Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In calculating the annual rate of the affected benefit in accordance with section 22CH, the basic service factor at the payment time and the basic service factor at the operative time are worked out under this section.

Period of service at least 8 years

(2) If the period of service is at least 8 years, then:

(a) the basic service factor at the payment time is the number calculated, by reference to the member spouse's period of service before the payment time, by adding:

(i) for service that occurred within the first 8 years--0.0625 for each full year; and

(ii) for service that occurred within the next 10 years:

(A) 0.025 for each full year; and

(B) 0.025/365 for each left - over day; and

(b) the basic service factor at the operative time is the number calculated, by reference to the member spouse's period of service before the operative time, by adding:

(i) for service that occurred within the first 8 years:

(A) 0.0625 for each full year; and

(B) 0.0625/365 for each left - over day; and

(ii) for service that occurred within the next 10 years:

(A) 0.025 for each full year; and

(B) 0.025/365 for each left - over day.

Period of service less than 8 years--retiring allowance (not under subsection 18(2AA))

(3) If the period of service is less than 8 years and the affected benefit is a retiring allowance (other than an allowance under subsection 18(2AA)), then:

(a) the basic service factor at the payment time is 0.5; and

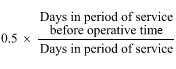

(b) the basic service factor at the operative time is the number calculated using the formula:

Period of service less than 8 years--retiring allowance under paragraph 18(2AA)(b) or (c) or annuity under paragraph 19(1)(a)

(4) If the period of service is less than 8 years and the affected benefit is a retiring allowance under paragraph 18(2AA)(b) or (c) or an annuity under paragraph 19(1)(a), then:

(a) the basic service factor at the payment time is 0.5; and

(b) the basic service factor at the operative time is the number calculated, by reference to the member spouse's period of service before the operative time, by adding:

(i) 0.0625 for each full year; and

(ii) 0.0625/365 for each left - over day.

Period of service less than 8 years--retiring allowance under paragraph 18(2AA)(d)

(5) If the period of service is less than 8 years and the affected benefit is a retiring allowance under paragraph 18(2AA)(d), then:

(a) the basic service factor at the payment time is 0.3; and

(b) the basic service factor at the operative time is the number calculated, by reference to the member spouse's period of service before the operative time, by adding:

(i) 0.0375 for each full year; and

(ii) 0.0375/365 for each left - over day.