Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) This section applies to a person who becomes entitled to a retiring allowance on or after 12 June 1978 other than a person who:

(a) becomes entitled to that allowance in pursuance of paragraph 18(2)(a) or (aa); and

(b) becomes entitled to that allowance under paragraph 18(2AA)(a), (b), (c) or (d).

Note: For the purposes of this section, a person who is a deferring member for the purposes of Part VA is treated as not becoming entitled to a retiring allowance before the person attains the age of 55 years. See section 22DC.

(3) Notwithstanding anything in this Act, a person may, not earlier than 3 months before, and not later than 3 months after, becoming a person to whom this section applies, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to convert such percentage (not exceeding 50%) of his or her retiring allowance as is specified in the notice (in this section referred to as the specified percentage ) to a lump sum payment determined in accordance with this section.

(3A) A person who has made an election under subsection (3) to convert a percentage of his or her retiring allowance to a lump sum payment may, not later than 3 months after, but not earlier than 3 months before, becoming a person to whom this section applies, by notice in writing given to the Secretary of the Finance Department, elect that the person's surcharge deduction amount be deducted from the lump sum payment

(4) If the person has not made an election under subsection (3A), the amount of the lump sum payment is:

(a) in any of the cases mentioned in subsection (5)--the specified percentage of the annual amount of the retiring allowance payable to him or her multiplied by 10; or

(b) in any other case--the specified percentage of the annual

amount of the retiring allowance payable to him or her multiplied by the

number ascertained in accordance with the formula ![]() ,

,

where x is the number of whole months in the period that commenced on the day on which he or she attained the age of 65 years and ended on the day immediately before he or she became entitled to the retiring allowance.

(4A) If the person has made an election under subsection (3A), the amount of the lump sum payment is the difference between:

(a) the amount of the lump sum payment that would have been payable to the person under subsection (4) if he or she had not made the election; and

(b) the person's surcharge deduction amount.

(5) The cases referred to in paragraph (4)(a) are:

(a) the case where the person had not attained the age of 66 years at the time when he or she became entitled to the retiring allowance;

(b) the case where the person attained the age of 66 years after the dissolution or expiration of the House of which he or she was last a member, or after the expiration of his or her last term of office as a member, and before he or she became entitled to the retiring allowance; and

(c) the case where:

(i) the person attained the age of 66 years at a time when he or she was a member;

(ii) the person ceased to be a member upon the dissolution or expiration of the House of which he or she was a member at the time when he or she attained that age or upon the expiration of the term of office during which he or she attained that age; and

(iii) the person did not, after so ceasing to be a member, again become a member before he or she became entitled to the retiring allowance.

(6) Where a person elects to convert a percentage of his or her retiring allowance to a lump sum payment in accordance with subsection (3):

(a) the percentage of the rate of parliamentary allowance applicable in relation to him or her under section 18 for the purpose of calculating the rate of retiring allowance payable to him or her under that section (other than any additional retiring allowance payable under subsection (9) of that section) shall, in lieu of the percentage (in this paragraph referred to as the previous percentage ) that would, but for this paragraph, be applicable in relation to him or her under that section, be ascertained in accordance with the formula

![]() ,

,

where:

p is the previous percentage; and

s is the specified percentage;

(b) if the person is entitled to additional retiring allowance under subsection 18(9), the percentage that is, under that subsection, the relevant percentage for the purpose of ascertaining the additional retiring allowance payable to him or her under that subsection in respect of his or her service in an office shall, in lieu of the percentage (in this paragraph referred to as the previous percentage ) that would, but for this paragraph, be the relevant percentage, under that subsection, in respect of his or her service in that office, be ascertained in accordance with the formula

![]() ,

,

where:

p is the previous percentage; and

s is the specified percentage; and

(c) if a payment or payments of retiring allowance has or have already been made to him or her since he or she became entitled to the retiring allowance, the amount of the lump sum payment referred to in subsection (4) shall be reduced by so much of the amount of the payment, or of the sum of the amounts of the payments, already made as relates or relate to the specified percentage of the retiring allowance.

(7) A reference in this section to the annual amount of the retiring allowance payable to a person shall be construed as a reference to the annual amount of the retiring allowance that was payable to the person at the time when he or she became entitled to that allowance.

(9) Notwithstanding anything contained in this section, where the Trust is of the opinion that a person who:

(a) has become entitled to a retiring allowance; and

(b) has made an election under subsection (3) to convert a percentage of his or her retiring allowance to a lump sum payment in accordance with that subsection;

would, within 12 months after having become entitled to that retiring allowance, be likely to become a member again, the Trust shall direct that the operation of the election be deferred for such period, not exceeding 12 months, as the Trust determines.

(10) The Trust may at any time during the period of deferment of the operation of an election made under subsection (3) reduce the period of deferment.

(11) During the period of deferment of the operation of an election made under subsection (3) by a person, retiring allowance shall, subject to subsection 20(3), be paid to the person as if the election had not been made.

(12) Where, during the period of deferment of the operation of an election made under subsection (3) by a person, the person becomes a member again, the election shall, for the purposes of this Act, be deemed never to have been made.

(13) Where, during the period of deferment of the operation of an election made under subsection (3) by a person, the person does not become a member again, the lump sum payment that would have been payable to him or her in accordance with subsection (3) but for the deferment shall be paid to him or her, but, in determining the amount by which the amount of the lump sum payment referred to in subsection (4) is to be reduced in accordance with paragraph (6)(c), payments of retiring allowance made to him or her after the election was made shall be treated as having been made to him or her before the election was made.

(14) Where, during the period of deferment of the operation of an election made under subsection (3) by a person, the person dies, the lump sum payment that would have been payable to him or her in accordance with subsection (3) but for the deferment shall be paid to his or her personal representative, but, in determining the amount by which the amount of the lump sum payment referred to in subsection (4) is to be reduced in accordance with paragraph (6)(c), payments of retiring allowance made to the person after the election was made shall be treated as having been made to him or her before the election was made.

(15) If:

(a) a person makes an election under subsection 18A(1) on a particular day (the election day ) in relation to his or her retiring allowance; and

(b) the person has already made an election under subsection (3) of this section in relation to the retiring allowance; and

(c) the person has not made an earlier election under subsection 18A(1) in relation to his or her retiring allowance;

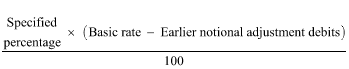

there is taken to have arisen at the start of the election day a notional adjustment debit of the person equal to the amount worked out using the following formula:

where:

"basic rate" has the same meaning as in subsection 18(8AC).

"earlier notional adjustment debits" means the total of the person's notional adjustment debits arising under any or all of the following provisions before the start of the election day:

(a) subsection 18(8AA);

(b) subsection 18(8AB);

(c) subsection 18A(6).

(15A) Any reduction under section 22CH is to be disregarded in applying the definition of basic rate in subsection (15) of this section.

(16) If:

(a) a person makes an election under subsection 18A(1) on a particular day (the election day ) in relation to his or her retiring allowance; and

(b) the person has already made an election under subsection (3) of this section in relation to the retiring allowance;

paragraph (6)(a) ceases to apply to the retiring allowance on the election day.

(17) If:

(a) a person makes an election under subsection 18A(1) in relation to his or her retiring allowance; or

(b) the amount of the person's retiring allowance is reduced in accordance with section 22SE to reflect a release authority lump sum (within the meaning of Part VC);

the person is not entitled to make a subsequent election under subsection (3) of this section in relation to the retiring allowance.