Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1A) In this section:

"cut off date" for a person means:

(a) the date that is 12 months after the person again becomes a member; or

(b) the date immediately before any day on which the person ceases to be a member upon the dissolution or expiration of the House of which he or she was then a member or upon the expiration of his or her term of office.

"eligible lump sum amount" means:

(a) a refund of contributions or a payment of the whole or a part of the Commonwealth supplement, or both; or

(b) the superannuation guarantee safety - net amount.

(1AA) If a person who has received an eligible lump sum amount under this Act again becomes a member, the person may enter into a contract with the Trust, in the manner required by the Trust, to repay the amount specified in subsection (1AD) to the Commonwealth within 3 years of the person again becoming a member.

(1AB) The contract must be made in the period of 3 months after the person again becomes a member.

(1AC) If there has not been a cut off date for the person in the 3 month period, the trust may extend the period until the first cut off date for the person after the person again becomes a member.

(1AD) The amount referred to in subsection (1AA) is calculated as follows:

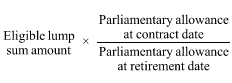

(a) if paragraph (b) does not apply to the person--the amount is worked out by using the formula:

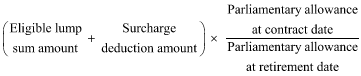

(b) if the person's surcharge debt account was in debit when the eligible lump sum amount became payable to the person--the amount is worked out by using the formula:

where:

"parliamentary allowance at contract date" means the annual amount of parliamentary allowance payable to a member at the date on which the person enters into the contract.

"parliamentary allowance at retirement date" means the annual amount of parliamentary allowance payable to a member at the date on which the person most recently retired from the Parliament.

"surcharge deduction amount" means the person's surcharge deduction amount when the eligible lump sum amount became payable to the person.

(1AE) If a person does not enter into a contract under subsection (1AA), the Trust must not, for the purposes of determining the person's rights to further benefits under this Act, take into account:

(a) any part of the member's period of service; or

(b) any occasion when he or she ceased to be a member;

before the person became entitled to the eligible lump sum amount.

(2) Where an amount referred to in subsection (1) was accepted in lieu of a retiring allowance, the amount which would otherwise be the subject of a contract of repayment under that subsection shall be reduced by the amount of retiring allowance to which the member would have been entitled, up to the time when he or she again became a member, if he or she had not elected to accept a payment in lieu of retiring allowance.

(2A) Where a person who is entitled to a parliamentary allowance on 12 June 1978 has, at any time before that date, received an amount referred to in subsection (1) that he or she did not contract, or was not entitled to contract, with the Trust to repay to the Commonwealth as provided by that subsection, the person may, within 3 months after that date, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to repay that amount to the Commonwealth.

(2B) Where a person who becomes entitled to a parliamentary allowance on or after 12 June 1978 has, at any time before that date, received an amount referred to in subsection (1) that he or she is not entitled to contract with the Trust to repay to the Commonwealth as provided by that subsection, the person may, within 3 months after the date on which he or she so becomes entitled to a parliamentary allowance, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to repay that amount to the Commonwealth.

(2C) Where an election is made under subsection (2A) or (2B) to repay an amount to the Commonwealth:

(a) the amount shall be repaid at such times and in such amounts as are agreed upon between the person and the Finance Minister or, in the absence of agreement, at such times and in such amounts as the Finance Minister determines, but so that the total of the amounts is repaid to the Commonwealth within 3 years after the date on which the person made the election; and

(b) subsection (1) does not prevent any part of the period of service of the person, and any occasion on which he or she ceased to be a member, before he or she became entitled to that amount from being taken into account for the purposes of determining his or her rights in respect of any further benefit under this Act.

(2D) Where a person who has contracted with the Trust under subsection (1), or has made an election under subsection (2A) or (2B), to repay an amount to the Commonwealth elects under subsection 18B(3) to convert a percentage of the retiring allowance to which he or she is entitled into a lump sum payment, there shall be deducted from that lump sum payment so much (if any) of the amount as remains to be paid under the contract or in pursuance of the election and, upon the deduction being made, the person is, to the extent of the amount deducted, discharged from further liability to make repayments under the contract or in pursuance of the election.

(3) Where a person who is entitled to a retiring allowance in respect of his or her service as a member (whether or not the retiring allowance is immediately payable) again becomes a member, the retiring allowance shall be cancelled, and, subject to subsections (3A) and (3D), thereafter his or her rights and liabilities under this Act shall be the same as if he or she had never been entitled to a retiring allowance.

(3A) Where:

(a) a person who has elected (including a person who has elected on more than one occasion) to convert into a lump sum payment a percentage of a retiring allowance to which he or she was entitled again becomes a member; and

(b) the person subsequently becomes entitled to a retiring allowance;

the annual amount of the last - mentioned retiring allowance shall be reduced by:

(c) if the person previously elected on more than one occasion to convert into a lump sum payment a percentage of the retiring allowance to which he or she was entitled--an amount equal to the total of the annual amounts by which the respective retiring allowances to which he or she was previously entitled were reduced by reason of the elections; or

(d) if the person previously elected on only one occasion to convert into a lump sum payment a percentage of the retiring allowance to which he or she was entitled--the annual amount by which that retiring allowance was reduced by reason of the election.

(3B) Subsection (3A) does not apply to an election under subsection 18A(1).

(3C) A reference in subsection (3A) to a retiring allowance to which a person was entitled shall be construed as a reference to the retiring allowance to which he or she was entitled at the time when he or she became entitled to that retiring allowance.

(3D) The rule in subsection (3) does not apply in working out a person's notional adjustment debits that have arisen under any of the following provisions:

(a) subsection 18(8AA);

(b) subsection 18(8AB);

(c) subsection 18A(6).

(5) This section does not apply in relation to a retiring allowance or annuity under section 19A.