Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- Income Tax Assessment Act 1936

1 Subsection 6(1)

Insert:

"life assurance company" has the meaning given to life insurance company by the Income Tax Assessment Act 1997 .

2 Subsection 6(1)

Insert:

"life assurance policy" has the meaning given to life insurance policy by the Income Tax Assessment Act 1997 .

3 Subsection 6(1)

Insert:

"life assurance premium" has the meaning given to life insurance premium by the Income Tax Assessment Act 1997 .

4 After subsection 26AH(6)

Insert:

(6A) If, during the year of income, an amount referred to in subsection ( 6) is received during the eligible period in relation to an eligible policy held by the trustee of a non - complying superannuation fund (within the meaning of Part IX):

(a) subsection ( 6) does not apply to the amount; and

(b) the amount is included in the assessable income of the fund of the year of income.

5 Paragraph 26AH(7)(b)

Repeal the paragraph, substitute:

(b) the eligible policy is held by the trustee of:

(i) a complying superannuation fund; or

(ii) a complying ADF; or

(iii) a pooled superannuation trust;

within the meaning of Part IX; or

(ba) the eligible policy is issued by a life assurance company and the company's liabilities under the policy are to be discharged out of:

(i) virtual PST assets within the meaning of the Income Tax Assessment Act 1997 ; or

(ii) segregated exempt assets within the meaning of that Act; or

6 After subsection 70B(2)

Insert:

(2A) A deduction is not allowable under subsection ( 2) for a loss on the disposal or redemption of traditional securities that are:

(a) segregated exempt assets (for the purposes of the Income Tax Assessment Act 1997 ) of a life assurance company; or

(b) segregated current pension assets (as defined in Part IX) of a complying superannuation fund (as defined in that Part); or

(c) segregated exempt superannuation assets (as defined in Part IX) of a PST (as defined in that Part).

7 After subsection 92(2)

Insert:

(2A) Subsection ( 2) does not apply to a partnership loss if the partner's interest in the partnership at the end of the income year is:

(a) a segregated exempt asset (as defined in the Income Tax Assessment Act 1997 ) of a life assurance company; or

(b) a segregated current pension asset (as defined in Part IX) of a complying superannuation fund (as defined in that Part); or

(c) a segregated exempt superannuation asset (as defined in Part IX) of a PST (as defined in that Part).

8 Subsection 110(1) (definition of non - exempt modified capital gain )

After "any capital gain", insert "(excluding a discount capital gain within the meaning of the Income Tax Assessment Act 1997 but including, in respect of a life assurance company that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of that Act)".

9 Subsection 110(1)

Insert:

"non-exempt modified discount capital gain" for a notional CGT event means any discount capital gain within the meaning of the Income Tax Assessment Act 1997 (including, in respect of a life assurance company that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of that Act) that would (apart from this Division) arise from the event if Division 10 of Part IX applied in respect of the event, reduced as follows:

(a) if, had the gain instead been ordinary income derived when the gain was made, some or all of the ordinary income would have been exempt income under section 112C:

(i) reduce the gain by so much of that ordinary income as would have been so exempt; and

(ii) further reduce the rest of the gain (if any) by the proportion worked out using the formula in section 112A;

(b) otherwise--reduce the gain by the proportion worked out using the formula in section 112A.

10 Subsection 110(1) (definition of non - exempt ordinary capital gain )

After "any capital gain", insert "(including, in respect of a life assurance company that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of the Income Tax Assessment Act 1997 )".

11 Subsection 110(1) (definition of total non - exempt modified capital gain )

Omit "as has", substitute "and non - exempt modified discount capital gains as have".

12 After section 110

Insert:

110A Year of income in which 1 July 2000 occurs

If the year of income of a life assurance company in which 1 July 2000 occurs ends after that date, the period beginning at the start of that year of income and ending at the end of 30 June 2000 is taken for the purposes of this Division to be a year of income of the company.

13 After paragraph 116CB(1)(g)

Insert:

(ga) any non - exempt modified discount capital gain;

14 Paragraph 116CB(3)(f)

After "non - exempt modified capital gain", insert ", non - exempt modified discount capital gain".

15 After subsection 116CD(6)

Insert:

(7) The life assurance company must choose the extent to which:

(a) the total modified capital loss (if any); and

(b) the losses (if any) that, under subsections ( 3) to (6), are to be applied in reduction of the CS/RA class;

are respectively applied:

(c) in respect of non - exempt modified capital gains; and

(d) in respect of non - exempt modified discount capital gains.

(7A) The non - exempt modified capital gains and the non - exempt modified discount capital gains are reduced by the amounts respectively applied in respect of them in accordance with the choices made under subsection ( 7).

(7B) After making the reductions referred to in subsection ( 7A), the assessable income of the CS/RA class includes:

(a) the amount left over of the non - exempt modified capital gains; and

(b) two - thirds of the amount left over of the non - exempt modified discount capital gains.

16 Subsection 116E(1) (definition of modified capital gain )

Repeal the definition, substitute:

"modified capital gain" for a notional CGT event means any capital gain (excluding a discount capital gain within the meaning of the Income Tax Assessment Act 1997 but including, in respect of a registered organisation that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of that Act) that would (apart from this Division) arise from the event if Division 10 of Part IX of this Act applied in respect of the event.

17 Subsection 116E(1)

Insert:

"modified discount capital gain" for a notional CGT event means any discount capital gain within the meaning of the Income Tax Assessment Act 1997 (including, in respect of a registered organisation that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of that Act) that would (apart from this Division) arise from the event if Division 10 of Part IX of this Act applied in respect of the event.

18 Subsection 116E(1) (definition of ordinary capital gain )

Repeal the definition, substitute:

"ordinary capital gain" for a notional CGT event means any capital gain (including, in respect of a registered organisation that is a beneficiary of a trust estate, any capital gain notionally included under subsection 115 - 215(3) of the Income Tax Assessment Act 1997 ) that would (apart from this Division) arise from the event.

19 Subsection 116E(1) (definition of total modified capital gain )

Omit "as has", substitute "and modified discount capital gains as have".

20 After paragraph 116GA(1)(g)

Insert:

(ga) any modified discount capital gain;

21 Paragraph 116GA(2)(f)

After "modified capital gain", insert ", modified discount capital gain".

22 After subsection 116GB(5)

Insert:

(6) The registered organisation must choose the extent to which:

(a) the total modified capital loss (if any); and

(b) the losses (if any) that, under subsections ( 3) to (5), are to be applied in reduction of the CS/RA class;

are respectively applied:

(c) in respect of modified capital gains; and

(d) in respect of modified discount capital gains.

(6A) The modified capital gains and the modified discount capital gains are reduced by the amounts respectively applied in respect of them in accordance with the choices made under subsection ( 6).

(6B) After making the reductions referred to in subsection ( 6A), the assessable income of the CS/RA class includes:

(a) the amount left over of the modified capital gains; and

(b) two - thirds of the amount left over of the modified discount capital gains.

23 Divisions 8 and 8A of Part III

Repeal the Divisions.

24 Section 121

Repeal the section, substitute:

121 Mutual insurance associations

(1) An association of persons formed for the purpose of insuring those persons against loss, damage or risk of any kind is taken, for the purposes of this Act, to be a company carrying on the business of insurance.

(2) The assessable income of such a company includes all premiums derived by it, whether from its members or not.

25 Subsection 160AAB(1)

Insert:

"statutory percentage" means:

(a) if the policy concerned was issued by a friendly society:

(i) if the year of income is earlier than the 2002 - 03 year of income--33%; or

(ii) if the year of income is the 2002 - 03 year of income or a later year of income--30%; or

(b) otherwise:

(i) if the year of income is earlier than the 2001 - 02 year of income--39%; or

(ii) if the year of income is the 2001 - 02 year of income--34%; or

(iii) if the year of income is the 2002 - 03 year of income or a later year of income--30%.

26 Subsections 160AAB(2) to (6)

Omit "39%" (wherever occurring), substitute "the statutory percentage".

35 Subsection 267(1) (definition of life assurance company )

Repeal the definition.

36 Subsection 267(1) (definition of life assurance policy )

Repeal the definition.

48 At the end of section 279E

Add:

(3) A complying superannuation fund cannot deduct an amount (otherwise than under section 279) for fees or charges incurred in respect of:

(a) virtual PST life insurance policies (as defined in the Income Tax Assessment Act 1997 ); or

(b) exempt life insurance policies (as defined in that Act); or

(c) exempt units in a PST.

53 Section 299A

Omit "or a registered organisation".

54 Section 299A (notes)

Repeal the notes, substitute:

Note: RSA providers that are life assurance companies are covered by Division 320 of the Income Tax Assessment Act 1997 .

55 Section 317 (definition of life assurance company )

Repeal the definition.

56 Section 317 (definition of life assurance policy )

Repeal the definition.

57 Section 317 (definition of life assurance premiums )

Repeal the definition.

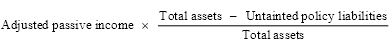

58 Subsection 446(2) (formula)

Repeal the formula, substitute:

59 Subsection 446(2) (definition of untainted average calculated liabilities )

Repeal the definition.

60 Subsection 446(2)

Insert:

"untainted policy liabilities" means so much of the company's policy liabilities, as defined in the Valuation Standard (within the meaning of the Income Tax Assessment Act 1997 ), as calculated by a Fellow or Accredited Member of the Institute of Actuaries of Australia, for the statutory accounting period as is referable to life assurance policies that do not give rise to tainted services income of the company of any statutory accounting period.

61 Subsection 446(3)

Repeal the subsection.

62 Application of amendments made by this Part

(1) The amendments made by items 4, 5, 25 and 26 apply to amounts received (within the meaning of section 26AH of the Income Tax Assessment Act 1936 ) on or after 1 July 2000.

(2) The amendments made by items 6 and 7 apply to losses arising on or after 1 July 2000.

(3) The amendments made by items 8 to 22 apply to assessments for the year of income in which 21 September 1999 occurs and later years of income.

(4) The amendments made by items 23, 24, 35, 36 and 53 apply to income derived on or after 1 July 2000.

(6) The amendments made by items 58 to 61 apply in calculating passive income that is derived on or after 1 July 2000.

Part 2 -- Income Tax Assessment Act 1997

63 Section 10 - 5 (table item headed "life assurance companies")

Repeal the item, substitute:

life insurance companies | Subdivision 320 - B |

64 Section 11 - 15 (table item headed "life assurance")

Repeal the item, substitute:

life insurance companies | Subdivision 320 - B |

65 Section 12 - 5 (table item headed "life assurance companies")

Repeal the item, substitute

life insurance companies | Subdivision 320 - C |

66 Section 50 - 20

Omit "section 50 - 70", substitute "sections 50 - 70 and 50 - 72".

67 Section 50 - 20

Repeal the section.

68 Section 50 - 70

Omit "4.1,".

69 After section 50 - 70

Insert:

50 - 72 Special condition for item 4.1

The income of a * friendly society covered by item 4.1 that is derived from * life insurance business (other than business relating to the issuing of * income bonds, * funeral policies or * scholarship plans) is not exempt from income tax under section 50 - 1.

70 Section 50 - 72

Repeal the section.

71 At the end of subsection 102 - 3(2)

Add:

; (d) life insurance companies, in relation to discount capital gains for CGT events in respect of CGT assets that are virtual PST assets.

72 Section 102 - 30 (table items 11 and 12)

Repeal the items, substitute:

11 | A life insurance company | Division 320 contains special rules that apply to capital gains and capital losses | Division 320 |

73 Section 109 - 60 (at the end of the table)

Add:

11 | A CGT asset is transferred to or from a life insurance company's virtual PST | at the time of the transfer | Division 320 |

12 | A CGT asset is transferred to or from the segregated exempt assets of a life insurance company | at the time of the transfer | Division 320 |

13 | A CGT asset is transferred to or from the segregated current pension assets of a complying superannuation fund | at the time of the transfer | section 273H |

14 | A CGT asset is transferred to or from the segregated exempt superannuation assets of a PST | at the time of the transfer | section 273H |

74 Subsection 110 - 25(1)

Omit "and (8)", substitute ", (8) and (9)".

75 At the end of section 110 - 25

Add:

(9) Also, for the purpose of working out the * capital gain of a * life insurance company from a * CGT event happening after 30 June 2000 in respect of a * CGT asset that is a * virtual PST asset, the cost base includes indexation only if the life insurance company chooses that the cost base includes indexation.

Note: Section 110 - 25 of the Income Tax (Transitional Provisions) Act 1997 provides that, in working out the capital gain from a CGT event after 11.45 am on 21 September 1999 and before 1 July 2000 in respect of an asset of a life insurance company or registered organisation, the cost base includes indexation only if the company or organisation chooses it.

76 Section 112 - 97 (at the end of the table)

Add:

21 | A CGT asset is transferred to or from a life insurance company's virtual PST | First element of cost base and reduced cost base | Division 320 |

22 | A CGT asset is transferred to or from the segregated exempt assets of a life insurance company | First element of cost base and reduced cost base | Division 320 |

23 | A CGT asset is transferred to or from the segregated current pension assets of a complying superannuation fund | First element of cost base and reduced cost base | section 273H |

24 | A CGT asset is transferred to or from the segregated exempt superannuation assets of a PST | First element of cost base and reduced cost base | section 273H |

77 At the end of section 114 - 5

Add:

(3) Indexation is not relevant to the * capital gain of a * life insurance company from a * CGT event happening after 30 June 2000 in respect of a * CGT asset that is a * virtual PST asset unless the company has chosen that the * cost base include indexation for the purposes of section 110 - 25.

Note: Section 114 - 5 of the Income Tax (Transitional Provisions) Act 1997 provides that indexation is not relevant to the capital gain of a life insurance company or registered organisation from a CGT event after 11.45 am on 21 September 1999 and before 1 July 2000 unless the company or organisation chooses it.

78 At the end of section 115 - 10

Add:

; or (d) a * life insurance company in relation to a * discount capital gain from a * CGT event in respect of a * CGT asset that is a * virtual PST asset.

Note: Section 115 - 10 of the Income Tax (Transitional Provisions) Act 1997 provides that a capital gain made by a life insurance company or registered organisation after 11.45 am on 21 September 1999 and before 1 July 2000 may be a discount capital gain in certain circumstances.

79 Section 115 - 100

Repeal the section, substitute:

115 - 100 What is the discount percentage for a discount capital gain

The discount percentage for an amount of a * discount capital gain is:

(a) 50% if the gain is made:

(i) by an individual; or

(ii) by a trust (other than a trust that is a * complying superannuation entity); or

(b) 33 1 / 3 % if the gain is made:

(i) by a complying superannuation entity; or

(ii) by a * life insurance company from a * CGT asset that is a * virtual PST asset.

79A Subsection 118 - 300(1) (table items 3, 4 and 5)

Omit " * life insurance policy", substitute "policy of insurance on the life of an individual".

79B Subsection 118 - 300(1) (example 2)

Omit "life insurance policy", substitute "policy of insurance on the life of an individual".

80 Subsection 118 - 300(1) (at the end of the table)

Add:

6 | A policy of insurance on the life of an individual or an * annuity instrument, where the * life insurance company's liabilities under the policy or instrument are to be discharged out of * virtual PST assets or * segregated exempt assets | the life insurance company |

81 At the end of Subdivision 118 - D

Add:

118 - 315 Segregated exempt assets of life insurance companies

A * capital gain or * capital loss that a * life insurance company makes from a * CGT event happening in relation to a * segregated exempt asset is disregarded.

118 - 320 Segregated current pension assets of a complying superannuation entity

A * capital gain or * capital loss that a * complying superannuation entity makes from a * CGT event happening in relation to a segregated current pension asset (as defined in Part IX of the Income Tax Assessment Act 1936 ) is disregarded.

82 At the end of Subdivision 118 - E

Add:

118 - 355 Segregated exempt superannuation assets of pooled superannuation trust

A * capital gain or a * capital loss that a * pooled superannuation trust makes from a * CGT event happening in relation to a segregated exempt superannuation asset (as defined in Part IX of the Income Tax Assessment Act 1936 ) is disregarded.

83 Paragraphs 118 - 350(2)(b) and (c)

Repeal the paragraphs, substitute:

(b) a * life insurance company and, just before the event happened, the unit must have been a * virtual PST asset or a * segregated exempt asset of the company.

83A Subparagraph 152 - 20(2)(b)(v)

Repeal the subparagraph, substitute:

(v) a policy of insurance on the life of an individual.

84 Section 195 - 35 (link note)

Repeal the link note, substitute:

[The next Part is Part 3 - 35]

Part 3 - 35 -- Life insurance business

[The next Division is Division 320]

Division 320 -- Life insurance companies

Table of Subdivisions

Guide to Division 320

320 - A Preliminary

320 - B What is included in a life insurance company's assessable income

320 - C Deductions and capital losses

320 - D Classes of taxable income of life insurance companies

320 - E RSA component of complying superannuation class

320 - F Virtual PST component of complying superannuation class

320 - G Specified roll - over component of complying superannuation class

320 - H Segregation of assets to discharge exempt life insurance policy liabilities

320 - 1 What this Division is about

This Division provides for the taxation of life insurance companies in a broadly comparable way to other entities that derive similar kinds of income.

Because of the nature of the business of life insurance companies, the Division contains special rules for working out their taxable income.

Those rules:

• include certain amounts in assessable income;

• identify certain amounts of exempt income;

• identify specific deductions.

The taxable income of life insurance companies is divided into 2 classes:

• the complying superannuation class, which contains taxable income that relates to complying superannuation business and is taxed at the rate of tax that applies to complying superannuation funds

• the ordinary class, which contains the rest of the taxable income and is taxed at the company tax rate.

The Division also contains rules for segregating the assets of life insurance companies into:

• assets that relate to complying superannuation business;

• assets that relate to immediate annuity and other exempt business.

[This is the end of the Guide]

Subdivision 320 - A -- Preliminary

(1) The object of this Division is to provide for the taxation of * life insurance companies in a broadly comparable way to other entities that derive similar kinds of income.

(2) To achieve this object, the Division:

(a) identifies certain amounts that are included in the assessable income, or are exempt income, of a * life insurance company; and

(b) identifies certain amounts that a life insurance company can deduct; and

(c) identifies the part of the taxable income of a life insurance company that relates to complying superannuation business and allocates that income to the * complying superannuation class of the company's taxable income; and

(d) allocates the rest of the taxable income to the * ordinary class of the company's taxable income; and

(e) contains other provisions necessary to enable the taxable income of a life insurance company to be worked out.

Note: Section 320 - 5 of the Income Tax (Transitional Provisions) Act 1997 provides that the tax consequences of certain transfers of assets of a life insurance company that is a friendly society to a complying superannuation fund are to be disregarded.

Subdivision 320 - B -- What is included in a life insurance company's assessable income

320 - 10 What this Subdivision is about

This Subdivision provides for certain amounts to be included in a life insurance company's assessable income and for certain other amounts to be exempt income.

T able of sections

Operative provisions

320 - 15 Assessable income--various amounts

320 - 20 Assessable income--asset transferred from virtual PST assets to segregated exempt assets and subsequently disposed of

320 - 25 Assessable income--asset transferred from virtual PST assets to segregated exempt assets and subsequently transferred

320 - 30 Assessable income--special provision for certain income years

320 - 35 Exempt income

320 - 40 Exemption of one - third of certain management fees received under contracts made before 1 July 2000

320 - 45 Tax treatment of gains or losses from CGT events in relation to virtual PST assets

[This is the end of the Guide]

320 - 15 Assessable income--various amounts

A * life insurance company's assessable income includes:

(a) the total amount of the * life insurance premiums paid to the company in the income year; and

(b) amounts received or recovered under * contracts of reinsurance to the extent to which they relate to the * risk components of claims paid under * life insurance policies; and

(c) any amount received or recovered that is a refund, or in the nature of a refund, of the life insurance premium paid under a * contract of reinsurance; and

(d) any amount received under a profit - sharing arrangement contained in, or entered into in relation to, a contract of reinsurance; and

(e) if an asset (other than money) is transferred from or to a * virtual PST under subsection 320 - 180(1) or (2), to a virtual PST under section 320 - 185 or from a virtual PST under subsection 320 - 195(2) or (3)--the amount (if any) that is included in the company's assessable income of the income year in which the asset was transferred because of section 320 - 200; and

(f) the * transfer values of assets transferred from the company's * segregated exempt assets under subsection 320 - 235(1) or 320 - 250(2); and

(g) if an asset (other than money) is transferred to the company's segregated exempt assets under subsection 320 - 235(2) or section 320 - 240--the amount (if any) that is included in the company's assessable income because of section 320 - 255; and

(h) if the * value, at the end of the income year, of the company's liabilities under the * net risk components of life insurance policies is less than the value, at the end of the previous income year, of those liabilities--an amount equal to the difference; and

Note: Where the value at the end of the income year exceeds the value at the end of the previous income year, the excess can be deducted: see section 320 - 85.

(i) amounts included in the company's assessable income under section 275 of the Income Tax Assessment Act 1936 ; and

(j) * specified roll - over amounts paid to the company; and

(k) fees and charges (not otherwise included in the company's assessable income) imposed by the company in respect of life insurance policies; and

(l) if the company is an * RSA provider-- * taxable contributions made to * RSAs provided by the company.

320 - 30 Assessable income--special provision for certain income years

(1) This section applies to a * life insurance company for each of the following income years (each a relevant income year ):

(a) the income year in which 1 July 2000 occurs;

(b) the 4 following income years.

(2) If:

(a) the * value of the company's liabilities at the end of 30 June 2000 under its * continuous disability policies (being the value used by the company for the purposes of its return of income);

exceeds

(b) the value of the company's liabilities at the end of 30 June 2000 under the * net risk components of its continuous disability policies as calculated under subsection 320 - 85(4);

the company's assessable income for each relevant income year includes an amount equal to one - fifth of the excess.

(3) However, if a * life insurance company ceases in a relevant income year to carry on * life insurance business or to have any liabilities under the * net risk components of * continuous disability policies, subsection ( 2) does not apply for that income year or any future income years but the company's assessable income for that income year includes so much of the excess referred to in subsection ( 2) as has not been included in the company's assessable income for any previous relevant income years.

(1) The following amounts received by a * life insurance company are exempt from income tax:

(a) amounts of * ordinary income and * statutory income accrued before 1 July 1988 that were derived from assets that have become * virtual PST assets;

(b) amounts of ordinary income and statutory income derived from * segregated exempt assets, being income that relates to the period during which the assets were segregated exempt assets;

(c) amounts of ordinary income and statutory income received from the * disposal of units in a * pooled superannuation trust;

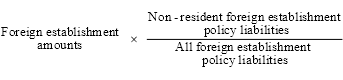

(d) if an * Australian/overseas fund or an * overseas fund established by the company derived * foreign establishment amounts--the non - resident proportion of the foreign establishment amounts;

(e) if the company is an * RSA provider--any amounts that, except for the operation of subsections 320 - 155(3) and (4), would have been taken into account under subsection 320 - 155(1) in calculating the * RSA component of the * complying superannuation class of the company's taxable income;

(f) if the company is a * friendly society:

(i) amounts received before 1 July 2001 that are exempt from income tax under section 50 - 1; and

(ii) amounts received on or after that date that are attributable to * income bonds, * funeral policies or * scholarship plans issued before 1 December 1999.

(2) For the purposes of paragraph ( 1)(d), the non - resident proportion of the * foreign establishment amounts is the amount worked out using the formula:

where:

"all foreign establishment policy liabilities" means the total of the policy liabilities (as defined in the * Valuation Standard), calculated by an * actuary, for all * life insurance policies included in the class of * life insurance business to which the company's * Australian/overseas fund or * overseas fund relates that were issued by the permanent establishment of the company in the foreign country.

"non-resident foreign establishment policy liabilities" means the total of the company's policy liabilities (as defined in the Valuation Standard), calculated by an actuary, for * non - resident life insurance policies.

(1) One - third of a * life insurance company's * specified management fees for the income year in respect of * life insurance policies constituted by contracts made with the company before 1 July 2000 are exempt from income tax.

(2) This section does not apply to amounts that become * specified management fees after 30 June 2005.

(3) There are no * specified management fees in respect of * life insurance policies that, at 30 June 2000, were:

(a) policies under which amounts are to be paid only on the death or disability of a person; or

(b) policies to which both of the following apply:

(i) the policies provide for * participating benefits or * discretionary benefits;

(ii) the policies do not become policies under which the company's liabilities are to be discharged out of its * virtual PST assets or its * segregated exempt assets.

(4) The specified management fees for the income year in respect of * life insurance policies to which subsection ( 3) does not apply are so much of the sum of the amounts applicable in respect of the policies under subsections ( 5), (6) and (7) (the applicable amounts ) as does not exceed any fees or charges made by the * life insurance company that the company was entitled to make under the terms of the policies as applying immediately before 1 July 2000.

(5) The applicable amount for * virtual PST life insurance policies where the company's liabilities under the policies are to be discharged out of its * virtual PST assets is:

(a) the sum of the amounts transferred from the * virtual PST in the income year under subsection 320 - 180(1) or 320 - 195(3);

less:

(b) so much of the sum of:

(i) any amounts transferred to the virtual PST in the income year under subsection 320 - 180(2) or 320 - 185(1); and

(ii) any of the amounts referred to in paragraph ( a) that related to the company's liability to pay amounts on the death or disability of a person;

as does not exceed the amount referred to in paragraph ( a).

(6) The applicable amount for * exempt life insurance policies where the company's liabilities under the policies are to be discharged out of its * segregated exempt assets is:

(a) the total amount transferred from the segregated exempt assets in the income year under subsection 320 - 235(1) or 320 - 250(2);

less:

(b) so much of the total amount transferred to the segregated exempt assets in the income year under subsection 320 - 235(2) or 320 - 240(1) as does not exceed the amount referred to in paragraph ( a).

(7) The applicable amount for other policies is:

(a) the sum of the * life insurance premiums received in respect of the policies in the income year;

less:

(b) so much of the total of:

(i) the amounts that the company can deduct under section 320 - 75; and

(ii) the * risk components of claims paid under those policies in the income year;

as does not exceed the amount referred to in paragraph ( a).

(8) An amount that is exempt from income tax under this section is taken to be assessable income of the * life insurance company for the purposes of section 8 - 1.

320 - 45 Tax treatment of gains or losses from CGT events in relation to virtual PST assets

If a * CGT event happens in respect of a * CGT asset that is a * virtual PST asset of a * life insurance company, Division 10 of Part IX of the Income Tax Assessment Act 1936 applies for the purpose of working out the amount of any * capital gain or * capital loss that arises from the event.

Subdivision 320 - C -- Deductions and capital losses

320 - 50 What this Subdivision is about

This Subdivision specifies particular deductions that are available to a life insurance company, specifies particular amounts that a life insurance company cannot deduct and contains provisions relating to a life insurance company's capital losses.

T able of sections

Operative provisions

320 - 55 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from virtual PST assets

320 - 60 Deduction for life insurance premiums where liabilities under life insurance policies are to be discharged from segregated exempt assets

320 - 65 Deduction for life insurance premiums in respect of life insurance policies that provide for participating or discretionary benefits

320 - 70 No deduction for life insurance premiums in respect of certain life insurance policies payable only on death or disability

320 - 75 Deduction in respect of other life insurance policies

320 - 80 Deduction for certain claims paid under life insurance policies

320 - 85 Deduction for increase in value of liabilities under net risk components of life insurance policies

320 - 90 Deduction where asset transferred from virtual PST assets to segregated exempt assets and subsequently disposed of

320 - 95 Deduction where asset transferred from virtual PST assets to segregated exempt assets and subsequently transferred

320 - 100 Deduction for life insurance premiums paid under contracts of reinsurance

320 - 105 Deduction for assets transferred to segregated exempt assets

320 - 110 Deduction for interest credited to income bonds

320 - 115 No deduction for amounts credited to RSAs

320 - 120 Capital losses from assets other than virtual PST assets or segregated exempt assets

320 - 125 Capital losses from virtual PST assets

[This is the end of the Guide]

(1) This section applies to a * life insurance company in respect of * life insurance policies where the company's liabilities under the policies are to be discharged out of * virtual PST assets.

(2) The company can deduct:

(a) the amounts of the * life insurance premiums received in respect of the policies that are transferred to its * virtual PST assets in the income year;

less:

(b) so much of those amounts as relate to the company's liability to pay amounts on the death or disability of a person.

(3) The amount of a * life insurance premium that relates to the company's liability mentioned in paragraph ( 2)(b) is:

(a) if the * life insurance policy states that the whole or a specified part of the premium is payable in respect of such a liability--the whole or that part of the premium, as the case may be; or

(b) if paragraph ( a) does not apply:

(i) where the policy provides for * participating benefits or * discretionary benefits--nil; or

(ii) where the policy is an * endowment policy and does not provide for participating benefits or discretionary benefits--10% of the premium; or

(iii) where the policy is a * whole of life policy and does not provide for participating benefits or discretionary benefits--30% of the premium; or

(iv) otherwise--so much of the premium as an * actuary determines to be attributable to the liability.

A * life insurance company can deduct the amounts of * life insurance premiums transferred in the income year to its * segregated exempt assets under subsection 320 - 240(3).

A * life insurance company can deduct the amounts of * net premiums received in respect of * life insurance policies (other than * virtual PST life insurance policies or * exempt life insurance policies) that provide for * participating benefits or * discretionary benefits.

(1) A * life insurance company cannot deduct any part of the amounts of * life insurance premiums received in respect of * life insurance policies under which amounts are to be paid only on the death or disability of a person.

(2) This section does not apply to * life insurance policies that provide for * participating benefits or * discretionary benefits.

320 - 75 Deduction in respect of other life insurance policies

(1) This section applies to a * life insurance company in respect of * life insurance policies to which sections 320 - 55, 320 - 60, 320 - 65 and 320 - 70 do not apply.

(2) In respect of policies issued on or after 1 July 2001, the company can deduct, in respect of * life insurance premiums received in the income year, the lesser of the following amounts:

(a) the amounts specified in the policies to be the capital components of those premiums, less any adjustments to be made because of * contracts of reinsurance;

(b) the sum of the * net premiums less so much of the net premiums as an * actuary determines to be attributable to fees and charges.

(3) In respect of policies issued before 1 July 2001, the company can deduct, in respect of * life insurance premiums received in the income year, the sum of the * net premiums less so much of the net premiums as an * actuary determines to be attributable to fees and charges.

(4) In making a determination referred to in paragraph ( 2)(b) or subsection ( 3), an * actuary is to have regard to the changes over the income year in the sum of the * net current termination values of the policies and the movements in those values during the income year.

320 - 80 Deduction for certain claims paid under life insurance policies

(1) A * life insurance company can deduct the amounts paid in respect of the * risk components of claims paid under * life insurance policies during the income year.

(2) The risk component of a claim paid under a * life insurance policy is:

(a) if:

(i) the policy does not provide for * participating benefits or * discretionary benefits; and

(ii) the policy is not an * exempt life insurance policy; and

(iii) an amount is payable under the policy only on the death or disability of the insured person;

the amount paid under the policy as a result of the occurrence of that event; or

(b) if the policy provides for participating benefits or discretionary benefits or is an exempt life insurance policy--nil; or

(c) otherwise--the amount paid under the policy as a result of the death or disability of the insured person less the * current termination value of the policy (calculated by an * actuary) immediately before the death, or the occurrence of the disability, of the person.

(3) Except as provided by subsection ( 1), a * life insurance company cannot deduct amounts paid in respect of claims under * life insurance policies.

(1) A * life insurance company can deduct the amount (if any) by which the * value, at the end of the income year, of its liabilities under the * net risk components of * life insurance policies exceeds the value, at the end of the previous income year, of those liabilities.

Note 1: Where the value at the end of the income year is less than the value at the end of the previous income year, the difference is included in assessable income: see paragraph 320 - 15(h).

Note 2: Section 320 - 85 of the Income Tax (Transitional Provisions) Act 1997 makes special provision in respect of the calculation of the value of a life insurance company's liabilities under the net risk components of life insurance policies at the end of the income year immediately preceding the income year in which 1 July 2000 occurs.

(2) A * life insurance company can deduct an amount under this section in respect of a * life insurance policy only if the company can deduct under section 320 - 80 an amount for the * risk components of claims paid under the policy.

(3) If a * life insurance policy is a * disability policy (other than a * continuous disability policy), the value at a particular time of the liabilities of the * life insurance company under the * net risk component of the policy is the * current termination value of the component at that time (calculated by an * actuary).

(4) In the case of * life insurance policies other than policies to which subsection ( 3) applies, the value at a particular time of the liabilities of the * life insurance company under the * net risk components of the policies is the amount calculated by an * actuary to be:

(a) the sum of the policy liabilities (as defined in the * Valuation Standard) in respect of the net risk components of the policies at that time;

less

(b) the sum of any cumulative losses (as defined in the Valuation Standard) for the net risk components of the policies at that time.

320 - 87 Deduction for assets transferred from or to virtual PST

If an asset (other than money) is transferred from a * virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3), or is transferred to a virtual PST under subsection 320 - 180(2) or section 320 - 185, the * life insurance company can deduct the amount (if any) that it can deduct because of section 320 - 200.

320 - 100 Deduction for life insurance premiums paid under contracts of reinsurance

A * life insurance company can deduct amounts paid in the income year as * life insurance premiums under * contracts of reinsurance.

320 - 105 Deduction for assets transferred to segregated exempt assets

(1) A * life insurance company can deduct the * transfer values of assets transferred in the income year to the company's * segregated exempt assets under subsection 320 - 235(2) or 320 - 240(1).

(2) If an asset (other than money) is transferred to a * life insurance company's * segregated exempt assets under subsection 320 - 235(2) or section 320 - 240, the company can deduct the amount (if any) that it can deduct because of section 320 - 255.

320 - 110 Deduction for interest credited to income bonds

A * life insurance company that is a * friendly society can deduct interest credited in the income year to the holders of * income bonds issued after 30 November 1999 where the interest accrued on or after 1 July 2001.

320 - 115 No deduction for amounts credited to RSAs

A * life insurance company that is an * RSA provider cannot deduct amounts credited to * RSAs.

320 - 120 Capital losses from assets other than virtual PST assets or segregated exempt assets

(1) This section applies to assets ( ordinary assets ) of a * life insurance company other than:

(a) * virtual PST assets; or

(b) * segregated exempt assets.

(2) In working out a * life insurance company's * net capital gain or * net capital loss for the income year, * capital losses from ordinary assets can be used only to reduce * capital gains from ordinary assets.

(3) If some or all of a * capital loss from an ordinary asset cannot be applied in an income year, the unapplied amount can be applied in the next income year in which the company's * capital gains from ordinary assets exceed the company's capital losses (if any) from ordinary assets.

(4) If the company has 2 or more unapplied * net capital losses from ordinary assets, the company must apply them in the order in which they were made.

320 - 125 Capital losses from virtual PST assets

(1) In working out a * life insurance company's * net capital gain or * net capital loss for the income year, * capital losses from * virtual PST assets can be used only to reduce * capital gains from virtual PST assets.

(2) If some or all of a * capital loss from a * virtual PST asset cannot be applied in an income year, the unapplied amount can be applied in the next income year in which the company's * capital gains from * virtual PST assets exceed the company's capital losses (if any) from virtual PST assets.

(3) If the company has 2 or more unapplied * net capital losses from * virtual PST assets, the company must apply them in the order in which they were made.

Subdivision 320 - D -- Classes of taxable income of life insurance companies

320 - 130 What this Subdivision is about

This Subdivision provides for a life insurance company's taxable income to be divided into an ordinary class and a complying superannuation class and explains what is included in each class.

T able of sections

Operative provisions

320 - 135 Classes of taxable income

320 - 140 Ordinary class of taxable income

320 - 145 Complying superannuation class of taxable income

[This is the end of the Guide]

320 - 135 Classes of taxable income

The taxable income of a * life insurance company for an income year is divided into 2 classes:

(a) the * ordinary class; and

(b) the * complying superannuation class.

320 - 140 Ordinary class of taxable income

The ordinary class is the total taxable income less the * complying superannuation class.

320 - 145 Complying superannuation class of taxable income

The complying superannuation class is the part of the taxable income that consists of:

(a) if the company is an * RSA provider--the * RSA component; and

(b) if the company has established a * virtual PST--the * virtual PST component; and

(c) in any case--the * specified roll - over component.

Subdivision 320 - E -- RSA component of complying superannuation class

320 - 150 What this Subdivision is about

This Subdivision explains how the RSA component of the complying superannuation class of a life insurance company's taxable income is worked out.

T able of sections

Operative provisions

320 - 155 What is the RSA component

320 - 160 Taxable income and RSA component in certain cases

[This is the end of the Guide.]

320 - 155 What is the RSA component

(1) The RSA component of the * complying superannuation class of the taxable income for an income year of a * life insurance company that is an * RSA provider is the sum of all amounts (other than contributions that are not * taxable contributions) credited during the income year to * RSAs provided by the company, reduced by any amounts debited from the RSAs other than benefits paid to, or in respect of, the holders of the RSAs.

(2) In calculating the * RSA component, any amount of tax paid in respect of an * RSA is taken not to have been an amount paid from the RSA.

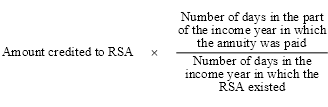

(3) If an * annuity was being paid from an * RSA in respect of the whole of the income year, or the whole of the part of the income year in which the RSA existed, amounts credited to the RSA during the income year are, in calculating the sum referred to in subsection ( 1), taken not to have been credited.

(4) If an * annuity was being paid from an * RSA in respect of a part, but not the whole, of the portion of the income year in which the RSA existed, amounts worked out using the following formula are, in calculating the sum referred to in subsection ( 1), taken not to have been credited:

320 - 160 Taxable income and RSA component in certain cases

(1) This section applies if:

(a) a * life insurance company that is an * RSA provider has no taxable income; or

(b) the taxable income of a life insurance company that is an RSA provider does not include any * complying superannuation class; or

(c) the complying superannuation class of the taxable income of a life insurance company that is an RSA provider is less than the * RSA component.

(2) If, apart from this subsection, a * life insurance company that is an * RSA provider has no taxable income or its taxable income is less than the * RSA component:

(a) the company is taken to have both a taxable income and a * tax loss for the income year; and

(b) the taxable income is taken to be equal to the RSA component; and

(c) the tax loss is taken to be the amount that would have been the company's tax loss if the RSA component had not been income derived by the company; and

(d) the * complying superannuation class of the taxable income is taken to be equal to the RSA component; and

(e) the * ordinary class of the company's taxable income is taken to be nil.

(3) If, apart from this subsection, the taxable income of a * life insurance company that is an * RSA provider is equal to or greater than the * RSA component:

(a) the * complying superannuation class of the taxable income is taken to be equal to the RSA component; and

(b) an amount equal to the difference between the RSA component and the amount that would, apart from this subsection, have been the complying superannuation class of the taxable income is to be applied in reducing the * ordinary class of taxable income.

Subdivision 320 - F -- Virtual PST component of complying superannuation class

320 - 165 What this Subdivision is about

This Subdivision explains:

• how a life insurance company can segregate assets (to be known as a virtual PST ) to be used for the sole purpose of discharging its complying superannuation liabilities

• how the virtual PST component of the complying superannuation class of taxable income is worked out.

T able of sections

Operative provisions

320 - 170 Establishment of virtual PST

320 - 175 Annual valuations of virtual PST assets

320 - 180 Consequences of annual valuation

320 - 185 Transfer of assets to virtual PST otherwise than as a result of an annual valuation

320 - 190 Virtual PST liabilities

320 - 195 Transfer of assets and payment of amounts from a virtual PST otherwise than as a result of an annual valuation

320 - 200 Consequences of transfer of assets to or from virtual PST

320 - 205 What is the virtual PST component

[This is the end of the Guide.]

320 - 170 Establishment of virtual PST

(1) A * life insurance company may, on or after 1 July 2000, segregate in accordance with subsections ( 2) and (3) any of its assets for the sole purpose of discharging its * virtual PST liabilities out of those assets.

Note: Section 320 - 170 of the Income Tax (Transitional Provisions) Act 1997 provides that a life insurance company may transfer a part of an asset to a virtual PST before 1 October 2000.

(1A) Except as provided by section 320 - 170 of the Income Tax (Transitional Provisions) Act 1997 , an asset is taken not to be included in the * virtual PST assets unless the whole of the asset is included among those assets.

(2) The assets segregated must, at the time of the segregation, be a representative sample of all the company's assets that support its * virtual PST liabilities immediately before the segregation.

(3) The assets segregated must have, at the time of the segregation, a total * transfer value that does not exceed the sum of:

(a) the company's * virtual PST liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of the assets segregated; and

(c) the total amount of any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of the company's taxable income for the income year.

(4) A * life insurance company that segregates assets as mentioned in subsections ( 1) to (3) at a time after 1 July 2000 but before 1 October 2000 is taken to have segregated those assets in accordance with those subsections on 1 July 2000.

(5) If a segregation of assets is made in accordance with the above subsections, the company must use the segregated assets, and any other assets afterwards included among the segregated assets, only for the purpose of discharging its * virtual PST liabilities.

(6) The assets from time to time segregated are together to be known as a virtual pooled superannuation trust or a virtual PST and each asset from time to time included among the segregated assets is to be known as a virtual PST asset .

(7) In this Subdivision:

(a) a reference to the transfer of an asset to, or from, the * virtual PST:

(i) is a reference to the inclusion of the asset among the segregated assets, or the exclusion of an asset from the segregated assets, as the case may be; and

(ii) includes a reference to the transfer of money to, or from, the virtual PST, as the case may be; and

(b) if an asset transferred to or from the virtual PST is money, a reference to the * transfer value of the asset transferred is a reference to the amount of the money.

320 - 175 Annual valuations of virtual PST assets

(1) A * life insurance company that has established a * virtual PST must cause the * transfer values of the * virtual PST assets to be calculated as at the following times ( valuation times ):

(a) the end of the income year in which the virtual PST was established;

(b) the end of each later income year.

(2) A calculation for a valuation time is to be made not later than 60 days after that time.

320 - 180 Consequences of annual valuation

(1) If the total * transfer value of the * virtual PST assets at a valuation time exceeds the sum of:

(a) the company's * virtual PST liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of those assets; and

(c) the total amount of any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of the company's taxable income for the income year;

the company must, within 30 days after the day on which the valuations of the transfer values of those assets are made, transfer, from the * virtual PST, assets of any kind having a total transfer value equal to the excess.

(2) If the total * transfer value of the * virtual PST assets at a valuation time is less than the sum of:

(a) the company's * virtual PST liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of those assets; and

(c) the total amount of any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of the company's taxable income for the income year;

the company can transfer, to the * virtual PST, assets of any kind that have a total transfer value not exceeding the difference.

(3) A transfer of assets under subsection ( 1) is taken to have been made in the income year at the end of which the valuation time occurred.

(4) If a transfer of assets under subsection ( 2) is made within 30 days after the day on which the valuations of the * transfer values of those assets are made, the transfer is taken to have been made in the income year at the end of which the valuation time occurred.

320 - 185 Transfer of assets to virtual PST otherwise than as a result of an annual valuation

(1) If a * life insurance company determines, at a time other than a valuation time, that the total * transfer value of the * virtual PST assets is less than the sum of:

(a) its * virtual PST liabilities; and

(b) any reasonable provision made by it in its accounts for liability for tax on unrealised gains in respect of those assets; and

(c) the total amount of any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of the company's taxable income for the income year;

the company can transfer, to the * virtual PST, assets of any kind having a total transfer value not exceeding the difference.

(2) A * life insurance company can at any time transfer an asset of any kind to a * virtual PST in exchange for an amount of money equal to the * transfer value of the asset at the time of the transfer.

(3) A * life insurance company can transfer to a * virtual PST in an income year assets of any kind having a total * transfer value not exceeding the total amount of the * life insurance premiums paid to the company in that income year for the purchase of * virtual PST life insurance policies.

(4) Except as provided by this section and subsection 320 - 180(2), a * life insurance company cannot transfer an asset to a * virtual PST.

320 - 190 Virtual PST liabilities

(1) The amount of the * virtual PST liabilities of a * life insurance company is to be worked out in accordance with subsection ( 2) in respect only of * life insurance policies issued by the company:

(a) that are * virtual PST life insurance policies; and

(b) the liabilities under which are to be discharged out of the company's * virtual PST assets.

(2) The amount of the virtual PST liabilities of a * life insurance company at a particular time is the sum of the following amounts at that time, as calculated by an * actuary:

(a) for policies providing for * participating benefits or * discretionary benefits:

(i) the values of supporting assets, as defined in the * Valuation Standard; and

(ii) the * policy owners' retained profits;

(b) for other policies--the * current termination values.

(1) If:

(a) a * life insurance policy issued by a * life insurance company becomes an * exempt life insurance policy; and

(b) immediately before the policy became an exempt life insurance policy, the policy was a policy referred to in subsection 320 - 190(1);

the company can transfer from a * virtual PST, to its * segregated exempt assets, assets of any kind whose total * transfer value does not exceed the sum of:

(c) the company's liabilities in respect of the policy; and

(d) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of the assets transferred under this subsection.

(2) A * life insurance company can at any time transfer an asset from a * virtual PST in exchange for an amount of money equal to the * transfer value of the asset at the time of the transfer.

(3) If a * life insurance company:

(a) imposes any fees or charges in respect of * virtual PST assets; or

(b) imposes any fees or charges in respect of * virtual PST life insurance policies other than policies:

(i) that provide death or disability benefits, within the meaning of Part IX of the Income Tax Assessment Act 1936 , that are * participating benefits; and

(ii) the liabilities under which are to be discharged out of the company's * virtual PST; or

(c) determines, at a time other than a valuation time, that the total * transfer value of the virtual PST assets exceeds the sum of:

(i) the company's * virtual PST liabilities at that time; and

(ii) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in relation to those assets; and

(iii) the total amount of any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of the company's taxable income for the income year;

the company must, when the fees or charges are imposed or the excess is determined, as the case may be, transfer, from the * virtual PST, assets having a total transfer value equal to the fees, charges or excess, as the case may be.

(4) If:

(a) any liabilities arise for the discharge of which a * life insurance company's * virtual PST is established; or

(b) any expenses are incurred by a life insurance company directly in respect of * virtual PST assets in relation to a period during which the assets are virtual PST assets; or

(c) there are any unpaid * PAYG instalments relating to the * virtual PST component of the * complying superannuation class of a life insurance company's taxable income for the income year;

the life insurance company must pay from the virtual PST any amounts required to discharge the liabilities, amounts equal to the expenses, or amounts equal to the total amount of the unpaid PAYG instalments, as the case may be.

320 - 200 Consequences of transfer of assets to or from virtual PST

(1) This section applies if:

(a) an asset (other than money) is transferred from a * virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3); or

(b) an asset (other than money) is transferred to a virtual PST under subsection 320 - 180(2) or section 320 - 185.

(2) In determining:

(a) for the purposes of this Act (other than Parts 3 - 1 and 3 - 3) whether an amount is included in, or can be deducted from, the assessable income of a * life insurance company in respect of the transfer of the asset; or

(b) for the purposes of Parts 3 - 1 and 3 - 3:

(i) whether the company made a * capital gain in respect of the transfer of the asset; or

(ii) whether the company made a * capital loss in respect of the transfer of the asset;

the company is taken:

(c) to have sold, immediately before the transfer, the asset transferred for a consideration equal to its * market value; and

(d) to have purchased the asset again at the time of the transfer for a consideration equal to its market value.

(3) If, apart from this subsection and section 320 - 55, a * life insurance company could deduct an amount or make a * capital loss as a result of a transfer of an asset to or from its * virtual PST, the deduction or capital loss is disregarded until:

(a) the asset ceases to exist; or

(b) the asset, or a greater than 50% interest in it, is * acquired by an entity other than an entity that is an * associate of the company immediately after the transfer.

320 - 205 What is the virtual PST component

(1) The virtual PST component of the * complying superannuation class of a * life insurance company's taxable income for an income year is the sum of the amounts of the company's assessable income for the income year referred to in subsection ( 3), reduced by the sum of the amounts of the reductions referred to in subsection ( 4).

(2) However, if the sum of the amounts of the company's assessable income for the income year referred to in subsection ( 3) is less than the sum of the amounts of the deductions referred to in subsection ( 4):

(a) the company cannot apply the difference to reduce the * complying superannuation class of the company's taxable income for the income year; but

(b) the company can apply the difference to reduce any * virtual PST component of the complying superannuation class of the company's taxable income for a later income year.

(3) The amounts of assessable income are:

(a) amounts of * ordinary income and * statutory income derived by the company during the income year from the investment of * virtual PST assets where the amounts relate to the period during which those assets were virtual PST assets; and

(b) the * transfer values of any assets transferred by the company during the income year to the * virtual PST under subsection 320 - 180(2) or 320 - 185(1) or (3); and

(c) if an asset (other than money) is transferred from a virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3)--the amount (if any) that is included in the company's assessable income because of section 320 - 200; and

(d) amounts included in the company's assessable income for the income year under section 275 of the Income Tax Assessment Act 1936 ; and

(e) * specified roll - over amounts paid to the company during the income year for the purchase of * deferred annuities where the * life insurance premiums relating to those annuities have been transferred to a virtual PST under subsection 320 - 185(3).

(4) The amounts of the reductions are:

(a) the amounts that the company can deduct in respect of * life insurance premiums under section 320 - 55; and

(b) any losses (other than * capital losses) made during the income year from the investment of * virtual PST assets where the losses relate to the period during which the assets were virtual PST assets; and

(c) the * transfer values of any assets transferred by the company during the income year from the * virtual PST under subsection 320 - 180(1) or 320 - 195(3); and

(ca) if an asset (other than money) is transferred from a virtual PST under subsection 320 - 180(1) or 320 - 195(2) or (3)--the amount (if any) that the company can deduct because of section 320 - 87; and

(d) deductible expenses incurred by the company during the income year directly in respect of virtual PST assets where the expenses relate to the period during which the assets were virtual PST assets; and

(e) the proportion of the amount that the company can deduct under subsection 115 - 215(6) for the income year that is attributable to capital gains that the company is taken to have under subsection 115 - 215(3) in respect of virtual PST assets that are interests in trust estates.

Subdivision 320 - G -- Specified roll - over component of complying superannuation class

320 - 210 What this Subdivision is about

This Subdivision explains how the specified roll - over component of the complying superannuation class of a life insurance company's taxable income is worked out.

T able of sections

Operative provision

320 - 215 What is the specified roll - over component

[This is the end of the Guide.]

320 - 215 What is the specified roll - over component

The specified roll - over component of the * complying superannuation class of a * life insurance company's taxable income for an income year consists of the * specified roll - over amounts that:

(a) are included in the company's assessable income for the income year; and

(b) relate to * life insurance policies that provide for * immediate annuities.

Subdivision 320 - H -- Segregation of assets to discharge exempt life insurance policy liabilities

320 - 220 What this Subdivision is about

This Subdivision explains how a life insurance company can segregate assets to be used for the sole purpose of discharging its liabilities under life insurance policies where the income derived by the company from those policies is exempt from income tax.

T able of sections

Operative provisions

320 - 225 Segregation of assets for purpose of discharging exempt life insurance policy liabilities

320 - 230 Annual valuations of segregated exempt assets

320 - 235 Consequences of annual valuation

320 - 240 Transfer of assets to segregated exempt assets otherwise than as a result of annual valuation

320 - 245 Exempt life insurance policy liabilities

320 - 250 Transfer of assets and payment of amounts from segregated exempt assets otherwise than as a result of an annual valuation

320 - 255 Consequences of transfer of assets to or from segregated exempt assets

[This is the end of the Guide.]

320 - 225 Segregation of assets for purpose of discharging exempt life insurance policy liabilities

(1) A * life insurance company may, on or after 1 July 2000, segregate in accordance with subsections ( 2) and (3) any of its assets for the sole purpose of discharging its * exempt life insurance policy liabilities out of those assets.

Note: Section 320 - 225 of the Income Tax (Transitional Provisions) Act 1997 provides that a life insurance company may transfer a part of an asset to its segregated exempt assets before 1 October 2000.

(1A) Except as provided by section 320 - 225 of the Income Tax (Transitional Provisions) Act 1997 , an asset is taken not to be included in the segregated assets under this Subdivision unless the whole of the asset is included among the segregated assets.

(2) The assets segregated must, at the time of the segregation, be a representative sample of all the company's assets that support its * exempt life insurance policy liabilities immediately before the segregation.

(3) The assets segregated must have, at the time of the segregation, a total * transfer value that does not exceed the sum of:

(a) the company's * exempt life insurance policy liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of assets transferred to its * segregated exempt assets under subsection 320 - 195(1).

(4) A * life insurance company that segregates assets as mentioned in subsections ( 1) to (3) at a time after 1 July 2000 but before 1 October 2000 is taken to have segregated those assets in accordance with those subsections on 1 July 2000.

(5) If a segregation of assets is made in accordance with the above subsections, the company must use the * segregated exempt assets, and any other assets afterwards included among the segregated assets, only for the purpose of discharging its * exempt life insurance policy liabilities.

(6) In this Subdivision:

(a) a reference to the transfer of an asset to, or from, a * life insurance company's * segregated exempt assets:

(i) is a reference to the inclusion of an asset among the segregated exempt assets, or the exclusion of an asset from the segregated exempt assets, as the case may be; and

(ii) includes a reference to the transfer of money to, or from, those assets, as the case may be; and

(b) if an asset transferred to or from those assets is money, a reference to the * transfer value of the asset transferred is a reference to the amount of the money.

320 - 230 Annual valuations of segregated exempt assets

(1) A * life insurance company that has segregated any of its assets in accordance with section 320 - 225 must cause the * transfer values of its * segregated exempt assets to be calculated as at the following times ( valuation times ):

(a) the end of the income year in which the segregation occurred;

(b) the end of each later income year.

(2) A calculation for a valuation time is to be made not later than 60 days after that time.

320 - 235 Consequences of annual valuation

(1) If the total * transfer value of the company's * segregated exempt assets at a valuation time exceeds the sum of:

(a) the company's * exempt life insurance policy liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of assets transferred to its segregated exempt assets under subsection 320 - 195(1);

the company must, within 30 days after the day on which the valuations of the transfer values of those assets are made, transfer, from the segregated exempt assets, assets of any kind having a total transfer value equal to the excess.

(2) If the total * transfer value of the company's * segregated exempt assets at a valuation time is less than the sum of:

(a) the company's * exempt life insurance policy liabilities at that time; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of assets transferred to its segregated exempt assets under subsection 320 - 195(1);

the company can transfer, to the segregated exempt assets, assets of any kind having a total transfer value not exceeding the difference.

(3) A transfer of assets under subsection ( 1) is taken to have been made in the income year at the end of which the valuation time occurred.

(4) If a transfer of assets under subsection ( 2) is made within 30 days after the day on which the valuations of the * transfer values of those assets are made, the transfer is taken to have been made in the income year at the end of which the valuation time occurred.

(1) If a * life insurance company determines, at a time other than a valuation time, that the total * transfer value of its * segregated exempt assets is less than the sum of:

(a) the company's * exempt life insurance policy liabilities; and

(b) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of assets transferred to its segregated exempt assets under subsection 320 - 195(1);

the company can transfer, to the segregated exempt assets, assets of any kind having a total transfer value not exceeding the difference.

(2) A * life insurance company can at any time transfer an asset of any kind to its * segregated exempt assets in exchange for an amount of money equal to the * transfer value of the asset at the time of the transfer.

(3) A * life insurance company can transfer, to its * segregated exempt assets in an income year, assets of any kind having a total * transfer value not exceeding the total amount of the * life insurance premiums paid to the company in that income year for the purchase of * exempt life insurance policies.

(4) Except as provided by this section and subsections 320 - 195(1) and 320 - 235(2), a * life insurance company cannot transfer an asset to its * segregated exempt assets.

320 - 245 Exempt life insurance policy liabilities

(1) The amount of the * exempt life insurance policy liabilities of a * life insurance company is to be worked out in accordance with subsection ( 2) in respect only of * life insurance policies issued by the company:

(a) that are * exempt life insurance policies; and

(b) the liabilities under which are to be discharged out of the company's * segregated exempt assets.

(2) The amount of the exempt life insurance policy liabilities of a * life insurance company at a particular time is the sum of the following amounts at that time, as calculated by an * actuary:

(a) for policies providing for allocated benefits (other than * participating benefits or * discretionary benefits)--the * current termination values;

(b) for policies providing for participating benefits or discretionary benefits:

(i) the values of supporting assets, as defined in the * Valuation Standard; and

(ii) the * policy owner's retained profits;

(c) for other policies--the policy liabilities, as defined in the Valuation Standard.

(3) An * exempt life insurance policy provides for allocated benefits if:

(a) the policy:

(i) is held by the trustee of a * complying superannuation fund; and

(ii) is a segregated current pension asset (within the meaning of Part IX of the Income Tax Assessment Act 1936 ) of the holder of the policy; and

(iii) provides for an * allocated pension; or

(b) the policy:

(i) is held by a * life insurance company other than the life insurance company that issued the policy; and

(ii) is a * segregated exempt asset of the life insurance company that issued the policy; and

(iii) provides for an allocated pension; or

(c) the policy provides for an * allocated annuity.

(1) A * life insurance company can at any time transfer an asset from its * segregated exempt assets in exchange for an amount of money equal to the * transfer value of the asset at the time of the transfer.

(2) If a * life insurance company:

(a) imposes any fees or charges in respect of * segregated exempt assets; or

(b) imposes any fees or charges in respect of * exempt life insurance policies where the liabilities under the policies are to be discharged out of the company's segregated exempt assets; or

(c) determines, at a time other than a valuation time, that the total * transfer value of the segregated exempt assets exceeds the sum of:

(i) the company's * exempt life insurance policy liabilities; and

(ii) any reasonable provision made by the company at that time in its accounts for liability for tax on unrealised gains in respect of assets transferred to its segregated exempt assets under subsection 320 - 195(1);

the company must, when the fees or charges are imposed or the excess is determined, as the case may be, transfer from the segregated exempt assets, assets having a total transfer value equal to the fees, charges or excess, as the case may be.

(3) If:

(a) any liabilities arise for the discharge of which a * life insurance company has * segregated exempt assets; or

(b) any expenses are incurred by a life insurance company directly in respect of segregated exempt assets in relation to a period during which the assets are segregated exempt assets;

the life insurance company must pay from the segregated exempt assets any amounts required to discharge the liabilities or amounts equal to the expenses, as the case may be.

(4) A * life insurance company can pay from its * segregated exempt assets any liability for tax on realised gains in respect of assets transferred to the segregated exempt assets under subsection 320 - 195(1).

320 - 255 Consequences of transfer of assets to or from segregated exempt assets

(1) This section applies if:

(a) an asset (other than money) is transferred from the company's * segregated exempt assets under subsection 320 - 235(1) or 320 - 250(1) or (2); or