Commonwealth Consolidated Acts

Commonwealth Consolidated Acts Commonwealth Consolidated Acts

Commonwealth Consolidated ActsNote: See section 29.

(1) In this Schedule:

"new scheme contribution period" , in relation to a person, has the same meaning as in the Parliamentary Superannuation Act 2004 .

"new scheme entry time" , in relation to a person, has the same meaning as in the Parliamentary Superannuation Act 2004 .

(2) In this Schedule, unless the contrary intention appears:

(a) a reference to a clause or subclause is a reference to a clause or subclause of this Schedule; and

(b) a reference to a section or subsection is a reference to a section or subsection of this Act.

Part 2 -- Closing off contributions to the scheme

2 No section 13 contributions in respect of new scheme contribution periods

A person is not required or entitled to make contributions under section 13 in respect of any new scheme contribution period of the person.

Part 3 -- Closing off entitlements to benefits under the scheme

3 No section 18 benefits at the end of new scheme contribution periods etc.

(1) A person is not entitled to any benefits under section 18 on ceasing to be entitled to a parliamentary allowance at the end of the first, or any later, new scheme contribution period of the person.

Note: A person may, however, be entitled to an allowance under clause 4 or 5 at a preserved percentage.

(2) Any retiring allowance, or additional retiring allowance, to which the person was entitled under section 18 immediately before the start of the first new scheme contribution period of the person is cancelled by force of this clause (rather than subsection 20(3)) as from the start of that period.

4 Entitlement to a retiring allowance at a preserved percentage

(1) This clause applies to a person if, immediately before the start of the first new scheme contribution period of the person, a retiring allowance (other than additional retiring allowance) was payable to the person under section 18.

Note: The reference in this subclause to a retiring allowance being payable to the person is affected by subclause (6).

(2) The person is entitled, after the end of the first new scheme contribution period, to a retiring allowance (the preserved basic allowance ) under this clause during his or her lifetime at the preserved basic percentage (see subclause (5)) of the rate of parliamentary allowance for the time being payable to a member.

Note 1: The reference in this subclause to the rate of parliamentary allowance for the time being payable to a member is affected by section 22T.

Note 2: Because of Division 3 of this Part, other provisions (for example, Part VA, subsection 20(3A) and sections 21 and 21B) may apply so that the preserved basic allowance is not payable to the person, or is payable at a reduced rate.

(3) For the purpose of the reference in subclause (2) to the rate of parliamentary allowance for the time being payable to a member, any reductions under Division 3 of Part 2 of the Parliamentary Business Resources Act 2017 (about salary sacrifice) of a particular member's entitlement to parliamentary allowance are to be disregarded.

(4) The person's entitlement to the preserved basic allowance is suspended for the duration of any later new scheme contribution period of the person.

(5) The preserved basic percentage is, from the end of a new scheme contribution period of the person to the start of the next (if any) new scheme contribution period of the person, the percentage that was applied to the rate of parliamentary allowance in order to calculate the rate of retiring allowance (other than additional retiring allowance) payable to the person under section 18, or under this clause, immediately before the start of the first - mentioned new scheme contribution period.

Note: The reference in this subclause to the rate of retiring allowance payable to the person is affected by subclause (6).

(6) If, immediately before the start of a new scheme contribution period of the person, the person was not being paid a retiring allowance, or was being paid a reduced rate of retiring allowance, because of all or any of the following provisions:

(a) Part VA;

(b) subsection 20(3A);

(c) section 21;

(d) section 21B;

this clause applies to the person as if the person were, at that time, being paid the retiring allowance he or she would have been paid if those provisions had not applied.

5 Entitlement to an additional retiring allowance at a preserved percentage

(1) This clause applies to a person if, immediately before the start of the first new scheme contribution period of the person, additional retiring allowance was payable to the person under subsection 18(9) in respect of either or both of the following:

(a) his or her service in an office or offices he or she held as a Minister of State;

(b) his or her service in an office or offices by virtue of which he or she was an office holder.

In this clause, each office in respect of which the additional retiring allowance was payable is a relevant office .

Note: The reference in this subclause to a retiring allowance being payable to the person is affected by subclause (5).

(2) The person is entitled, after the end of the first new scheme contribution period and in respect of each relevant office, to additional retiring allowance (the preserved additional allowance ) under this clause during his or her lifetime at the preserved additional percentage for the office (see subclause (4)) of the rate, for the time being, of:

(a) for an office referred to in paragraph (1)(a)--the salary payable to a Minister of State; or

(b) for an office referred to in paragraph (1)(b)--the allowance by way of salary payable to an office holder in respect of that office.

Note 1: The reference in this subclause to the rate of salary, or allowance by way of salary, for the time being payable in respect of an office is affected by sections 22T and 23.

Note 2: Subclause (6) imposes a cap on the rate of the preserved additional allowance.

Note 3: Because of Division 3 of this Part, other provisions (for example, Part VA, subsection 20(3A) and sections 21 and 21B) may apply so that the preserved additional allowance is not payable to the person, or is payable at a reduced rate.

(3) The person's entitlement to the preserved additional allowance is suspended for the duration of any later new scheme contribution period of the person.

(4) The preserved additional percentage for a relevant office is, from the end of a new scheme contribution period of the person to the start of the next (if any) new scheme contribution period of the person, the percentage that was applied to:

(a) for an office referred to in paragraph (1)(a)--the salary payable to a Minister of State; or

(b) for an office referred to in paragraph (1)(b)--the allowance by way of salary payable to an office holder in respect of that office;

in order to calculate the rate of additional retiring allowance payable to the person in respect of the office under subsection 18(9), or under this clause, immediately before the start of the first - mentioned new scheme contribution period.

Note: The reference in this subclause to the rate of additional allowance payable to the person is affected by subclause (5).

(5) If, immediately before the start of a new scheme contribution period of the person, the person was not being paid additional retiring allowance, or was being paid a reduced rate of additional retiring allowance, because of all or any of the following provisions:

(a) Part VA;

(b) subsection 18(10B) or subclause (6) of this clause;

(c) subsection 20(3A);

(d) section 21;

(e) section 21B;

this clause applies to the person as if the person were, at that time, being paid the additional retiring allowance he or she would have been paid if those provisions had not applied.

(6) Nothing in this clause entitles the person to additional retiring allowance at a rate that exceeds:

(a) if the person is entitled to additional retiring allowance in respect of one relevant office only--75% of the rate, for the time being, at which salary or allowance by way of salary, as the case may be, is payable in respect of that office; or

(b) if a person is entitled to additional retiring allowance in respect of 2 or more relevant offices--75% of the rate that is the highest rate, for the time being, at which salary or allowance by way of salary, as the case may be, is payable in respect of either or any of those offices.

Division 3 -- How this Act applies in relation to a person after the new scheme entry time

6 Act applies subject to this Division in relation to a person after the new scheme entry time

(1) This Act applies in relation to a person after the new scheme entry time for the person subject to Division 1 and this Division, and to Part 2.

(2) Subject to Division 1 and this Division, this Act applies in relation to a retiring allowance (the preserved basic allowance ) to which the person is entitled under clause 4 in the same way as it applies in relation to a retiring allowance under section 18.

(3) Subject to Division 1 and this Division, this Act applies in relation to additional retiring allowance (the preserved additional allowance ) to which the person is entitled under clause 5 in the same way as it applies in relation to an additional retiring allowance under subsection 18(9).

7 Disapplying sections 15A, 15B and 15C

(1) Sections 15A and 15B do not apply in relation to the person ceasing to be a member as mentioned in section 15A, if the cessation occurs after the new scheme entry time for the person.

(2) The Trust cannot, under section 15C, review a person's classification as a class 1 invalid or a class 2 invalid after the new scheme entry time for the person.

8 Modified application of section 16A

Section 16A applies after the new scheme entry time for a person as if the reference in subparagraph (1)(c)(i) to the person's capacity as a member were a reference to the person's capacity as a member before the new scheme entry time.

9 Provisions applying instead of subsection 18(8A)

(1) Subsection 18(8A) does not apply in relation to the preserved basic allowance. Instead, subclauses (2) and (3) of this clause apply.

(2) If the person's surcharge debt account is in debit at the end of a new scheme contribution period (the most recent contribution period ) of the person, then, until whichever (if any) of the following happens first:

(a) another new scheme contribution period of the persons starts;

(b) the person makes an election under subsection 18A(1);

clause 4 applies as if the reference in subclause 4(2) to the preserved basic percentage were instead a reference to the percentage worked out under subclause (3) of this clause.

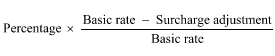

(3) The percentage is worked out using the formula:

where:

"basic rate" means the rate at which, after the end of the most recent contribution period, the preserved basic allowance would have been payable to the person if subclause (2) did not apply to the person.

"percentage" means the preserved basic percentage determined in accordance with subclause 4(5).

"surcharge adjustment" means the person's notional adjustment debit arising under subclause 10(2) at the end of the most recent contribution period.

10 Provision applying instead of subsection 18(8AA)

(1) Subsection 18(8AA) does not apply in relation to the preserved basic allowance. Instead, subclause (2) of this clause applies.

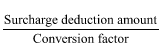

(2) If the person's surcharge debt account is in debit at the end of a new scheme contribution period of the person, there is taken to have arisen, at the end of that period, a notional adjustment debit of the person equal to the amount worked out using the formula:

where:

"conversion factor" means the factor applicable to the person under the determination made by the Trust under section 22A.

"surcharge deduction amount" means the person's surcharge deduction amount.

11 Provisions applying instead of subsection 18(8AC)

(1) Subsection 18(8AC) does not apply in relation to the preserved basic allowance. Instead, subclauses (2) and (3) of this clause apply.

(2) If the person makes an election under subsection 18A(1) on a particular day (the election day ) after the end of a new scheme contribution period of the person (the most recent contribution period ) then, from the election day until another (if any) new scheme contribution period of the person starts, clause 4 applies as if the reference in subclause 4(2) to the preserved basic percentage were instead a reference to the percentage worked out under subclause (3) of this clause.

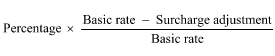

(3) The percentage is worked out using the formula:

where:

"basic rate" means the rate at which, after the end of the most recent contribution period, the preserved basic allowance would have been payable to the person if subclause (2) of this clause and subclause 9(2) did not apply to the person.

"percentage" means the preserved basic percentage determined in accordance with subclause 4(5).

"surcharge adjustment" means the sum of the following:

(a) the person's notional adjustment debit (if any) arising under subclause 10(2) at the end of the most recent contribution period;

(b) the person's notional adjustment debit arising under subsection 18A(6) because of the making of the election.

12 Modified application of section 18A

Section 18A applies in relation to the preserved basic allowance as if:

(a) paragraph 18A(1)(a) included a reference to the preserved basic allowance; and

(b) the note under subsection 18A(4) included a reference to subclause 11(2).

Section 18B does not apply in relation to the preserved basic allowance or the preserved additional allowance.

14 Modified application of section 19

Section 19 applies in relation to the preserved basic allowance and the preserved additional allowance as if paragraph 19(3)(b) were omitted.

15 Modified application of section 20

(1) After the new scheme entry time for the person, the person cannot:

(a) enter into a contract as mentioned in subsection 20(1AA); or

(b) make an election as mentioned in subsection 20(2A) or (2B).

(2) Subsection 20(3) does not apply in relation to the preserved basic allowance or the preserved additional allowance.

16 Modified application of section 21AA

Section 21AA applies in relation to the preserved basic allowance and the preserved additional allowance as if paragraph 21AA(5)(c) were omitted.

17 Modified application of section 21B

Section 21B applies in relation to the preserved basic allowance and the preserved additional allowance as if paragraph 21B(4)(a) were omitted.

18 Modified application of Part VB

After the new scheme entry time for a person, the person cannot make an election under any of the provisions of Part VB.