Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsElection

(1) If:

(a) a person is entitled to a retiring allowance under subsection 18(1A), (1B), (8A) or (8AC) or paragraph 18(2)(a) or (aa) or 18(2AA)(a), (b), (c) or (d); and

(b) an assessment is made of the surcharge on the person's surchargeable contributions for a financial year; and

(c) the person becomes liable to pay the surcharge under the assessment in accordance with paragraph 10(4)(c) of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 ;

the person may, within:

(d) 3 months after the assessment was made; or

(e) such longer period as the Trust allows;

give the Secretary of the Finance Department a written notice electing to commute the whole or a part of the person's retiring allowance to a lump sum benefit equal to the amount specified in the election.

(1A) However, a person may not make an election under subsection (1) if the person has given the Secretary of the Finance Department a written notice under paragraph 22SC(2)(c).

(2) The election must be accompanied by:

(a) a written notice requesting that the amount of the lump sum benefit be:

(i) paid to the Commissioner of Taxation; and

(ii) wholly applied in payment of surcharge under the assessment; and

(b) a copy of the notice of assessment.

Surcharge commutation amount

(3) The amount specified in the election:

(a) must be equal to or less than the amount of surcharge under the assessment; and

(b) must not have the effect of reducing the person's retiring allowance below zero; and

(c) is to be known as the surcharge commutation amount for the purposes of this section.

Entitlement to lump sum benefit

(4) If a person makes an election under subsection (1), the person is entitled to a lump sum benefit equal to the surcharge commutation amount.

Note: The person's retiring allowance will be reduced under subsection 18(8AC).

(5) If a person is entitled to a lump sum benefit under subsection (4), the liability to pay that benefit must be discharged by:

(a) paying the amount of that benefit to the Commissioner of Taxation in accordance with the person's request; and

(b) informing the Commissioner of Taxation of the person's request that the amount be wholly applied in payment of surcharge under the assessment concerned.

Notional adjustment debit

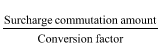

(6) If a person makes an election under subsection (1) on a particular day, there is taken to have arisen at the start of that day a notional adjustment debit of the person equal to the amount worked out using the following formula:

where:

"conversion factor" means the factor applicable to the person under the determination made by the Trust under section 22B.

One election per assessment

(7) A person is not entitled to make more than one election under subsection (1) in relation to a particular assessment.