Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated Acts(1) In calculating the annual rate of the affected benefit in accordance with section 22CH, the additional service factor at the payment time and the additional service factor at the operative time are worked out under this section.

Where subsection 18(10B) does not apply

(2) If subsection 18(10B) does not apply, then:

(a) for each office, the additional service factor at the payment time is the number calculated, by reference to the member spouse's period of service in the office before the payment time, by adding:

(i) 0.0625 for each full year; and

(ii) 0.0625/365 for each left - over day; and

(b) for each office, the additional service factor at the operative time is the number calculated, by reference to the member spouse's period of service in the office before the operative time, by adding:

(i) 0.0625 for each full year; and

(ii) 0.0625/365 for each left - over day.

Where paragraph 18(10B)(a) applies (one office)

(3) If paragraph 18(10B)(a) applies, then:

(a) the additional service factor at the payment time is 0.75; and

(b) the additional service factor at the operative time is:

(i) if the period of service in the office is at least 12 years--0.75; or

(ii) otherwise--the number calculated, by reference to the member spouse's period of service in the office before the operative time, by adding:

(A) 0.0625 for each full year; and

(B) 0.0625/365 for each left - over day.

Where paragraph 18(10B)(b) applies (highest - paid office)

(4) If paragraph 18(10B)(b) applies, then:

(a) the additional service factor at the payment time is 0.75; and

(b) if, at the operative time, the member spouse is not entitled to parliamentary allowance, then the additional service factor at the operative time for the highest - paid office to which paragraph 18(10B)(b) applies is 0.75; and

(c) if, at the operative time, the member spouse is entitled to parliamentary allowance, then the additional service factor at the operative time for the highest - paid office to which paragraph 18(10B)(b) applies is worked out as follows:

(i) calculate a factor under paragraph (2)(b) of this section for each office referred to in paragraph 18(10B)(b), other than an office for which the period of service began after the operative time;

(ii) for each such factor, calculate a weighted factor under subsection (6) of this section;

(iii) add together the weighted factors calculated under subparagraph (ii) of this paragraph.

(5) If the additional service factor at the operative time, worked out under paragraph (4)(c), would be more than 0.75, then it is taken to be 0.75.

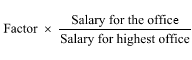

(6) The weighted factor is calculated using the formula:

where:

"salary for highest office" means the number of whole dollars in the salary applicable at the payment time to the office referred to in paragraph 18(10B)(b) that had the highest rate of salary, or allowance by way of salary, at the payment time.

"salary for the office" means the number of whole dollars in the salary, or allowance by way of salary, applicable to the office at the payment time.