to be taken into account.

Cost of equity or debt that becomes trading stock after relevant time

(9) If:

(a) an equity or debt becomes an item of * trading stock of the affected entity after the relevant time; and

(b) had the equity or debt been an item of trading stock of the affected entity at an earlier time that was, or at 2 or more earlier times each of which was, the relevant time for the purposes of a previous application or previous applications of this section, its * cost for the purposes of Division 70 would have exceeded its market value at the earlier time or at one of the earlier times;

its cost for the purposes of Division 70 is taken to be its market value at the earlier time or the smallest of its market values at the earlier times.

Reduction of proceeds of disposal of trading stock

(10) If:

(a) an equity or debt was an item of * trading stock of the affected entity immediately before a relevant time or became such an item of trading stock after a relevant time; and

(b) the equity or debt is * disposed of by the entity after the relevant time concerned; and

(c) the equity or debt is an item of trading stock of the affected entity at the time of the disposal; and

(d) the proceeds of the disposal exceed the market value of the equity or debt immediately before the relevant time concerned or the market value of the equity or debt immediately before any previous relevant time;

the proceeds of the disposal are taken to be reduced by so much of the amount or the total of the amounts of any reductions made by any previous application or applications of subsection ( 5) in relation to the affected entity in respect of the equity or debt as does not exceed the excess amount or the greater or greatest of the excess amounts referred to in paragraph ( d).

165 - 115ZB Adjustment amounts for the purposes of section 165 - 115ZA

Calculation of adjustment amount

(1) For the purposes of section 165 - 115ZA, an adjustment amount in relation to an equity or debt is to be worked out by the affected entity, and applied by it in making reductions referred to in that section:

(a) if subsection ( 2) applies--in accordance with subsection ( 3); or

(b) otherwise--in accordance with subsection ( 6).

Selection of method of calculation

(2) This subsection applies if:

(a) the affected entity has a relevant equity interest, but does not have a relevant debt interest, in the * loss company immediately before the alteration time and:

(i) all the * shares in the loss company are of the same class and have the same * market value; and

(ii) the equity consists only of a share or shares in the loss company; or

(b) the affected entity has both a relevant equity interest, and a relevant debt interest under subsection 165 - 115Y(1), in the loss company immediately before the alteration time and:

(i) all the shares in the loss company are of the same class and have the same market value; and

(ii) the equity consists only of a share or shares in the loss company; and

(iii) the debt consists of a single debt or 2 or more debts of the same kind;

and the reductions that would result from the application of subsection ( 3) would be reasonable in the circumstances.

Formula method

(3) The adjustment amount to be worked out under this subsection is the amount worked out using the formula:

and the amount so worked out is to be applied in making reductions as follows:

(a) the adjustment amount is to be applied in relation to the * share or shares constituting the equity; and

(b) if there is an amount remaining after making reductions in relation to those shares--the amount remaining is to be applied in relation to any debt or, if there is a debt consisting of 2 or more separate debts, in relation to those debts.

Applying adjustment amount under formula method to shares

(4) If the adjustment amount referred to in subsection ( 3) is to be applied in relation to an equity consisting of 2 or more * shares:

(a) it is to be applied equally among the shares; and

(b) if there is any amount remaining after the application of part of the adjustment amount to a share, the amount remaining is to be applied to any other share, or equally among any other shares, to the maximum extent possible.

Applying adjustment amount under formula method to debt

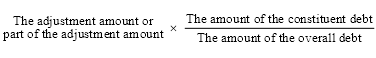

(5) If the adjustment amount referred to in subsection ( 3) or part of it is to be applied in relation to a debt (the overall debt ) and the overall debt consists of 2 or more debts (the constituent debts ), the amount to be applied in relation to each constituent debt is the amount worked out using the formula:

Non - formula method

(6) The adjustment amount to be worked out under this subsection is the amount that is appropriate having regard to:

(a) the object of this Subdivision and other matters set out in section 165 - 115J; and

(b) the extent of the affected entity's relevant equity interests or relevant debt interests, as the case may be, in the * loss company immediately before the alteration time; and

(c) when, and under what circumstances, the relevant equity interests or relevant debt interests were * acquired by the affected entity; and

(d) the loss company's overall loss at the alteration time; and

(e) the extent to which that overall loss has reduced the market values of the equity or debt; and

(f) to prevent double counting, the extent of any adjustments required under this Subdivision because of any application of this Subdivision to another loss company in which the affected entity has a relevant equity interest or relevant debt interest;

and the amount so worked out is to be applied in making reductions in an appropriate way.

How to work out the extent to which the overall loss has reduced the market value of an equity or debt

(7) To avoid doubt in applying paragraph ( 6)(e) in relation to an equity or a debt, if factors other than an overall loss altered the market value of the equity or debt, the extent to which the overall loss reduced that market value is taken to be the extent to which that market value would have been reduced apart from those other factors.

Note 1: For a company's overall loss see subsections 165 - 115R(5) and 165 - 115S(5).

Note 2: An example of a factor other than the overall loss is the unrealised value of assets (including assets in respect of which there is an unrealised gain) of the loss company, whether or not generated by outlays or economic losses reflected in the loss for income tax purposes.

165 - 115ZC Notices to be given

Application

(1) This section applies when an alteration time occurs in respect of a * loss company.

Controlling entity

(2) For the purposes of this section, an entity is a controlling entity of a * loss company if:

(a) the entity is not an individual; and

(b) the entity, disregarding any of its * associates, has a controlling stake in the loss company; and

(c) no other entity (except an individual or 2 or more individuals between them) has a controlling stake in the entity.

Non - resident controlling entity to be disregarded in certain circumstances

(3) If:

(a) apart from this subsection, an entity that is a non - resident (the non - resident entity ) would be a controlling entity of a * loss company; and

(b) there is an entity that is a resident (the resident entity ) and would be a controlling entity of the loss company if all the non - resident entities that held direct or indirect interests in the resident entity were individuals;

then, for the purposes of this section, the non - resident entity is taken not to be a controlling entity of the company but the resident entity is taken to be a controlling entity of the company.

Notice by controlling entity of loss company

(4) An entity that was a controlling entity of the * loss company immediately before the alteration time must, before the end of 6 months after the later of the following:

(a) the alteration time;

(b) the day on which the New Business Tax System (Miscellaneous) Act (No. 2) 2000 received the Royal Assent;

give a written notice, setting out the information mentioned in subsection ( 6), to each of its * associates that, to the loss company's knowledge, had a relevant equity interest or relevant debt interest in the loss company immediately before the alteration time.

Penalty: 30 penalty units.

Notice by loss company

(5) If:

(a) there was no controlling entity of the * loss company immediately before the alteration time; or

(b) no entity that was a controlling entity of the loss company immediately before the alteration time told the loss company in writing, within 2 months after the later of the following:

(i) the alteration time;

(ii) the day on which the New Business Tax System (Miscellaneous) Act (No. 2) 2000 received the Royal Assent;

that it had given, or proposed to give, notices to its associates under subsection ( 4);

the loss company must, before the end of 6 months after the later of the following:

(c) the alteration time;

(d) the day on which the New Business Tax System (Miscellaneous) Act (No. 2) 2000 received the Royal Assent;

give a written notice, setting out the information mentioned in subsection ( 6), to each entity that, to the loss company's knowledge, had a relevant equity interest or relevant debt interest in the company immediately before the alteration time.

Penalty: 30 penalty units.

Information to be included in notice

(6) The information to be contained in a notice given under subsection ( 4) or (5) must include:

(a) the time that is the alteration time; and

(b) the amount of the * loss company's overall loss at that time; and

(c) for each income year for which the loss company had at that time a * tax loss or * net capital loss referred to in subsection 165 - 115R(3) or 165 - 115S(3)--the type and amount of the loss; and

(d) the amount of any adjusted unrealised loss that the loss company had at that time; and

(e) particulars (for the purpose of assisting the entity to whom the notice is given (the recipient ) to comply with the requirements of this Subdivision) of the amounts, proportions, and times of * acquisition, of all relevant equity interests and relevant debt interests in the loss company held by entities through which the recipient had relevant equity interests or relevant debt interests in the loss company.

Entity or loss company not required to give information about matters that are not known to it

(7) An entity or * loss company is not required by this section to set out information in a notice unless:

(a) the information is known to the entity or company; or

(b) the entity or company could reasonably be expected to know the information and can readily obtain it.

Obligations of person not affected by failure to give notice

(8) Any failure by an entity or the * loss company to give a notice to a person under this section does not affect any obligation of the person to comply with the requirements of this Subdivision.

19 Subsection 165 - 123(2) (note)

Omit "rights to".

20 At the end of section 165 - 123

Add:

Conditions in subsections ( 2), (3) and (4) may be treated as having been satisfied in certain circumstances

(7) If any of the conditions in subsections ( 2), (3) and (4) have not been satisfied, those conditions are taken to have been satisfied if:

(a) they would have been satisfied except for the operation of section 165 - 165; and

(b) the company has information from which it would be reasonable to conclude that less than 50% of the debt or of the part of a debt has been reflected in deductions, capital losses, or reduced assessable income, that occurred, or could occur in future, because of the happening of any * CGT event in relation to any direct or indirect equity interests in the company during the * ownership test period.

Time of happening of CGT event

(8) The happening of any * CGT event in relation to a direct or indirect equity interest in the company that results in the failure of the company to satisfy a condition in subsection ( 2), (3) or (4) is taken, for the purposes of paragraph ( 7)(b), to have occurred during the * ownership test period.

Meaning of direct and indirect equity interests

(9) The direct equity interests in the company are * shares in the company.

(10) The indirect equity interests in the company are * shares or other interests in entities interposed between the company and persons referred to in subsection ( 2), (3) or (4).

21 Sections 165 - 150 to 165 - 160

Repeal the sections, substitute:

165 - 150 Who has more than 50% of the voting power in the company

The primary test

(1) Applying the primary test: if there are persons who, at a particular time, beneficially own (between them) * shares that carry (between them) the right to exercise more than 50% of the voting power in the company, those persons have more than 50% of the voting power in the company at that time.

The alternative test

(2) Applying the alternative test: if it is the case, or it is reasonable to assume, that there are persons (none of them companies or * trustees) who (between them) at a particular time control, or are able to control (whether directly, or indirectly through one or more interposed entities) the voting power in the company, those persons have more than 50% of the voting power in the company at that time.

165 - 155 Who has rights to more than 50% of the company's dividends

The primary test

(1) Applying the primary test: if there are persons who, at a particular time, beneficially own (between them) * shares that carry (between them) the right to receive more than 50% of any * dividends that the company may pay, those persons have rights to more than 50% of the company's dividends at that time.

The alternative test

(2) Applying the alternative test: if it is the case, or it is reasonable to assume, that there are persons (none of them companies) who (between them) at a particular time have the right to receive for their own benefit (whether directly or * indirectly) more than 50% of any * dividends that the company may pay, those persons have rights to more than 50% of the company's dividends at that time.

165 - 160 Who has rights to more than 50% of the company's capital distributions

The primary test

(1) Applying the primary test: if there are persons who, at a particular time, beneficially own (between them) * shares that carry (between them) the right to receive more than 50% of any distribution of capital of the company, those persons have rights to more than 50% of the company's capital distributions at that time.

The alternative test

(2) Applying the alternative test: if it is the case, or it is reasonable to assume, that there are persons (none of them companies) who (between them) at a particular time have the right to receive for their own benefit (whether directly or * indirectly) more than 50% of any distribution of capital of the company, those persons have rights to more than 50% of the company's capital distributions at that time.

22 Section 165 - 165

Repeal the section, substitute:

165 - 165 Rules about tests for a condition or occurrence of a circumstance

Exactly the same shares or interests must continue to be held

(1) For the purpose of determining whether a company has satisfied a condition or whether a time is a changeover time or an alteration time in respect of a company:

(a) a condition that has to be satisfied is not satisfied; or

(b) a time that, apart from this subsection, would not be a changeover time or alteration time is taken to be a changeover time or alteration time, as the case may be;

unless, at all relevant times:

(c) the only * shares in the company that are taken into account are exactly the same shares and are held by the same persons; and