Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsPart 1 -- PAYG (Pay As You Go) instalments

Income Tax Assessment Act 1936

1 Section 160APA (after subparagraph ( a)(iab) of the definition of applicable general company tax rate )

Insert:

(iaba) a payment of a PAYG instalment in respect of a year of income;

(iabb) the application of a PAYG rate variation credit to reduce a person's liability for a PAYG instalment in respect of a year of income;

(iabc) a payment of company tax in respect of a year of income;

(iabd) a claim for a PAYG rate variation credit in respect of a year of income;

2 Section 160APA (after subparagraph ( a)(ie) of the definition of applicable general company tax rate )

Insert:

(iea) the payment of a refund of a PAYG instalment or company tax in respect of a year of income;

3 Section 160APA (definition of company tax instalment )

Repeal the definition, substitute:

"company tax instalment" means:

(a) an instalment, or other amount, payable under Division 1C of Part VI; or

(b) a PAYG instalment.

4 Section 160APA (definition of paid )

Repeal the definition.

5 Section 160APA

Insert:

"pay" , in relation to a PAYG instalment or company tax, has the meaning given by section 160APBB.

6 Section 160APA

Insert:

"PAYG instalment" has the same meaning as in the Income Tax Assessment Act 1997 .

7 Section 160APA

Insert:

"PAYG rate variation credit" means a credit under section 45 - 215 in Schedule 1 to the Taxation Administration Act 1953 .

8 Section 160APA

Insert:

"RBA" has the same meaning as in Part IIB of the Taxation Administration Act 1953 .

9 Section 160APA

Insert:

"refund" , in relation to a company tax instalment or company tax, has the meaning given by section 160APBD.

10 Section 160APA ( paragraph ( aa) of the definition of termination time )

After "a company tax instalment", insert "that is not a PAYG instalment".

11 Section 160APA (after paragraph ( aa) of the definition of termination time )

Insert:

(ab) in relation to the payment of a company tax instalment that is a PAYG instalment in respect of a year of income--the earlier of:

(i) the time at which the company next claims a PAYG rate variation credit under section 45 - 215 in Schedule 1 to the Taxation Administration Act 1953 ; or

(ii) the time at which a notice of original company tax assessment is served, or taken to have been served, on the company in respect of that year of income; or

(iii) the time at which the Commissioner next pays the company a refund under section 8AAZLF of the Taxation Administration Act 1953 in response to a request from the company in the approved form; or

12 After section 160APBA

Insert:

160APBB Paying PAYG instalment or company tax

(1) For the purposes of this Part, a person pays a PAYG instalment or company tax if and only if:

(a) the person has a liability to pay the instalment or the company tax; and

(b) either:

(i) the person makes a payment to satisfy the liability (in whole or in part); or

(ii) a credit, or an RBA surplus, is applied to discharge or reduce the liability.

Note: The requirement in paragraph ( a) means that the company cannot generate franking credits by making a "voluntary" payment of company tax (that is, paying an amount on account of company tax for which the company is not liable at the time when the payment is made).

(2) Subparagraph ( 1)(b)(ii) does not apply to the application of a credit allowable under or by virtue of:

(a) Division 18, 18A or 18B of Part III; or

(b) the International Tax Agreements Act 1953 ; or

(c) section 45 - 30 or 45 - 215 in Schedule 1 to the Taxation Administration Act 1953 .

(3) The amount of the PAYG instalment or company tax paid is equal to:

(a) the amount of the liability if it is satisfied in full; or

(b) the amount by which the liability is reduced if it is not satisfied in full.

(4) If:

(a) a surplus in an RBA of a company is applied to satisfy a liability of the company to pay a PAYG instalment in respect of a year of income; and

(b) a credit allowable under section 45 - 30 in Schedule 1 to the Taxation Administration Act 1953 in respect of that year of income is included in the RBA; and

(c) the RBA does not include the liability to pay the PAYG instalment; and

(d) the amount of the credit exceeds the company tax assessed to the company in respect of that year of income;

the amount of the PAYG instalment paid by virtue of the application of the surplus is reduced by the amount of the excess referred to in paragraph ( d).

160APBC Application of PAYG rate variation credit

If a company:

(a) is liable to pay a PAYG instalment; and

(b) has a PAYG rate variation credit;

the PAYG rate variation credit must be fully applied to reduce the liability for the PAYG instalment before any other credit or payment can be applied to reduce that liability.

160APBD Refund of company tax instalment or company tax

(1) For the purposes of this Part, a company receives a refund of a company tax instalment or company tax if and only if:

(a) either:

(i) the company receives an amount as a refund; or

(ii) the Commissioner applies a credit, or an RBA surplus, against a liability or liabilities of the company; and

(b) the refund of the amount, or the application of the credit, represents in whole or in part a return to the company of an amount paid or applied to satisfy the company's liability to pay the company tax instalment or company tax.

(2) The amount of the refund is so much of the amount refunded or applied as represents the return referred to in paragraph ( 1)(b).

(3) The following are not refunds of a company tax instalment or company tax for the purposes of this Part:

(a) a refund to the extent to which it is referable to a PAYG rate variation credit;

(b) the application of a PAYG rate variation credit against a liability of the company.

13 At the end of section 160APM

Add:

Note: See section 160APME for franking credits for PAYG instalment payments.

14 Subsection 160APMAB(3)

After "refund" (first occurring), insert ", or a PAYG rate variation credit arises,".

15 Subsection 160APMAB(3)

After "refund" (second occurring), insert "or PAYG rate variation credit".

16 Paragraph 160APMD(e)

Repeal the paragraph, substitute:

(e) if the year of income is later than the 1994 - 95 year of income, but earlier than the 2000 - 01 year of income--a class C franking credit of the company equal to the adjusted amount in relation to the amount of that payment.

17 After section 160APMD

Insert:

160APME Franking credits for paying PAYG instalments

(1) If, on a particular day, a company pays a PAYG instalment in respect of a year of income, there arises on that day a class C franking credit of the company.

(2) The class C franking credit is equal to the adjusted amount in relation to the amount of the instalment paid.

(3) This section does not apply if the company is a life assurance company.

Note: For the treatment of life assurance companies, see sections 160APVJ to 160APVL.

(1) If, on a particular day, a PAYG rate variation credit of a company is applied to reduce the company's liability for a PAYG instalment in respect of a year of income, there arises on that day a class C franking credit of the company.

(2) The class C franking credit is equal to the adjusted amount in relation to the amount by which the company's liability for the PAYG instalment is reduced.

(3) This section does not apply if the company is a life assurance company.

Note: For the treatment of life assurance companies, see sections 160APVJ to 160APVL.

160APMG Franking credits for payments of company tax

(1) If a company pays company tax in respect of a year of income on a particular day, there arises on that day a class C franking credit of the company.

(2) The class C franking credit is equal to the adjusted amount in relation to the amount of the company tax paid.

(3) This section does not apply if the company is a life assurance company.

Note: For the treatment of life assurance companies, see section 160APVM.

18 After section 160APYBA

Insert:

160APYBAA Refunds for 2000 - 01 year of income and later years of income

(1) If:

(a) a class C franking credit of a company arises under section 160APME, 160APMF or 160APMG in respect of a PAYG instalment or company tax; and

(b) on a particular day, the company receives a refund of the PAYG instalment or the company tax; and

(c) the amount refunded is not attributable to a reduction of company tax covered by section 160APZ;

a class C franking debit of the company arises on that day.

(2) The class C franking debit is equal to the adjusted amount in relation to the amount of the refund.

(3) This section does not apply if the company is a life assurance company.

Note: For the treatment of life assurance companies, see section 160AQCNCD.

160APYBAB PAYG rate variation credits

(1) If, on a particular day, a company claims a PAYG rate variation credit in respect of a year of income under section 45 - 215 in Schedule 1 to the Taxation Administration Act 1953 , there arises on that day a class C franking debit of the company.

(2) The class C franking debit is equal to the adjusted amount in relation to the amount of the PAYG rate variation credit.

(3) This section does not apply if the company is a life assurance company.

Note: For the treatment of life assurance companies, see section 160AQCNCE.

19 After subparagraph 160APYBB(b)(ii)

Insert:

(iia) a liability for a PAYG instalment; or

20 After subsection 160AQDAA(2)

Insert:

(2A) An estimated class C debit in relation to a PAYG instalment must relate to a PAYG rate variation credit in relation to the instalment.

21 After subsection 160AQJC(1)

Insert:

(1A) If:

(a) during a franking year (the first franking year ) a company pays one or more PAYG instalments in respect of a year of income; and

(b) at a particular time during the next franking year (the second franking year ), a PAYG rate variation credit for the company arises in relation to the instalment or one or more of the instalments; and

(c) the company would have had a class C franking deficit, or an increased class C franking deficit, at the end of the first franking year assuming that the PAYG rate variation credit, together with any previous PAYG rate variation credit in respect of the year of income, had arisen on the last day of the first franking year;

a class C deficit deferral amount (defined in subsection ( 2)) arises in relation to the company and the PAYG rate variation credit.

22 Subsection 160AQJC(2)

After "(1)(c)", insert "or (1A)(c)".

23 Subsection 160AQJC(3)

After "refund" (wherever occurring), insert "or PAYG rate variation credit".

24 Subsection 160AQJC(3)

After "refunds", insert "or PAYG rate variation credits".

25 Section 160AREA

After "refund" (first occurring), insert "or PAYG rate variation credit".

26 Section 160AREA

After "refund" (second occurring), insert "or claiming the PAYG rate variation credit".

27 At the end of section 160ARYC

Add:

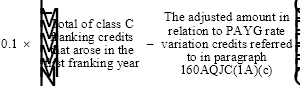

(2) A company is liable to pay, by way of penalty, additional tax equal to 30% of the class C deficit deferral tax that is payable by the company in relation to a PAYG rate variation credit if the class C deficit deferral amount that arises under subsection 160AQJC(2) in relation to the PAYG rate variation credit is greater than the amount worked out using the formula:

28 Paragraph 160ARX(3)(a)

Repeal the paragraph, substitute:

(a) the class C franking deficit of a company at the end of a franking year is more than 10% of the difference between:

(i) the total of the class C franking credits arising during the franking year; and

(ii) the total of the class C franking debits arising under section 160APYBAB during the franking year; and

29 Application of amendments

The amendments made by this Part (other than item 16) apply to the 2000 - 01 year of income and later years of income.

Part 2 -- Life assurance companies

Income Tax Assessment Act 1936

30 Subsection 6(1)

Insert:

"insurance funds" has the same meaning as the insurance funds had in Division 8 of Part III (as in force immediately before 1 July 2000).

31 Subsection 6(1)

Insert:

"mutual life assurance company" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

32 Subsection 6(1)

Insert:

"ordinary class" has the same meaning as in the Income Tax Assessment Act 1997 .

33 Subsection 6(1)

Insert:

"shareholders' funds" has the same meaning as in the Life Insurance Act 1995 .

34 Subsection 46(1) (definition of life assurance company )

Repeal the definition.

35 Subsection 46(1) (definition of standard component )

Repeal the definition.

36 Subsection 46(1) (definition of the insurance funds )

Repeal the definition.

37 Subsection 46(1A)

Repeal the subsection, substitute:

(1A) A reference in this section to the taxable income of a year of income of a shareholder that is a life assurance company is a reference to that part of the life assurance company's taxable income that is attributable to shareholders' funds income of the life assurance company for that year of income.

38 Subsection 46(6AA)

Repeal the subsection, substitute:

(6AA) For the purposes of subsections ( 2) and (3), the average rate of tax payable for a year of tax by a shareholder that is a life assurance company is the rate of tax applicable under sections 23A and 23B of the Income Tax Rates Act 1986 for the year of income in respect of the ordinary class of the life assurance company's taxable income.

39 Subsection 46(10)

Repeal the subsection, substitute:

(10) If:

(a) a dividend is paid by the company to a shareholder that is a life assurance company; and

(b) the assets of the life assurance company from which the dividend was derived were included in the insurance funds of the life assurance company at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

the life assurance company is not entitled to a rebate under this section in its assessment in respect of the dividend unless at all times when those assets were included in the insurance funds of the life assurance company during that period they were held on behalf of the life assurance company's shareholders.

40 Subsection 46A(1) (definition of life assurance company )

Repeal the definition.

41 Subsection 46A(1) (definition of standard component )

Repeal the definition.

42 Subsection 46A(1) (definition of the insurance funds )

Repeal the definition.

43 Subsection 46A(6A)

Repeal the subsection, substitute:

(6A) If:

(a) the shareholder mentioned in subsection ( 5) or (6) is a life assurance company; and

(b) the sum mentioned in paragraph ( 5)(a), or the net income derived from dividends mentioned in paragraph ( 5)(b) or subsection ( 6), is greater than that part of the life assurance company's taxable income in respect of the relevant year that is attributable to shareholders' funds income of the year of income;

the reference to the sum or the net income is taken instead to be a reference to the amount of that part of the life assurance company's taxable income in respect of the relevant year that is attributable to shareholders' funds income of the year of income.

44 Subsection 46A(8AA)

Repeal the subsection, substitute:

(8AA) For the purposes of subsections ( 5) and (6), the average rate of tax payable for a year of tax by a shareholder that is a life assurance company is the rate of tax applicable under sections 23A and 23B of the Income Tax Rates Act 1986 for the year of income in respect of the ordinary class of the life assurance company's taxable income.

45 Subsection 46A(17)

Repeal the subsection, substitute:

(17) If:

(a) a dividend is paid by the company to a shareholder that is a life assurance company; and

(b) the assets of the life assurance company from which the dividend was derived were included in the insurance funds of the life assurance company at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

the life assurance company is not entitled to a rebate under this section in its assessment in respect of the dividend unless at all times when those assets were included in the insurance funds of the life assurance company during that period they were held on behalf of the life assurance company's shareholders.

46 Section 160APA (definition of AD/RLA component )

Repeal the definition, substitute:

"AD/RLA component" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

47 Section 160APA (after paragraph ( bc) of the definition of applicable general company tax rate )

Insert:

(bd) in relation to the amount of a class C franking credit or franking debit calculated in respect of a payment of a company tax instalment or company tax, or the application of a PAYG variation credit, in respect of a year of income under any of the following provisions:

(i) section 160APVJ;

(ii) section 160APVK;

(iii) section 160APVL;

(iv) section 160APVM;

(v) section 160AQCNCF;

(vi) section 160AQCNCG;

(vii) section 160AQCNCH;

(viii) section 160AQCNCI;

the general company tax rate for the year of tax to which the year of income relates;

(be) in relation to the amount of a class A franking credit or franking debit calculated in respect of a payment of a company tax instalment or company tax, or the application of a PAYG variation credit, in respect of a year of income under any of the following provisions:

(i) section 160AQCNCF;

(ii) section 160AQCNCG;

(iii) section 160AQCNCH;

(iv) section 160AQCNCI;

39%;

(bf) in relation to an amount calculated in respect of an assessment of company tax in respect of a year of income for the purposes of section 160AQCNCC--the general company tax rate for the year of tax to which the year of income relates;

(bg) in relation to the amount of a class C franking credit or franking debit calculated in respect of an amended assessment of company tax in respect of a year of income for the purposes of section 160AQCNCD, 160AQCNCH or 160AQCNCI--the general company tax rate for the year of tax to which the year of income relates;

(bh) in relation to the amount of a class A franking credit or franking debit calculated in respect of an amended assessment of company tax in respect of a year of income for the purposes of section 160AQCNCD, 160AQCNCH or 160AQCNCI--39%;

48 Section 160APA (definition of CS/RA component )

Repeal the definition, substitute:

"CS/RA component" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

49 Section 160APA (definition of general fund component )

Repeal the definition, substitute:

"general fund component" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

50 Section 160APA (definition of insurance funds )

Repeal the definition.

51 Section 160APA (definition of life assurance company )

Repeal the definition.

52 Section 160APA (definition of mutual life assurance company )

Repeal the definition.

53 Section 160APA (definition of NCS component )

Repeal the definition, substitute:

"NCS component" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

54 Section 160APA

Insert:

"shareholders' funds income" , in relation to a year of income, means income that is:

(a) derived in that year of income; and

(b) included in the shareholders' funds of the company on or before the day on which the company's company tax in respect of that year of income is assessed.

55 Section 160APA (definition of standard component )

Repeal the definition, substitute:

"standard component" has the same meaning as in Division 8 of Part III (as in force immediately before 1 July 2000).

56 Before section 160APC

Insert:

160APBE Life assurance company's company tax assessed

For the purposes of this Part, a life assurance company's company tax is assessed in respect of a year of income if a notice of an original company tax assessment is served, or taken to have been served, on the company in respect of that year of income.

57 Section 160APHB

Repeal the section, substitute:

160APHB Life assurance companies--application of rebates against components of taxable income

(1) This section applies in working out any of the following for the purposes of this Part:

(a) how much of the company tax assessed to a life assurance company in respect of a year of income is attributable to shareholders' funds income for a year of income;

(b) how much of an amount of a reduction or increase in the company tax of a life assurance company in respect of a year of income is attributable to shareholders' funds income for the year of income.

(2) Rebates of tax (other than rebates under section 46 or 46A) are taken to be applied against components of taxable income in the following order:

(a) taxable income referable to income other than shareholders' funds income;

(b) taxable income referable to shareholders' funds income.

58 Subdivision B of Division 2 of Part IIIAA (heading)

Repeal the heading, substitute:

Subdivision B -- General provisions on franking credits

59 Section 160APKB

Repeal the section.

60 Subsection 160APP(5)

Repeal the subsection, substitute:

(5) If:

(a) the dividend is paid to a shareholder that is a life assurance company; and

(b) the assets of the life assurance company from which the dividend was derived were included in the insurance funds of the life assurance company at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

no franking credit arises under subsection ( 1), (1A) or (1B) in relation to the dividend unless at all times when those assets were included in the insurance funds of the life assurance company during that period they were held on behalf of the life assurance company's shareholders.

61 Subsection 160APPA(9)

Repeal the subsection, substitute:

(9) If:

(a) the second company is a life assurance company; and

(b) the assets of the life assurance company from which the dividend was derived were included in the insurance funds of the life assurance company at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

no franking credit arises under subsection ( 1) or (2) in relation to the dividend unless at all times when those assets were included in the insurance funds of the life assurance company during that period they were held on behalf of the life assurance company's shareholders.

62 Subsection 160APQ(3)

Repeal the subsection, substitute:

(3) If:

(a) the company is a life assurance company; and

(b) the assets of the life assurance company to which the trust amount or partnership amount is attributable were included in the insurance funds of the life assurance company at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the franking credit would arise but for this subsection; and

(ii) ends at the time when the franking credit would arise but for this subsection;

no franking credit arises under subsection ( 1), (1A) or (2) in relation to the trust amount or partnership amount unless at all times when those assets were included in the insurance funds of the life assurance company during that period they were held on behalf of the life assurance company's shareholders.

63 Before Subdivision C of Division 2 of Part IIIAA

Insert:

This Subdivision applies to a company tax instalment, company tax or a refund in respect of a year of income that is no later than the 1999 - 2000 year of income.

64 After paragraph 160APVA(3A)(b)

Insert:

and (c) section 160AQCNCH (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) does not apply to the class C franking debit;

65 Before subsection 160APVBA(1)

Insert:

(1A) This section does not apply to a franking debit if section 160AQCNCH (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) applies to the franking debit.

66 Before subsection 160APVD(1)

Insert:

(1A) This section does not apply to a franking debit if section 160AQCNCH (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) applies to the franking debit.

67 After section 160APVH

Insert:

This Subdivision applies to a company tax instalment, company tax, refund or PAYG rate variation credit in respect of the 2000 - 01 year of income or a later year of income.

160APVJ PAYG instalment payment, or application of PAYG rate variation credit, before assessment

(1) If:

(a) on a particular day:

(i) a life assurance company pays a PAYG instalment in respect of a year of income; or

(ii) a PAYG rate variation credit of a life assurance company is applied to reduce the company's liability for a PAYG instalment in respect of a year of income; and

(b) the company's company tax in respect of that year of income has not been assessed on or before that day;

there arises on that day, a class C franking credit of the company equal to the adjusted amount in relation to the provisional franking component of the amount paid or applied.

(2) The provisional franking component of the amount paid or applied is so much of the amount paid or applied as is attributable to income that the company estimates will be shareholders' funds income for that year of income.

Note 1: At the time the life assurance company's company tax is assessed, the actual allocation of income to the relevant funds will be known. At that point, the franking credit that arises under this section is reversed by a franking debit under section 160AQCNCB and replaced with a franking credit under section 160APVK.

Note 2: Section 160AQCNCC imposes a penalty for overestimating the tax paid that is attributable to income that is likely to be allocated to shareholders' funds.

160APVK Franking credit on assessment for earlier PAYG instalment payment

(1) If:

(a) a class C franking credit of a life assurance company arises under section 160APVJ in relation to a payment of a PAYG instalment in respect of a year of income; and

(b) the company's company tax in respect of the year of income is assessed on a day (the assessment day ) that occurs on or after the day on which the class C franking credit arises; and

(c) section 160AQCNCG (transitional provision for early balancing life assurance company for 2000 - 01 year of income) does not apply to the class C franking credit;

there arises on the assessment day a class C franking credit of the company equal to the adjusted amount in relation to the final franking component of the amount paid or applied.

(2) The final franking component of the amount paid or applied is so much of the amount paid or applied as is attributable to shareholders' funds income for that year of income.

160APVL PAYG instalment payment after assessment

(1) If:

(a) on a particular day a life assurance company pays a PAYG instalment in respect of a year of income; and

(b) the company's company tax in respect of the year of income has been assessed before that day; and

(c) section 160AQCNCG (transitional provision for early balancing life assurance company for 2000 - 01 year of income) does not apply to the amount paid or applied;

there arises on that day, a class C franking credit of the company equal to the adjusted amount in relation to the franking component of the amount paid or applied.

(2) The franking component of the amount paid or applied is so much of the amount paid or applied as is attributable to shareholders' funds income for that year of income.

160APVM Payment of company tax after assessment

(1) If:

(a) on a particular day, a life assurance company pays company tax in respect of a year of income; and

(b) section 160AQCNCG (transitional provision for early balancing life assurance company for 2000 - 01 year of income) does not apply to the payment;

there arises on that day a class C franking credit of the company equal to the adjusted amount in relation to the franking component of the amount paid.

(2) The franking component of the amount paid is so much of the amount paid as is attributable to shareholders' funds income for that year of income.

160APVN Reversing subsection 160AQCNCE(1) franking debit on assessment

If:

(a) a class C franking debit of a life assurance company arises under subsection 160AQCNCE(1) because a company becomes entitled to a PAYG rate variation credit in respect of a year of income; and

(b) the company's company tax in respect of the year of income is assessed on a day (the assessment day ) that occurs on or after the day on which the class C franking debit arises;

there arises on the assessment day, a class C franking credit of the company equal to the amount of the class C franking debit.

160APVO Substituted franking credit for payment of excess foreign tax credit

(1) If a class C franking credit of a life assurance company arises on a particular day under section 160APQB in respect of the 2000 - 01 year of income or a later year of income because of an amount paid by the company, there arises on that day:

(a) a class C franking debit of the company equal to the amount of that class C franking credit; and

(b) a class C franking credit of the company equal to the adjusted amount in relation to the franking component of the amount paid.

Paragraph ( b) does not apply if section 160AQCNCG (transitional provision for early balancing life assurance company for 2000 - 01 year of income) applies to the class C franking credit.

(2) The franking component of the amount paid is so much of the amount paid as is attributable to shareholders' funds income for that year of income.

68 Subdivision C of Division 2 of Part IIIAA (heading)

Repeal the heading, substitute:

Subdivision C -- General provisions on franking debits

69 Subsection 160AQCA(3)

Repeal the subsection, substitute:

(3) If:

(a) a class C franking credit of a life assurance company arises under section 160APP or 160APQ at a particular time (the crediting time ) during a year of income of the company; and

(b) at any time after the crediting time and during the year of income:

(i) if section 160APP applied--the asset of the company from which the dividend referred to in subsection ( 1B) of that section was derived; or

(ii) if section 160APQ applied--the asset of the company to which the trust amount or partnership amount referred to in subsection ( 2) of that section is attributable;

is both part of the insurance funds of the company and not held on behalf of the company's shareholders;

a class C franking debit of the company equal to the class C franking credit arises on the first day on which paragraph ( b) applies to the asset.

70 After section 160AQCC

Insert:

This Subdivision applies to a company tax instalment, company tax or a refund in respect of a year of income that is no later than the 1999 - 2000 year of income.

71 After paragraph 160AQCCA(3A)(b)

Insert:

and (c) section 160AQCNCF (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) does not apply to the class C franking credit;

72 Before subsection 160AQCK(1)

Insert:

(1A) This section does not apply to a franking credit if section 160AQCNCF (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) applies to the franking credit.

73 Before subsection 160AQCL(1)

Insert:

(1A) This section does not apply to a franking credit if section 160AQCNCF (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) applies to the franking credit.

74 After subsection 160AQCN(2AA)

Insert:

(2AAA) Paragraphs ( 2AA)(b), (c) and (e) do not apply to a franking credit if section 160AQCNCH (transitional provision for late balancing life assurance company for 1999 - 2000 year of income) applies to the franking credit.

75 Before Subdivision D of Division 2 of Part IIIAA

Insert:

This Subdivision applies to a company tax instalment, company tax, refund or PAYG rate variation credit in respect of the 2000 - 01 year of income or a later year of income.

160AQCNCB Reversing section 160APVJ franking credits on assessment

If:

(a) a class C franking credit of a life assurance company arises under section 160APVJ because of:

(i) a payment by the company of an amount in respect of a PAYG instalment in respect of the year of income; or

(ii) the application of a PAYG rate variation credit in respect of a PAYG instalment in respect of the year of income; and

(b) the company's company tax in respect of the year of income is assessed on a day (the assessment day) that occurs on or after the day on which the class C franking credit arises;

there arises on the assessment day, a class C franking debit of the company equal to the amount of the class C franking credit.

160AQCNCC Penalty for overestimating income attracting franking credits

(1) A class C franking debit of a life assurance company arises under this subsection if:

(a) class C franking credits of the company (the provisional franking credits ) arise under subparagraph 160APVJ(1)(a)(i) in relation to the payment of PAYG instalments in respect of a year of income; and

(b) class C franking credits of the company (the final franking credits ) of the company arise under section 160APVK in relation to the payment of those PAYG instalments; and

(c) the sum of the provisional franking credits is more than 110% of the amount of the sum of the final franking credits.

The amount of the debit is equal to the difference between the sum of the provisional franking credits and the sum of the final franking credits.

(2) A class C franking debit of a life assurance company arises under this subsection if:

(a) class C franking credits of the company (the provisional franking credits ) arise under subparagraph 160APVJ(1)(a)(i) in relation to the payment of PAYG instalments in respect of a year of income; and

(b) when the company's company tax in respect of the year of income is assessed, no class C franking credits of the company arise under section 160APVK in relation to the payment of the PAYG instalments.

The amount of the debit is equal to the amount of the provisional franking credit.

(3) Subsections ( 1) and (2) do not apply to a company's 2000 - 01 year of income if it starts before 1 July 2000.

(4) The Commissioner may, in the Commissioner's discretion, determine that:

(a) the franking debit is not to arise under this section; or

(b) the amount of the franking debit that arises under this section is to be reduced to the amount specified in the determination.

(5) For the purposes of the application of subsection 33(1) of the Acts Interpretation Act 1901 to the power to make a determination under subsection ( 4), nothing in this Act prevents the exercise of the power at a time before the franking debit arises.

160AQCNCD Refunds, and amended assessments, for 2000 - 01 and later years of income

Refund

(1) If:

(a) a class C franking credit of a company arises under section 160APVJ, 160APVK, 160APVL or 160APVM because of:

(i) a payment of a PAYG instalment in respect of a year of income; or

(ii) the application of a PAYG rate variation credit to reduce the company's liability for a PAYG instalment in respect of a year of income; or

(iii) the payment by the company of an amount of company tax in respect of a year of income; and

(b) the company receives a refund of the amount paid or applied on a day (the refund day ) that occurs on or after the day on which the company's company tax in respect of that year of income is assessed; and

(c) the amount refunded or applied is not attributable to a reduction of company tax covered by subsection ( 3); and

(d) section 160AQCNCI (transitional provision for early balancing life assurance company for 2000 - 01 year of income) does not apply to the refund;

a class C franking debit of the company arises on the refund day.

Amount of class C franking debit

(2) The amount of the class C franking debit that arises under subsection ( 1) is equal to the adjusted amount in relation to so much of the amount refunded as represents a return to the company of an amount paid or applied to satisfy the company's liability to pay:

(a) a company tax instalment; or

(b) company tax;

in respect of shareholders' funds income for that year of income.

Amended assessment

(3) If a class C franking debit of a life assurance company arises on a particular day under section 160APZ in relation to the 2000 - 01 year of income or a later year of income because of a reduction in the company's company tax, there arises on that day:

(a) a class C franking credit of the company equal to the amount of that class C franking debit; and

(b) a class C franking debit of the company equal to the adjusted amount in relation to so much of the reduction as represents a return to the company of an amount paid or applied to satisfy the company's liability to pay:

(i) a company tax instalment; or

(ii) company tax;

in respect of shareholders' funds income for that year of income.

A class C franking debit does not arise under paragraph ( b) if section 160AQCNCI (transitional provision for early balancing life assurance company for 2000 - 01 year of income) applies to the reduction.

160AQCNCE PAYG rate variation credits arising before assessment

(1) If:

(a) on a particular day, a life assurance company claims a PAYG rate variation credit in respect of a year of income under section 45 - 215 in Schedule 1 to the Taxation Administration Act 1953 ; and

(b) the company's company tax in respect of that year of income has not been assessed on or before that day;

there arises on that day a class C franking debit of the company equal to the adjusted amount in relation to the provisional franking component of the PAYG rate variation credit.

(2) The provisional franking component of the PAYG rate variation credit is so much of the credit as is referable to an amount paid or applied to the extent to which the amount paid or applied gave rise to franking credits of the company.

Subdivision CB -- Transitional provisions (life assurance companies)

160AQCNCF Late balancing life assurance company (1999 - 2000 year of income)

When franking credits and debits arise under this section

(1) Franking debits and credits of a life assurance company arise under this section in relation to the 1999 - 2000 year of income if:

(a) the company's 1999 - 2000 year of income ends on or after 1 July 2000; and

(b) some of the company tax payable by the company in respect of that year of income is attributable to taxable income derived on or after 1 July 2000; and

(c) one of the items in the following table is satisfied:

Circumstances in which this section applies | ||

| General description | This item is satisfied if ... |

1 | Assessment after section 160APM credit | (a) a class C franking credit of the company arose under section 160APM because of an amount the company paid under section 221AZK in respect of the year of income; and (b) the company's company tax in respect of the year of income is assessed on a day (the adjustment day ) that occurs on or after the day on which the class C franking credit arose. |

2 | Section 160APM credit after assessment | (a) on a particular day (the adjustment day ), a class C franking credit of the company arises under section 160APM because an amount the company pays under section 221AZK in respect of the year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

3 | Assessment after section 160APMAA credit | (a) a class C franking credit of the company arose under section 160APMAA because of an amount the company paid under subsection 221AZR(1) in respect of the year of income; and (b) the company's company tax in respect of the year of income is assessed on a day (the adjustment day ) that occurs on or after the day on which the class C franking credit arose. |

4 | Section 160APMAA credit after assessment | (a) on a particular day (the adjustment day ), a class C franking credit of the company arises under section 160APMAA because of an amount the company pays under subsection 221AZR(1) in respect of the year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

5 | Section 160APMD credit after assessment | (a) on a particular day (the adjustment day ), a class C franking credit of the company arises under section 160APMD because of an amount of company tax the company pays in respect of a year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

6 | Substituted franking credit for payment of excess foreign tax credit | on a particular day (the adjustment day ), a class C franking credit of the company arises under section 160APQB in relation to the year of income because of an amount paid by the company. |

Pre 1 July 2000 and post 1 July 2000 proportions

(2) For the purposes of this section:

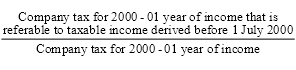

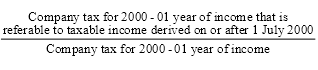

(a) the pre 1 July 2000 proportion is:

(b) the post 1 July 2000 proportion is:

Treatment of amount derived before 1 July 2000

(3) On the adjustment day:

(a) a class A franking credit of the company arises in relation to the pre 1 July 2000 proportion of the amount paid; and

(b) a class C franking debit of the company arises in relation to the pre 1 July 2000 proportion of the amount paid.

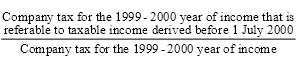

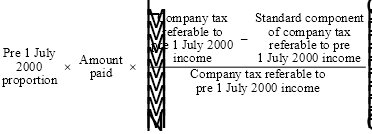

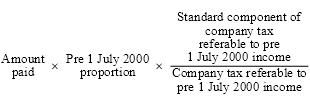

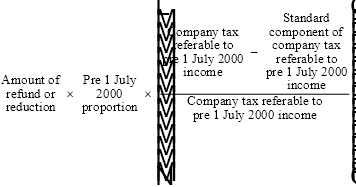

(4) The amount of the class A franking credit referred to in paragraph ( 3)(a) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"general component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the general component and referable to taxable income derived before 1 July 2000.

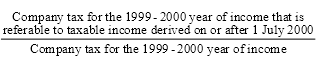

(5) The amount of the class C franking debit referred to in paragraph ( 3)(b) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"standard component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the standard component and referable to taxable income derived before 1 July 2000.

Treatment of amount derived on or after 1 July 2000

(6) On the adjustment day, there also arises:

(a) a class C franking debit of the company equal to the adjusted amount in relation to the post 1 July 2000 proportion of the amount paid; and

(b) a class C franking credit of the company equal to the adjusted amount in relation to the final franking component of the post 1 July 2000 proportion of the amount paid.

(7) The final franking component of the post 1 July 2000 proportion of the amount paid is so much of that proportion of the amount paid as is attributable to shareholders' funds income for that year of income that is derived on or after 1 July 2000.

160AQCNCG Early balancing life assurance company (2000 - 01 year of income)

When franking credits arise under this section

(1) Franking credits of a life assurance company arise under this section in relation to the 2000 - 01 year of income if:

(a) the company's 2000 - 01 year of income starts before 1 July 2000; and

(b) some of the company tax payable by the company in respect of the 2000 - 01 year of income is referable to taxable income derived before 1 July 2000; and

(c) one of the items in the following table is satisfied:

Circumstances in which this section applies | ||

Item | General description | This item is satisfied if ... |

1 | Assessment after payment of PAYG instalment, that gave rise to franking credits | (a) a class C franking credit of the company arose under section 160APVJ because of a payment by the company of an amount in respect of a PAYG instalment in respect of the year of income; and (b) the company's company tax in respect of the year of income is assessed on a day (the adjustment day ) that occurs on or after the day on which the class C franking credit arose. |

2 | Payment of PAYG instalment after assessment | (a) on a particular day (the adjustment day ), the company pays a PAYG instalment in respect of the year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

3 | Company tax payment after assessment | (a) on a particular day (the adjustment day ), the company pays an amount in respect of company tax that the company is liable to pay in respect of the year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

4 | Substituted franking credit for payment of excess foreign tax credit | on a particular day (the adjustment day ), a class C franking credit of the company arises under section 160APQB in relation to the year of income because of an amount paid by the company. |

Pre 1 July 2000 and post 1 July 2000 proportions

(2) For the purposes of this section:

(a) the pre 1 July 2000 proportion is:

(b) the post 1 July 2000 proportion is:

Franking credits for tax on income derived before 1 July 2000

(3) On the adjustment day:

(a) a class A franking credit of the company arises in relation to the pre 1 July 2000 proportion of the amount paid or applied; and

(b) a class C franking credit of the company arises in relation to the pre 1 July 2000 proportion of the amount paid or applied.

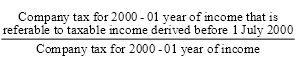

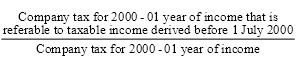

(4) The amount of the class A franking credit referred to in paragraph ( 3)(a) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"general fund component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the general fund component and referable to taxable income derived before 1 July 2000.

(5) The amount of the class C franking credit referred to in paragraph ( 3)(b) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"standard component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the standard component and referable to taxable income derived before 1 July 2000.

Franking credits for tax on income derived on or after 1 July 2000

(6) On the adjustment day, there also arises a class C franking credit of the company equal to the adjusted amount in relation to the final franking component of the post 1 July 2000 proportion of the amount paid.

(7) The final franking component of the post 1 July 2000 proportion of the amount paid is so much of that proportion of the amount as is attributable to shareholders' funds income for that year of income that is derived on or after 1 July 2000.

When franking debits and credits arise under this section

(1) Franking debits and credits of a life assurance company arise under this section if:

(a) the company's 1999 - 2000 year of income ends on or after 1 July 2000; and

(b) some of the company tax payable by the company in respect of that year of income is referable to taxable income derived on or after 1 July 2000; and

(c) one of the items in the following table is satisfied:

Circumstances in which this section applies | ||

Item | General description | This item is satisfied if ... |

1 | Assessment after refund | (a) a class C franking debit of the company arose under section 160APY or 160APYA in relation to the refund of a company tax instalment in respect of the year of income; and (b) the company's company tax in respect of the year of income is assessed on a day (the adjustment day ) that occurs on or after the day on which the class C franking debit arose. |

2 | Refund after assessment | (a) on a particular day (the adjustment day ) a class C franking debit of the company arises under section 160APY or 160APYA in relation to the refund of a company tax instalment in respect of the year of income; and (b) the company's company tax in respect of the year of income has been assessed before the adjustment day. |

3 | Amended assessment | on a particular day (the adjustment day ), a class C franking debit of the company arises under section 160APZ in relation to the amount of a reduction in the company's company tax. |

Pre 1 July 2000 and post 1 July 2000 proportions

(2) For the purposes of this section:

(a) the pre 1 July 2000 proportion is:

(b) the post 1 July 2000 proportion is:

Franking debit in respect of refund of tax on income derived before 1 July 2000

(3) On the adjustment day:

(a) a class A franking debit of the company arises in relation to the pre 1 July 2000 proportion of the amount of the refund or reduction; and

(b) a class C franking credit of the company arises in relation to the pre 1 July 2000 proportion of the amount of the refund or reduction.

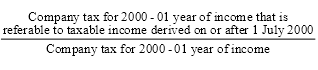

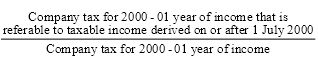

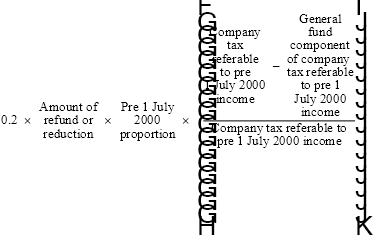

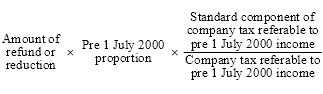

(4) The amount of the class A franking debit referred to in paragraph ( 3)(a) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"general fund component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the general fund component and referable to taxable income derived before 1 July 2000.

(5) The amount of the class C franking credit referred to in paragraph ( 3)(b) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"standard component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the standard component and referable to taxable income derived before 1 July 2000.

Franking debits for refund of tax on income derived on or after 1 July 2000

(6) On the adjustment day, there also arises:

(a) a class C franking credit of the company equal to the adjusted amount in relation to the post 1 July 2000 proportion of the amount of the refund or reduction; and

(b) a class C franking debit of the company equal to the adjusted amount in relation to the franking component of the post 1 July 2000 proportion of the amount of the refund or reduction.

(7) The franking component of the post 1 July 2000 proportion of the amount of the refund or reduction is so much of that proportion of that amount as is attributable to shareholders' funds income for that year of income that is derived on or after 1 July 2000.

When franking debits arise under this section

(1) Franking debits of a life assurance company arise under this section if:

(a) the company's 2000 - 01 year of income starts before 1 July 2000; and

(b) some of the income tax payable by the company in respect of the year of income is referable to taxable income derived before 1 July 2000; and

(c) one of the items in the following table is satisfied:

Circumstances in which this section applies | ||

Item | General description | This item is satisfied if ... |

1 | Refund after assessment | the company receives a refund of a PAYG instalment, or a refund of company tax, in respect of the year of income on a day (the adjustment day ) that occurs on or after the day on which the company's company tax in respect of that year of income is assessed.

|

2 | Amended assessment | a class C franking debit of the company arises under section 160APZ in respect of the amount of a reduction in the company's company tax on a day (the adjustment day ) that occurs on or after the day on which the company's company tax in respect of that year of income is assessed. |

Pre 1 July 2000 and post 1 July 2000 proportions

(2) For the purposes of this section:

(a) the pre 1 July 2000 proportion is:

(b) the post 1 July 2000 proportion is:

Franking debit for refund of tax on income derived before 1 July 2000

(3) On the adjustment day:

(a) a class A franking debit of the company arises in relation to the pre 1 July 2000 proportion of the amount of the refund or reduction; and

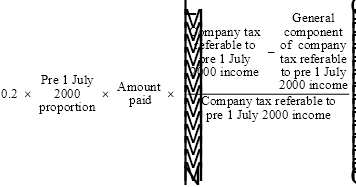

(b) a class C franking debit of the company arises in relation to the pre 1 July 2000 proportion of the amount of the refund or reduction.

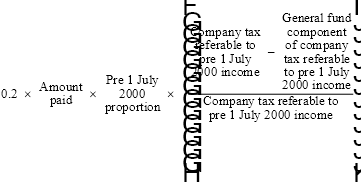

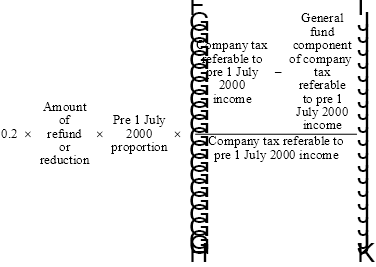

(4) The amount of the class A franking debit referred to in paragraph ( 3)(a) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"general fund component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the general fund component and referable to taxable income derived before 1 July 2000.

(5) The amount of the class C franking debit referred to in paragraph ( 3)(b) is equal to the adjusted amount in relation to the amount calculated using the formula:

where:

"company tax referable to pre 1 July 2000 income" is the company tax assessed to the company in respect of the year of income to the extent to which it is referable to taxable income derived before 1 July 2000.

"standard component of company tax referable to pre 1 July 2000 income" is so much of the company tax assessed to the company in respect of the year of income as is attributable to the standard component and referable to taxable income derived before 1 July 2000.

Franking debits for refund of tax on income derived on or after 1 July 2000

(6) On the adjustment day, there also arises a class C franking debit of the company equal to the adjusted amount in relation to the franking component of the post 1 July 2000 proportion of the amount of the refund or reduction.

(7) The franking component of the post 1 July 2000 proportion of the amount of the refund or reduction is so much of that proportion of that amount as is attributable to shareholders' funds income for that year of income that is derived on or after 1 July 2000.

(1) If:

(a) a franking credit or debit of a life assurance company arises on the day on which the company's company tax in respect of the 2000 - 01 year of income is assessed; and

(b) the credit or debit arises in relation to an amount paid by the company, or the application of an amount of a PAYG rate variation credit, in respect of a PAYG instalment; and

(c) the amount was paid or applied during the 2000 - 01 year of income; and

(d) the year of income starts before 1 July 2000;

the debit or credit is taken to have arisen on the last day of the 2000 - 01 year of income for the purposes of the deficit tax, deficit deferral tax and franking additional tax provisions.

(2) The deficit tax, deficit deferral tax and franking additional tax provisions are:

(a) Subdivision B of Division 5 of this Part; and

(b) Subdivision BA of Division 5 of this Part; and

(c) sections 160ARX, 160ARYA and 160ARYL.

76 Subsection 160AQCNF(8)

Repeal the subsection, substitute:

(8) No franking credit arises under subsection ( 1) or (2) in relation to an exempted dividend if:

(a) the exempted dividend is paid to:

(i) a former exempting company; or

(ii) an exempting company;

that is a life assurance company; and

(b) the assets of the company from which the dividend was derived were included in the insurance funds of the company at any time during the period that:

(i) starts at the beginning of the year of income of the company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

unless at all times when those assets were included in the insurance funds of the company during that period they were held on behalf of the company's shareholders.

77 Subsection 160AQT(1C)

Repeal the subsection, substitute:

(1C) If:

(a) a shareholder in a company is a life assurance company; and

(b) a class C franked dividend is paid by the company to the life assurance company in a year of income; and

(c) the life assurance company is a qualified person in relation to the dividend for the purposes of Division 1A; and

(d) the dividend is not exempt income of the life assurance company; and

(e) the dividend was not paid as part of a dividend stripping operation; and

(f) at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

the assets of the life assurance company from which the dividend was derived were both:

(iii) included in the insurance funds of the life assurance company; and

(iv) not held on behalf of the life assurance company's shareholders;

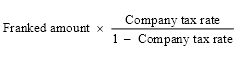

the assessable income of the life assurance company of the year of income includes the amount worked out using the formula:

where:

"company tax rate" means the applicable general company tax rate.

"franked amount" means the class C franked amount of the dividend.

78 Subsection 160AQT(4)

Repeal the subsection, substitute:

(4) In determining for the purposes of this section whether a dividend is exempt income, disregard:

(a) sections 282B and 297B of this Act; and

(b) paragraph 320 - 35(1)(b) and subparagraph 320 - 35(1)(f)(ii) of the Income Tax Assessment Act 1997 .

79 Subsection 160AQU(2)

Repeal the subsection, substitute:

(2) For the purposes of subsection ( 1), in determining the amount included under section 160AQT in the assessable income of a shareholder, disregard:

(a) sections 282B and 297B of this Act; and

(b) paragraph 320 - 35(1)(b) and subparagraph 320 - 35(1)(f)(ii) of the Income Tax Assessment Act 1997 .

80 Section 160AQWA

Repeal the section, substitute:

In determining a taxpayer's entitlement to a rebate under section 160AQX, assume that:

(a) sections 282B and 297B of this Act; and

(b) paragraph 320 - 35(1)(b) and subparagraph 320 - 35(1)(f)(ii) of the Income Tax Assessment Act 1997 ;

had not been enacted.

81 Paragraph 160AQZB(1)(c)

Repeal the paragraph, substitute:

(c) an amount attributable to the relevant dividend:

(i) is included in the assessable income of the holder of the interest; or

(ii) would have been included in the assessable income of the holder of the interest if paragraph 320 - 35(1)(b) and subparagraph 320 - 35(1)(f)(ii) of the Income Tax Assessment Act 1997 had not been enacted;

82 Paragraph 160AQZC(1)(c)

Repeal the paragraph, substitute:

(c) an amount attributable to the relevant dividend:

(i) is included in the assessable income of the holder of the interest; or

(ii) would have been included in the assessable income of the holder of the interest if paragraph 320 - 35(1)(b) and subparagraph 320 - 35(1)(f)(ii) of the Income Tax Assessment Act 1997 had not been enacted;

83 Paragraph 160ASEP(1)(i)

Repeal the paragraph, substitute:

(i) if the shareholder is a life assurance company--at any time during the period that:

(i) starts at the beginning of the year of income of the life assurance company in which the dividend was paid; and

(ii) ends at the time when the dividend was paid;

the assets of the life assurance company from which the dividend was derived were both:

(iii) included in the insurance funds of the life assurance company; and

(iv) not held on behalf of the life assurance company's shareholders;

84 Application of amendments

(1) The amendments made by items 33 to 44 (inclusive), 60, 61, 62, 69, 76, 77 and 83 apply to dividends paid on or after 1 July 2000.

(2) The amendments made by items 78 to 82 (inclusive) apply to income derived on or after 1 July 2000.

Part 3 -- Conversion of franking account balances

Income Tax Assessment Act 1936

85 After paragraph 160ATA(1)(a)

Insert:

(aa) then, if the company is a life assurance company, the company's class A franking account balance (if any) at the start of that day is converted under section 160ATC to reflect the new company tax rate and transferred to the class C franking account;

86 After section 160ATB

Insert:

(1) If a company that is a life assurance company has a class A franking surplus at the start of 1 July 2000:

(a) a class A franking debit of the company arises equal to that surplus; and

(b) a class C franking credit of the company arises equal to the amount of the class A franking debit multiplied by the conversion factor in subsection ( 3).

(2) If a company that is a life assurance company has a class A franking deficit at the start of 1 July 2000:

(a) a class A franking credit of the company arises equal to that deficit; and

(b) a class C franking debit of the company arises equal to the amount of the class A franking credit multiplied by the conversion factor in subsection ( 3).

(3) The conversion factor is:

87 Subparagraphs 160ATD(1)(b)(ii) and (iii)

Repeal the subparagraphs, substitute:

(ii) is not a franking credit arising under section 160APL (carry - forward of franking surplus); and

(iii) is not a franking debit arising under section 160APX (under - franking of a dividend), 160AQB (payment of a franked dividend), 160AQCB, 160AQCBA, 160AQCNA or 160AQCNB (dividend streaming or franking credit trading arrangements), 160AQCC (on - market share buy back arrangements) or 160AQCNC (private company distributions treated as dividends);

88 Subsection 160ATD(1) (table item 1)

Omit "and the company is not a life assurance company".

89 Subsection 160ATD(1) (table item 2)

Omit "and the company is not a life assurance company".

90 Paragraphs 160ATD(2)(b) and (c)

Repeal the paragraphs.

91 After section 160ATD

Insert:

160ATDA Special treatment of some franking credits and debits arising before 1 July 2000

(1) If:

(a) any of the events specified in the event column of the following table occurred in relation to a company before 1 July 2000; and

(b) the event:

(i) was not a franking credit arising under section 160APL (carry - forward of franking surplus); and

(ii) was not a franking debit arising under section 160APX (under - franking of a dividend), 160AQB (payment of a franked dividend), 160AQCB, 160AQCBA, 160AQCNA or 160AQCNB (dividend streaming or franking credit trading arrangements), 160AQCC (on - market share buy back arrangements) or 160AQCNC (private company distributions treated as dividends);

the adjustments specified in the adjustment column for that item are taken to have been made to the company's franking accounts immediately after the event occurred:

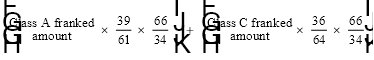

Credits and debits arising before 1 July 2000 | ||

Item | Event | Adjustments |

1 | a class C franking credit of a company arose under this Part and the amount of the credit reflected an applicable general company tax rate of 34% | (a) a class C franking debit equal to the amount of the class C franking credit; and (b) a class C franking credit equal to the amount worked out using the formula:

|

2 | a class C franking debit of a company arose under this Part and the amount of the debit reflected an applicable general company tax rate of 34% | (a) a class C franking credit equal to the amount of the class C franking debit; and (b) a class C franking debit equal to the amount worked out using the formula:

|

3 | a venture capital credit of a PDF arose under this Part and the amount of the credit reflected an applicable general company tax rate of 34% | (a) a venture capital debit of the PDF equal to the amount of the venture capital credit; and (b) a venture capital credit of the PDF equal to the amount worked out using the formula:

|

4 | a venture capital debit of a PDF arose under this Part and the amount of the debit reflected an applicable general company tax rate of 34% | (a) a venture capital credit of the PDF equal to the amount of the venture capital debit; and (b) a venture capital debit equal to the amount worked out using the formula:

|

(2) The amount of a credit or debit reflects an applicable general company tax rate of 34% if:

(a) the applicable general company tax rate used to calculate the amount of the credit or debit is 34%; or

(b) the debit arises under subsection 160AQC(3) or section 160ASEI and the application for the estimated debit was lodged on or after 9 June 2000; or

(c) the credit or debit is equal to the amount of an earlier debit or credit and the earlier debit or credit reflected an applicable general company tax rate of 34%.

Note 1: Paragraph ( a)--the applicable general company tax rate will always be involved in the calculation of a credit or debit if an "adjusted amount" is used in the calculation.

Note 2: Paragraph ( c) covers provisions such as sections 160APV, 160APVB, 160APVF, 160AQCA, 160AQCCB and 160AQCM.

92 Section 160ATE

Repeal the section.

93 Paragraph 160ATF(1)(a)

Repeal the paragraph, substitute:

(a) a company pays a number of dividends under a resolution made before 1 July 2000; and

(aa) before 1 July 2000, the dividends are declared under section 160AQF to be:

(i) if the company is not a life assurance company--class C franked; or

(ii) if the company is a life assurance company--class C franked, class A franked or both class C franked and class A franked; and

94 Paragraph 160ATF(2)(c)

Repeal the paragraph, substitute:

(c) the consequences provided for in the following table occur if the company does not make a declaration under section 160AQF or 160ASEL in relation to the second series dividends before the reckoning day for the second series dividends:

Default declaration for second series dividends | |||

| If ... | the company is taken to have declared that ... | under ... |

1 | the first series dividends were class C franked but not class A franked | each dividend in the second series is a class C franked dividend to the extent of the same percentage as in the original declaration | subsection 160AQF(1AAA) |

2 | (a) the company is a life assurance company; and (b) the first series dividends were class A franked but not class C franked | each dividend in the second series is a class C franked dividend to the extent of the same percentage as in the original declaration | subsection 160AQF(1AAA) |

3 | (a) the company is a life assurance company; and (b) the first series dividends were both class C franked and class A franked | each dividend in the second series is a class C franked dividend to the extent of the sum of: (a) the percentage specified in the original declaration as the extent to which the dividend was class C franked; and (b) the percentage specified in the original declaration as the extent to which the dividend was class A franked | subsection 160AQF(1AAA) |

4 | the first series dividends were also franked with a venture capital franked amount | each dividend in the second series is a venture capital dividend to the extent of the same percentage as in the original declaration | section 160ASEL |

95 Subsection 160ATG(1)

Repeal the subsection, substitute:

(1) This section deals with the situation in which:

(a) on or after 1 July 2000, a company pays a dividend or a number of dividends under a resolution made before 1 July 2000; and

(b) before 1 July 2000, the dividend or dividends are declared under section 160AQF to be:

(i) if the company is not a life assurance company--class C franked; or

(ii) if the company is a life assurance company--class C franked, class A franked or both class C franked and class A franked; and

(c) section 160ATF does not apply to the dividend or dividends.

96 Subsection 160ATH(3)

Repeal the subsection, substitute:

(3) If the company is a life assurance company at the beginning of the reckoning day for the current dividend, the component EFA in the formula in subsection 160AQE(3) is worked out using the following formula:

where:

"class A franked amount" is the amount (if any) that is the class A franked amount of the earlier dividend.

"class C franked amount" is the amount (if any) that is the class C franked amount of the earlier dividend.

97 Section 160ATI

Repeal the section.

Part 4 -- Thresholds for franking credit trading rules

Income Tax Assessment Act 1936

98 Section 160APHT

Repeal the section, substitute:

160APHT Individual taxpayers qualified as small shareholders

(1) A taxpayer is a qualified person in relation to all dividends paid during a year of income on shares that the taxpayer held or held an interest in if:

(a) the taxpayer is an individual; and

(b) the total of the amounts of the rebates to which the taxpayer would be entitled under sections 160AQU, 160AQX and 160AQZ in respect of the year of income if the taxpayer were a qualified person in relation to each of those dividends does not exceed $5000.

(2) A taxpayer is not a qualified person under subsection ( 1) in relation to a dividend if the taxpayer or an associate of the taxpayer:

(a) has made; or

(b) is under an obligation to make; or

(c) is likely to make;

a related payment in respect of the dividend or a distribution attributable to the dividend.

99 Subdivision BB of Division 7 of Part IIIAA

Repeal the Subdivision.

100 Application of amendments

The amendments made by this Part apply to assessments for the 1999 - 2000 year of income and later years of income.